2020: Exit Smarter

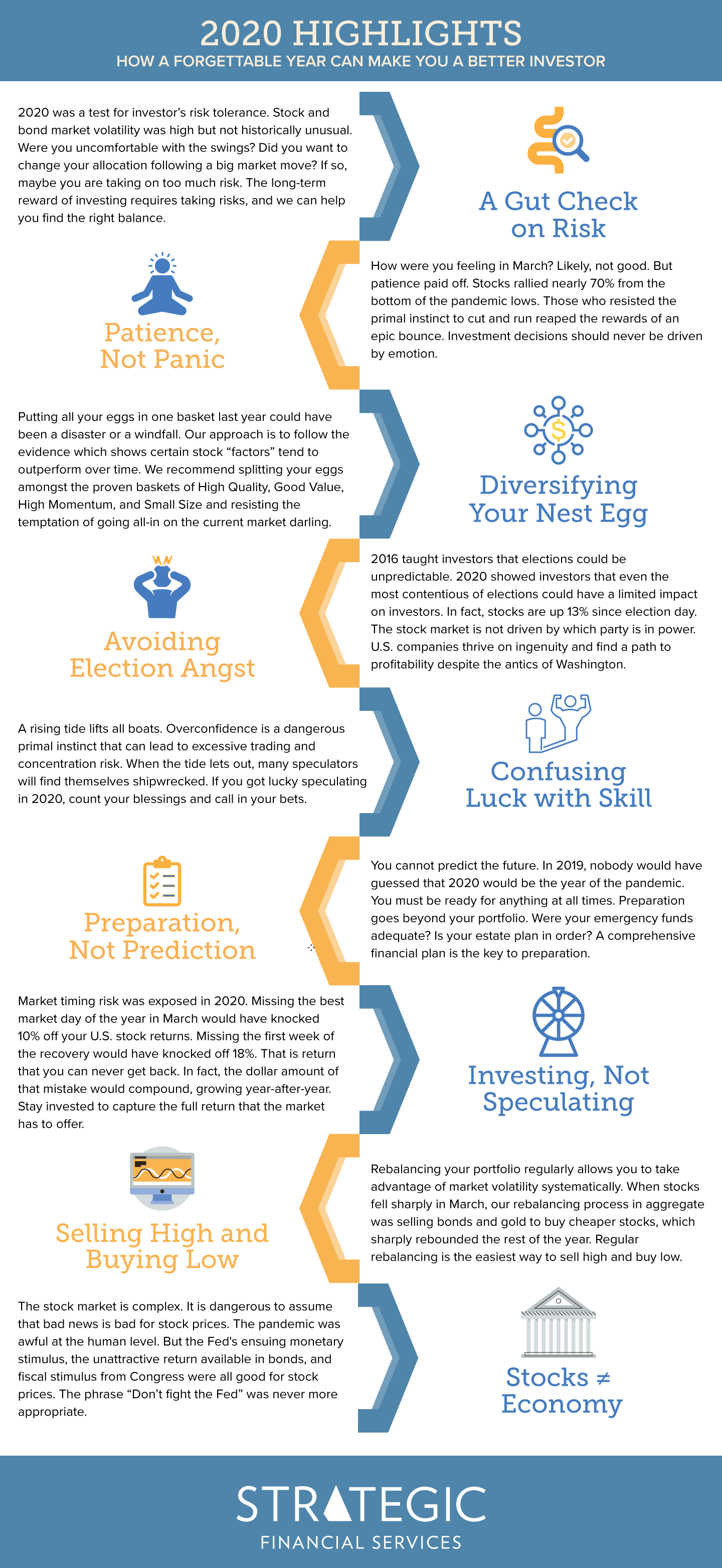

2020 tried investor’s nerves. Yet those who stared down fear, and avoided common investing behavioral pitfalls, likely came out ahead. In a year full of lessons, we highlight those that no investor should go without.

To exit 2020 without having become a smarter investor would be a missed opportunity. 2020 was a microcosm of a 10-year economic cycle packed into 12 months. Investor pitfalls came fast and furious, teaching harsh lessons to those that fell victim to their lure. For those who resisted their primitive survival instincts and instead focused on good investment discipline, 2020 provided at least one bright spot: their portfolio.

Against all odds, 2020 was a good year for investment returns – at least it should have been. Stock and bond markets produced positive returns across the globe, despite economic closures that came in the wake of a horrific coronavirus pandemic. However, emotions, particularly fear, were elevated due to the pandemic, market volatility, and a contentious election. Fear and investing generally do not mix well. Our primitive instincts try to take over in the face of fear and can lead to ill-conceived decisions.

So let us take this opportunity at the end of this unusual year to highlight some important lessons that every investor should take away to ensure they enter 2021 poised for success.

2020 is now in the books and we are optimistic for a return to normality in 2021. This is the point where many financial prognosticators will inject their predictions of the year ahead. Those skilled at the trade will ensure they are suitably vague so that they can claim forecasting success at year-end. At Strategic, we see preparation as more appropriate than prediction. In preparation for 2021, our strategies have been increasingly leaning toward Small-Cap and Value stocks where the pandemic has opened up some relative value. At the same time, the expected economic expansion, as the post-COVID economy emerges, favors the addition of Momentum stocks. On the Protection side of the portfolio, historically low bond yields have made Treasury Inflation Protection Securities (TIPS) more attractive and a larger part of our strategies. These tactical portfolio tilts are not based on speculation, but the facts we see in front of us today. Ours is an evidence-based approach, born out of science, not speculation.

On behalf of the entire Strategic team, I would like to thank all of you who are a part of our community of investors. Our sole purpose is to help each and every one of you live your best life, and we hope that in 2020 that goal was achieved despite the pandemic challenges. Best wishes for continued success in the new year!

Sincerely,

About Strategic

Founded in 1979, Strategic is a leading investment and wealth management firm managing and advising on client assets of over $2 billion.

OverviewDisclosures

Strategic Financial Services, Inc. is a SEC-registered investment advisor. The term “registered” does not imply a certain level of skill or training. “Registered” means the company has filed the necessary documentation to maintain registration as an investment advisor with the Securities and Exchange Commission.

The information contained on this site is for informational purposes and should not be considered investment advice or a recommendation of any particular security, strategy or investment product. Every client situation is different. Strategic manages customized portfolios that seek to properly reflect the particular risk and return objectives of each individual client. The discussion of any investments is for illustrative purposes only and there is no assurance that the adviser will make any investments with the same or similar characteristics as any investments presented. The investments identified and described do not represent all of the investments purchased or sold for client accounts. Any representative investments discussed were selected based on a number of factors including recent company news or earnings release. The reader should not assume that an investment identified was or will be profitable. All investments contain risk and may lose value. There is no assurance that any investments identified will remain in client accounts at the time you receive this document.

Some of the material presented is based upon forward-looking statements, information and opinions, including descriptions of anticipated market changes and expectations of future activity. Strategic Financial Services believes that such statements, information, and opinions are based upon reasonable estimates and assumptions. However, forward-looking statements, information and opinions are inherently uncertain and actual events or results may differ materially from those reflected in the forward-looking statements. Therefore, undue reliance should not be placed on such forward-looking statements, information and opinions.

No content on this website is intended to provide tax or legal advice. You are advised to seek advice on these matters from separately retained professionals.

All index returns, unless otherwise noted, are presented as price returns and have been obtained from Bloomberg. Indices are unmanaged and cannot be purchased directly by investors.

Doug Walters

Doug Walters