A surprising read

The Federal Reserve surprised investors this week, revealing that a June rate hike was a real possibility. After some initial indigestion, equity markets rallied, with the S&P 500 ending the week in positive territory.

Market Review

Contributed by Doug Walters

Reloading the Arsenal

The S&P 500 managed to squeak out a positive return for the week thanks to a rally Friday, on what was otherwise a slow news day. The real excitement was earlier in the week when minutes from the Federal Reserve’s April meeting surprised many by indicating that a June rate hike was back on the table.

- Higher rates in isolation are a headwind for stock prices. However, there are positive implications of a decision to raise rates. Most notably is that the Fed sees enough strength in the economy to justify the hike. After the initial shock, stocks should celebrate that news.

- In addition, each time the Fed successfully notches rates higher, they take a step towards refilling their stimulus arsenal to fend off a future economic soft patch.

A Strong Foundation

While the Fed appears to be seeing the economic progress necessary to raise rates, we still sense a preponderance of uncertainty in market participants. It is easy to see where this trepidation comes from: the U.S. is going through one of the more uncertain presidential cycles; one of the world’s greatest growth engines, China, has slowed down; and Britain is threatening to exit the European Union.

- Each of these are real near-term concerns, and will add to market volatility in the short-term.

- To help weather these and future potential economic shocks, we have built the foundation of our security selection process on the dual tenets of Quality and Value.

- In addition, proper diversification enables us to capitalize on attractive valuations when markets experience a pull back.

| Indices & Price Returns | Week (%) | Year (%) |

|---|---|---|

| S&P 500 | 0.3 | 0.4 |

| S&P 400 (Mid Cap) | 0.5 | 3.5 |

| Russell 2000 (Small Cap) | 0.6 | -2.3 |

| MSCI EAFE (Developed International) | -0.7 | -5.6 |

| MSCI Emerging Markets | -1.8 | -1.5 |

| S&P GSCI (Commodities) | 1.4 | 17.7 |

| Gold | -1.7 | 18 |

| MSCI U.S. REIT Index | -2.7 | 2.8 |

| Barclays Int Govt Credit | -0.6 | 1.8 |

| Barclays US TIPS | -1.0 | 4.1 |

Economic Commentary

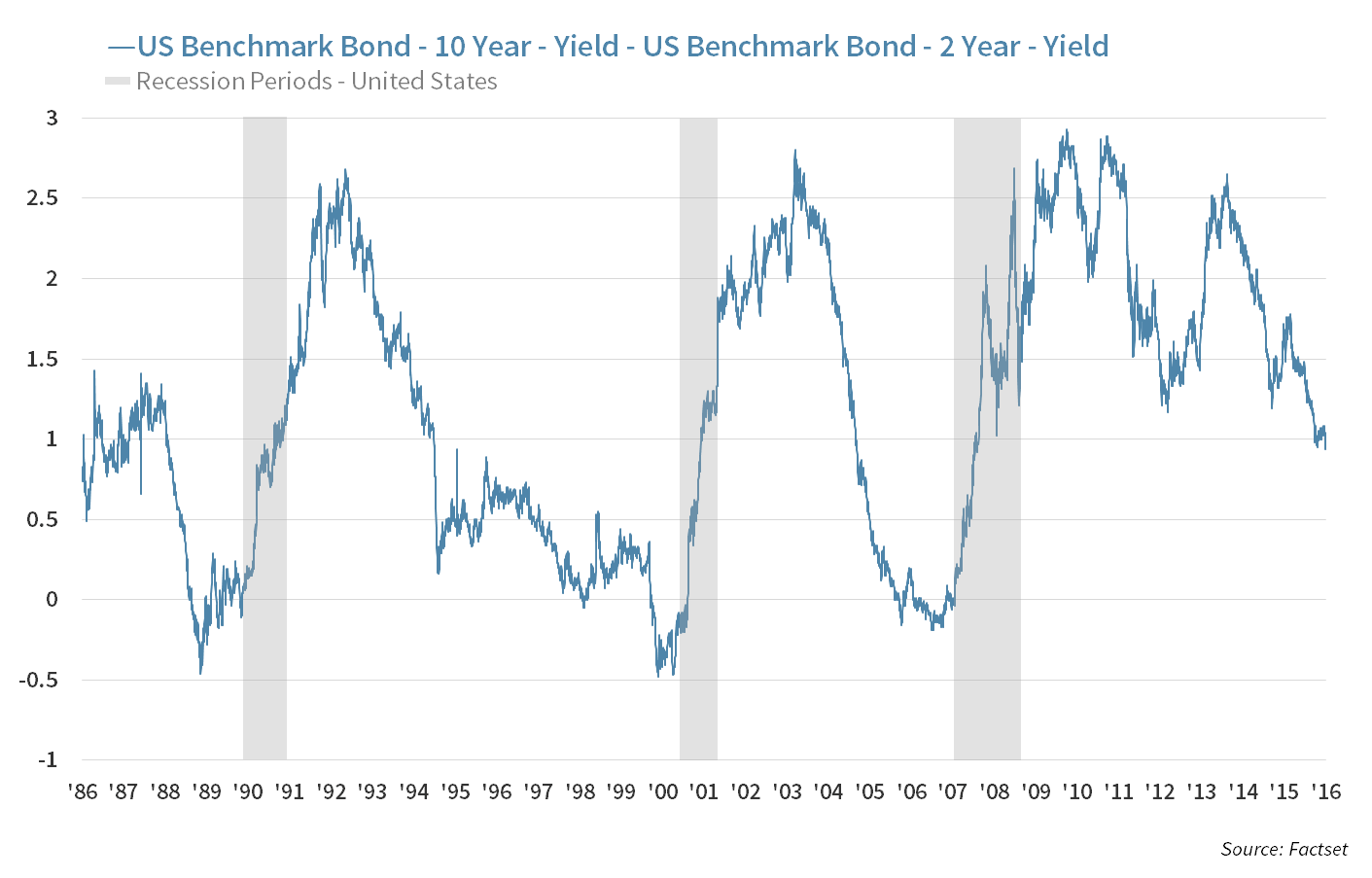

Flat Curves

The Treasury yield curve is the slope of interest rates the government charges over different time periods. It is usually upward sloping as investors normally demand a higher interest rate for a longer period loan. Recently, however, the yield curve has flattened. This development is important to monitor as an inverted yield curve (long term rates are lower than short term rates) can be a sign that a recession is coming.

Past recessions such as the ones in 1990, 2001 and 2008 were precluded by a yield curve inversion as investors expected interest rates to fall due to a weakening economy. This time however, the flattening of the yield curve is being driven more by central banks around the world than by private investors. The Japanese central bank has lowered interest rates below zero which makes long term US Treasuries relatively more attractive to buy and in turn pushes down their yields. (See more on Japan in The Week Ahead). Short term US Treasury rates are being pushed up because there is an increased probability the Fed will raise rates next month as the economy recovers and consumers spend more. These dynamics have made the yield curve less of a predictor of macro-economic health in our opinion.

Week Ahead

A Sustainable Yen Rally?

As Japan’s Finance minister tells G7 leaders that his nation will refrain from “competitive devaluation” of their currency, the nation will report key data early next week. Import/Export data, the Corporate Price Index and an All-Industry Index on Supply Outputs are among the highlights.

- Negative interest rates continue to give a tail wind to the Yen as GDP climbed 7% in Q1.

- Japan may look to raise the sales tax from 8% to 10% in months to come.

Consumers in Focus

Strategic holdings within the consumer discretionary sector ULTA Salon & Fragrance (ULTA), Dollar Tree (DLTR) and Williams Sonoma (WSM) will report first quarter earnings next week.

- ULTA – Retail has taken a hit this quarter, but as a specialty retailer ULTA will look to snap the trend by building on recent strong momentum.

- DLTR – Almost a year removed from its acquisition of Family Dollar, DLTR looks to begin to capture some synergies found within the deal.

- WSM – Planning on a home upgrade this spring into summer? WSM sure hopes so as they look to follow suit of Lowe’s recent Q1 earnings beat.

Strategy Update

Contributed by David Lemire , Max Berkovich

Strategic Asset Allocation

Stemming the Tide

Global equity markets looked to halt recent losses that saw declines hit the mid-single digits. Most markets remain down for the month, quarter, and year. Although Mega-caps, Mid-caps, and Large Value remain in positive territory. Bond markets have edged down recently but remain positive for the quarter and year.

Treading Water

After two double digit moves (down to start the year and up starting in mid-February), equity markets appear to be searching for a catalyst regardless of direction. With the Fed signaling June rate hike possibilities, tidal direction remains a mystery. The strengthening economy thesis could help push markets higher once the fear of less monetary stimulus subsides.

Noise – No Signal

Portfolio allocations have naturally rebalanced themselves although the moves remain “noisy”. No one asset class has separated itself from the portfolio to the point that signals the need to address it through rebalancing.

Strategic Growth

Take Me to Church

Health Care and Technology sectors floated to the top this week, while both the Consumer sectors continue to sink to the bottom. One exception…

- Consumer product company Church & Dwight Co. Inc. (CHD) found itself in the middle of M&A intrigue. On Wednesday the rumor (per a Spanish news site) was that fellow strategy holding, Procter & Gamble (PG), was going to make a bid. On Thursday morning, the rumor mill had British consumer goods company Reckitt Benckiser (RBGLY) buying the company. The company did not wait very long to put the hammer down on the rumors, saying, it is “not engaged in any talks with any party.”

Strategic Equity Income

A Superstore

Financials responded positively to chatter of a Fed rate hike in June being in play as higher rates generally mean higher bank margins. Consumer discretionary stocks were the worst sector. In other consumer related news…

- Wal-Mart Stores Inc. (WMT) had its best day since 2008 as the stock responded to consensus topping results. Comparable same-store sales were up 1% in the quarter and store traffic was up 1.5%. While low in the absolute, the results relative to expectations were solid.The hit to the bottom line from higher wages may have been overblown by analysts.

About Strategic

Founded in 1979, Strategic is a leading investment and wealth management firm managing and advising on client assets of over $2 billion.

OverviewDisclosures

Strategic Financial Services, Inc. is a SEC-registered investment advisor. The term “registered” does not imply a certain level of skill or training. “Registered” means the company has filed the necessary documentation to maintain registration as an investment advisor with the Securities and Exchange Commission.

The information contained on this site is for informational purposes and should not be considered investment advice or a recommendation of any particular security, strategy or investment product. Every client situation is different. Strategic manages customized portfolios that seek to properly reflect the particular risk and return objectives of each individual client. The discussion of any investments is for illustrative purposes only and there is no assurance that the adviser will make any investments with the same or similar characteristics as any investments presented. The investments identified and described do not represent all of the investments purchased or sold for client accounts. Any representative investments discussed were selected based on a number of factors including recent company news or earnings release. The reader should not assume that an investment identified was or will be profitable. All investments contain risk and may lose value. There is no assurance that any investments identified will remain in client accounts at the time you receive this document.

Some of the material presented is based upon forward-looking statements, information and opinions, including descriptions of anticipated market changes and expectations of future activity. Strategic Financial Services believes that such statements, information, and opinions are based upon reasonable estimates and assumptions. However, forward-looking statements, information and opinions are inherently uncertain and actual events or results may differ materially from those reflected in the forward-looking statements. Therefore, undue reliance should not be placed on such forward-looking statements, information and opinions.

No content on this website is intended to provide tax or legal advice. You are advised to seek advice on these matters from separately retained professionals.

All index returns, unless otherwise noted, are presented as price returns and have been obtained from Bloomberg. Indices are unmanaged and cannot be purchased directly by investors.

Doug Walters

Doug Walters