Long Road to Recovery

As Texas residents begin the arduous process of digging out from the destruction left in Harvey’s wake, the U.S. economy continues to distance itself from the great financial storm of 2008.

Market Review

Contributed by Doug Walters

Hurricane Harvey pounded Texas this week, while equities advanced in blissful ignorance. With events like Harvey, we often get asked, “what is going to be the impact on my investments?” The answer often is, very little, particularly in the long-run.

Storm Surge

If we look at some major U.S. storms like Katrina, Sandy, and Andrew, we see that the S&P 500 was higher a month after each storm. That is not to say some individual stocks are not impacted. Clearly, there is disruption to the Energy sector (see our Economics section), as well as Insurance. On the other hand, companies connected to home building and construction could be positively impacted by rebuilding efforts.

One report I came across puts the estimated damage of Harvey at $190m and implies that this will be a direct hit (about 1%) to U.S. Gross Domestic Product (GDP). This week, second quarter U.S. GDP was revised up to a healthy 3.0%. A 1% negative hit would be significant. However, we disagree that the economic implications are so bleak. First, $190m is the damage estimate. Much of this damage will need to be replaced or repaired. These recovery activities are a positive contributor to GDP. Secondly, one of the main issues the Federal Reserve has had with the U.S. economic recovery since the Financial Crisis is the lack of healthy inflation. The storm has already driven up gasoline prices and could push up wages in certain sectors, like construction, where worker supply is likely to be tight. Both would be positive for inflation.

Harvey is a storm of unprecedented damage, which will impact the lives of some Texans for many years to come. However, investing is a long-term endeavor, and Harvey’s lasting impact on stocks is likely to be minimal.

Economic Commentary

The Impact of Harvey

Last October, we wrote about the impact of Hurricane Matthew on the southeast U.S. as it made its way up the coast to North Carolina (Hurricane Economics). This past week, Hurricane Harvey was, unfortunately, more devastating and could prove to be the costliest hurricane in U.S. history. Many areas in eastern Texas received more than 40 inches of rain over four days. Hundreds of thousands of homes have been flooded, and 30,000 people have been displaced.

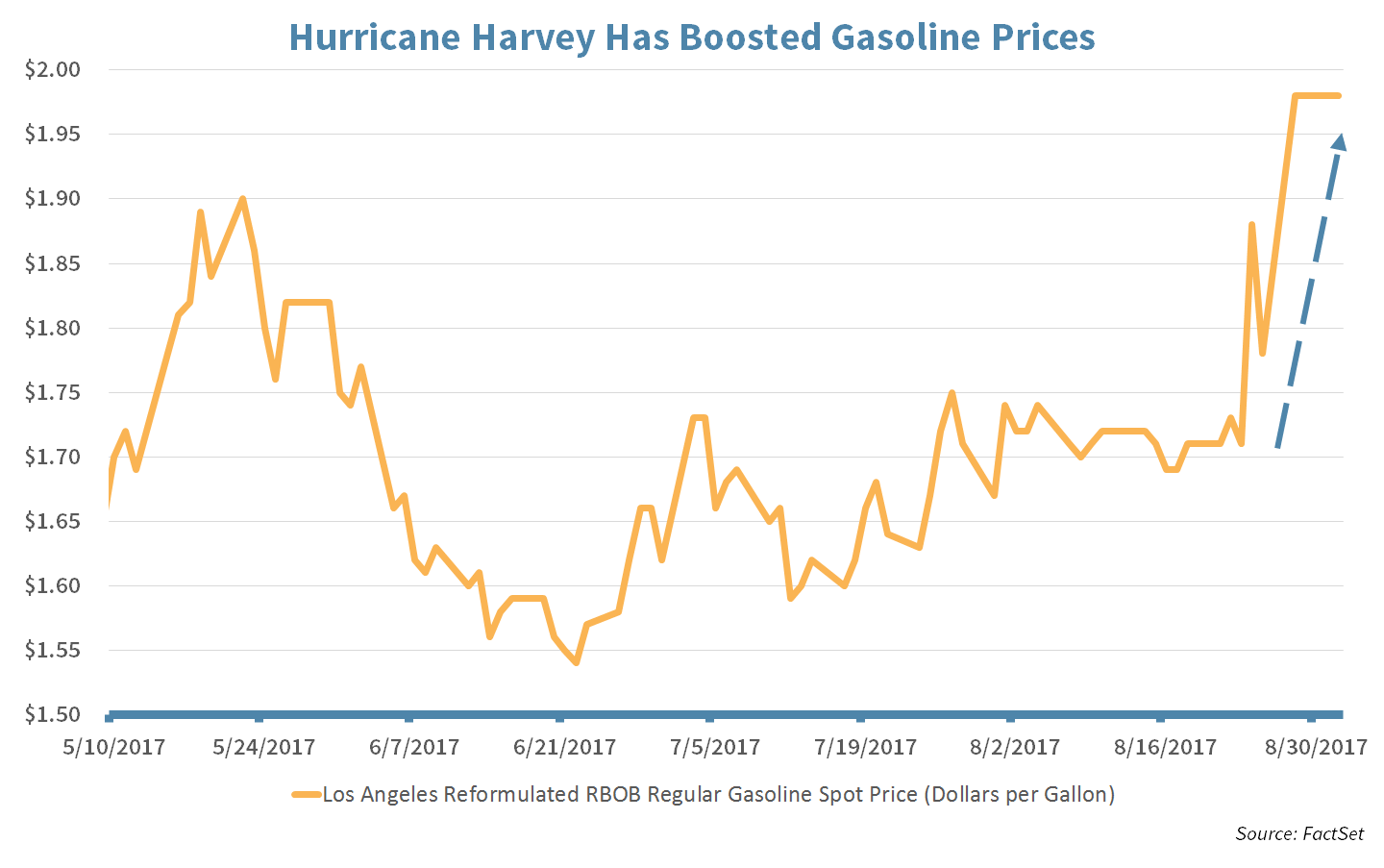

The hurricane has also impacted the oil and gas market as pipeline companies announced that shipments have been curtailed. The natural disaster has knocked out 20% of U.S. refining capacity. Refining utilization rates were already sky high (above 90%), and any reduction in capacity affects gasoline prices.

Gasoline prices have increased about 30 cents per gallon at the pump, thanks to Harvey, and may increase further. Transportation to the refineries has become problematic, and refineries themselves will require greater maintenance time. Gasoline stockpiles stand around 230 million barrels right now, and analysts believe that if this number drops below 200 million, tanks in certain areas of the country will begin to run out. Refiners such as Phillips 66 (PSX) will need to refine more crude post the hurricane to refill the gasoline tanks and maintain a high stockpile.

Week Ahead

FEMA, Let the Recovery Begin!

Football season begins this Thursday, September 7th at 8:30 pm EST. The Kansas City Chiefs will face Super Bowl LI (2017) champions New England Patriots on NBC.

- At Strategic that also means the start of our pick‘em league. Defending champ (technically) and two-time winner Alan Leist, III can start bragging about being the frontrunner.

European Central Bank (ECB) will release their rate decision on Thursday.

- Investors are expecting the ECB to hold rates steady, as inflation in the region remains soft and below the ECB’s 2% target rate.

- The policy statement will be under review to see if the accommodative stance of the central bank will remain unchanged as well.

Mortgage applications survey produced by the Mortgage Bankers Association (MBA) will release their weekly data on Wednesday.

- The recent decline in house sales is blamed on the short supply of homes.

- The shortage of properties is driving up home prices further as well.

August economic data for the services sector is expected to remain healthy.

- The Markit PMI Services is expected to remain at a 2-year high, and the ISM Non-Manufacturing Index is predicted to improve by nearly 2.5%.

Strategy Updates

STRATEGIC ASSET ALLOCATION

The Rise of ETFs

Exchange Traded Funds (ETFs) are known for their passive approach to tracking certain indexes. These funds are fast replacing traditional mutual funds as the preferred pooled asset investment. According to Bloomberg Intelligence, there are now more indexes than U.S. stocks! There is an index for many sectors, countries, investment styles, valuation metrics, investment themes and so on. There are active, passive, leveraged, and hybrid ETFs. The most traditional ETFs track major indexes. ETFs help investors to diversify their portfolio and gain exposures to niche sectors or countries with ease. But there are caveats.

- Money flowing into ETFs may cause valuations for their holdings to rise as they don’t care about a specific company’s earnings and profitability.

- ETFs may create a “vicious circle”, making the mega capitalization companies even larger as ETFs are designed to allocate money flows to their biggest holdings.

- Many of these investment vehicles are new and have been created during an up market, so their performance in a down market is unproven.

We at Strategic have embraced the ETF movement, using them as passive compliments to our active management and where applicable as an alternative to traditional mutual funds.

- Our preference for ETFs versus mutual funds centers on their ability to have a static investment mandate, low expenses, high transparency, liquidity and most importantly providing an efficient mechanism to execute our investment decisions.

- More information on our view of active vs. passive can be found here.

STRATEGIC GROWTH

Unstapled

Biotechnology received a big boost from a merger, which unleashed enthusiasm for further deals. Biotech’s hot week pushed the entire Health Care sector higher. Consumer Staples ended up as the laggard on the week, but it wasn’t without its share of headlines…

- First, Hain Celestial Group, Inc. (HAIN) reported a solid quarter and above consensus guidance. That enthusiasm did not last for long as grocer Whole Foods announced price cuts which agitated new fears of margin pressure for organic food.

- Then, famed investor Warren Buffet, in an interview, dismissed rumors that Kraft-Heinz (KHC) was perusing confectionery goliath Mondelez International (MDLZ) as an acquisition.

- On the positive side, Costco Wholesale Corp. (COST) reported strong sales numbers. Sales grew 10% in August on a year-over-year basis, and comparable sales were up 7.4% for the month.

STRATEGIC EQUITY INCOME

Making an Incision

The Technology sector was the clear leader this week, while the Telecom sector was a laggard. In other strategy news…

- Medical equipment giant Medtronic plc. (MDT) announced a strategic partnership with Israeli Mazor Robotics Ltd. (MZOR). Mazor is a manufacturer of robotic guidance system for spinal surgery. The partnership gives Medtronic the exclusive on the Mazor X Surgical Assurance Platform for spine surgery. In exchange, Medtronic will invest $40 Million in Mazor, bringing its stake to 10.6%. There will also be warrants for additional shares at a 15% premium, which would bring Medtronic’s stake to roughly 14.2%.

About Strategic

Founded in 1979, Strategic is a leading investment and wealth management firm managing and advising on client assets of over $2 billion.

OverviewDisclosures

Strategic Financial Services, Inc. is a SEC-registered investment advisor. The term “registered” does not imply a certain level of skill or training. “Registered” means the company has filed the necessary documentation to maintain registration as an investment advisor with the Securities and Exchange Commission.

The information contained on this site is for informational purposes and should not be considered investment advice or a recommendation of any particular security, strategy or investment product. Every client situation is different. Strategic manages customized portfolios that seek to properly reflect the particular risk and return objectives of each individual client. The discussion of any investments is for illustrative purposes only and there is no assurance that the adviser will make any investments with the same or similar characteristics as any investments presented. The investments identified and described do not represent all of the investments purchased or sold for client accounts. Any representative investments discussed were selected based on a number of factors including recent company news or earnings release. The reader should not assume that an investment identified was or will be profitable. All investments contain risk and may lose value. There is no assurance that any investments identified will remain in client accounts at the time you receive this document.

Some of the material presented is based upon forward-looking statements, information and opinions, including descriptions of anticipated market changes and expectations of future activity. Strategic Financial Services believes that such statements, information, and opinions are based upon reasonable estimates and assumptions. However, forward-looking statements, information and opinions are inherently uncertain and actual events or results may differ materially from those reflected in the forward-looking statements. Therefore, undue reliance should not be placed on such forward-looking statements, information and opinions.

No content on this website is intended to provide tax or legal advice. You are advised to seek advice on these matters from separately retained professionals.

All index returns, unless otherwise noted, are presented as price returns and have been obtained from Bloomberg. Indices are unmanaged and cannot be purchased directly by investors.

Doug Walters

Doug Walters