Rising Above Uncertainty

A wild ride this week in U.S. equities was driven by rising uncertainty. Thoughtful investors and consumers will find opportunities in these volatile times.

Contributed by Doug Walters , Max Berkovich , ,

Sitting at my desk on Friday morning, with CNBC on in the background doing their best to spread market fear with overly dramatic headlines, it occurred to me that U.S. equities were up on the week. It did not feel like it had been a good week in the markets, yet here we were, going into Friday with stocks in positive territory. Last week in our report (Panic or Profit?), we touched on the explanation. U.S. stocks were incredibly volatile this week, with the first four days of trading up 5%, down 3%, up 4%, down 3%. Even though the magnitude of the up days outweighed the down days, there is a natural tendency for humans to dwell more on the negative. For investors, this can lead to unnecessary angst and irrational decision-making. If you are feeling this, my first recommendation… turn off CNBC.

While U.S. equities did not finish the week in positive territory, there was at least a cessation of the one-way trip down that started on February 20th. The volatility, while impressive, is understandable given the backdrop of a global coronavirus epidemic combined with an ever-shifting political landscape in a presidential election year. Uncertainty will generally drive down stock prices, and investors find themselves awash in it. Do we see a near-term end to the slide? We never try to predict the unpredictable. Instead, we systematically take advantage of the opportunities that these dislocations present to patient investors.

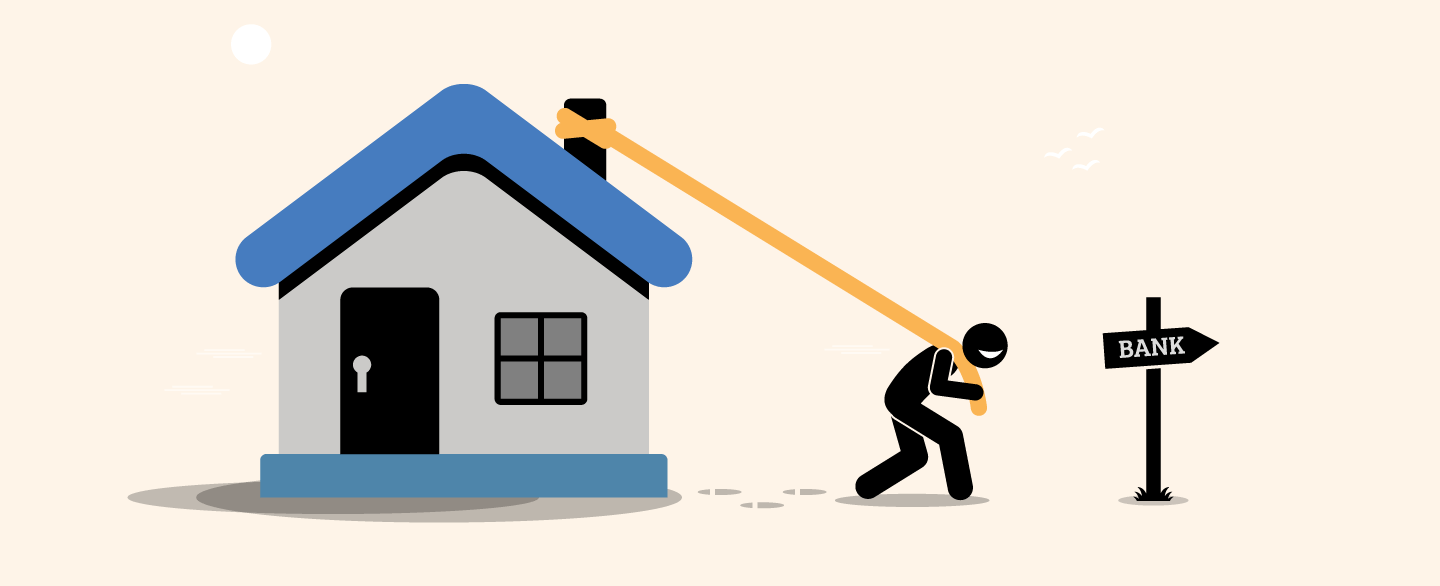

One opportunity we are encouraging our clients to look into is mortgage refinancing as interest rates slide (see spotlight section below).

Spotlight: The Going Rate

With Mortgage Rates So Low, Is Now A Good Time To Refinance?

The Federal Reserve’s recent interest rate cut has also impacted mortgage rates; notably bringing the current average 30-year fixed mortgage rate to 3.29%1. These historically low mortgage rates provide existing homeowners, along with first-time buyers, with potential opportunities to take advantage of locking in very favorable rates. For those would-be homeowners out there, now is a great time to buy from a financing standpoint.

Existing homeowners may want to review their current mortgage, particularly focusing on their remaining term and current interest rate versus market rates. The decision of whether or not refinancing makes financial sense will also depend upon personal objectives (i.e. minimize lifetime interest expense or free up cash flow) and refinancing expenses.

There are many important factors that should ultimately be considered before making this decision but the interest rate environment and mortgage market is objectively providing attractive opportunities. As always, please contact us if we can be of service.

1. Source: https://fred.stlouisfed.org/series/MORTGAGE30US

Headlines This Week

Jobs Well Done!

- The U.S. economy added 273,000 jobs in February, way above Street consensus of 174,000.

- The prior two months were also revised higher by 85,000.

- The average hourly earnings grew by 3% in February on a year-over-year basis.

Emergency Rate Cut

- The Fed reduced the overnight lending rate by 0.5% this Tuesday to respond to fears over the Coronavirus.

- The Dallas Fed President Kaplan said that the Fed should act faster and more aggressively to make a meaningful impact on the economy.

Refi-Boom 2020

- The mortgage refinance boom began in January and now is at the full throttle, as the 30-year Treasury yield touched an all-time low.

- The 10-year Treasury was trading below 0.7% on Friday, while the 2-year rate slipped below 0.5%.

Being Crude

- The talks between Russia and other OPEC members ended without a deal, causing a swift decline in global oil prices. Saudi Arabia is demanding deep cuts from OPEC members to respond to the oil glut in the market.

- Russia stated back in November that it is difficult for the country to meaningfully cut oil production during the winter months, especially in the Siberian region. According to their experts, an oil well could explode if halted in cold conditions.

Tidings from China

- Starbucks (SBUX) said on Thursday that more than 90% of its stores in China are open.

- While the stores are operating at reduced hours, the company is saying that signs of recovery in China are ‘encouraging.’

The Week Ahead

Oracle Corp (ORCL) and Ulta Beauty (ULTA) report next week.

- Ulta is expected to continue its strong recent performance and grow its earnings.

The European Central Bank releases its interest rate decision on Thursday.

- Given the U.S. Federal Reserve’s surprise rate cut this week, experts feel the ECB is under pressure to follow suit.

- However, with rates currently at -0.5%, many feel there is not much room left for the ECB to operate, at least with traditional tools.

February figures for the U.S. Consumer Price Index on Wednesday.

- The year-over-year figures are expected to decline slightly, while the month-over-month numbers are predicted to remain steady.

- There will be U.S. Treasury Auctions for 10-year and 30-year bonds during the week. Markets will carefully gauge the demand for these bonds with all-time low rates.

Don’t forget to set your clocks an hour ahead on Sunday as Daylight Saving Time begins.

- The majority of the U.S. states observe DST, with the exception of some parts of Arizona and all of Hawaii.

Stock Highlights from Max

What about Bob?

A tragic tornado in Tennessee this week was not the only tornado to hit. The current risk-off move to bonds has caused a tornado for the Financials sector. With lower rates, banks took a big hit as declining interest income is expected to sting earnings. No surprise, the sector was the biggest laggard. The Healthcare sector was a star, boosted by a relief rally in health insurers thanks to the rising prospect of Vice President Biden and the declining hopes for Senator Sanders in the Democratic Presidential nominating process. The biggest winner this week, though, would be the Consumer Staples sector thanks to…

![]()

- Costco Wholesale Corp. (COST) reported a solid quarter and dazzled with a comparable sales growth figure of 7.9% for the quarter. Expectations were for a 5.7% increase. A 28% rise in e-commerce sales was also helpful. The glaring number was an 11.7% comparable sales jump for February. This increase, of course, is due to the hoarding of food and goods in response to the coronavirus outbreak and may not be expected to repeat. Speaking of earnings…

- A prior week’s earning report from TJX Companies, Inc. (TJX) also dazzled. TJX’s comparable sales were up 6% in the 4th quarter of last year, almost doubling expectations. Speaking of the previous week…

![]()

- The Walt Disney Co. (DIS) caught everyone off-guard when it announced the immediate exit of Bob Iger from the CEO position. Another Bob (Chapek) was named his successor. Chapek, a nearly 30-year veteran of Disney, was chief of Parks division before his promotion. When Iger was asked, “why now?” he sited a successful acquisition of Fox Media, a hugely successful launch of Disney Plus+, and that he is ready to focus on the creative side of the business. What about Bob Iger? He will stay on as executive chairman of the company through December 31, 2021, which should aid in a smooth transition from Bob to Bob. While both Bob’s are well-accomplished, we prefer our Bob!

About Strategic

Founded in 1979, Strategic is a leading investment and wealth management firm managing and advising on client assets of over $2 billion.

OverviewDisclosures

Strategic Financial Services, Inc. is a SEC-registered investment advisor. The term “registered” does not imply a certain level of skill or training. “Registered” means the company has filed the necessary documentation to maintain registration as an investment advisor with the Securities and Exchange Commission.

The information contained on this site is for informational purposes and should not be considered investment advice or a recommendation of any particular security, strategy or investment product. Every client situation is different. Strategic manages customized portfolios that seek to properly reflect the particular risk and return objectives of each individual client. The discussion of any investments is for illustrative purposes only and there is no assurance that the adviser will make any investments with the same or similar characteristics as any investments presented. The investments identified and described do not represent all of the investments purchased or sold for client accounts. Any representative investments discussed were selected based on a number of factors including recent company news or earnings release. The reader should not assume that an investment identified was or will be profitable. All investments contain risk and may lose value. There is no assurance that any investments identified will remain in client accounts at the time you receive this document.

Some of the material presented is based upon forward-looking statements, information and opinions, including descriptions of anticipated market changes and expectations of future activity. Strategic Financial Services believes that such statements, information, and opinions are based upon reasonable estimates and assumptions. However, forward-looking statements, information and opinions are inherently uncertain and actual events or results may differ materially from those reflected in the forward-looking statements. Therefore, undue reliance should not be placed on such forward-looking statements, information and opinions.

No content on this website is intended to provide tax or legal advice. You are advised to seek advice on these matters from separately retained professionals.

All index returns, unless otherwise noted, are presented as price returns and have been obtained from Bloomberg. Indices are unmanaged and cannot be purchased directly by investors.

Doug Walters

Doug Walters