A House Divided

Janet Yellen and the Federal Open Market Committee presented a surprisingly divided view on the need for a near-term rate increase. With the next rate rise not appearing imminent, the dollar continued to weaken, while stocks and commodities got a boost.

Market Review

Contributed by Doug Walters

Full of Energy

Stocks closed the week relatively flat, but the real action was in the Energy space where oil prices continued their ascent. Brent Crude is up around 20% from the lows in early August.

- There has been no single driver of the higher oil prices. Thanks to the summer driving season and production declines, U.S. crude oil supplies declined. In addition, there has been recent talk (though no action) from OPEC members about a coordinated production freeze.

- Also helping to boost oil, and commodities in general, has been the recent slide in the U.S. dollar. Dovish comments from the Federal Reserve gave the dollar another excuse to weaken against its global peers.

For the Birds

The minutes from the Federal Reserve’s July meeting were the only major fodder for economic wonks this week. Those expecting a more hawkish tone were disappointed to find the Fed still quite divided on the timing of the next rate rise. With a September increase unlikely, the dollar weakened and stocks rose.

If you have ever wondered what these terms Dove and Hawk really mean, you are not alone.

- Doves are concerned about jobs. They want to keep interest rates low to promote business investment and job creation. With rates near historical lows, the U.S. Fed policy is currently very dovish.

- Hawks are concerned about inflation. If rates stay too low for too long, the economy can overheat, resulting in excess inflation. The December rate rise, and discussions about the next increase are signs that the Fed is turning incrementally more hawkish.

- The goal of Janet Yellen and the Federal Open Market Committee is to strike the right balance between dovish and hawkish to keep the U.S. economy healthy. Time will be the ultimate judge of their success.

| Indices & Price Returns | Week (%) | Year (%) |

|---|---|---|

| S&P 500 | 0.0 | 6.8 |

| S&P 400 (Mid Cap) | 0.3 | 11.7 |

| Russell 2000 (Small Cap) | 0.6 | 8.9 |

| MSCI EAFE (Developed International) | -0.6 | -1.0 |

| MSCI Emerging Markets | 0.0 | 14.6 |

| S&P GSCI (Commodities) | 4.9 | 18.9 |

| Gold | 0.4 | 26.1 |

| MSCI U.S. REIT Index | -1.9 | 10.9 |

| Barclays Int Govt Credit | -0.2 | 3.0 |

| Barclays US TIPS | -0.1 | 5.8 |

Economic Commentary

The Economics of Cattle

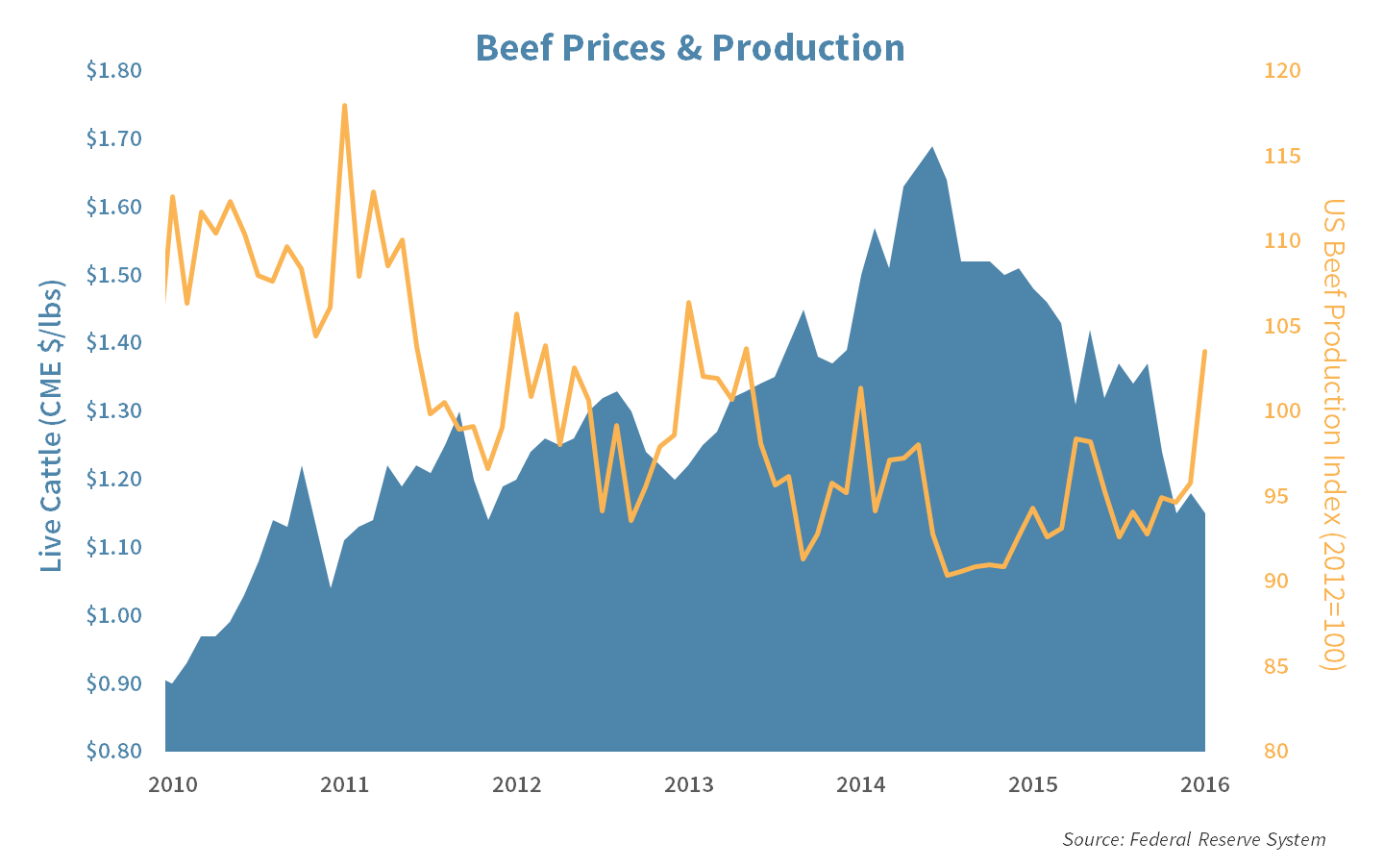

The cattle futures market has been so volatile recently that traders are calling it “the meat casino” and the lack of price signaling has caused the Chicago Mercantile Exchange to cancel additional future listings. This is bad news for ranchers that would like to hedge their risks by locking in their future cattle prices.

Ranchers profited in 2014 when cattle prices reached an all-time high of $1.69 per pound but prices have since steeply fallen to $1.10 today. The 35% drop was caused by a variety of reasons including:

- An increase in beef production as ranchers were incentivized to add supply.

- Higher placements of heavy cattle.

- An escalation of slaughter numbers.

- Large amounts of other meats which can be beef substitutes weighing on demand.

Farm level cattle prices have dropped a lot faster than the retail price which has benefited margins of food packaging companies such as Tyson Foods because they buy at the farm level and sell to the retail consumer. Eventually the retail price will drop at the same rate as its farm level source but in the meantime, end consumers are charged a higher price. This in turn reduces demand for beef and cattle which puts even more downward pressure on the falling cattle price.

Week Ahead

Millennial Focused

Two of Strategic’s holding’s, Ulta Salon, Cosmetics & Fragrance and Dollar Tree will be reporting quarterly earnings next week. Both of these stores have been driven by a shift in millennial’s spending habits.

- Ulta will look to add to its 47% year-to-date gains by beating earnings for another quarter.

- Dollar Tree will also be reporting and will be hoping to add to it’s 25% year-to-date gains. Analyst’s will be looking for evidence of more synergies from last year’s merger with Family Dollar.

New York State Fair

Running from August 25th to September 2nd, The Great New York State Fair will be underway in Syracuse NY. Several new changes are coming for this year’s fair. Some of the attractions include:

- Lakeview Amphitheater for concert venues.

- A larger Kiddie Land with more rides and a picnic area for lunch.

- A new commercial strip named “Broadway” that will feature more vendors and updated features.

- Additional parking along Bridge Street.

Strategy Update

Contributed by , Max Berkovich

Strategic Asset Alloaction

Soft Dollars

U.S. Equities were flat this week, despite strength in Energy. Weakening of the dollar helped boost commodities, with a positive knock on effect for Emerging Markets. Real Estate was particularly weak, with REITs down nearly 2%. These moves have yet to prompt us to make changes to our asset allocation.

Silver and Gold

The strength in commodities did not fully carry over to precious metals last week, where silver was weak relative to gold. However, both metals are up sharply this year, with silver (up around 40%), being the better performer of the two. One can argue that silver is a much more fundamental investment than gold because it has many uses beyond its ornamental value. It is being used in a number of industrial applications, it is found in virtually all electronics, and it has anti-bacterial properties. As a result, silver is more directly tied to the economic cycle than gold, and therefore should be more correlated to stocks. Gold lacks this link, which is exactly what makes it a more valuable diversifier.

STRATEGIC Growth

Hainus news

Cyclical sectors had a nice week, while Consumer Discretionary sector was the big dud, thanks entirely to…

- The Hain Celestial Group (HAIN), a natural food and personal care company, announced on Monday that they are evaluating potential accounting issues and will delay their Fiscal 4th quarter report. The company is undergoing an audit of its books, based on irregularities in revenue recognition of some sales to certain distributors. To add insult to injury, the Lake Success, NY based company also added that it will not meet its previous guidance for the 4th quarter and full year.

- While the extent of what the audit may find is unknown, we are assuming for now it is the timing of the revenue recognition that is in question not the actual sales.

- The stock was up 32% on the year before the announcement, mostly on M&A rumors after a peer was acquired in July. This news will likely scare any suitor from a bid in the near future.

STRATEGIC Equity income

Switcheroo

Energy and Financial sectors stood out this week, while Utilities were a laggard. In other strategy news…

- Cisco System Co. (CSCO) reported a beat on both the top and bottom lines. This quarter’s report took a back seat to a rumor that the company was going to lay-off 20% of its staff (14,000 employees). Cisco instead reported that it would only be cutting about 5,500 jobs. The lay-offs are part of restructuring plan to to shift the business toward software and services and away from selling hardware that sits in data centers.

- Deere reported stronger than expected results and guidance on Friday. Investors chased shares higher after the stock had been unloved by Wall Street for much of the past year.

About Strategic

Founded in 1979, Strategic is a leading investment and wealth management firm managing and advising on client assets of over $2 billion.

OverviewDisclosures

Strategic Financial Services, Inc. is a SEC-registered investment advisor. The term “registered” does not imply a certain level of skill or training. “Registered” means the company has filed the necessary documentation to maintain registration as an investment advisor with the Securities and Exchange Commission.

The information contained on this site is for informational purposes and should not be considered investment advice or a recommendation of any particular security, strategy or investment product. Every client situation is different. Strategic manages customized portfolios that seek to properly reflect the particular risk and return objectives of each individual client. The discussion of any investments is for illustrative purposes only and there is no assurance that the adviser will make any investments with the same or similar characteristics as any investments presented. The investments identified and described do not represent all of the investments purchased or sold for client accounts. Any representative investments discussed were selected based on a number of factors including recent company news or earnings release. The reader should not assume that an investment identified was or will be profitable. All investments contain risk and may lose value. There is no assurance that any investments identified will remain in client accounts at the time you receive this document.

Some of the material presented is based upon forward-looking statements, information and opinions, including descriptions of anticipated market changes and expectations of future activity. Strategic Financial Services believes that such statements, information, and opinions are based upon reasonable estimates and assumptions. However, forward-looking statements, information and opinions are inherently uncertain and actual events or results may differ materially from those reflected in the forward-looking statements. Therefore, undue reliance should not be placed on such forward-looking statements, information and opinions.

No content on this website is intended to provide tax or legal advice. You are advised to seek advice on these matters from separately retained professionals.

All index returns, unless otherwise noted, are presented as price returns and have been obtained from Bloomberg. Indices are unmanaged and cannot be purchased directly by investors.

Doug Walters

Doug Walters