Springing Forward

Stocks closed out an impressive four week rally with enthusiasm on Friday. The S&P 500 is closing in on unchanged for the year after a difficult start. Economic stability and monetary stimulus are among the themes that have kept the party going.

Market Commentary

Contributed by Doug Walters

America is Still Great

The rise in U.S. equities, which is now in its fourth week, should come as no surprise to our readers (see link). Despite the naysayers, we continue to see the U.S. economy showing resilience relative to its global peers. While growth is not extraordinary, it is positive, and the job picture continues to show steady improvement.

- Market volatility will continue to be the norm this year as noise from the Federal Reserve, oil markets, china and the like dominates the airwaves. However, ultimately economic fundamentals prevail, and fundamentals remain in reasonably good shape.

A Problem, Made in China

The rebounding U.S. equity market is cause for celebration, but the real excitement this week was overseas. The European Central Bank’s president Mario Draghi surprised the market with his stimulus plan, sending European equities on a two day roller-coaster ride (see our Economic Commentary). China held its National People’s Congress this week, laying out priorities for the year and outlining the government’s five-year plan.

- Evident in the report is the damage of untethered growth which has left a legacy of pollution and oversupply in many industries. The five-year plan focuses on addressing these issues, but the effects may be felt for generations.

- China’s difficulties remain a risk to global growth, but one that is now better-understood. Concern about the ultimate impact on U.S. equities persists, but for now it is Chinese equities that are underperforming, trailing the broader Emerging Markets index this past year.

| Indices & Price Returns | Week (%) | Year (%) |

|---|---|---|

| S&P 500 | 1.1 | -1.1 |

| S&P 400 (Mid Cap) | 0.6 | 0.6 |

| Russell 2000 (Small Cap) | 0.5 | -4.3 |

| MSCI EAFE (Developed International) | 1.0 | -4.2 |

| MSCI Emerging Markets | 0.0 | -0.4 |

| S&P GSCI (Commodities) | 4.0 | 5.1 |

| Gold | -0.9 | 17.7 |

| MSCI U.S. REIT Index | 1.7 | 1.4 |

| Barclays Int Govt Credit | -0.2 | 1 |

| Barclays US TIPS | -0.5 | 2.2 |

Economic Commentary

Super Mario Acts

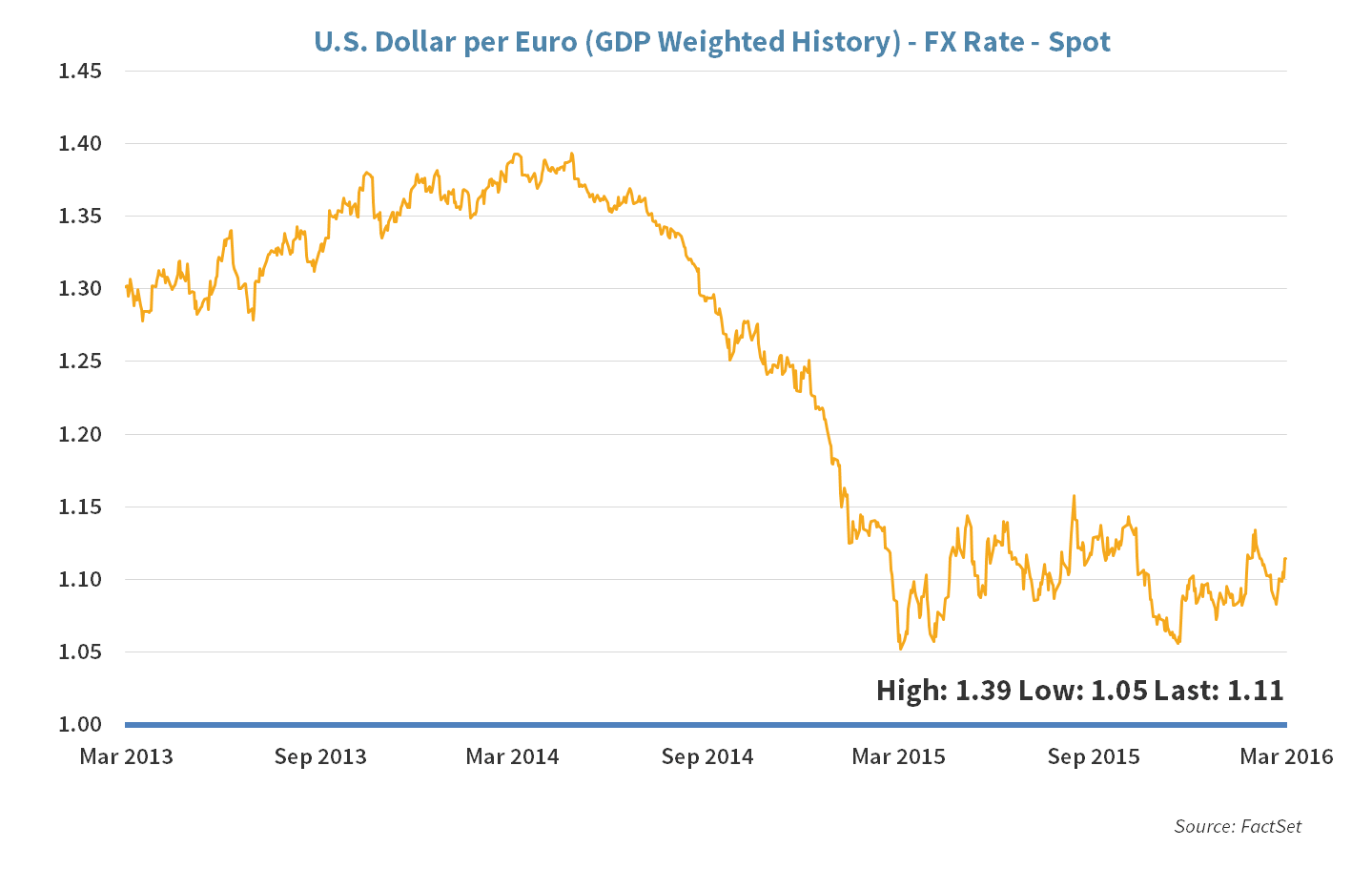

European Central Bank President Mario Draghi continued to deliver on his promise made over three years ago “to do whatever it takes” to stimulate the European economy. In that spirit, he has weakened the Euro to boost exports and lowered interest rates to encourage companies to borrow, and therefore spend more. The more money that circulates, the faster the continent will recover from its recent recession. The chart below shows Draghi has been successful in devaluating the Euro.

Draghi’s actions this past Thursday were bold as he:

- lowered the central bank’s main refinancing rates to 0%,

- lowered the marginal lending facility rate to 0.25%,

- lowered the deposit facility rate to -0.40% and perhaps most importantly,

- raised the bank’s asset purchase program from €60 billion per month to €80 billion.

Not only did Draghi increase the purchase program amount materially, he also decided to buy European corporate bonds in addition to the government bonds he was already buying. This is a positive for our bond investments as they trade relatively to the corporate bonds he is buying.

Draghi has signaled that further rate cuts are unlikely as there is simply no more room to cut. In our view however, he will continue to use the asset purchase program to stimulate the economy as his capacity to create money is endless.

Week Ahead

Contributed by Aaron Evans

Steady Fed-y

The Federal Reserve will hold its monthly policy meeting next week in D.C.

- The majority believes there is zero chance of the Fed taking any action next week with regards to the benchmark interest rate.

- With the March market rally and energy prices stabilizing, a small faction are however calling for the Fed to follow through on its intentions to raise rates throughout the year.

Delegate Situation

The primary battlegrounds shift to five large states next week in terms of their number of delegates for the party conventions (691 Democratic and 358 Republican).

Macro Mix

Domestic data due out next week include February reports on retail sales, inflation and housing starts.

- Inflation should come in under the Fed’s 2% target level, while higher housing starts were likely offset by slower consumer spending. Both outcomes would support a slow and steady hiking pace from the Federal Reserve.

Strategy Update

Contributed by Max Berkovich

Strategic Asset Allocation

Spring Fever

With spring training in full swing, equity markets also are trying to get back in shape. Fears of drowning in oil have eased as have recessionary concerns. Interestingly, diverging monetary policy directions in Europe and the U.S. have been received well by both markets. Since plumbing some near term lows in mid-February, most equity markets have posted double digit gains and are now flirting with break-even for the year.

Round trip with Emerging Markets

This past Christmas saw Emerging Markets start a just over 14% correction over the ensuing weeks. However, the past few weeks the market has rebounded over 15% almost making investors whole over that time. Double digits moves of this sort are not uncommon for this asset class.

Source of funds?

Gold and long-bonds have declined recently after big rallies as equities have stolen the show in recent weeks but the moves are not indicative of a bigger sell-off. More definitive signs of a hawkish Fed could be needed to push longer term rates higher, and stop gold’s year-to-date strength.

Strategic Growth

Fairy tales do come true

With crude prices moving back towards $40 per barrel, the energy sector was this week’s leader, while financials lagged. In other strategy news…

- Ulta Salon (ULTA) continued its streak of topping expectations and grew sales by double digits. The specialty retailer increased guidance and announced an accelerated $200 million stock buyback program. E–commerce sales jumped 44% year over year and this was the 8th straight quarter of at least 19% revenue growth.

Strategic Equity Income

Turning the corner

Health Care stocks quietly finished the week on top, while the Industrial sector lagged. In other news…

- Chevron Corp. (CVX) held a meeting with Wall Street analysts this week. The company informed investors of plans for capital expenditure cuts and indicated some of its capital intensive projects are winding down. With positive statements on its cash flow, investors were assured of not only the safety of the 4.5% yield, but also that there is room to continue to grow the dividend despite low oil prices.

About Strategic

Founded in 1979, Strategic is a leading investment and wealth management firm managing and advising on client assets of over $2 billion.

OverviewDisclosures

Strategic Financial Services, Inc. is a SEC-registered investment advisor. The term “registered” does not imply a certain level of skill or training. “Registered” means the company has filed the necessary documentation to maintain registration as an investment advisor with the Securities and Exchange Commission.

The information contained on this site is for informational purposes and should not be considered investment advice or a recommendation of any particular security, strategy or investment product. Every client situation is different. Strategic manages customized portfolios that seek to properly reflect the particular risk and return objectives of each individual client. The discussion of any investments is for illustrative purposes only and there is no assurance that the adviser will make any investments with the same or similar characteristics as any investments presented. The investments identified and described do not represent all of the investments purchased or sold for client accounts. Any representative investments discussed were selected based on a number of factors including recent company news or earnings release. The reader should not assume that an investment identified was or will be profitable. All investments contain risk and may lose value. There is no assurance that any investments identified will remain in client accounts at the time you receive this document.

Some of the material presented is based upon forward-looking statements, information and opinions, including descriptions of anticipated market changes and expectations of future activity. Strategic Financial Services believes that such statements, information, and opinions are based upon reasonable estimates and assumptions. However, forward-looking statements, information and opinions are inherently uncertain and actual events or results may differ materially from those reflected in the forward-looking statements. Therefore, undue reliance should not be placed on such forward-looking statements, information and opinions.

No content on this website is intended to provide tax or legal advice. You are advised to seek advice on these matters from separately retained professionals.

All index returns, unless otherwise noted, are presented as price returns and have been obtained from Bloomberg. Indices are unmanaged and cannot be purchased directly by investors.

Alan Leist III

Alan Leist III