Strategic Perspectives

Equity markets have rebounded after a difficult start and are near even for the year. In our latest edition of Strategic Perspectives, we reassess the lay of the land, with focus on the most important trends shaping the economy and financial markets.

U.S. Economy

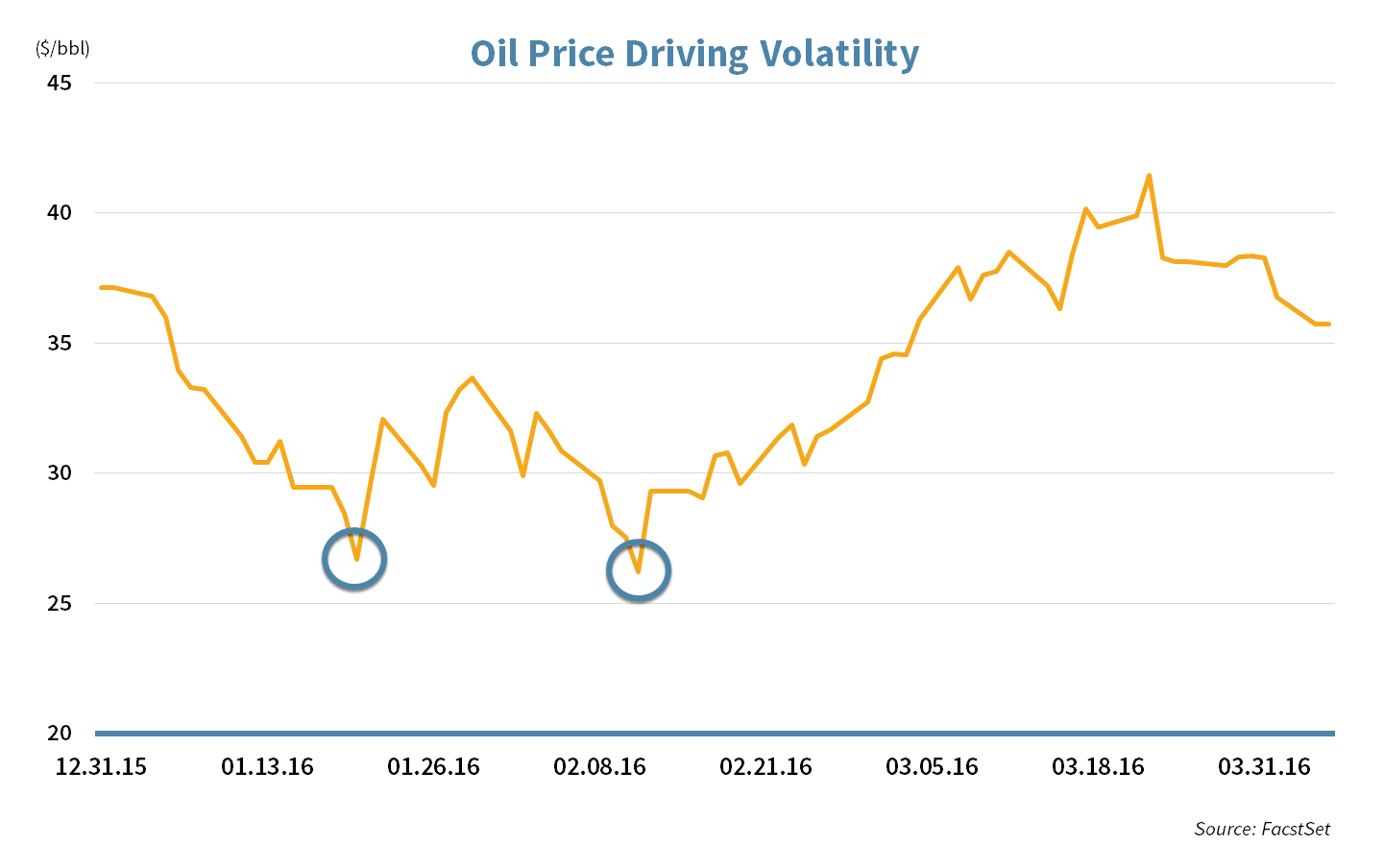

Oil appeared to drive the market at the start the year, first lower than higher. However, we still see this as more of a supply than demand issue, as the U.S. economy remains stable in our view.

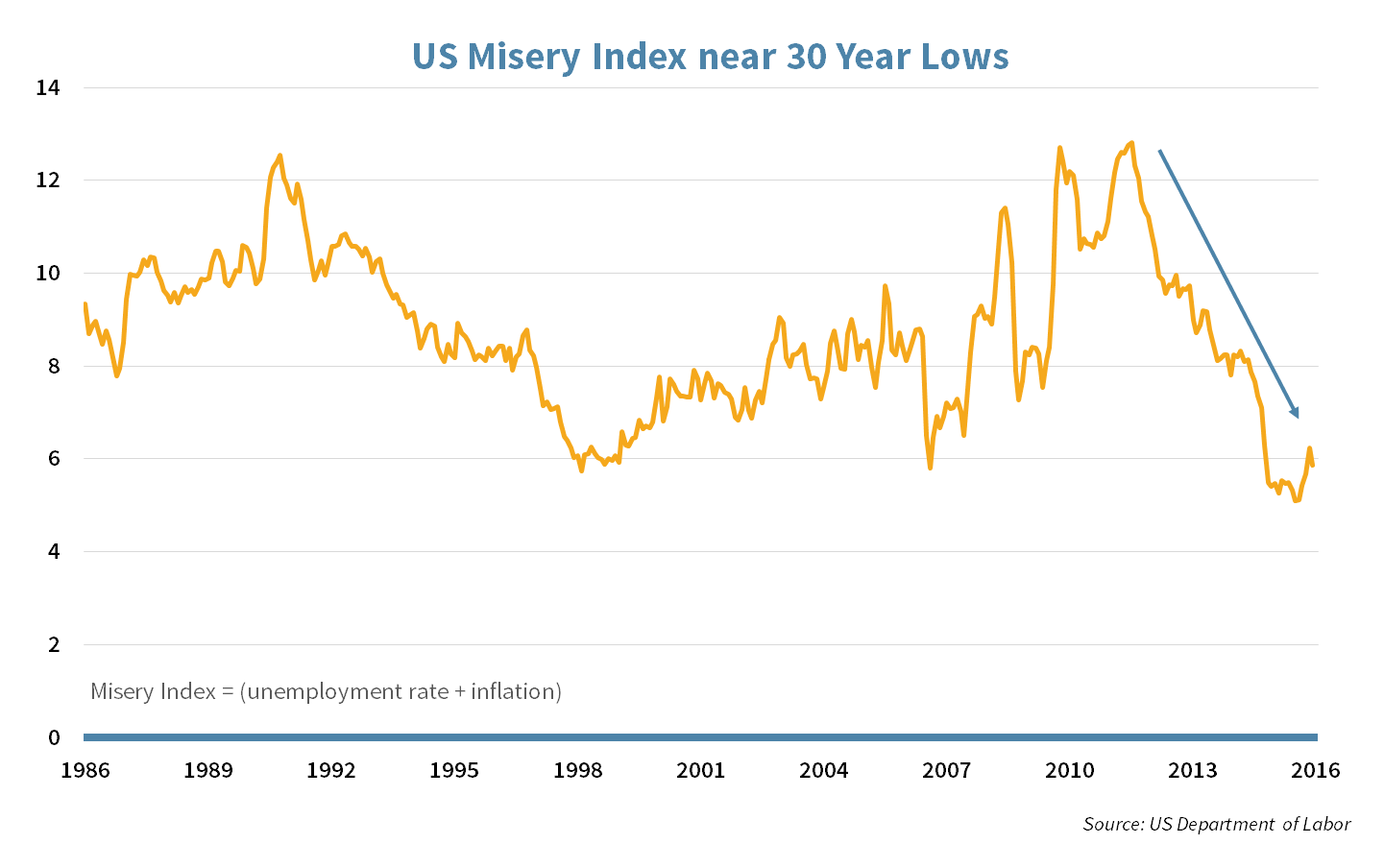

In the U.S., consumer confidence is fairly high and “misery” is low. Job creation continues, helping the unemployment rate inch ever lower, and interest rates remain very accommodative.

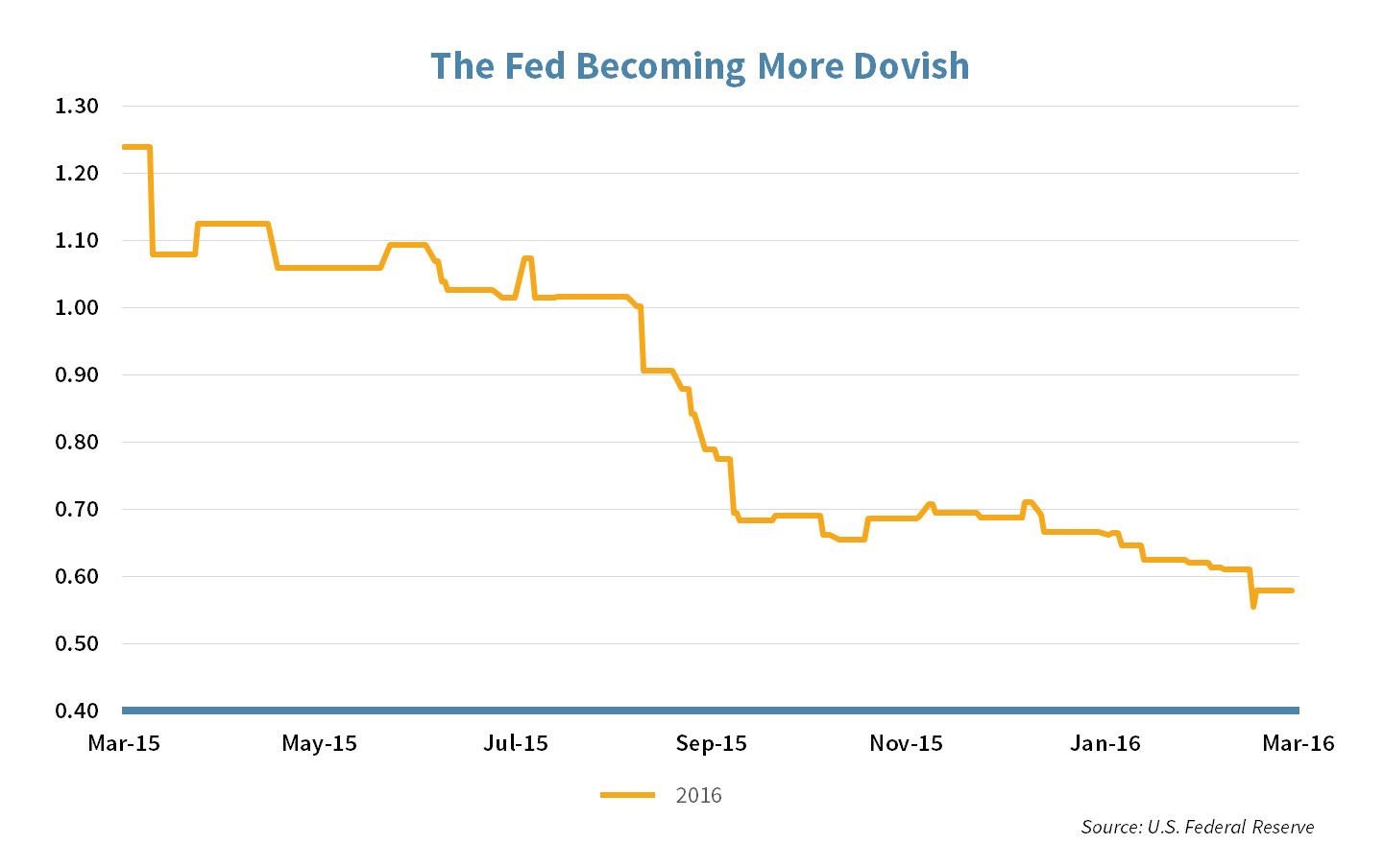

The potential for weakness overseas to leak into the U.S. remains a real concern, but the Fed – which turned more dovish this quarter – still appears poised to do what it takes to defend the U.S economy.

International Economy

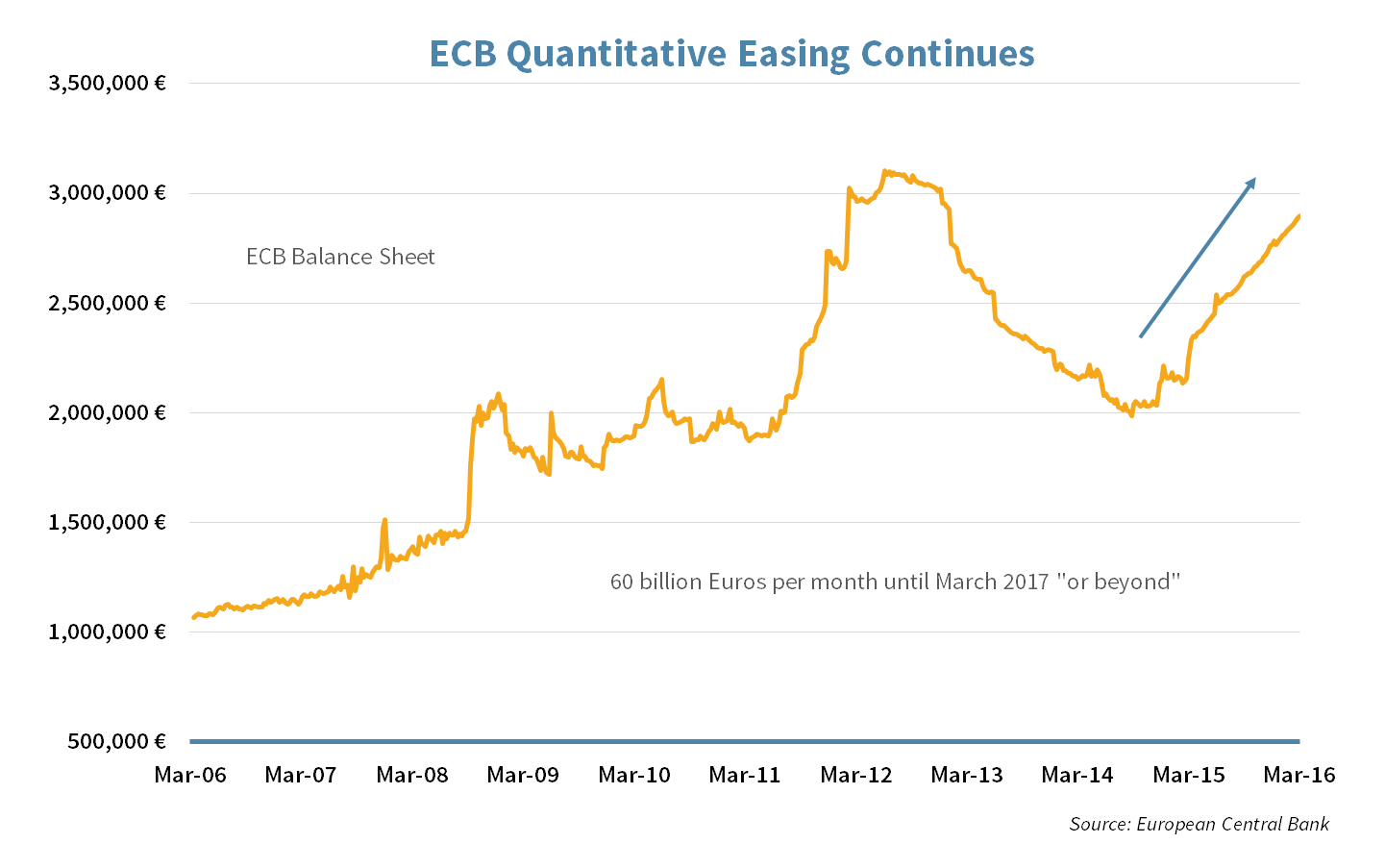

Developed International economies continue on the stimulus path as they seek a way to restart growth.

- The ECB has pledged to buy EUR60 billion in European government or corporate bonds per month until March 2017 or beyond.

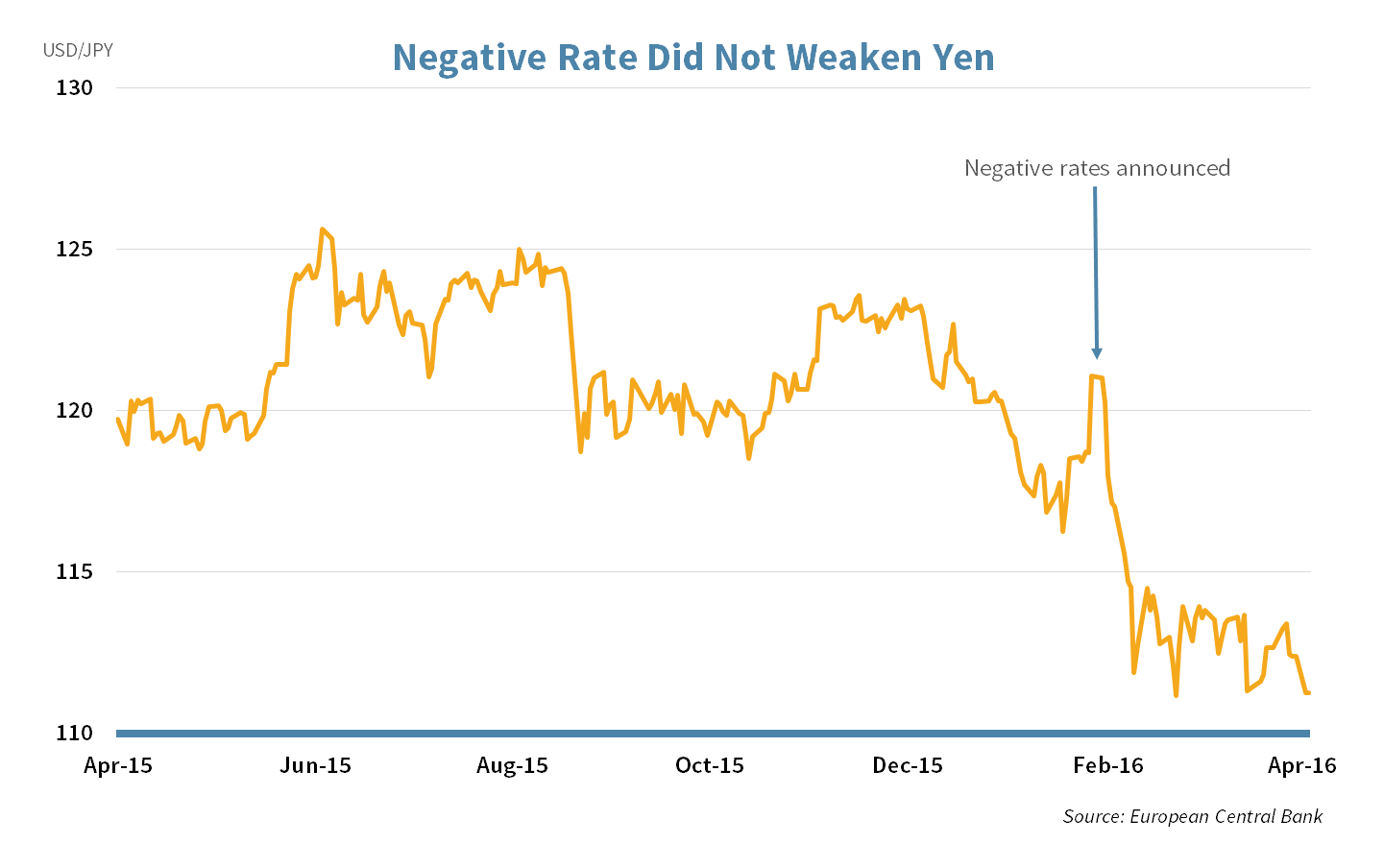

- In Japan, Abenomics, which has yet to unleash the promised, sustained growth, took another bold step. The BOJ instituted negative interest rates on some deposits. Stock prices rose and the YEN fell on the news (as was hoped), but both have since reversed.

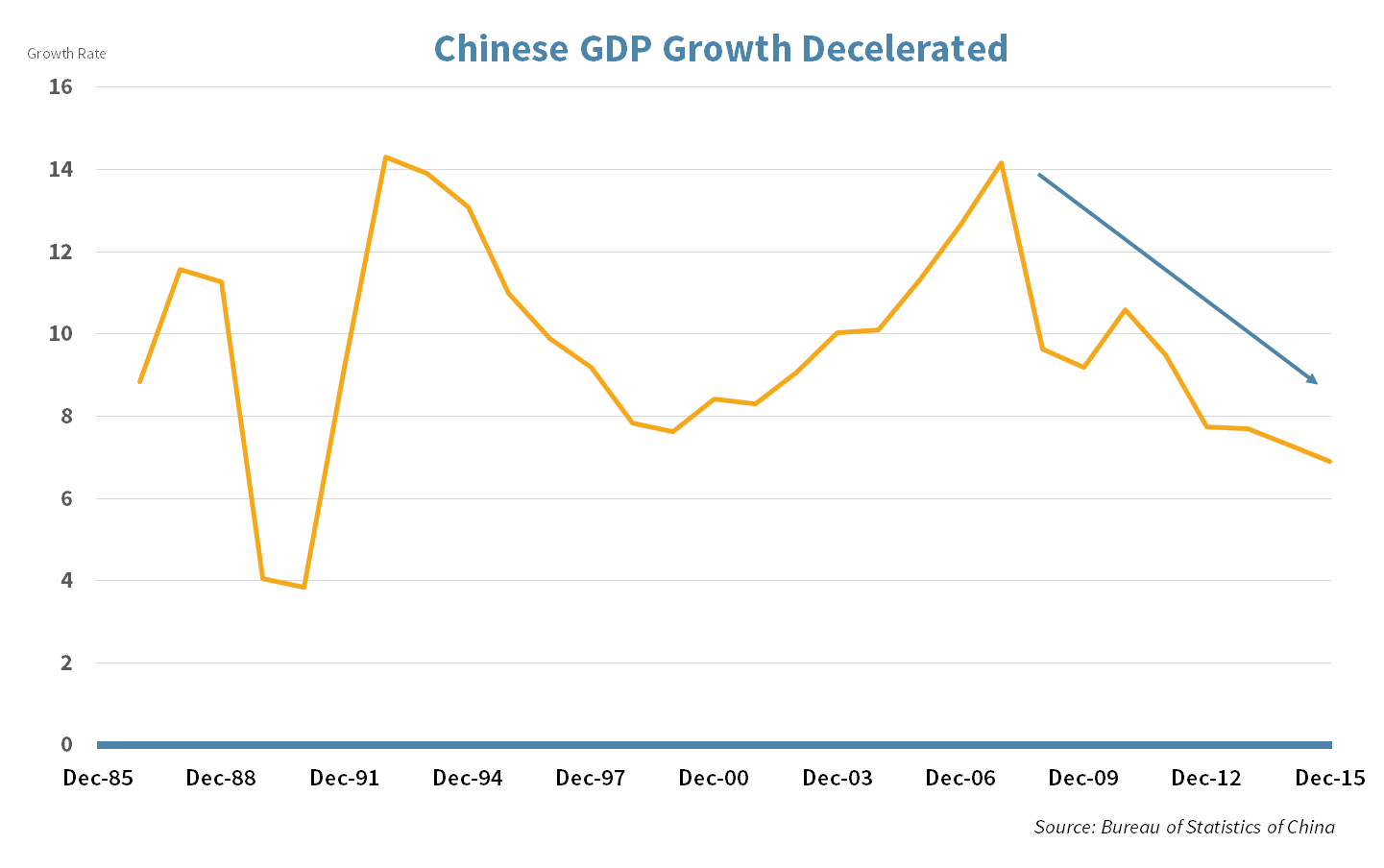

The recovery in Emerging Market indices was achieved without the help of China, where growth continues to slow.

- Brazil faces a challenge of confidence, with the economy weakened by a global slowdown in mining, and political turmoil. Yet, Brazilian equities performed well in Q1, bouncing off a very low base.

- India claims faster growth than China now, though some question the data.

Core Equities

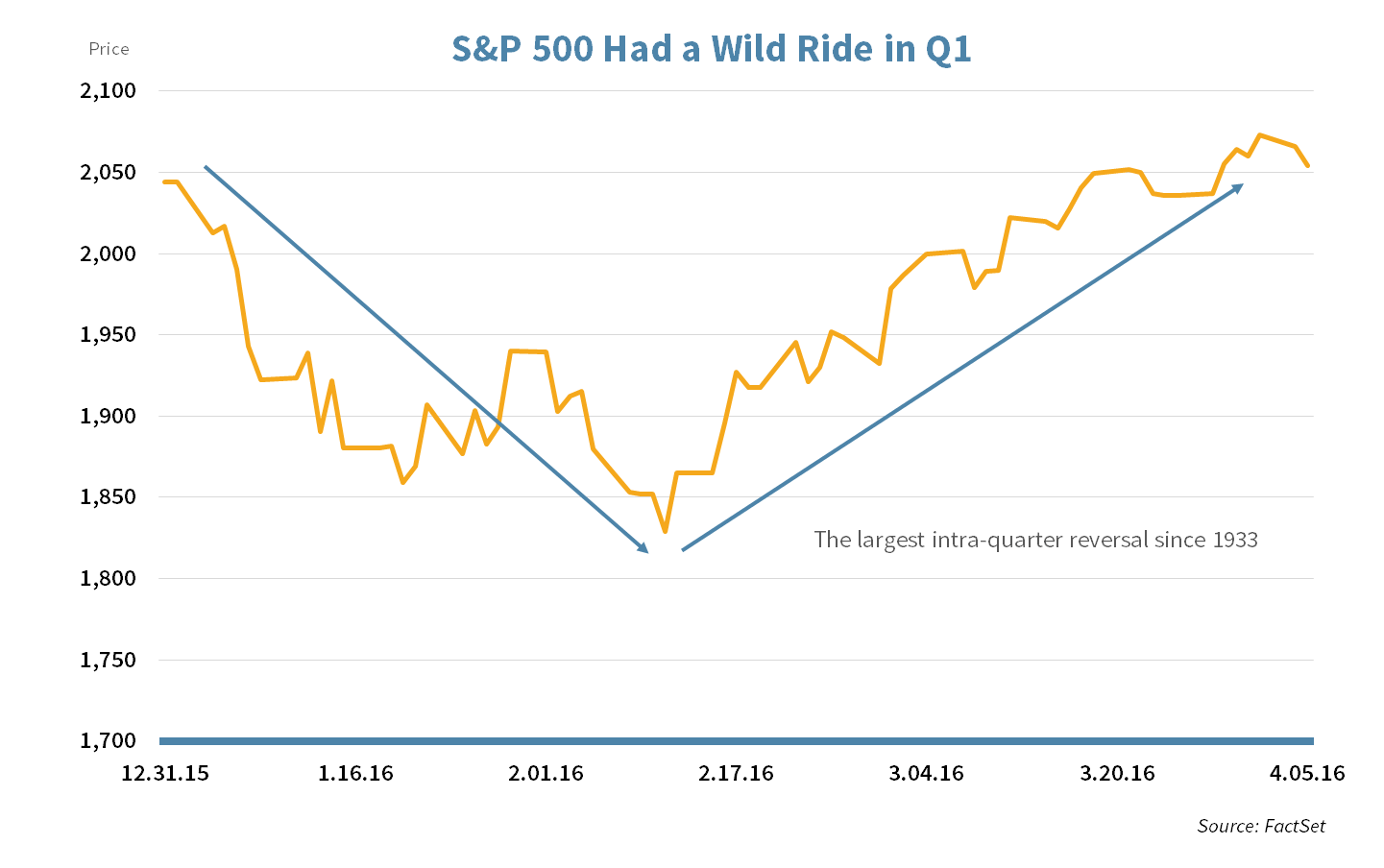

Equities were very volatile in Q1, posting the largest intra-quarter reversal since 1933. Investors had to contend with:

- large swings in the price of oil,

- escalating terrorist activity, and

- weak international economies.

Yet, despite these challenges, the S&P 500 ended the quarter in positive territory.

We believe the first quarter may turn out to be a microcosm of 2016: elevated volatility with opportunities for disciplined active investors.

Our focus remains on quality investments that we expect to weather the turbulence, combined with thoughtful rebalancing when volatility creates attractive valuation opportunities.

Core Fixed Income

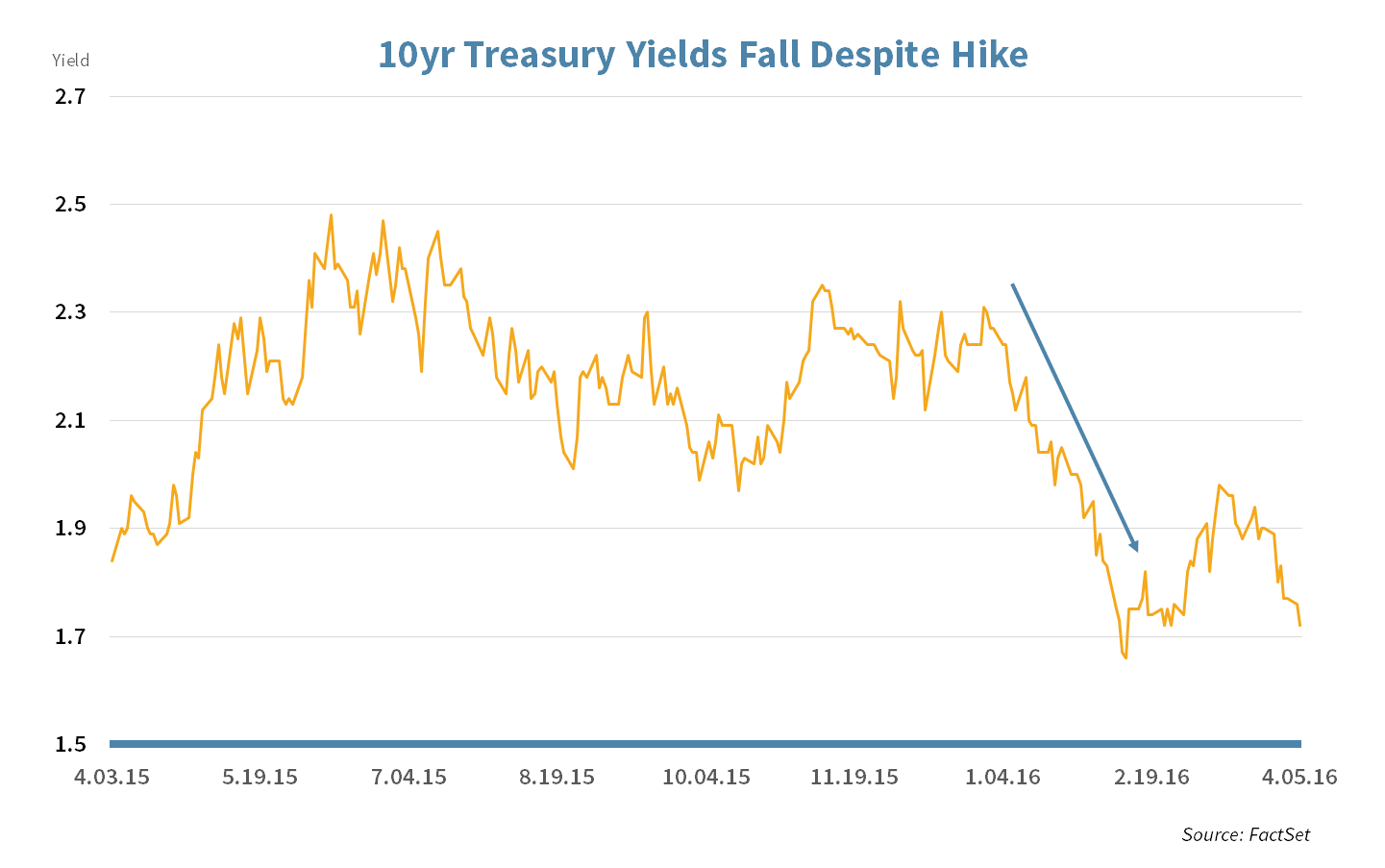

Market expectations for further rate hikes fizzled in Q1. In fact the 10yr Treasury touched 1.66% in February. Expectations for the next rate rise have been shifted to 2nd half of the year.

- U.S. treasury rates are a near ½ of 1% lower than the start of the year.

- The 2yr and 10yr spread, at around 1%, provides little incentive to extend maturities.

- While the U.S. flirts with further rate normalization, the rest of the world goes the other way. Negative interest rates are the norm in six countries. Hungary is the newest member.

- Diversifying asset classes in Fixed Income led the way in Q1, with TIPS and International outpacing Core Bonds by a noticeable margin.

We continue to focus on security selection within the highest echelon of credit to produce yield instead of extending duration.

Asset Allocation

A wild ride for risk assets in Q1 drove many to the perceived safety of gold. While we do not subscribe to the view that gold is inherently safe, we do see it as an important piece of a diversified portfolio given that it is often relatively uncorrelated to other asset classes.

- Investors favored income, leading to outperformance of REITs, and dividend payers within U.S. Large Cap Equities.

- Despite the dual headwinds of weakness in China and continued declines in Commodities, Emerging Markets as a whole were strong, particularly in March. Brazil rebounded sharply, albeit from a very low base, as did Russia.

With 2016 likely to remain volatile, we still favor the quality of U.S. Equities. Valuation of International Markets remains relatively low, and we will look for attractive entry points where quality is sufficient.

- Through proper diversification and thoughtful rebalancing, disciplined long-term investors can take advantage of short-term market weakness, and turn it into an asset allocation opportunity.

YTD 2016 RETURNS BY ASSET CLASS: MARCH 31, 2016

| YTD | 1 YR | 3 YR | 5 YR | |

|---|---|---|---|---|

| Equities | ||||

| S&P 500 | 1.3 | 1.8 | 11.8 | 11.6 |

| S&P MidCap 400 | 3.8 | -3.6 | 9.5 | 9.5 |

| Russell 2000 (Small Cap) | -1.5 | -9.8 | 6.8 | 7.2 |

| MSCI EAFE (Developed International) | -3 | -8.3 | 2.2 | 2.3 |

| MSCI Emerging Markets | 5.7 | -12 | -4.5 | -4.1 |

| REAL ASSETS | ||||

| S&P GSCI Total Return (Commodities) | -2.5 | -28.7 | -24.5 | -17.4 |

| Gold | 16.7 | 4.2 | -8.2 | -3 |

| MSCI U.S. REIT Index (Real Estate) | 5.9 | 2.6 | 9.1 | 10.5 |

| FIXED INCOME | ||||

| Barclays Capital Intermediate U.S. Gov/Credit | 2.4 | 2.1 | 1.8 | 3 |

| Barclays US TIPS | 4.5 | 1.5 | -0.7 | 3 |

| JPMorgan Global Bond ex-US | 9.1 | 8.2 | 0.1 | 0.3 |

About Strategic

Founded in 1979, Strategic is a leading investment and wealth management firm managing and advising on client assets of over $2 billion.

OverviewDisclosures

Strategic Financial Services, Inc. is a SEC-registered investment advisor. The term “registered” does not imply a certain level of skill or training. “Registered” means the company has filed the necessary documentation to maintain registration as an investment advisor with the Securities and Exchange Commission.

The information contained on this site is for informational purposes and should not be considered investment advice or a recommendation of any particular security, strategy or investment product. Every client situation is different. Strategic manages customized portfolios that seek to properly reflect the particular risk and return objectives of each individual client. The discussion of any investments is for illustrative purposes only and there is no assurance that the adviser will make any investments with the same or similar characteristics as any investments presented. The investments identified and described do not represent all of the investments purchased or sold for client accounts. Any representative investments discussed were selected based on a number of factors including recent company news or earnings release. The reader should not assume that an investment identified was or will be profitable. All investments contain risk and may lose value. There is no assurance that any investments identified will remain in client accounts at the time you receive this document.

Some of the material presented is based upon forward-looking statements, information and opinions, including descriptions of anticipated market changes and expectations of future activity. Strategic Financial Services believes that such statements, information, and opinions are based upon reasonable estimates and assumptions. However, forward-looking statements, information and opinions are inherently uncertain and actual events or results may differ materially from those reflected in the forward-looking statements. Therefore, undue reliance should not be placed on such forward-looking statements, information and opinions.

No content on this website is intended to provide tax or legal advice. You are advised to seek advice on these matters from separately retained professionals.

All index returns, unless otherwise noted, are presented as price returns and have been obtained from Bloomberg. Indices are unmanaged and cannot be purchased directly by investors.

Doug Walters

Doug Walters