Perspectives Q3 2019

Investor uncertainty was on display in Q3, with U.S. stocks ending the quarter flat after a bumpy ride.

Dissecting Q3 2019

Contributed by Doug Walters , Max Berkovich

Stocks ended the quarter up, barely, as the Fed took action that helped soothe frayed nerves in a volatile Q3. Investors are in a period of heightened uncertainty. Is the economy heading to a slowdown? Will tariffs impact growth? How will securities react to impeachment proceedings? It is no surprise that Q3 was a bumpy ride for investors. There are signs that investors are becoming more cautious, but we would warn against trying to time this market. History is rife with examples of timing gone wrong. In the wise words of famed investor Peter Lynch, “Far more money has been lost by investors preparing for corrections, or trying to anticipate corrections, than has been lost in corrections themselves.”

Equities Pause

Recent trends continued with large-cap and domestic stocks outpacing small-cap and international stocks, respectively. We would still classify large-cap valuations as being in the normal range, albeit at the high end of normal. International stocks are valued in line with their long-term average, while small-cap stocks have slipped below trend.

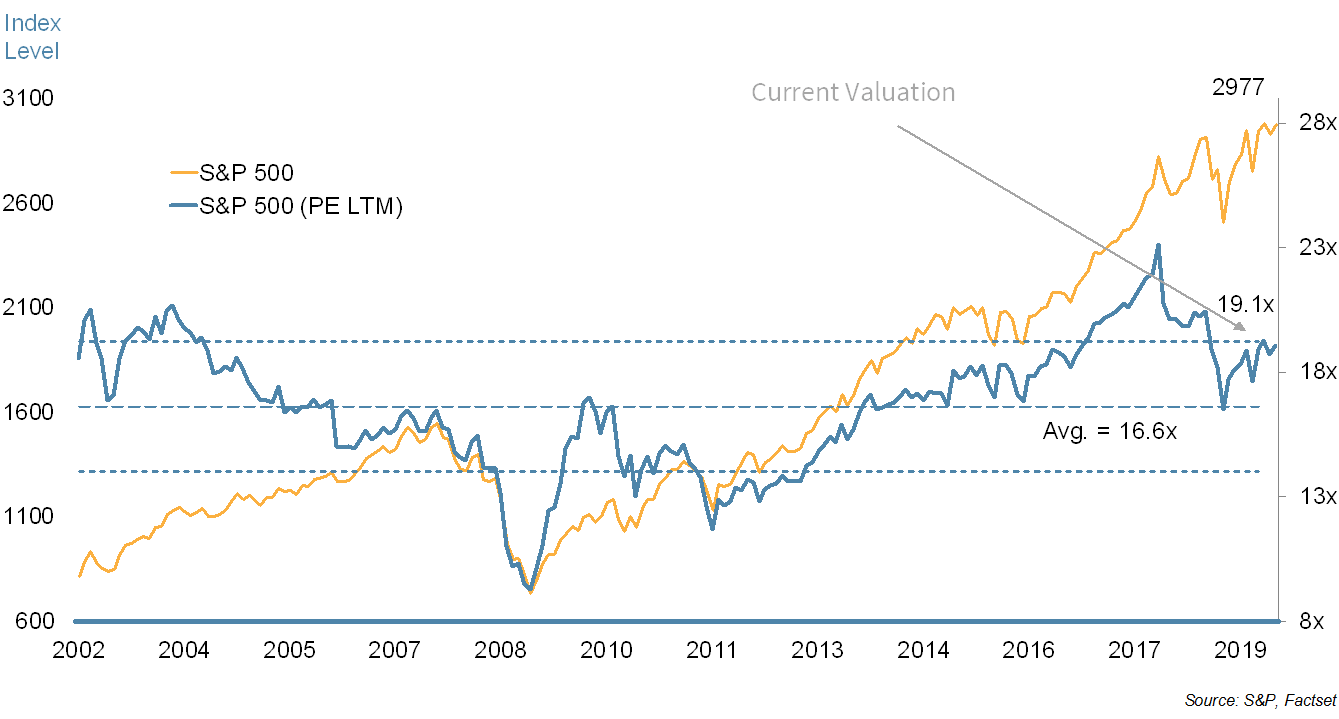

Chart 1: Large-cap equity valuations at the high end of normal

Stocks were flat in Q3, but so were earnings, leaving valuations little changed.

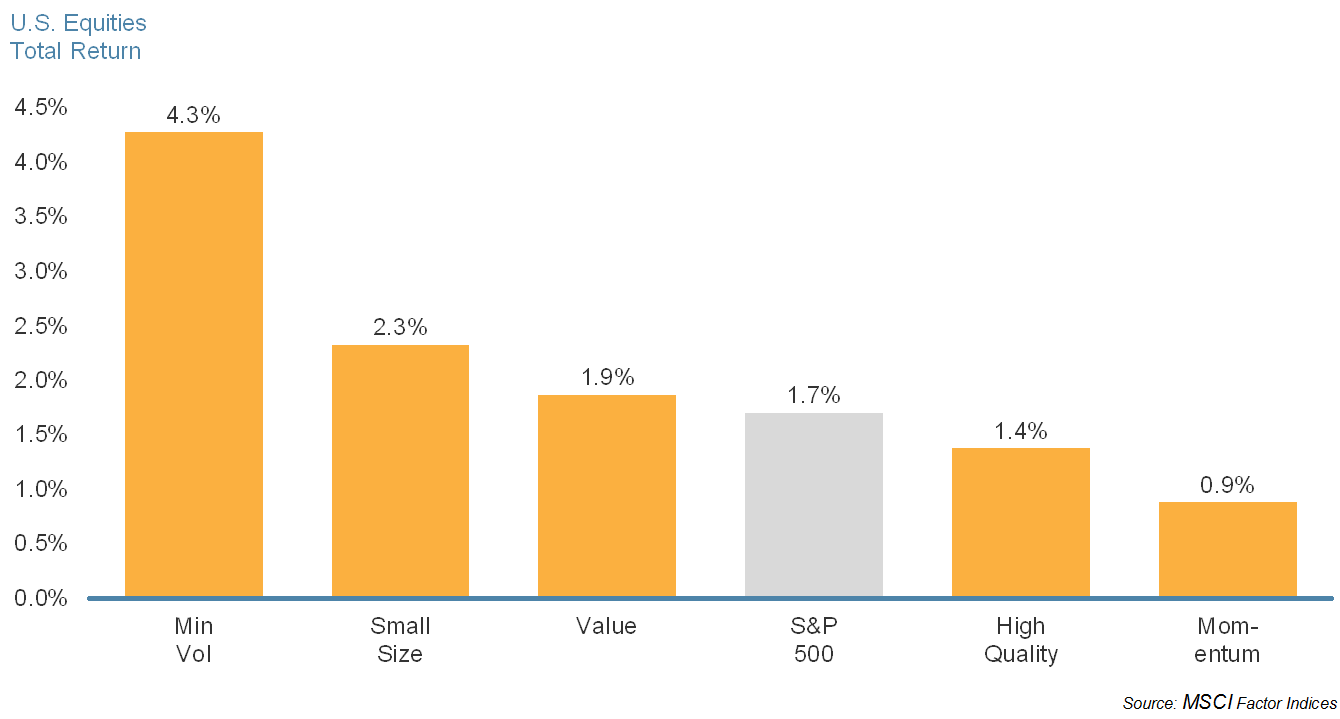

Historically there are five stock characteristics that have been persistently rewarded: Good Value, High Quality, High Momentum, Small Size, and Minimum Volatility. Looking at performance through this lens for U.S. equities, we see that in Q3, Minimum Volatility was the most rewarded factor followed by Small Size. Minimum Volatility is a defensive factor that tends to perform best as the economy slows or contracts. Investors appear to be preparing for a late-cycle economy.

Chart 2: U.S. Factors. Minimum Volatility outperformed in an uncertain environment

Minimum Volatility was the star this quarter as investors were drawn to its defensive characteristics.

More Dovish

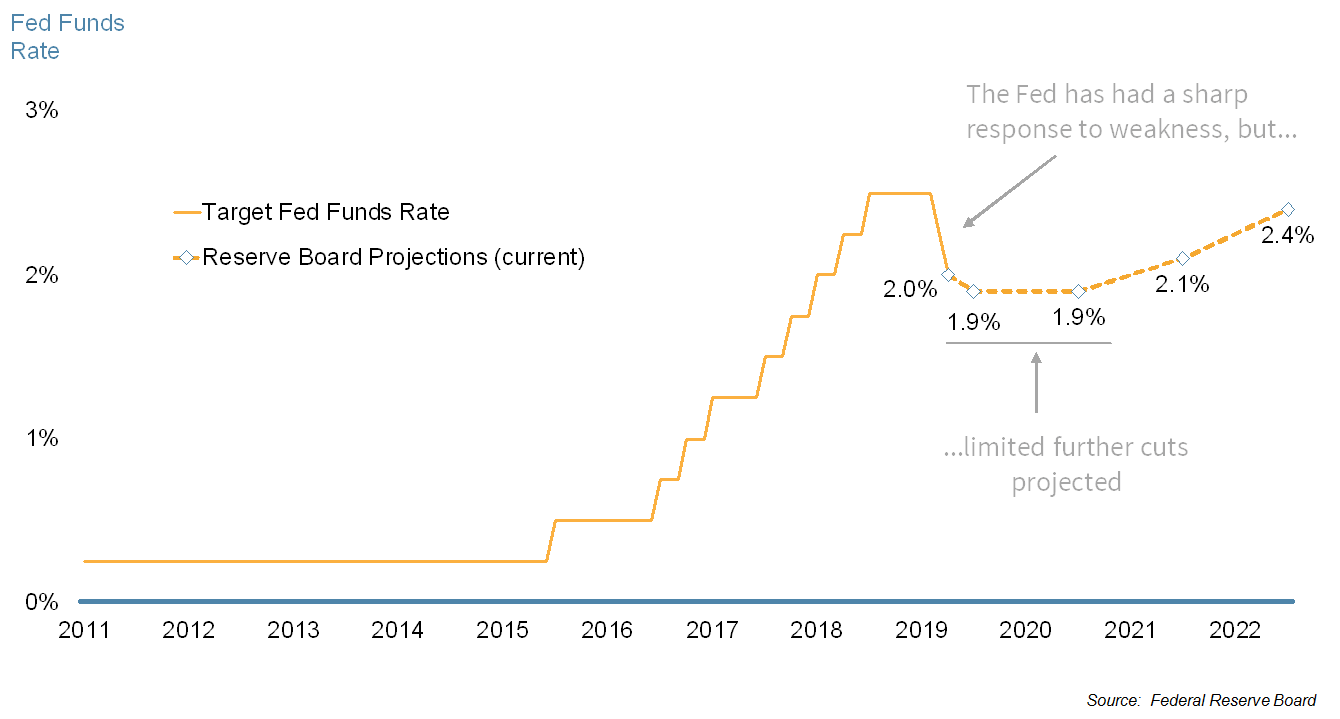

While equities were flat, fixed income was anything but. With growth tempering, trade tensions heightening, and inflation remaining stubbornly low, the Fed acted, lowering rates twice. Bond yields fell further, adding to an already impressive year for fixed income returns (as yields fall, bond prices rise). Investors are anticipating another 0.25-0.50% cut by year-end, which is somewhat in contrast to the Feds’ projection showing rates bottoming out just below current levels. Despite projections, we expect the Fed to stay nimble and ready to step in when needed.

Chart 3: The Fed proved nimble in Q3, cutting rates twice

The Fed cut rates twice in Q3. While they project we are near the bottom, investors are anticipating that more cuts will be necessary.

Asset Roundup

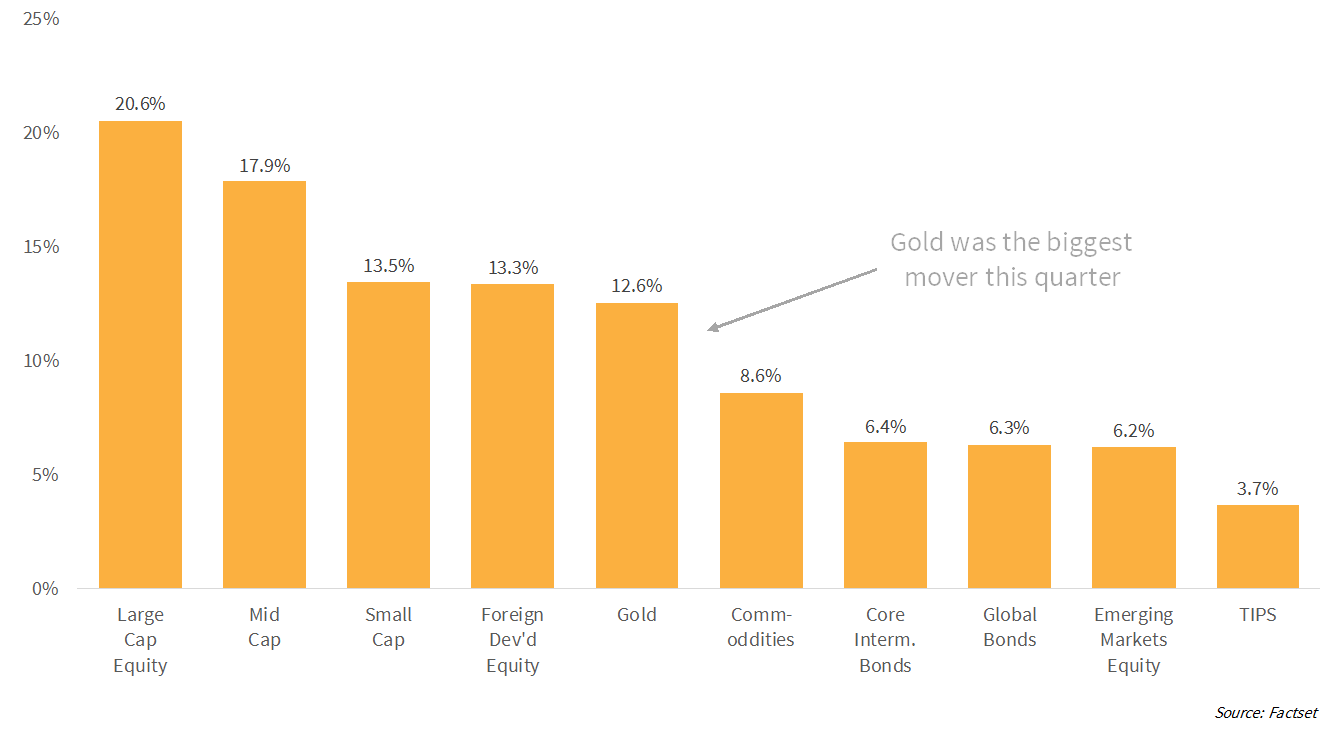

Gold was the best performing asset class in Q3, but year-to-date, U.S. large cap equities remain on top. Bonds put in a positive performance thanks in part to the Fed rate cuts. While the year-to-date performance figures in the chart below look impressive across the board, we would urge investors not to be complacent. The recent strong performance of Gold and Minimum Volatility stocks give insight into current investor sentiment: they are turning more defensive. Could we be moving closer to the end of the current cycle? Possibly. But it is also possible that after taking a breather in Q3, stocks are primed for another leg up. For investors, the goal should not be trying to predict the unknown, but rather to prepare for it with a well-diversified portfolio, poised to take advantage of any opportunities that the market offers.

Chart 4: Asset classes are up across the board this year

Gold made a big move up the chart this quarter, but U.S. large-cap equities are still the market leader.

The Q4 2019 Playbook

Investors appear to be turning a little more defensive, and it is hard to blame them. In addition to the uncertainty introduced by tariff wars and an impeachment inquiry, there are some signs of economic slowdown which are culminating in weaker leading indicator data, not to mention a partially inverted yield curve. In such an environment, how should investors be positioned as we enter the final quarter of 2019?

First off, this is no time to panic (in fact, there is never a time to panic in investing). While the U.S. economy is not without blemishes, we would still classify it as robust. The unemployment rate is low, wage growth is outpacing inflation, and the all-important consumer remains confident. And let’s not forget the Fed appears willing to do whatever is necessary to continue the expansion. Would-be market timers, ready to pull the plug on equities, have been forewarned.

In a maturing economic cycle, with uncertainty above average, our approach is to:

- Overweight investment “factors” that have shown to persistently advantage portfolios throughout the cycle: High Quality, Good Value, Small Size, High Momentum, and Minimum Volatility.

- Tilt our factor exposure toward Minimum Volatility, which has historically held up better in a slowing and contracting economy.

- Enhance equity diversification. We believe in owning just as much Small and Mid Cap exposure as Large Cap. In addition, we hold a sizable exposure to international equities, which not only provide natural diversification but also happen to be relatively inexpensive currently.

- Include Gold as part of portfolio protection. Gold provides some inflation protection yet has low correlation to the stock market, improving the risk-adjusted returns of the portfolio.

About Strategic

Founded in 1979, Strategic is a leading investment and wealth management firm managing and advising on client assets of over $2 billion.

OverviewDisclosures

Strategic Financial Services, Inc. is a SEC-registered investment advisor. The term “registered” does not imply a certain level of skill or training. “Registered” means the company has filed the necessary documentation to maintain registration as an investment advisor with the Securities and Exchange Commission.

The information contained on this site is for informational purposes and should not be considered investment advice or a recommendation of any particular security, strategy or investment product. Every client situation is different. Strategic manages customized portfolios that seek to properly reflect the particular risk and return objectives of each individual client. The discussion of any investments is for illustrative purposes only and there is no assurance that the adviser will make any investments with the same or similar characteristics as any investments presented. The investments identified and described do not represent all of the investments purchased or sold for client accounts. Any representative investments discussed were selected based on a number of factors including recent company news or earnings release. The reader should not assume that an investment identified was or will be profitable. All investments contain risk and may lose value. There is no assurance that any investments identified will remain in client accounts at the time you receive this document.

Some of the material presented is based upon forward-looking statements, information and opinions, including descriptions of anticipated market changes and expectations of future activity. Strategic Financial Services believes that such statements, information, and opinions are based upon reasonable estimates and assumptions. However, forward-looking statements, information and opinions are inherently uncertain and actual events or results may differ materially from those reflected in the forward-looking statements. Therefore, undue reliance should not be placed on such forward-looking statements, information and opinions.

No content on this website is intended to provide tax or legal advice. You are advised to seek advice on these matters from separately retained professionals.

All index returns, unless otherwise noted, are presented as price returns and have been obtained from Bloomberg. Indices are unmanaged and cannot be purchased directly by investors.

Doug Walters

Doug Walters