The Greatest of All Time

As the world loses an icon, stocks were flat on the week. The market focused on Friday’s labor report which left investors once again waiting for the economic recovery to accelerate and for the Federal Reserve to retreat.

Market Review

Contributed by Alan Leist, III

Bombshell

Friday’s labor report (explored in detail below) further muddles the economic and market picture in a world that hangs on every word from the Fed.

- We have long-argued that ineffective and dysfunctional fiscal policy has been masked by hyper-aggressive monetary policy – a game that can only end in tears.

- If elections are indeed about “the economy, stupid”, than we can expect this issue to rise to the surface and maybe, just maybe, finally lead to a substantive policy debate ahead of November’s contests.

Home is Where the Cash is

10 years after the peak of the housing bubble, S&P/Case Shiller reports that home prices are now only 4% below the all-time high.

- Note: Adjusted for inflation, we are still 20% below the peak.

- One reason for the recent rise in prices is a lack of new inventory – especially at the lower end of the market where builders have steered clear of borrowers less likely to find financing on the back-end of the Great Recession.

- Nevertheless, as the Fed looks for an economic bright spot and an excuse to continue raising rates, housing is at least providing a glimmer of hope.

| Indices & Price Returns | Week (%) | Year (%) |

|---|---|---|

| S&P 500 | 0.0 | 2.7 |

| S&P 400 (Mid Cap) | 0.6 | 7.3 |

| Russell 2000 (Small Cap) | 1.2 | 2.5 |

| MSCI EAFE (Developed International) | 0.1 | -2.6 |

| MSCI Emerging Markets | 1.0 | 2.8 |

| S&P GSCI (Commodities) | 0.6 | 20.0 |

| Gold | 2.8 | 17.2 |

| MSCI U.S. REIT Index | 0.9 | 5.7 |

| Barclays Int Govt Credit | 0.4 | 2.2 |

| Barclays US TIPS | 0.7 | 4.9 |

Economic Commentary

Contributed by Max Berkovich

Miserable May

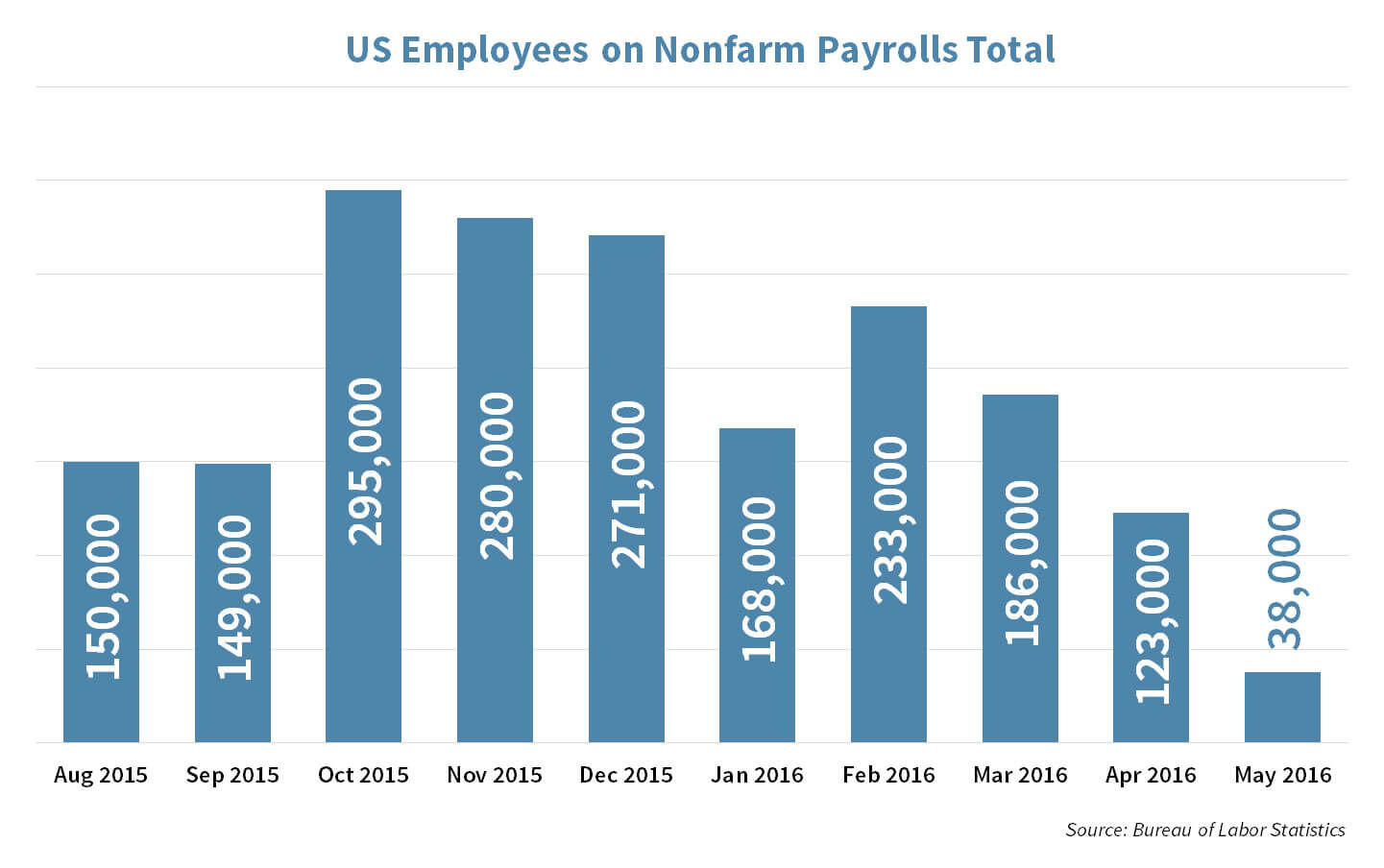

After a decent run of 170,000 monthly job gains the past 6 months, the hot-ish streak came to a halt. The May Non-Farm Payroll increase was a minuscule 38,000. To add insult to injury the revisions for previous months totaled a reduction of 59,000.

We Can Hear Them

The big strike at Verizon (now resolved) was expected to weigh on the report, but it subtracted only about 35,000 jobs. A 73,000 job print would still be a very weak report.

Good is Bad and Bad is Good

Counterintuitively, the unemployment rate slid by 0.3% to 4.7% because 458,000 people exited the work force. Unemployment is down because fewer people are looking to work. The labor participation rate is now just 62.2% moving us back to the December 2015 level.

Fed Bet

The Federal Reserve was all but certain to raise the Fed Funds Rate in June after some masterful expectation setting by the various Bank presidents, but this awful jobs number along with previous month revisions should take June and maybe July off of the table.

Week Ahead

Brotherly Love for Yellen?

Fed Chair Janet Yellen will be speaking to the World Affairs Council in Philadelphia on Monday in her first public appearance following Friday’s monthly jobs report, the weakest release since 2010.

- Investors on will be watching her every word regarding the recent jobs report and the implications that it could have on the timing of an impending hike.

California Love

Democratic Primaries will be in the forefront on Tuesday as Hillary Clinton looks to lock up the nomination with a win in California.

- A loss in the state could potentially lead to the race not being settled until the Democratic National Convention in late July.

- Primaries will also be occurring in NJ, NM, ND, SD, and MT next week.

A Strategic Final

Not only are two NBA MVP’s currently squaring off in the 2016 NBA Finals for a rematch of the 2015 contest, but the Finals will also feature a few of Strategic’s holdings.

The entire best of 7 game series will be broadcast on ABC which falls under the umbrella of Strategic holding Disney (DIS).

- Nike (NKE), also a Strategic holding, is the lifetime sponsor of the Cavs’ Lebron James who is matched up against current MVP Steph Curry of the Golden State Warriors. Curry is backed by Under Armour (UA) which we do not own.

Strategy Update

Contributed by David Lemire , Max Berkovich

Strategic Asset allocation

Economic hiccup?

Before the jobs disappointment, Large Value had hit a 9-month high having pushed past 18% since its February low. Small Cap also has made moves higher cresting over 10% since early March lows. These are just two of the contributors to higher equity allocations of late.

Follow the curve

The jobs number could be vindication for the bond market which largely has not bought the Fed’s assessment of the economy. Long rates have declined generally by 0.50% this year with shorter rates having moved higher in anticipation of a Fed hike. The resulting flatter yield curve highlights these diverging views.

Bond Recycling

Given the rate picture and a Fed itching to hike, we have been selectively trading in shorter maturities for more attractive coupons with less rate hike risk.

Strategic Growth

En Vogue

Health Care stocks were en fuego this week as defensive sector rotation and decent value created a bid. Speaking of health care…

- Johnson & Johnson (JNJ) known as a pharmaceutical and medical equipment maker took a swing at a bigger chunk of the personal care market with an acquisition of a privately held company Vogue International. The $3.3Bil cash deal is tiny compared to the near $315Bil market cap of JNJ, but it is interesting in that the move comes after another strategy holding Ulta Beauty Salons (ULTA) showcased how profitable the space can be.

Strategic Equity Income

Bank Shot

Friday’s jobs report changed the direction of the strategy. Interest rate sensitive names clawed back all of the week’s losses, while financials sold off on lower rates. On the earnings front…

- Medtronic PLC (MDT) a medical device maker, reported a slight beat for the quarter, but more impressive numbers were on the year over year basis. Revenue was up 42% and earnings were up 32%. Those numbers were impacted by the transformative acquisition of Covidien in 2015.

About Strategic

Founded in 1979, Strategic is a leading investment and wealth management firm managing and advising on client assets of over $2 billion.

OverviewDisclosures

Strategic Financial Services, Inc. is a SEC-registered investment advisor. The term “registered” does not imply a certain level of skill or training. “Registered” means the company has filed the necessary documentation to maintain registration as an investment advisor with the Securities and Exchange Commission.

The information contained on this site is for informational purposes and should not be considered investment advice or a recommendation of any particular security, strategy or investment product. Every client situation is different. Strategic manages customized portfolios that seek to properly reflect the particular risk and return objectives of each individual client. The discussion of any investments is for illustrative purposes only and there is no assurance that the adviser will make any investments with the same or similar characteristics as any investments presented. The investments identified and described do not represent all of the investments purchased or sold for client accounts. Any representative investments discussed were selected based on a number of factors including recent company news or earnings release. The reader should not assume that an investment identified was or will be profitable. All investments contain risk and may lose value. There is no assurance that any investments identified will remain in client accounts at the time you receive this document.

Some of the material presented is based upon forward-looking statements, information and opinions, including descriptions of anticipated market changes and expectations of future activity. Strategic Financial Services believes that such statements, information, and opinions are based upon reasonable estimates and assumptions. However, forward-looking statements, information and opinions are inherently uncertain and actual events or results may differ materially from those reflected in the forward-looking statements. Therefore, undue reliance should not be placed on such forward-looking statements, information and opinions.

No content on this website is intended to provide tax or legal advice. You are advised to seek advice on these matters from separately retained professionals.

All index returns, unless otherwise noted, are presented as price returns and have been obtained from Bloomberg. Indices are unmanaged and cannot be purchased directly by investors.

Alan Leist III

Alan Leist III