Wheeling and Dealing

Stock markets continue to ring in record highs as solid earnings reports continue to propel stocks to new highs and help investors to forget about the D.C. soap opera.

Market Review

Contributed by Max Berkovich

Scars and Stripes

Newly appointed White House Chief of Staff John Kelly sent a clear message on his 1st day in charge. The retired 4-Star Marine Corps general fired communications director Anthony Scaramucci after only 10 days on the job. “The Mooch”, as he likes to be called, used very colorful language in what turned out to be an “on the record” interview. The move by the Chief of Staff could be the start of a newly found discipline in the West Wing, a regime change that the market would welcome.

iBeat

Apple Inc. (AAPL) reported a strong quarter, beating consensus expectations. Key takeaways from the earnings call of the S&P 500’s largest company were that they reported $24.8 Billion dollars in revenue from iPhones and $7.3 Billion of revenue from services. Apple’s cash hoard grew to $261.5 Billion, leading to further speculation of acquisitions. Management’s commentary also eased concerns about iPhone production delays. Bullish analysts expect Apple to be the first company to achieve $1 Trillion(!) in market capitalization.

| Indices & Price Returns | Week (%) | Year (%) |

|---|---|---|

| S&P 500 | 0.0 | 10.4 |

| S&P 400 (Mid Cap) | -0.7 | 6.1 |

| Russell 2000 (Small Cap) | -0.5 | 5.3 |

| MSCI EAFE (Developed International) | 0.2 | 14.7 |

| MSCI Emerging Markets | 0.3 | 23.3 |

| S&P GSCI (Commodities) | 4.2 | -2.9 |

| Gold | 1.2 | 10.1 |

| MSCI U.S. REIT Index | 0.5 | 1.7 |

| Barclays Int Govt Credit | -0.1 | 1.1 |

| Barclays US TIPS | 0.1 | 0.4 |

Economic Commentary

Spinning Their Wheels

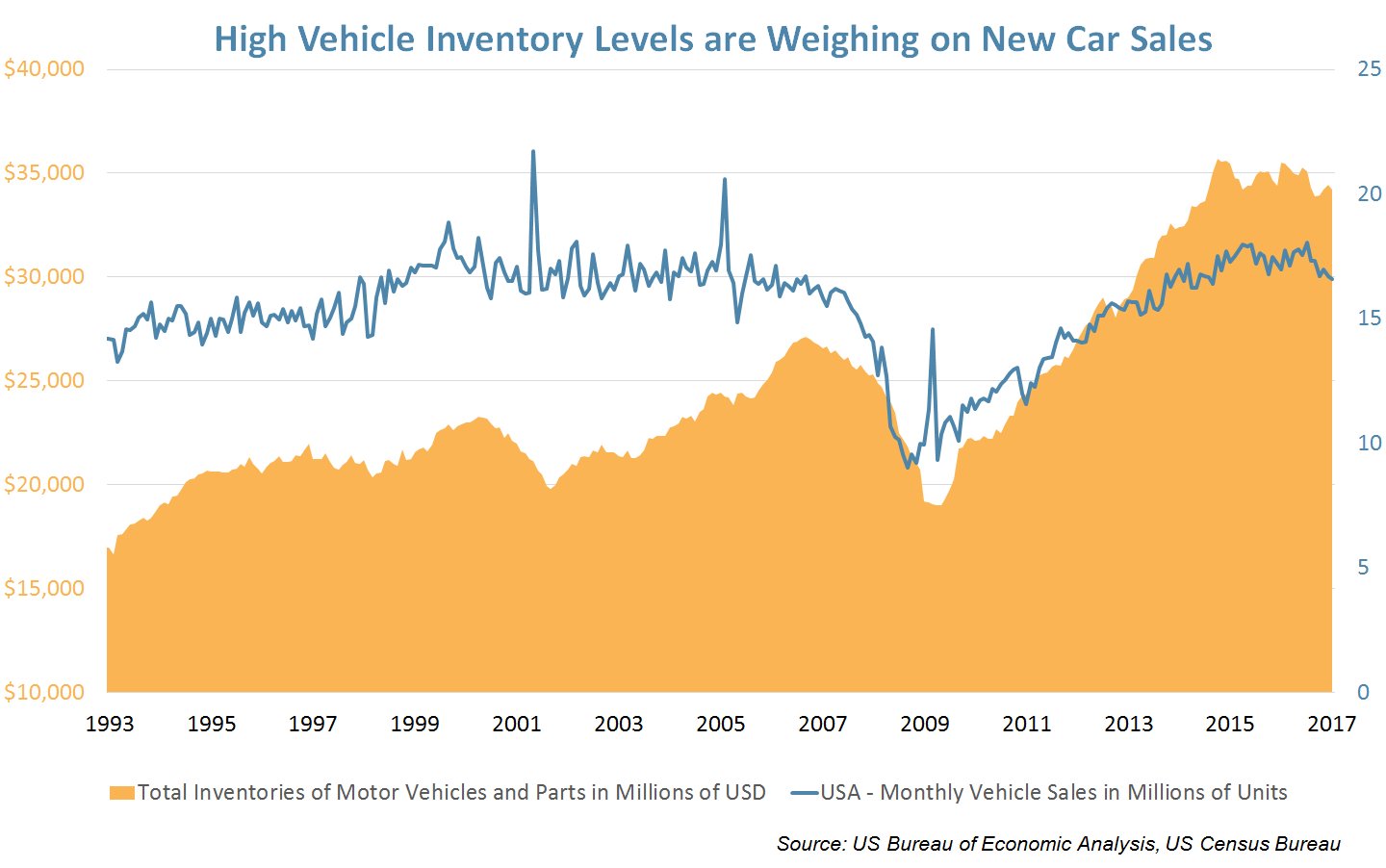

Last September, we mentioned here in Insights that the auto sector was showing bearish signals and posed the question: Has the auto cycle peaked? This week, those signs came to fruition with July monthly vehicle sales rolling over and ending several years of robust growth.

General Motors Co. (GM) reported a 15.4% decline in new vehicle sales in July compared with the same time last year. The car maker has almost 940,000 vehicles in its inventory, the equivalent to 104 days of supply and well above the historic industry norm of 65 to 70 days. Fiat Chrysler and Ford also reported declining sales, down 10% and 7.4% respectively from the previous year.

Inventories of new vehicle are sky high filling up dealer lots and auto defaults have crept up to post-recession highs. With the steep decline in vehicle unit sales, the auto industry has entered a post-peak era.

One bright spot for the auto industry is within the truck and sport utility segments where demand remains strong. Drivers have switched from passenger cars to larger vehicles amid the low price of oil. The decline in revenue for car makers has come from weak passenger car demand.

Week Ahead

Rolling the DICE

Disney (DIS) is scheduled to report earnings. investors’ will focus on their ESPN business. ESPN is a key revenue driver and has been losing viewers as many consumers are “cutting the cord”.

- Any improvement from the media segment, including ESPN and Hulu, could drive the stock price, but parks and movie studio results are always showstoppers.

- On a side note, our own Alan Leist will be taking a break from his family vacation to report on earnings live from the Bippidi Bobbidi Boutique with his 4-year-old daughter, Remy.

Inflation has been singled out by the Fed as the one deciding factor for the next Fed rate hike. Investors will be watching the Producer Price Index (PPI) and Consumer Price Index (CPI) for any sign of inflation.

- Economists expect no change in PPI and a slight bump in CPI.

- Core Inflation of around 1.9% is estimated for full year 2017.

CVS Health (CVS) is scheduled to report their earnings on Tuesday morning.

- Price competition in Pharmacy Benefit Management (PBM) has pressured CVS earnings and revenue growth.

- Any improvement from the PBM will be a big positive for the stock.

Employment data in the form of Job Openings and Labor Turnover Survey (JOLTS) is due out next week.

- The report estimates the number of job openings, hires, and separations.

- Chairwoman Yellen uses this report to measure the underlying strength (or weakness) of the labor market.

Contributed by Max Berkovich ,

Strategic Asset Allocation

Bye, Bye – Buybacks

Banks and other financial companies bought back nearly $92.8 Billion of their own shares in June after the Federal Reserve announced their “stress test” results. To put it in perspective, the total amount of stock buybacks across the market in June was around $107 Billion, which means financials were single handedly responsible for nearly 87% of the action that month. This suggests that second quarter earnings per share growth for non-financial companies is more genuine, as it is not driven by a decrease in share count.

- Textbook finance attributes stock buybacks to corporations believing the market is undervaluing that company’s stock, but the use of cash for financial engineering as opposed to reinvestment in the core business may have a negative long-term impact on corporate health.

- The pace of share buybacks has declined to levels not seen since 2009.

- Recent data suggests that companies repurchased only $17 billion of their own stock in July.

- It is too soon to tell if corporate buybacks are just on a summer break or if the buyback party is over.

- Could the recent trend be a signal that companies see their stock as overvalued? A lack of faith in D.C. could also be to blame.

Strategic Growth

Pumped up!

Crude oil prices dipped below $50 per barrel and the energy sector again finds itself a laggard. The Industrial sector was the top mover on the week thanks to an earnings report from…

- Xylem Inc. (XYL), the water technology provider, reported just a slight earning beat, but under the hood there was plenty to cheer. The company’s quarterly earnings were 23% higher than last year, revenue was up 25% year over year, orders grew 8% organically and the company pumped up its earnings forecast for the full year by $0.10.

- Late Friday, talk of a United Technologies Corp. (UTX) bid for Rockwell Collins Inc. (COL) emerged. No further details are available right now.

Strategic Equity Income

The British Lion

Consumer stocks had a rough week, with the Discretionary sector finishing as the largest laggard. Interest rates moved lower on the week boosting the usual suspects: Telecom and Utilities. Financials were also a top sector. Speaking of Financials…

- HSBC Holding Plc. (HSBC) Europe’s largest bank reported earnings on Monday. The bank holding company reported pre-tax profits of $10.24 Billion for the first half of 2017. Revenue for the first six months of 2017 was $26.2 Billion. The British bank has benefited from the slumping British currency. Earnings from outside the UK are a boost to the company when they are translated to British Pounds. The company announced a $2 Billion share buyback as well.

About Strategic

Founded in 1979, Strategic is a leading investment and wealth management firm managing and advising on client assets of over $2 billion.

OverviewDisclosures

Strategic Financial Services, Inc. is a SEC-registered investment advisor. The term “registered” does not imply a certain level of skill or training. “Registered” means the company has filed the necessary documentation to maintain registration as an investment advisor with the Securities and Exchange Commission.

The information contained on this site is for informational purposes and should not be considered investment advice or a recommendation of any particular security, strategy or investment product. Every client situation is different. Strategic manages customized portfolios that seek to properly reflect the particular risk and return objectives of each individual client. The discussion of any investments is for illustrative purposes only and there is no assurance that the adviser will make any investments with the same or similar characteristics as any investments presented. The investments identified and described do not represent all of the investments purchased or sold for client accounts. Any representative investments discussed were selected based on a number of factors including recent company news or earnings release. The reader should not assume that an investment identified was or will be profitable. All investments contain risk and may lose value. There is no assurance that any investments identified will remain in client accounts at the time you receive this document.

Some of the material presented is based upon forward-looking statements, information and opinions, including descriptions of anticipated market changes and expectations of future activity. Strategic Financial Services believes that such statements, information, and opinions are based upon reasonable estimates and assumptions. However, forward-looking statements, information and opinions are inherently uncertain and actual events or results may differ materially from those reflected in the forward-looking statements. Therefore, undue reliance should not be placed on such forward-looking statements, information and opinions.

No content on this website is intended to provide tax or legal advice. You are advised to seek advice on these matters from separately retained professionals.

All index returns, unless otherwise noted, are presented as price returns and have been obtained from Bloomberg. Indices are unmanaged and cannot be purchased directly by investors.

Max Berkovich

Max Berkovich