Panic or Profit?

In times of market stress, investors are faced with the option of panic or profit. While humans are wired through evolution to flee loss, this tendency is not well-suited for investing.

Contributed by Doug Walters , Max Berkovich , ,

With investor emotions running high, we deviate from our standard Insights to take a deep dive into recent market moves and provide a roadmap for avoiding common behavioral pitfalls.

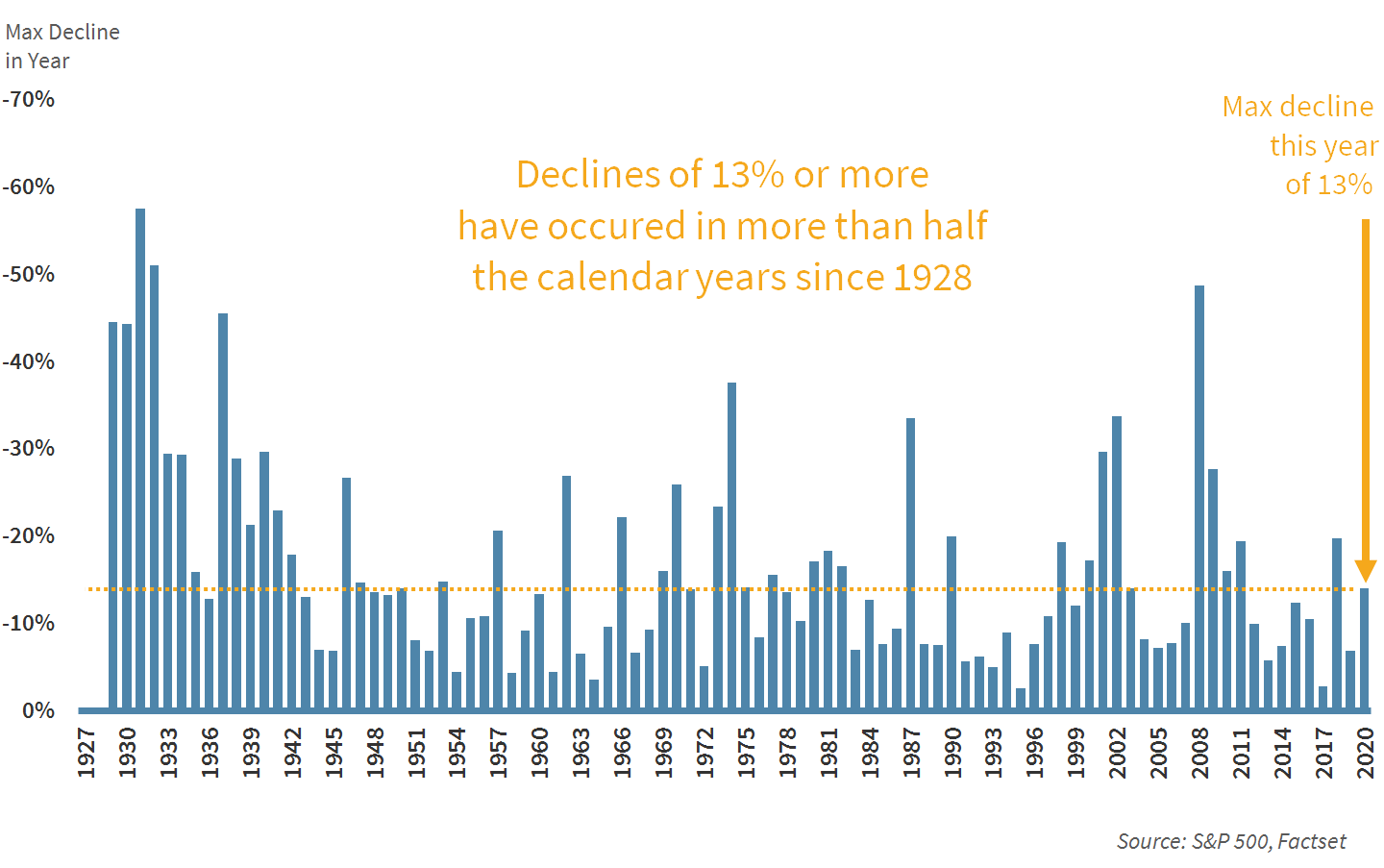

U.S. stocks fell sharply, extending last week’s losses. Equities are down around 13% since last Wednesday’s all-time high as fears spread that the Coronavirus will disrupt global trade and impact corporate profitability. As painful as this can feel, declines of 13% in a year are not unusual. In fact, since 1928, stocks have dropped at least that much in over half of the years (see chart below). What makes this week’s move unique is its speed. By comparison, stocks fell nearly 20% in 2018, but that was spread over three months. Such is the nature of the stock market. Equities are volatile, and the reward for the patient investor historically has been attractive gains!

Figure 1: Maximum declines of the S&P 500 by year

Despite big moves in stocks being normal, when we get a shock like we had this week, we tend to see two responses from investors: panic and profit.

Panic!

The “panic” response to declining markets is to run for the hills. Risk aversion is a natural human behavioral bias. We are wired for survival and feel strong emotions in the face of loss. A famous study (Shiv et al., 2005) looked at this behavior. It demonstrated, with a simple coin flip, that investors are much more likely to invest after experiencing profit than they are after experiencing loss. This, despite the odds of winning being a constant 50%. Those who follow instinct and panic in the face of market disruption are at risk of damaging long-term returns.

Profit!

The patient investor who can set aside their natural behavioral biases has a chance to profit in the face of disruption. A stock market decline of 13% has opened opportunities that did not exist two weeks ago. Nobody likes to see their investment portfolio decline, but rational long-term investors will see this market move as an opportunity to identify some newly discounted stock market bargains.

The Big Picture

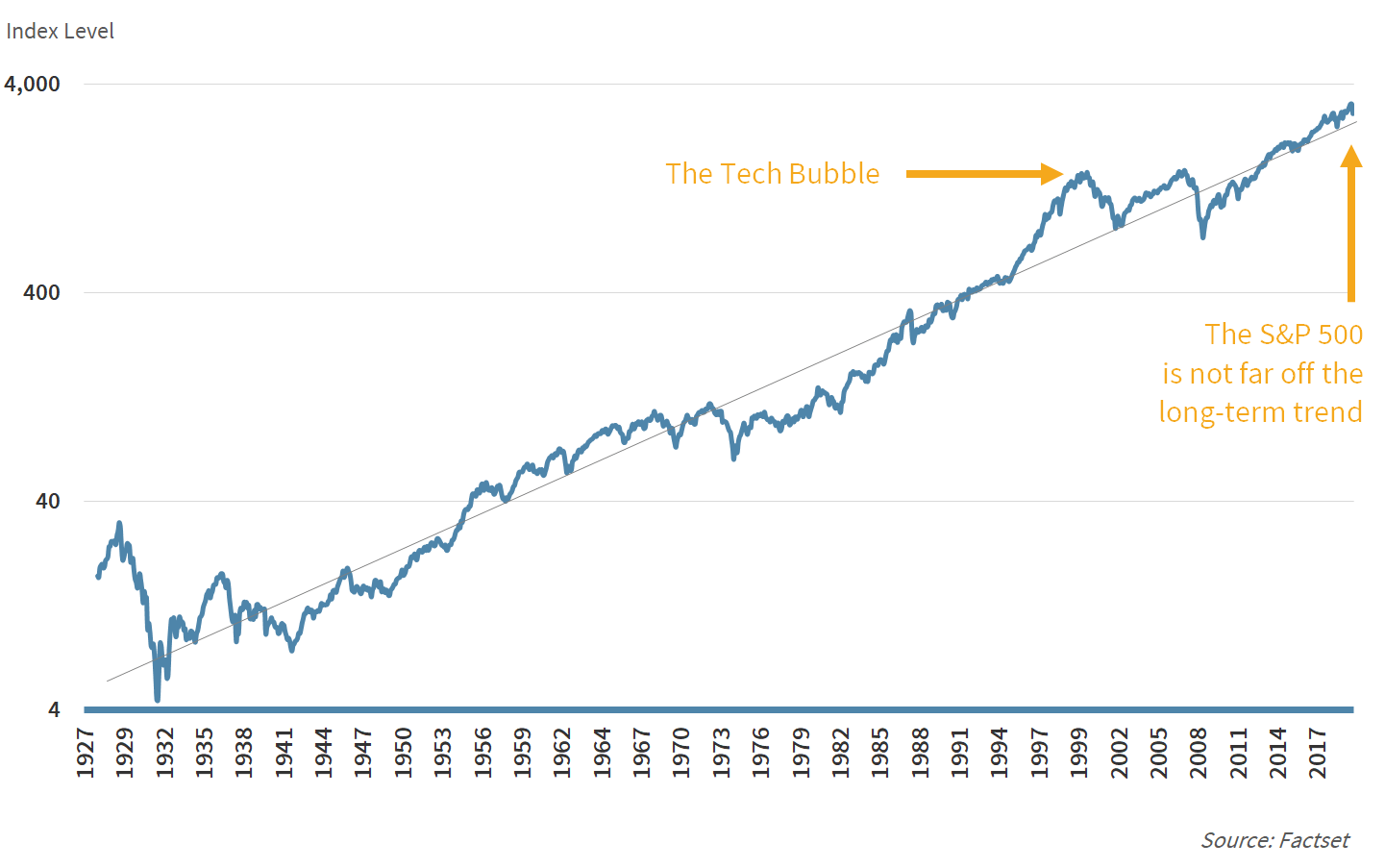

We find it useful in times like this to take several steps back and look at the big picture. The chart below shows the price of the S&P 500 going back to the 1920s. Over the past 90+ years, the general trend has been up, but there are times when the market appears to get ahead of trend. The Tech Bubble in 2000 is the most evident case from relatively recent history. Today, we are close to trend, and this week’s pullback barely registers. While this chart says nothing about valuation, we still find it helpful in putting this week in its proper perspective.

Figure 2: Historical Trend of the S&P 500 Index

Preparation not Prediction

The first step to success for an investor is admitting that you cannot predict the future. No one can, and trying to do so is a recipe for underperformance. That is just as true during bull markets as it is during virus pandemics. At Strategic, we do not predict the future, but we prepare for it, by:

- Constructing well-diversified portfolios grounded in rewarded factors,

- Consistently monitoring the market for attractive asset classes, and

- Following a process of regular rebalancing to lock in outperformance as it happens.

We appreciate the trust that our clients have put in us. Sometimes markets misbehave, and our goal, particularly in difficult times, is to provide complete peace of mind so that our clients can continue to pursue their best life!

Sincerely,

About Strategic

Founded in 1979, Strategic is a leading investment and wealth management firm managing and advising on client assets of over $2 billion.

OverviewDisclosures

Strategic Financial Services, Inc. is a SEC-registered investment advisor. The term “registered” does not imply a certain level of skill or training. “Registered” means the company has filed the necessary documentation to maintain registration as an investment advisor with the Securities and Exchange Commission.

The information contained on this site is for informational purposes and should not be considered investment advice or a recommendation of any particular security, strategy or investment product. Every client situation is different. Strategic manages customized portfolios that seek to properly reflect the particular risk and return objectives of each individual client. The discussion of any investments is for illustrative purposes only and there is no assurance that the adviser will make any investments with the same or similar characteristics as any investments presented. The investments identified and described do not represent all of the investments purchased or sold for client accounts. Any representative investments discussed were selected based on a number of factors including recent company news or earnings release. The reader should not assume that an investment identified was or will be profitable. All investments contain risk and may lose value. There is no assurance that any investments identified will remain in client accounts at the time you receive this document.

Some of the material presented is based upon forward-looking statements, information and opinions, including descriptions of anticipated market changes and expectations of future activity. Strategic Financial Services believes that such statements, information, and opinions are based upon reasonable estimates and assumptions. However, forward-looking statements, information and opinions are inherently uncertain and actual events or results may differ materially from those reflected in the forward-looking statements. Therefore, undue reliance should not be placed on such forward-looking statements, information and opinions.

No content on this website is intended to provide tax or legal advice. You are advised to seek advice on these matters from separately retained professionals.

All index returns, unless otherwise noted, are presented as price returns and have been obtained from Bloomberg. Indices are unmanaged and cannot be purchased directly by investors.

Doug Walters

Doug Walters