Your Questions, Answered

In this week’s Insights, we provide answers to frequently asked questions to help you navigate the recent market turmoil.

“The economic and Covid-19 news was terrible this week (3/16/20), why did the stock markets rally?”

It is a matter of expectations. Stock prices do not just reflect what is going on today for a company, but they also reflect expectations of what will happen tomorrow, next month, next year, ten years out and beyond. We do not need the services of an economist to know that workers have been sent home, unemployment numbers will skyrocket, and corporate profitability for the first half of the year will be, for many companies, horrendous. That is well-known and already priced into stocks. We will see economic headlines over the next weeks and months the likes of which we have never seen before. GDP may be down 40%, and unemployment claims will rise in increments of millions… all horrible, but this is known. Stocks should not respond much to these headlines since we all know they are coming. What the stock market will react to is new information. The coming together of Democrats and Republicans to pass a stimulus plan was new positive information, as was the Fed’s renewed quantitative easing program. All of these headlines helped drive stocks up.

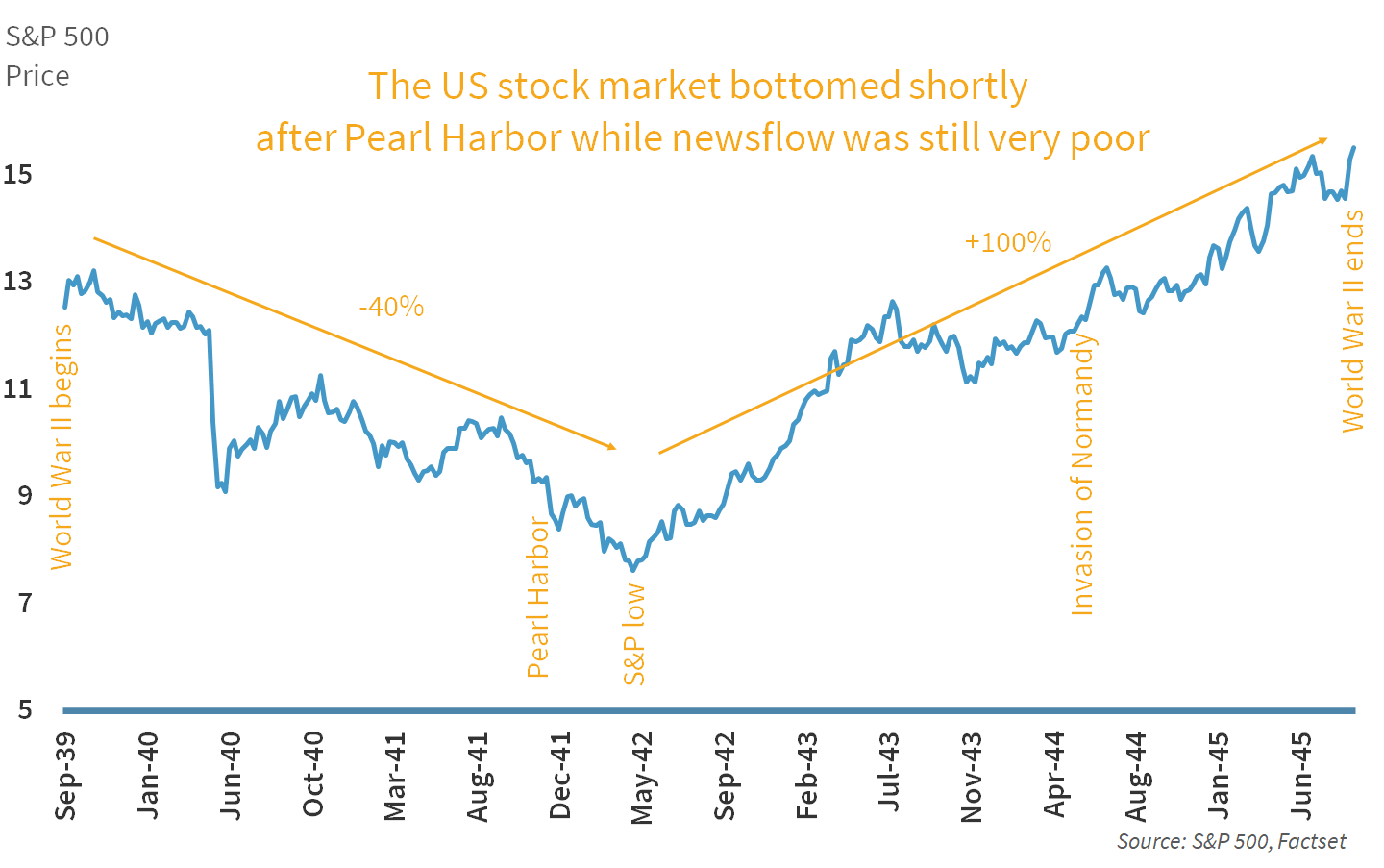

The point is that in any stock market crisis (or any day for that matter) investors will be looking past the current news to what is coming next. As a result, often stocks will begin rebounding just as headlines are their worst. World War II is an interesting example (see below). Stocks bottomed shortly after the attack on Pearl Harbor despite the fact that news flow was still very poor. We do not need positive headlines to have positive stock market moves.

“Should I put all my investments in cash and sit this out?”

No. To sit this out would imply that somehow you can predict the future and would be akin to market timing. The practice of market timing is a surefire way to damage your long-term returns (see our white paper). Stocks are priced based on the combined input of millions of investors and therefore have likely already done a decent job of pricing in all known information. As such, on any given day, stocks are just as likely to go up as they are to go down.

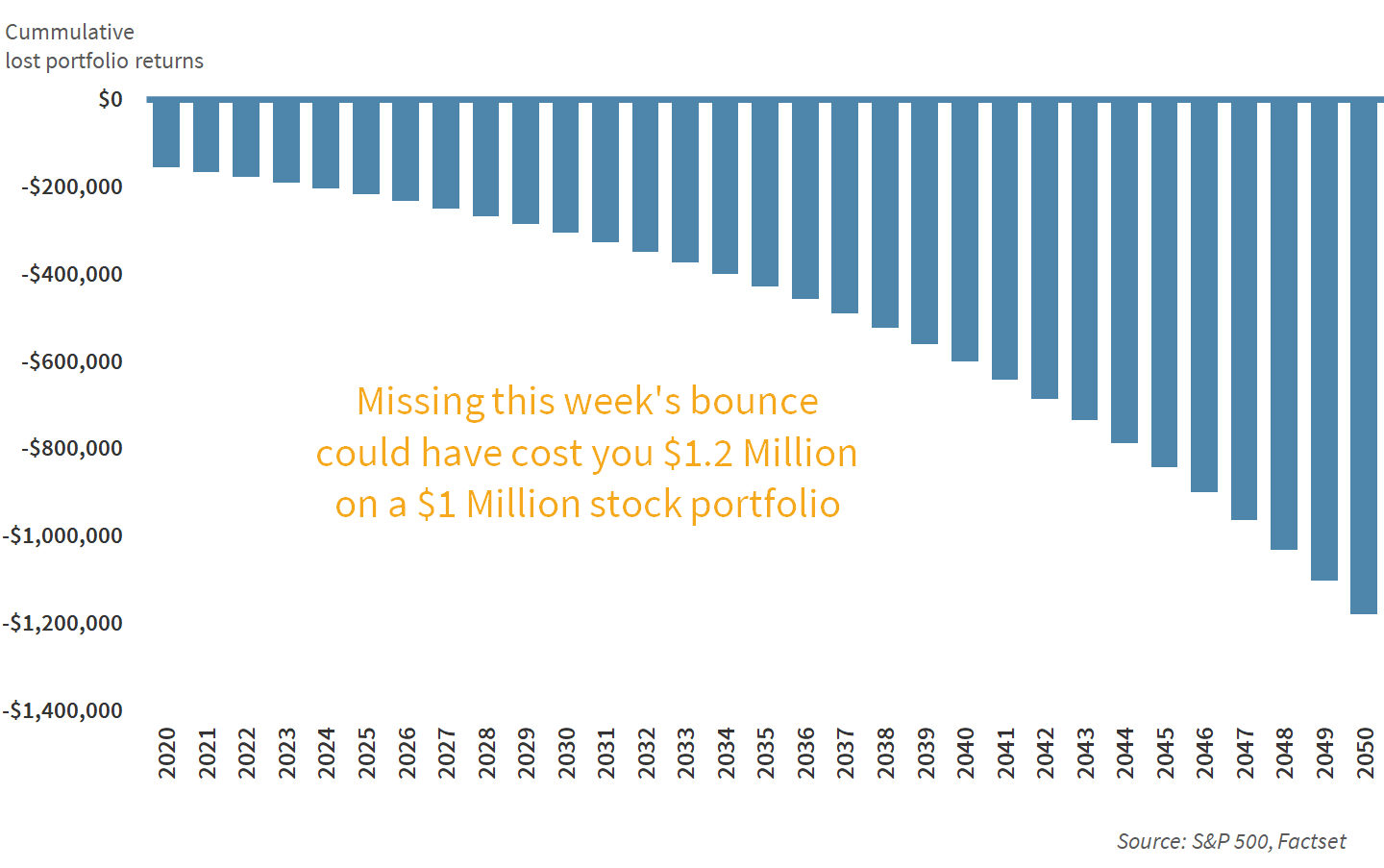

Last week’s stock returns were terrible. Investors who exited in fear missed out on a massive rally this week. The missed opportunity over the past week will compound over an investor’s lifetime. On a million-dollar stock portfolio, missing this week’s rally compounds to a $1.2 million missed opportunity over the span of thirty years.

“How long will it take for my portfolio to recover?”

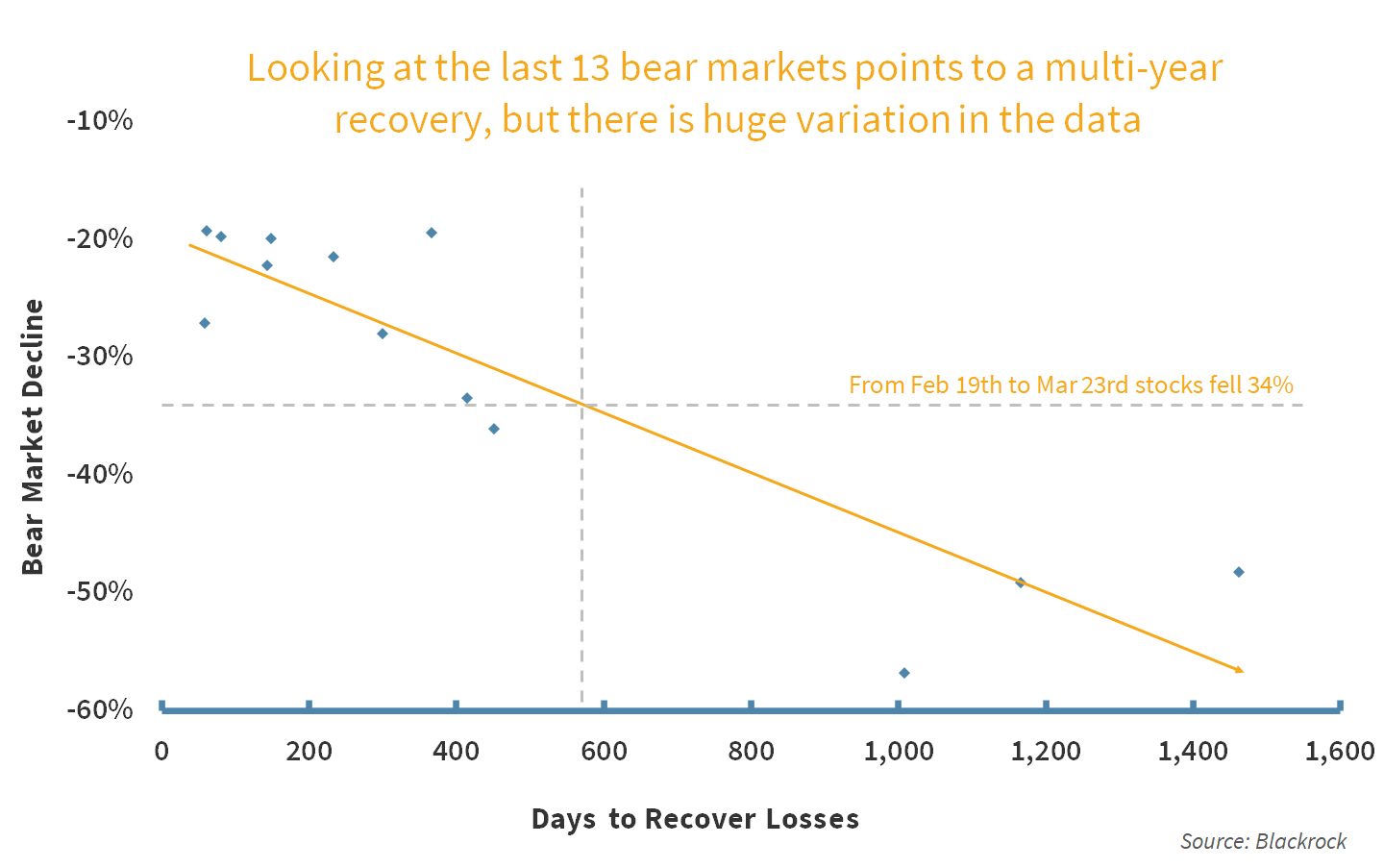

It is impossible to say, particularly as we do not know if we have reached a market bottom yet. However, we can look at history as a guide. There is a correlation between the extent of bear market declines and the length of time it takes to recover. If we assume, we reached a market bottom on Monday (this is a big assumption), then we are looking at a 34% decline. That would imply about a year and a half to recover the losses. But there is enormous variation in the data. By historical standards, there has been nothing typical about the current bear market, so there is no reason to assume the rebound will be typical.

“How low can the market go?”

How low can the market go? Very low. It can also go very high! Anyone trying to convince you they know the next move the market will make is likely trying to sell you something. We can see from the chart above that declines of 20-35% are not uncommon, and on occasion, we see declines of 50-60%. But the truth is we do not know how low we will go this time, nor do we see it as our job to know. Our job is to know our client’s appropriate risk allocation and ensure we give them the best exposure to that risk.

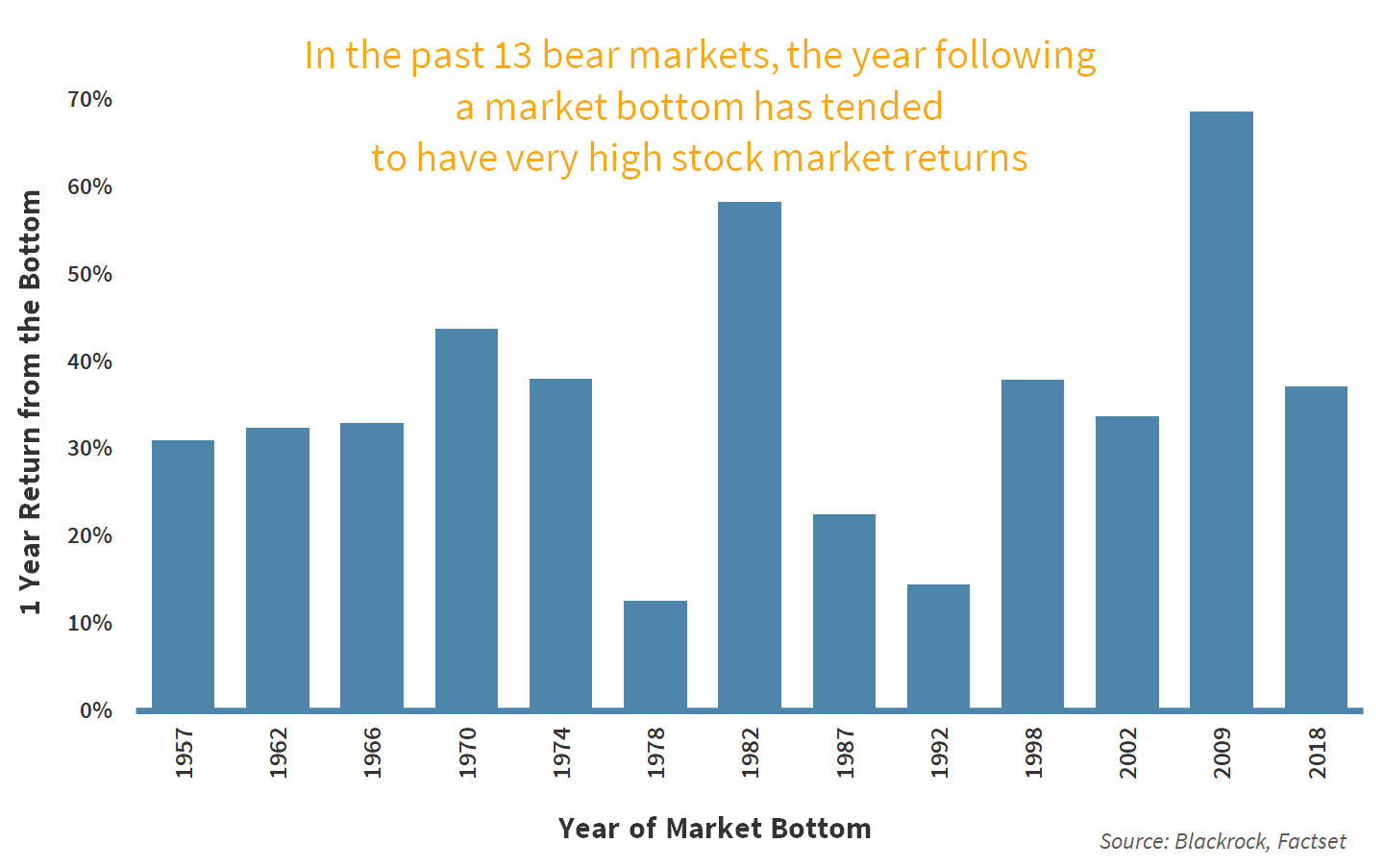

What we do know from history is that as the market gets cheaper, expected future returns will generally rise. As the chart below shows, the stock market returns in the year following a bear market bottom tend to be very high. Therefore, our tendency in market declines will be to add exposure to equities.

“If you do not know how low the market can go, can I lose everything?”

Compliance frowns on us giving guarantees, but no, it is not conceivable you would lose everything investing at Strategic or other reputable wealth managers. Here is how we avoid that scenario:

| How to Lose Everything | How to Avoid Permanent Loss |

|---|---|

| Concentration risk - putting all your assets in a small number of risky investments exposes you to the potential of catastrophic events such as corporate bankruptcy. | Diversification - splitting your portfolio allocation among a variety of asset classes (e.g. stocks, bonds, and gold) as well as regions (e.g. U.S., international, emerging), lowers overall portfolio risk significantly. A preference for funds over individual securities also reduces concentration risk. |

| Leverage - borrowing to purchase more securities than you have money to buy can result in devastating losses and forced sales in times of market stress. | No leverage - eliminating leverage from a portfolio helps ensure you can ride out significant declines without being forced to sell. |

| Poor security selection - selecting a stock, bond or funds that do not have the quality to survive a downturn without a permanent loss of capital will hamper your ability to recovery along with the market. | Quality securities - portfolios that focus on quality securities are less likely to suffer a permanent loss of capital. When the smoke clears, the goal is to ensure your investments are able to participate in the recovery. |

| Illiquid securities - investing in illiquid securities (e.g. micro-cap, private equity, hedge funds) can result in big losses in a forced sale, and could limit your ability to respond to changing market conditions. | Liquid securities - access to your money when you need it can be critical during market shocks. |

| Exotic securities - derivatives, if used improperly, and other exotic securities can provide investors with negative surprises in times of stress if they do not fully understand their construction. | Transparency - if you always know what you own, know what it is worth, and know how it fits in your portfolio, you should never be surprised by how it behaves in market stress. Often with investing, simple is better. |

| Poor custody - entrusting your wealth manager to also custody your assets creates unnecessary risk (e.g. Madoff). | Third party custody - having an independent party (in our case Schwab) custody your assets ensures you always know where your money is. |

“When do we see the economy returning to normal?”

The U.S. economy was strong ahead of the Covid-19 crisis, and the hope is that that strength will return as the crisis is contained. But it is impossible to know when that will happen. We do not believe our crystal ball is any better than anyone else’s, and certainly would not rely on it within our investment process. Long-term investors should not worry themselves with the timing of economic cycles, but rather should put in place a process that will allow them to efficiently capture the benefits of the market over that cycle. Our process in its purest form is to:

- Start with a well-diversified portfolio with proven factors at the core

- Rebalance regularly, which will naturally bank gains and shift capital to better value

- Lock in tax losses to offset future gains where it makes sense

- Look for opportunities to shift allocation if dislocations arise

We hope the economy rebounds quickly from Covid-19, but if it does not, we know we have a process in place that is prepared to handle whatever the market throws our way.

“What industry or stocks should I be buying or selling?”

This question has good intentions but is out of step with how we think about investment management. Our approach is to:

- Start with a well-diversified portfolio with proven factors at the core

- Rebalance regularly, which will naturally bank gains and shift capital to better value

- Lock in tax losses to offset future gains where it makes sense

- Look for opportunities to shift allocation if dislocations arise

What is implied in our process that we will always be looking to shift assets from what has outperformed to what has underperformed. If you are happy with the quality of what you own in your diversified portfolio, then the natural move is to buy assets that have significantly underperformed. In this market, that generally means selling fixed income and buying equities. Within equities, the weakest performers on the way down have been small-cap stocks and at the sector level Financials and Energy. You do not need to swing for the fences or try to seek the “next big thing,” and that is certainly not what we are doing. But following our process will naturally lead us to be rebalancing portfolios in favor of those significant underperformers.

“Why should I own anything other than U.S. large-cap stocks?”

(International or small-cap stocks have underperformed and bond yields are so low.)

In a word, diversification. Yes, U.S. stocks have had a very good run, and before this downturn, diversified portfolios have likely underperformed for the better part of a decade. Yet history shows us that in the long run, diversification is beneficial to risk-adjusted portfolio returns.

So why does it not feel that way? Here is why:

- In good times, when the U.S. stock market has strong performance, your diversified portfolio, which includes international stocks as well as bonds, will almost certainly underperform. This does not feel good.

- In bad times, when the U.S. stock market falls significantly, your diversified portfolio will likely fall as well, but it will also almost certainly outperform. But outperformance does not feel good when returns are negative.

- Over the long-term, though, by avoiding the steep declines of the U.S. stock market, a diversified portfolio can outperform with significantly less risk.

Fund giant Blackrock put it well when they said, “Diversification wins even when it feels its losing.”

The short-term path to success may be uncertain, but brighter days are most definitely ahead. Strategic is here to help you see the way. We encourage you to contact us at 315-724-1776 or by email when we can be of service.

Have a Question? Ask Us.

If you have any questions you want to ask our investment team or advisors, fill in the form below and look for your answer in an upcoming edition.About Strategic

Founded in 1979, Strategic is a leading investment and wealth management firm managing and advising on client assets of over $2 billion.

OverviewDisclosures

Strategic Financial Services, Inc. is a SEC-registered investment advisor. The term “registered” does not imply a certain level of skill or training. “Registered” means the company has filed the necessary documentation to maintain registration as an investment advisor with the Securities and Exchange Commission.

The information contained on this site is for informational purposes and should not be considered investment advice or a recommendation of any particular security, strategy or investment product. Every client situation is different. Strategic manages customized portfolios that seek to properly reflect the particular risk and return objectives of each individual client. The discussion of any investments is for illustrative purposes only and there is no assurance that the adviser will make any investments with the same or similar characteristics as any investments presented. The investments identified and described do not represent all of the investments purchased or sold for client accounts. Any representative investments discussed were selected based on a number of factors including recent company news or earnings release. The reader should not assume that an investment identified was or will be profitable. All investments contain risk and may lose value. There is no assurance that any investments identified will remain in client accounts at the time you receive this document.

Some of the material presented is based upon forward-looking statements, information and opinions, including descriptions of anticipated market changes and expectations of future activity. Strategic Financial Services believes that such statements, information, and opinions are based upon reasonable estimates and assumptions. However, forward-looking statements, information and opinions are inherently uncertain and actual events or results may differ materially from those reflected in the forward-looking statements. Therefore, undue reliance should not be placed on such forward-looking statements, information and opinions.

No content on this website is intended to provide tax or legal advice. You are advised to seek advice on these matters from separately retained professionals.

All index returns, unless otherwise noted, are presented as price returns and have been obtained from Bloomberg. Indices are unmanaged and cannot be purchased directly by investors.

Doug Walters

Doug Walters