Perspectives

A roller-coaster quarter for equities ended on a high thanks to some helpfully dovish comments from the Federal Reserve on rate expectations.

Dissecting Q2 2019

Contributed by Doug Walters , Max Berkovich ,

Stocks ended the quarter up, but not before experiencing meaningful declines in May. Investors who “sold in May and went away,” would have looked like geniuses in May as stocks fell around 6%, but would have missed the boat in June as stocks rebounded more than 9%. Trade and tariff headlines were a concern for investors throughout the quarter, but more dovish commentary out of the Fed proved to have the most influence on markets.

Equities – Opportunities persist

Large-Cap stocks outpaced Small-Cap, while Domestic continued to outperform International. Overall, valuations remain within the normal range, albeit on the high end, with some segments of the market (Small-Cap and International, for example) showing some value.

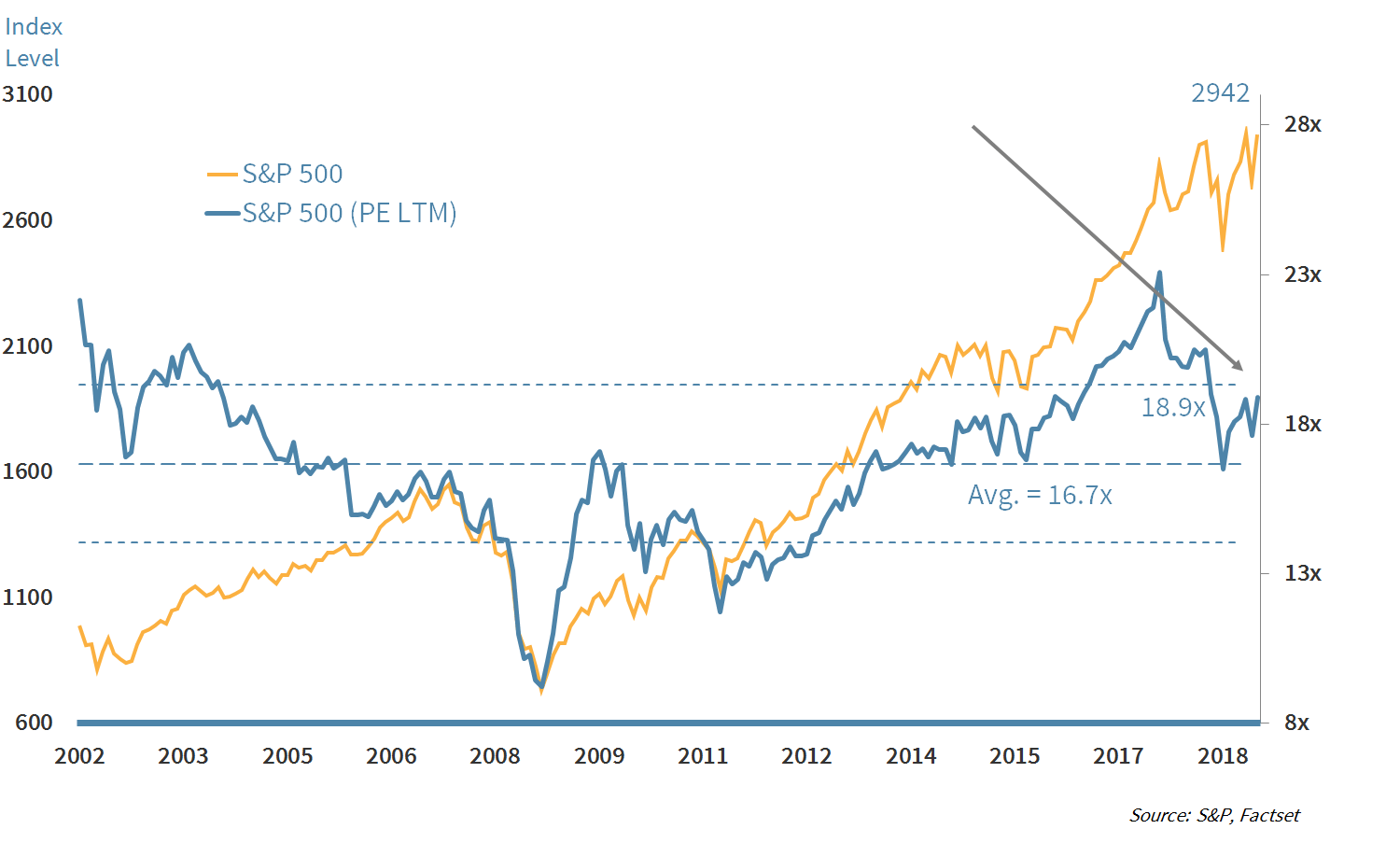

Chart 1: Equity valuations within the historical range

The stock advancement in Q2 did not push valuations above the normal historical range.

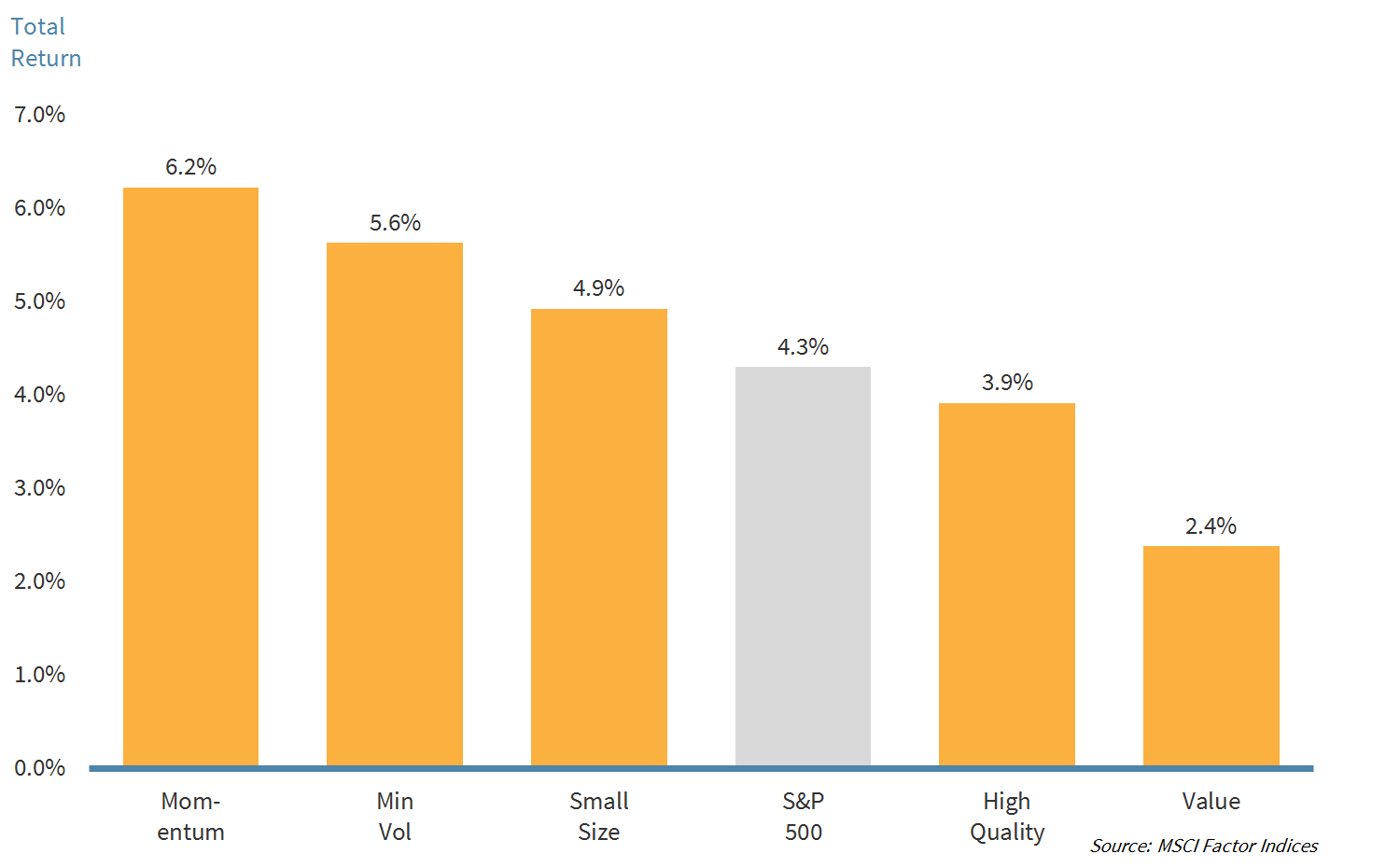

Dissecting performance, we see that the market was driven by both the Momentum and Minimum Volatility factors. It may seem counterintuitive that these factors would both work at the same time as Momentum is a “risk-on” factor, while Minimum Volatility is defensive. Investors appear to be trying to participate in the later-cycle rally with Momentum, while at the same time hedging potential downside with exposure to Minimum Volatility.

Chart 2: Momentum and Min Vol are driving returns

Momentum and Minimum Volatility were drivers of stocks this quarter, while Value continued to be a drag on performance.

Fixed Income – Living in a flat world

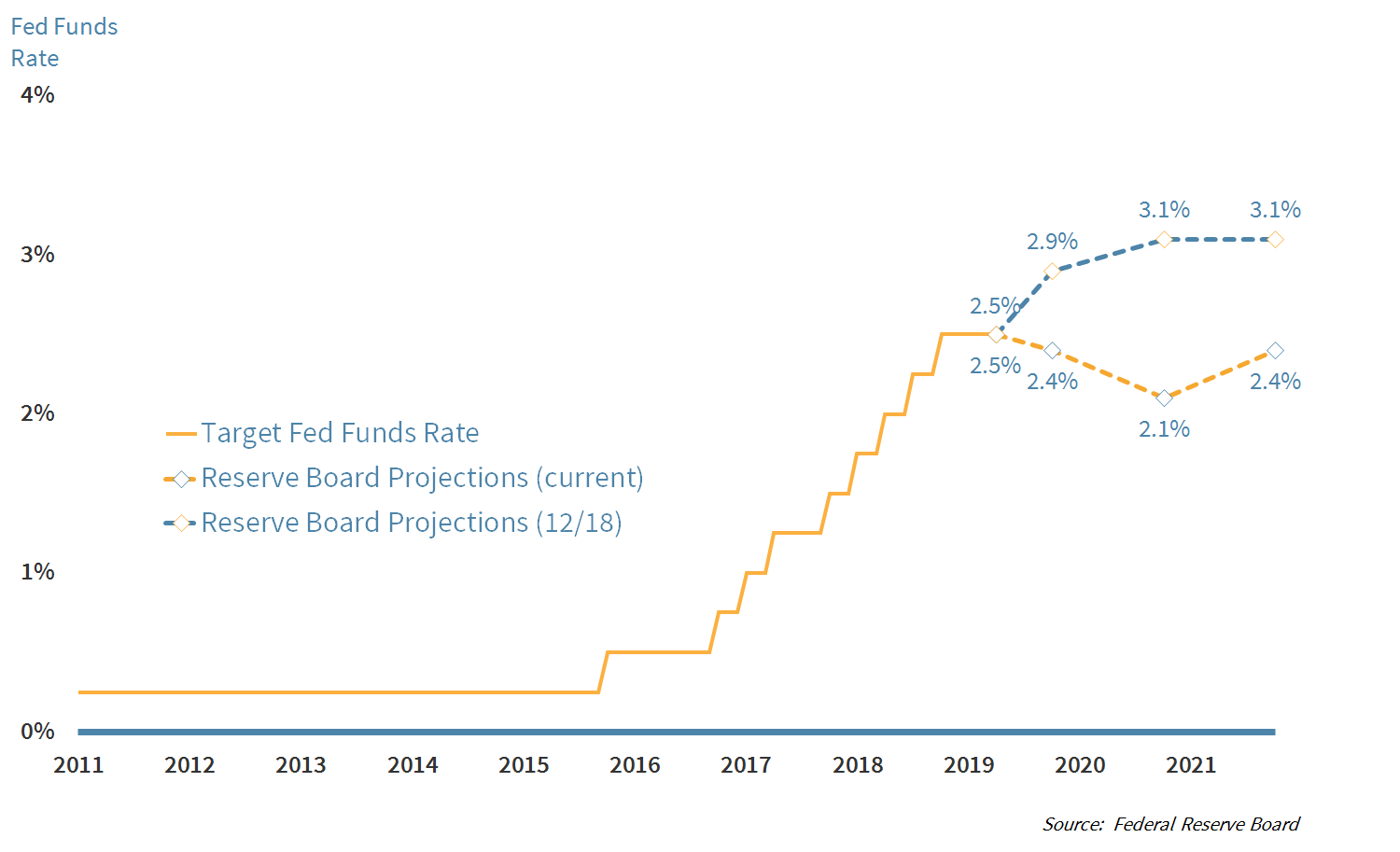

The fixed income world is flat, with parts of the yield curve inverted. Fear that inversion is a prelude to an economic downturn has been abated by the Fed’s softer language on rates, which opened the door for a cut sooner than had previously been anticipated. We have seen a significant shift in rate expectations out of the Fed since just the end of last year.

Chart 3: Rate expectations lowered

Rate projections have come down significantly over the past two quarters. The steady rate increase envisioned in December has been replaced by projected rate cuts.

Asset Roundup

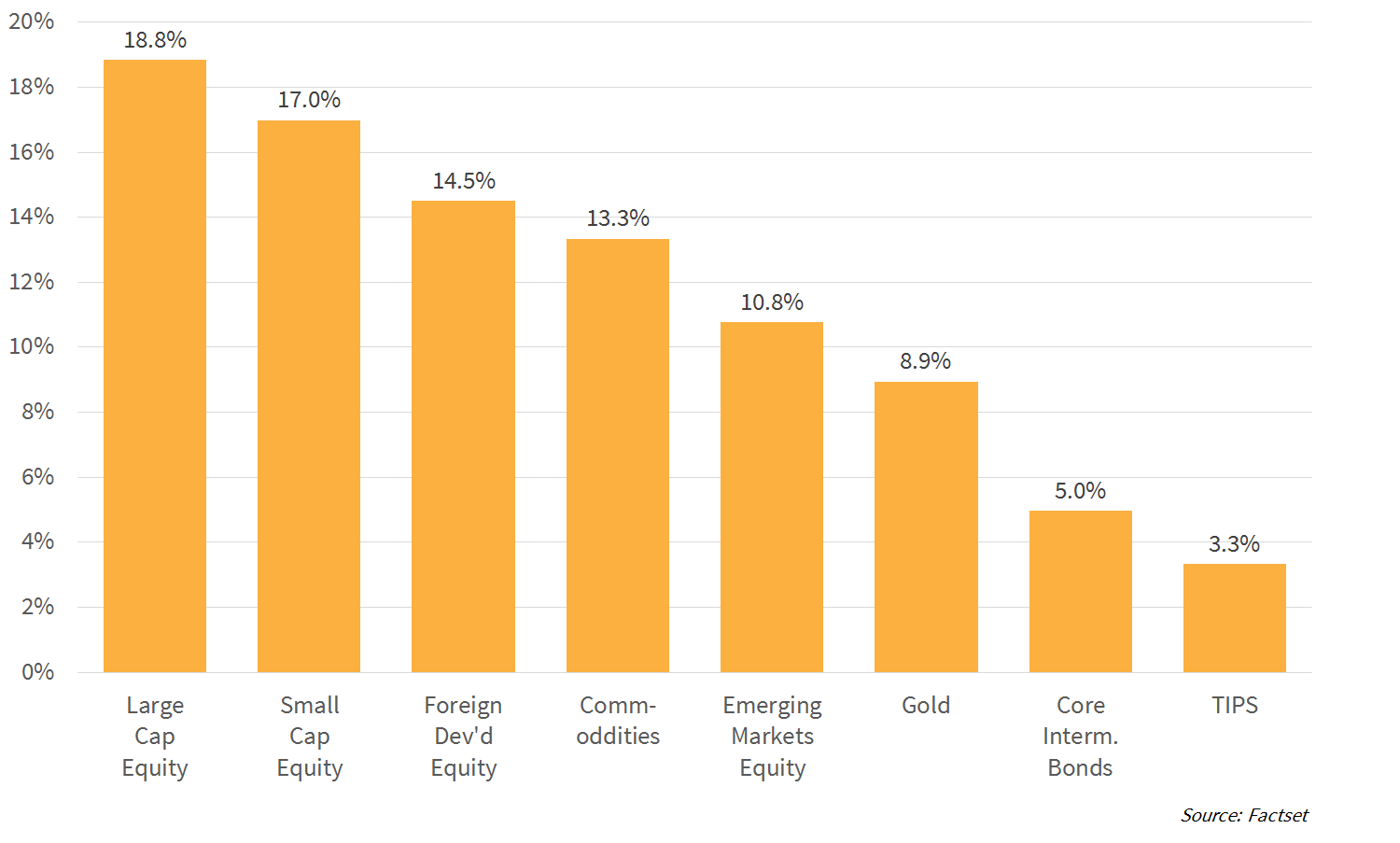

Year-to-date, Large-Cap equities are atop the performance charts, but it has been a big year for most core portfolio asset classes. Even assets like Gold, which we hold because of their lack of correlation with equities, were up. It is easy to get complacent as an investor and begin to question the benefits of diversification. Why own anything other than Large-Cap U.S. equities? They seem to always be near the top of the performance charts. While Large-Cap U.S. has been a strong asset class in recent years, that will not always be the case. Proper diversification will capture the market return at a lower level of risk.

Chart 4: A strong performance across the board

Year-to-date returns are positive across most asset classes, with U.S. equities leading the way.

The Q3 2019 Playbook

Little has changed in three months. We still face a somewhat uncertain international economic picture, with trade disputes threatening to accelerate a slowdown. The yield curve is flat and slightly inverted, having some raise a recession red flag. How should investors be positioned as we enter the third quarter of 2019?

We believe we are at the mature end of the economic cycle but do not see any signs that a near-term end to the expansion is near. Market timers beware. No rule states how long an expansion can last and trying to time it based on historical norms could have you missing the next leg up. Also, this quarter, the Fed showed us that they are willing to be nimble (at least in language) in the face of any weakness, and the market response was swift.

A better approach is a portfolio built to perform throughout the economic cycle. To us, that means:

- Overweighting investment “factors” that have shown to persistently advantage portfolios throughout the cycle. Our preferred factors are Quality (profitable companies), Value (cheap stocks), Size (small market cap), Momentum (stock price rising), and Minimum Volatility.

- Incorporating equity diversification. We believe in owning just as much Small and Mid-Cap exposure as Large-Cap. In addition, we hold a sizable exposure to International equities, which not only provide natural diversification but also happen to be reasonably inexpensive currently.

- Adding extra exposure to “Momentum” in our more aggressive model portfolios where maximizing returns takes priority over reducing risks.

- Adding extra exposure to “Minimum Volatility” for more conservative portfolios where near-term market weakness is more concerning.

- Including Gold which provides portfolio protection given its exposure to inflation yet low correlation to the stock market, improving the risk-adjusted returns of the portfolio.

About Strategic

Founded in 1979, Strategic is a leading investment and wealth management firm managing and advising on client assets of over $2 billion.

OverviewDisclosures

Strategic Financial Services, Inc. is a SEC-registered investment advisor. The term “registered” does not imply a certain level of skill or training. “Registered” means the company has filed the necessary documentation to maintain registration as an investment advisor with the Securities and Exchange Commission.

The information contained on this site is for informational purposes and should not be considered investment advice or a recommendation of any particular security, strategy or investment product. Every client situation is different. Strategic manages customized portfolios that seek to properly reflect the particular risk and return objectives of each individual client. The discussion of any investments is for illustrative purposes only and there is no assurance that the adviser will make any investments with the same or similar characteristics as any investments presented. The investments identified and described do not represent all of the investments purchased or sold for client accounts. Any representative investments discussed were selected based on a number of factors including recent company news or earnings release. The reader should not assume that an investment identified was or will be profitable. All investments contain risk and may lose value. There is no assurance that any investments identified will remain in client accounts at the time you receive this document.

Some of the material presented is based upon forward-looking statements, information and opinions, including descriptions of anticipated market changes and expectations of future activity. Strategic Financial Services believes that such statements, information, and opinions are based upon reasonable estimates and assumptions. However, forward-looking statements, information and opinions are inherently uncertain and actual events or results may differ materially from those reflected in the forward-looking statements. Therefore, undue reliance should not be placed on such forward-looking statements, information and opinions.

No content on this website is intended to provide tax or legal advice. You are advised to seek advice on these matters from separately retained professionals.

All index returns, unless otherwise noted, are presented as price returns and have been obtained from Bloomberg. Indices are unmanaged and cannot be purchased directly by investors.

Doug Walters

Doug Walters