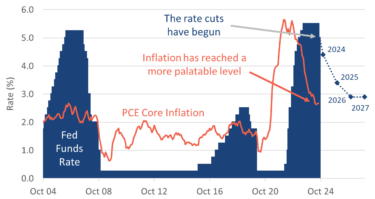

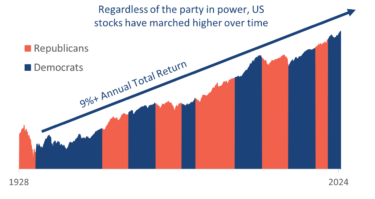

We received the rate cut we were waiting for in Q3 and then some. Investors handled the shift in policy in stride, with most asset classes we follow posting positive returns. The hope for a soft landing remains alive. But many now have their eyes fixed on the upcoming Presidential election and are wondering how best to prepare their portfolios. We review the quarter and provide some perspective on the fast-approaching November 5th vote.

Diversifiers provided market leadership in Q3

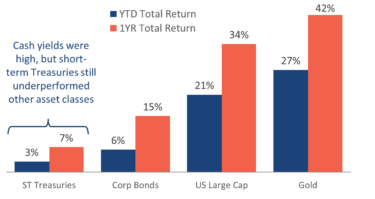

As always, we wrap up our charts with an overview of the performance of the major asset classes. Performance was notably universally positive in the first three quarters of the year.

As good as US Large Cap stocks have performed this year, Gold has surpassed them as the best performing asset class this year. Gold is viewed as a store of value and a go to asset in times of uncertainty. However, the driver may have more to do with central bank stockpiling around the globe.

While US Large Cap stocks are leading amongst equities this year, diversifiers are catching up. Emerging Markets, US Mid-Cap stocks, Developed International stocks, and US Small Cap stocks all outperformed US Large Cap in the third quarter of the year. In short, it was an excellent quarter for a well-diversified portfolio.

On the bond side of the portfolio, yields have been attractive and market values have benefited from falling interest rates, but returns have not been able to match those of riskier assets.

Chart 5: YTD Asset Class Performance (through Q3)

Source: Factset

We always say we don’t predict we prepare. Warren Buffett said it better: “Predicting rain doesn’t count. Building arks does.”

About Strategic

Founded in 1979, Strategic is a leading investment and wealth management firm managing and advising on total client assets of over $2.5 billion.

Disclosures

Strategic Financial Services, Inc. is registered with the Securities and Exchange Commission (SEC) as an Investment Advisor. The term “registered” signifies compliance with regulatory requirements and does not imply a certain level of skill or training.

The information provided on our website, including weekly market commentaries, financial planning articles, and other educational resources, is intended solely for educational purposes. It is designed to offer insights into financial planning and investment management, aiming to enhance understanding of financial concepts, strategies, and market trends. This content should not be interpreted as personalized investment advice or a recommendation for any specific strategy, financial planning approach, or investment product. Financial decisions are deeply personal and should be made considering the individual’s specific circumstances, goals, and risk tolerance. We recommend consulting with a professional financial advisor for personalized advice.

Please be aware that Strategic Financial Services, Inc. does not provide legal or tax advice. The content on this website is not intended to be used as such or as a substitute for legal or tax advice from a licensed professional. We advise seeking guidance from qualified legal and tax advisors regarding these matters.

Investment Risks and Portfolio Management.

The discussion of any investments on this website is for illustrative purposes only and provides no guarantee that the advisor will make any investments with the same or similar characteristics as those presented. The investments identified and described herein do not represent all the investments purchased or sold for client accounts. The selection of representative investments to discuss is based on various factors, including recent company news or earnings releases.

It should not be assumed that any investments discussed were or will be profitable. All investments involve risk, including the potential loss of principal. There is no assurance that investments mentioned will remain in client accounts at the time you view this information.

When index returns are mentioned on this site, they are provided as a general indicator of market conditions and are not representative of any client’s portfolio performance. Indices are unmanaged, do not incur management fees, costs, and expenses, and cannot be invested in directly. Therefore, their performance does not reflect the expenses associated with the management of an actual portfolio.

While index returns are used as a framework to report on general market conditions, they should not be construed as an indicator of future performance of any specific investment or portfolio. Discussion of index returns is intended to provide context and insight, not to suggest that clients will achieve similar results. Each client’s portfolio is managed according to their specific investment goals and financial situation.

The opinions and any forward-looking statements expressed in the articles and videos featured in our resource center are as of the date of publication. These statements are based on current laws, regulations, market conditions, and other relevant factors, including third-party data. Given the dynamic nature of financial and regulatory environments, as well as potential changes in market conditions or economic circumstances, the information provided may become outdated or may no longer be accurate.

We rely on third-party data to form our opinions and projections, which means that these are subject to the same uncertainties that affect all data-dependent analyses. As such, we advise readers to exercise caution and not rely solely on the statements made herein for making financial decisions. It is recommended that investors consult with a professional advisor who can help assess the relevance and accuracy of the content in light of the current economic climate and personal financial situation.

Our website contains links to third-party websites as a convenience to our users. Strategic Financial Services, Inc. does not control, endorse, or guarantee the content found on such sites. We are not responsible for the accuracy, legality, or content of the external site or for that of subsequent links.

Contact the external site for answers to questions regarding its content.

The inclusion of any link does not imply our endorsement of the site, nor does it imply any association with its operators. Use of any such linked website is at the user’s own risk.