Digging Out

The Fed raised rates as expected, while winter storm Stella, somewhat unexpectedly, lowered several feet of snow on the Northeast and Strategic’s headquarters. The market response to the Fed was positive, with the S&P 500 rising and bond yields retreating.

Market Review

Contributed by Doug Walters

While the Northeast, including us here at Strategic, were busy shoveling out from the aftermath of Stella, Fed Chairwoman Yellen continued her quest to dig the U.S. out of the mountain of monetary stimulus that has helped prop up economic activity for so long. The S&P 500 ended the week in positive territory, thanks largely to a 0.8% gain on Wednesday.

A shovel or a snowplow

On Wednesday, the Federal Reserve raised the Fed Funds target rate 0.25% to a range of 0.75% to 1.00%. This is the third rate increase since December 2015 as the Fed looks to normalize rates to their 3% target. At the moment, the Fed is using its monetary shovel. A major economic acceleration could require the Fed to fire up the snowplow.

- Low rates help to stimulate the economy. As the economy strengthens, rates can be raised to help moderate growth and control potential inflation. On Wednesday, the Fed provided an upbeat assessment of the U.S. economy, which was received well by investors and justified the rate increase.

- However, the Chairwoman’s tone was still somewhat dovish (see For the Birds for a reminder of what dovish means). She expects three rate hikes this year, which we see as a slow and steady normalization. However, an unexpected increase in the pace of economic improvement could require the Fed to pull out some bigger machinery in the form of larger and more frequent rate hikes.

| Indices & Price Returns | Week (%) | Year (%) |

|---|---|---|

| S&P 500 | 0.2 | 6.2 |

| S&P 400 (Mid Cap) | 1.2 | 4.2 |

| Russell 2000 (Small Cap) | 1.9 | 2.5 |

| MSCI EAFE (Developed International) | 1.9 | 6.7 |

| MSCI Emerging Markets | 4.0 | 11.7 |

| S&P GSCI (Commodities) | 0.6 | -4.0 |

| Gold | 2.0 | 6.7 |

| MSCI U.S. REIT Index | 2.3 | -0.7 |

| Barclays Int Govt Credit | 0.3 | -0.1 |

| Barclays US TIPS | 0.8 | 0.6 |

Economic Commentary

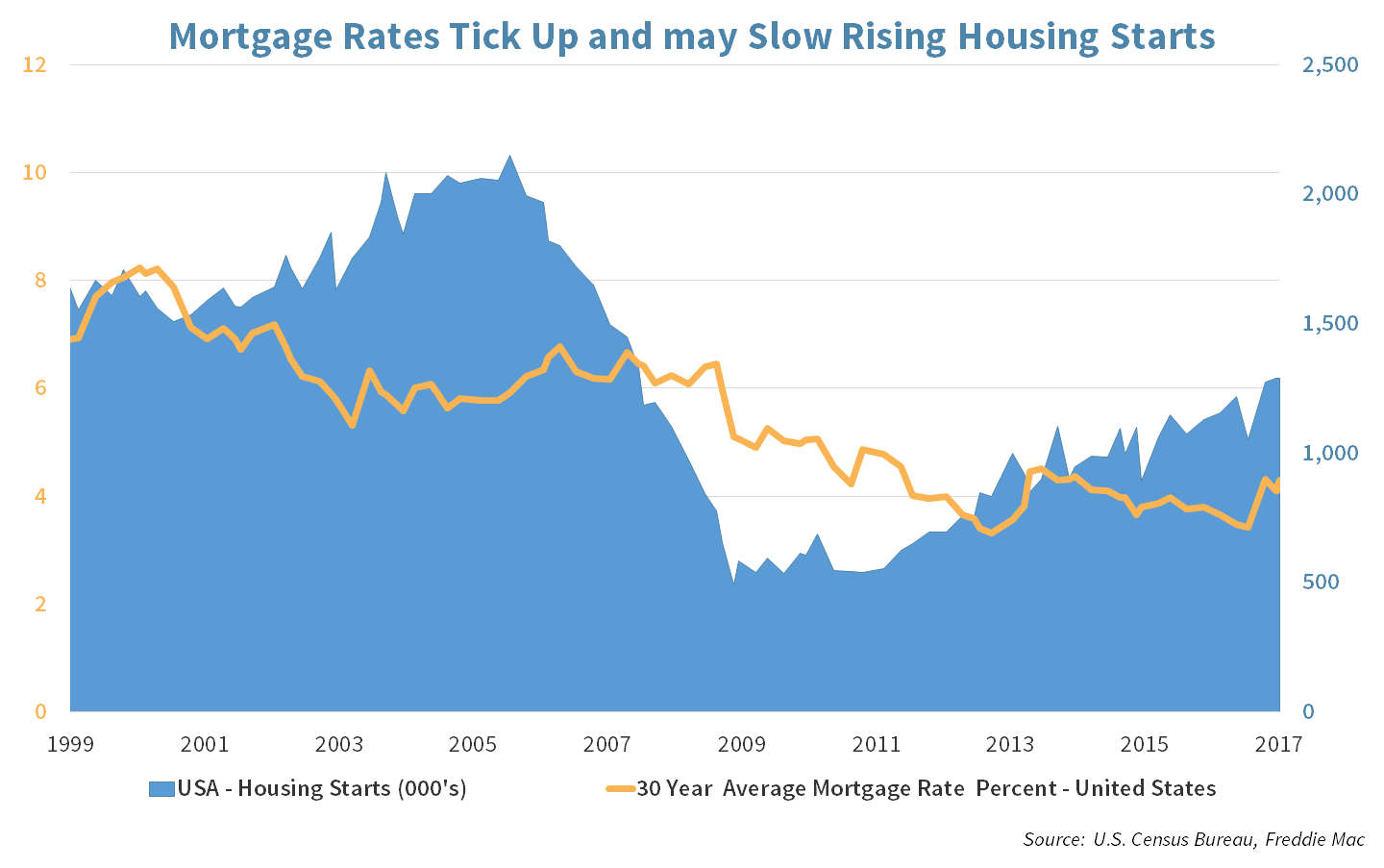

Mortgage rates and housing starts

As noted above, Federal Reserve Chairwoman Janet Yellen raised short-term interest rates this past Wednesday and indicated further rate hikes ahead. Many economists believe this marks an end to the Fed’s easy money policy as the economy has improved. A stronger economy could lead to higher inflation, which can be countered with higher interest rates. Yellen stated that inflation is “moving closer” to her target of 2% after undershooting it for years.

As rates rise, so do mortgage rates. According to Freddie Mac, the average 30-year fixed mortgage rate has increased from 3.5% before the election to 4.3% today. Higher rates may eventually slow down the economy, as financing costs are a headwind. This is perhaps most evident within the housing sector, as housing permits decreased 6% in February from the month before.

That said, housing starts in February did well and in fact reached their highest levels since 2007, to a seasonally adjusted annual rate of 1.29 million. The strong housing start number was driven by:

- Warm February weather boosting construction activity,

- A strengthening economy evident by a tightening labor market, and

- Home buyers looking to lock in low mortgage rates in anticipation they will rise.

Average US 30-year mortgage rate. Source: Freddie Mac

Week Ahead

Nuclear deal

Nike (NKE) – is scheduled to report their fiscal 3rd quarter. In the past 2 quarters, Nike was able to grow both sales and earnings, beating consensus both times.

- The company is expected to grow sales by nearly 5.6% to 8.5 billion vs. previous 3rd quarter of 8 billion in sales.

- Analysts are expecting $0.53 cents earnings per share.

U.S. home sales – There are 2 key issues looming over existing home sales; supply shortage and rising interest rates. House construction has risen steadily for houses in the price range of 200K and up, but the supply of houses under 200K has dried up.

- Existing home sales for February are forecasted to remain nearly flat at 5,565,000 sales.

Korea – The U.S. administration is done talking with North Korea on their Nuclear Program. South Korea and the U.S. have tried to improve relationships since the end of the Korean war in 1953. Secretary of State Rex Tillerson is scheduled to meet with Chinese leaders in Beijing, with the hopes of gaining Chinese support for the efforts to stop North Korean long-range nuclear weapon development.

Eurozone economic data – many EU countries will report their preliminary manufacturing and services PMI and final 4th quarter GDP.

- Economists see a slight increase in Markit PMI manufacturing and slight decline in the Markit PMI Services for Germany and France in the month of March.

- France is expected to post GDP growth of 1.2% which remains flat vs. the prior year.

Strategy Updates

Contributed by Max Berkovich ,

STRATEGIC ASSET ALLOCATION

A winner emerging

Emerging Markets claimed a clean win this week, rising nearly 4% and almost 13% thus far this year. Historically, rising U.S. rates leads to a stronger dollar, which has a negative impact on Emerging Markets. This is because some of these countries have a large amount of dollar denominated debt and interest payments become much more expensive. Market reaction this week suggests that this was priced in already. Separately, commodity prices are on the rise, due to higher manufacturing demand and expectations for stronger global growth. That is good news for Emerging Markets who produce siginificant amounts.

Rush back

Bond investors have welcomed the Fed’s rate hike and outlook, and have rushed back to the market for yield. For the past two weeks, the 10-year Treasury bond has been trading back and forth between 2.5% and 2.6%. Wednesday’s pull back to the bottom end of that range suggests that bond investors were pessimistic going into the Fed’s meeting.

Yellow cake

The rejection of far-right candidate Geert Wilders by Dutch voters and dovish language from the U.S. Federal Reserve were two developments on Wednesday that drove Gold prices higher. Gold previously had sold off for two consecutive weeks, but is now up almost 7% year-to-date.

STRATEGIC GROWTH

On cloud 9

The health care debate in the Capital weighed on the sector this week, while Consumer Staples out-jostled the Technology sector for the top spot, despite a phenomenal earnings report from….

- Database software designer Oracle Corp. (ORCL) topped bottom line estimates, but reported a slight miss on revenue. The company raised its dividend by 27%. Oracle reported $1.2 Billion of total cloud-based revenue for the quarter, 62% higher than the year ago period. CEO Safra Catz said that in the quarter, the company demonstrated it is “…improving nearly every important non-GAAP business metric you care to inspect; total revenue is up, margins are up, operating income is up, net income is up, EPS is up. Take a look. Q3 was a very strong quarter.”

StrategIc EQUITY INCOME

In search of rejuvenation

The yield curve flattened despite a rate hike this week, taking a bite out of banks, which caused financials to be the laggard. On the other hand, the less aggressive rate hike expectations bumped the Utilities and Telecom sectors to the lead spot. In other strategy news…

- William-Sonoma Corp. (WSM), the home decor retailer, reported results that were better than consensus. Most importantly, the company raised its dividend to a 3.25% annual yield and reported continued growth in e-commerce. Currently 51.1% of total revenue comes from on-line, up from 49.9% last year. The company also indicated double digit growth for West Elm and two newer divisions: Rejuvenation and Mark and Graham.

About Strategic

Founded in 1979, Strategic is a leading investment and wealth management firm managing and advising on client assets of over $2 billion.

OverviewDisclosures

Strategic Financial Services, Inc. is a SEC-registered investment advisor. The term “registered” does not imply a certain level of skill or training. “Registered” means the company has filed the necessary documentation to maintain registration as an investment advisor with the Securities and Exchange Commission.

The information contained on this site is for informational purposes and should not be considered investment advice or a recommendation of any particular security, strategy or investment product. Every client situation is different. Strategic manages customized portfolios that seek to properly reflect the particular risk and return objectives of each individual client. The discussion of any investments is for illustrative purposes only and there is no assurance that the adviser will make any investments with the same or similar characteristics as any investments presented. The investments identified and described do not represent all of the investments purchased or sold for client accounts. Any representative investments discussed were selected based on a number of factors including recent company news or earnings release. The reader should not assume that an investment identified was or will be profitable. All investments contain risk and may lose value. There is no assurance that any investments identified will remain in client accounts at the time you receive this document.

Some of the material presented is based upon forward-looking statements, information and opinions, including descriptions of anticipated market changes and expectations of future activity. Strategic Financial Services believes that such statements, information, and opinions are based upon reasonable estimates and assumptions. However, forward-looking statements, information and opinions are inherently uncertain and actual events or results may differ materially from those reflected in the forward-looking statements. Therefore, undue reliance should not be placed on such forward-looking statements, information and opinions.

No content on this website is intended to provide tax or legal advice. You are advised to seek advice on these matters from separately retained professionals.

All index returns, unless otherwise noted, are presented as price returns and have been obtained from Bloomberg. Indices are unmanaged and cannot be purchased directly by investors.

Doug Walters

Doug Walters