Three’s a Crowd

The number three was in focus this week, with all eyes on the triad of hurricanes wreaking havoc down south. U.S. equities were unable to hold on to last week’s gains thanks to a Senate disaster relief bill which brought policy uncertainty to the fore.

Market Review

Contributed by Doug Walters

Those with triskaphobia were not in good spirits this week. While the south is dealing with three, category 4+ hurricanes in a row for the first time on record, Washington and equity markets were left reeling from a Federal Reserve which is down to three board members and a surprise disaster relief deal between the president and Democrats which includes a three month debt ceiling extension.

One Two (Three) Punch

For the second week in a row, our focus is on a major hurricane. This time it is Irma, which looks set to impact much of the state of Florida after leaving a path of destruction in the Caribbean. It is unprecedented to have three, category 4+ hurricanes in a row (Harvey, Irma, and Jose), not to mention that there are currently three active Atlantic hurricanes (Irma, Jose, and Katia). Jose looks poised to rub salt in the wounds of the already battered Leeward Islands. Thankfully, this bad hombre is not currently expected to cross the border to the U.S. mainland. Our thoughts are with those in Florida and the Caribbean this weekend.

As we discussed last week (Long Road to Recovery), we expect these hurricanes will have a significant economic impact locally, but only modest and temporary impact nationally.

Strange Bedfellows

President Trump joined hands with Senate Democrats this week, agreeing on a bill to provide over $15B in disaster relief. The bill, which was later passed by the House, also includes a provision to kick the debt ceiling debate three months down the road. U.S. equity markets greeted the news with caution. There is a concern, expressed by some Republicans, that pushing the debt ceiling discussion out three months will lessen their bargaining power with Democrats on other stock-sensitive initiatives like tax-reform (which the GOP has promised before year end).

Seats to Fill

Adding to the uncertainty this week was the announcement by Federal Reserve Vice Chairman Stanley Fischer that he will be resigning, effective mid-October. His departure will take the seven-member Board of Governors down to a skeletal staff of (you guessed it) three. With Chairwoman Yellen’s term up in February, the Trump administration has the potential to completely reshape one of the most important economic institutions in the country. Equity markets have appreciated Yellen’s steady, accommodative hand, and are rewarding investors with buoyant share prices. All eyes will be on the future nominees.

| Indices & Price Returns | Week (%) | Year (%) |

|---|---|---|

| S&P 500 | -0.6 | 9.9 |

| S&P 400 (Mid Cap) | -1.1 | 3.5 |

| Russell 2000 (Small Cap) | -1.0 | 3.1 |

| MSCI EAFE (Developed International) | 0.8 | 16.0 |

| MSCI Emerging Markets | 0.0 | 26.5 |

| S&P GSCI (Commodities) | 0.2 | -2.8 |

| Gold | 1.5 | 16.8 |

| MSCI U.S. REIT Index | 0.7 | 2.4 |

| Barclays Int Govt Credit | 0.4 | 1.6 |

| Barclays US TIPS | 1.0 | 1.8 |

Economic Commentary

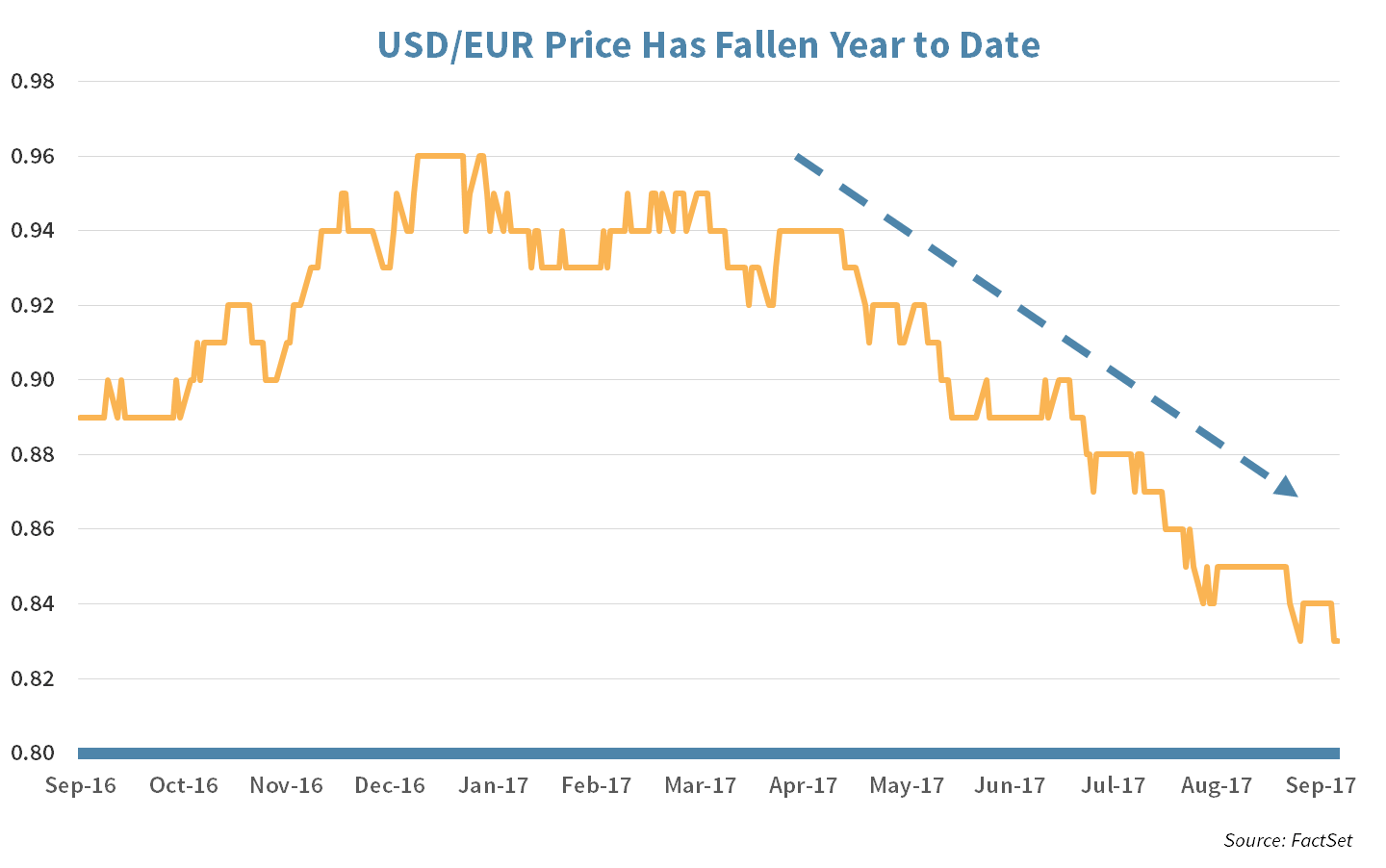

The Dollar’s Fall

The U.S. dollar is at a 20-month low and has been falling at a steady pace for the past six months. Two big drivers of any national currency are:

- Trade Dynamics: where large trade deficits lead to a weaker currency, and

- Interest Rates: which are primarily determined by central banks.

In the case of the U.S. dollar’s recent decline, interest rates, more than trade dynamics, have moved the currency. In fact, the U.S. trade deficit has decreased this year as exports increased to their highest level in two and a half years. Interest rates, on the hand, have been falling, with the U.S. 10-year Treasury note now yielding 2%, well below its 2.6% year-to-date high. Low domestic interest rates incentivize investors to park their money abroad where yields are relatively more attractive and thereby adversely impact the local currency.

In the case of the U.S. dollar’s recent decline, interest rates, more than trade dynamics, have moved the currency. In fact, the U.S. trade deficit has decreased this year as exports increased to their highest level in two and a half years. Interest rates, on the hand, have been falling, with the U.S. 10-year Treasury note now yielding 2%, well below its 2.6% year-to-date high. Low domestic interest rates incentivize investors to park their money abroad where yields are relatively more attractive and thereby adversely impact the local currency.

The main reason why U.S. interest rates have been falling is due to lower expectations of a Fed rate hike while the European Central Bank is on track to raise rates. With hurricanes hitting the Southeast and inflation at very low levels, it becomes less likely Federal Reserve Chair Janet Yellen will increase rates and pressure company finances. Yellen’s term ends in February, and it is still uncertain who will replace her, but President Trump has mentioned in the past he prefers lower rates and a weak dollar that would help stimulate exports and boost the U.S. manufacturing sector.

U.S. companies with global operations, such as Procter & Gamble (PG) and Caterpillar (CAT), benefit from a weaker dollar as their U.S. priced goods become more attractive abroad. U.S. consumers, however, would be adversely affected as their purchasing power of foreign goods decreases along with the USD. With that said, the U.S. economy looks to be growing at a healthy rate, and if we do see exports continue to increase and inflation picks up, forcing interest rates upwards, we could see a rapid comeback in the greenback.

Week Ahead

Irma poised to ECHO Harvey’s destruction

Economic data, namely the Consumer Price Index (CPI) and Producer Price Index (PPI), will shine some light on the status of U.S. inflation.

- Janet Yellen has emphasized growth in inflation as one of the catalysts for further Fed rate hikes.

- The Fed is targeting a 2% inflation rate.

Consumer Sentiment Index from Michigan University and Retail Sales will fill in the consumer spending part of the economic picture.

- Consumer Sentiment (Michigan) is forecast to remain robust.

- A decline in auto sales in August is expected to be a material drag on retail sales.

Hurricane Irma is due to arrive on the shores of Miami Florida Sunday morning.

- Florida Gov. Rick Scott has issued a state of emergency, asking people to evacuate as soon as possible. He said “You can rebuild your home . . . you cannot recreate your family.”

Oracle Corp. (ORCL) will report earnings on Thursday after market hours.

- All eyes will be on Oracle’s cloud growth and its profitability.

Strategy Updates

Contributed by Max Berkovich ,

STRATEGIC ASSET ALLOCATION

Not So FLATtering

The 10-year U.S. Treasury bond is flirting with 2% yield. It’s been just over a year since the U.S. 10-year hit an all-time low in June of 2016, yielding 1.36%. Since then we have witnessed three rate hikes, increasing the U.S. Fed Funds rate from 0.5% to 1.25%, but the 10-year Treasury has not complied. The current 2-10 U.S. Treasury spread is at 0.77%, meaning investors demand less than 1% of extra yield annually for increasing a bond’s maturity from 2019 to 2027.

- A 3rd Fed rate hike in 2017 should send bond yields higher, but will it mean the stubborn 10-year yield will also move higher or will the yield curve flatten even more?

- According to Bloomberg’s World Interest Rate Probability, the probability of a rate hike in 2017 is around 28%.

- The 30-year U.S. Treasury is yielding a measly 2.69%, down from over 3% at the start of the year.

Flight to Safety

As Floridians flee to higher ground, some investors are fleeing to the perceived safety of gold. The precious metal has hit its highest level in 11 months, as investors weigh the impact of tensions with North Korea and further hurricane damage.

- A weaker U.S. dollar is considered a net positive for gold.

- The ICE U.S. Dollar Index (DXY) hit a new 2-year low and is down nearly 10.6% year-to-date (see our Economics section).

- Also, Foreign Developed and Emerging Markets are benefiting from the weak dollar, helping those asset classes reach 2017 highs.

STRATEGIC GROWTH

Rocking the United Technologies

Natural gas drillers had a tough week dragging the Energy sector to the bottom, while the Healthcare sector was the leading sector despite a cooling week for Biotechnology. In other strategy news…

- The previously speculated acquisition by United Technologies Corp. (UTX) of Rockwell Collins Inc. (COL) came to fruition this week as the deal was announced at a stiff price of $30 Billion. The $140 per share deal includes $93.33 per share in cash with the remaining in UTX shares. The deal was not well received as it will face heavy regulatory scrutiny. More importantly, questions quickly arose whether the new company will “rock the plane” and split into two companies, an aerospace company and an industrial company with Otis elevators and Carrier air conditioning.

STRATEGIC EQUITY INCOME

Generally Speaking

Supply issues in the energy market post-Hurricane Harvey boosted the energy sector this week. The Telecom sector was the biggest laggard, but Financials were not that far behind. In other news…

- General Electric Corp. (GE) keeps coming up in the news. Generally accepted theory is that the new general at the industrial conglomerate, John Flannery, will throw the “kitchen sink” when the company reports its 3rd quarter. Analysts expect accelerated restructuring. Reuters news services reported that Flannery had told senior executives that job cuts at headquarters and other parts of that company that do not produce profits or revenue are coming.

About Strategic

Founded in 1979, Strategic is a leading investment and wealth management firm managing and advising on client assets of over $2 billion.

OverviewDisclosures

Strategic Financial Services, Inc. is a SEC-registered investment advisor. The term “registered” does not imply a certain level of skill or training. “Registered” means the company has filed the necessary documentation to maintain registration as an investment advisor with the Securities and Exchange Commission.

The information contained on this site is for informational purposes and should not be considered investment advice or a recommendation of any particular security, strategy or investment product. Every client situation is different. Strategic manages customized portfolios that seek to properly reflect the particular risk and return objectives of each individual client. The discussion of any investments is for illustrative purposes only and there is no assurance that the adviser will make any investments with the same or similar characteristics as any investments presented. The investments identified and described do not represent all of the investments purchased or sold for client accounts. Any representative investments discussed were selected based on a number of factors including recent company news or earnings release. The reader should not assume that an investment identified was or will be profitable. All investments contain risk and may lose value. There is no assurance that any investments identified will remain in client accounts at the time you receive this document.

Some of the material presented is based upon forward-looking statements, information and opinions, including descriptions of anticipated market changes and expectations of future activity. Strategic Financial Services believes that such statements, information, and opinions are based upon reasonable estimates and assumptions. However, forward-looking statements, information and opinions are inherently uncertain and actual events or results may differ materially from those reflected in the forward-looking statements. Therefore, undue reliance should not be placed on such forward-looking statements, information and opinions.

No content on this website is intended to provide tax or legal advice. You are advised to seek advice on these matters from separately retained professionals.

All index returns, unless otherwise noted, are presented as price returns and have been obtained from Bloomberg. Indices are unmanaged and cannot be purchased directly by investors.

Doug Walters

Doug Walters