Time to Sell?

U.S. stocks failed to continue the rally this week, with retail earnings missing the mark. After a 20%+ run year-to-date, should investors be looking to sell?

Contributed by Doug Walters , Max Berkovich , ,

U.S. stocks slipped a bit this week. After a 20%+ run this year, we are starting to get more questions along the lines of “is it time to sell?” The short answer is no. The stock market is not excessively valued. We see valuation as above average but within the normal range. Also, “Selling” implies exiting the stock market. This equates to market timing to which we do not ascribe. Here’s why…

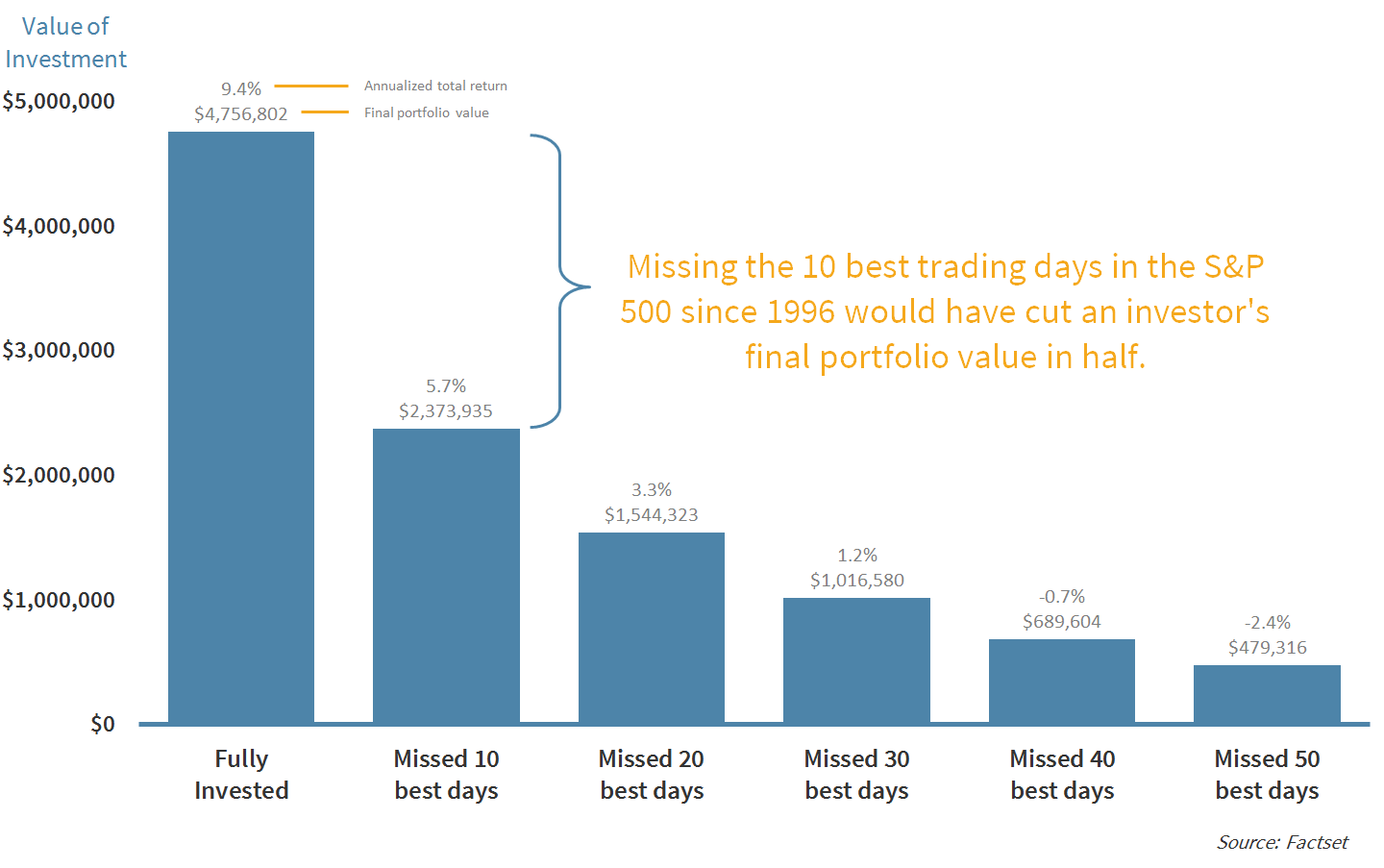

Quite simply, the market rewards long-term patience. Missing the ten best days of performance in the S&P 500 since 1996 would have cut your current portfolio value in half! (see chart below). Long-term investors should always be fully invested at a level of risk that they are comfortable maintaining. Risk appetite should not change as a result of market fluctuations. If yours does, you may have too much risk to begin with.

Our job as investment advisors is to build robust portfolios and fill them with the best opportunities that the market has to offer at any given time. So, are we selling? No. We are investing.

The Impact of Market Timing on a $1,000,000 Investment

Missing just the ten best trading days in the S&P 500 since 1996 would have had a devastating impact on the current value of the portfolio. Famed investor Peter Lynch said it well, “Far more money has been lost by investors preparing for corrections, or trying to anticipate corrections than has been lost in corrections themselves.” Stay invested!

Headlines This Week

With all eyes focused on the impeachment in Congress, it was easy to forget there were other market-sensitive events this week.

Deal or no deal

Equity markets lost steam this week as a promised “phase one” trade deal with China has yet to materialize. Chinese President Xi Jinping, did throw a bone to investors, saying that trade relations are moving in the “right direction” and is working towards completing the initial deal based on “mutual respect and equality.”

- Phase One may not be signed until 2020 according to the latest reports.

- Markets seem only to care that a deal is made. Timing and substance seem to be secondary.

The Fed

- Federal Open Market Committee (FOMC) minutes revealed that members see no need for further rate cuts in the near future and feel that the policy is well-positioned to sustain current economic expansion.

- The slowdowns in business investment and exports remain the weak points in global growth.

Old World, New View

- The European Central Bank (ECB) President, Christine Lagarde, gave her first policy speech since replacing Mario Draghi.

- Lagarde said that while ECB will continue to utilize monetary policy to support the economy, it should not be the only tool used to promote economic activity.

- Lagarde’s push for European governments to use fiscal policy to resuscitate their economies may be a key to advance them going forward since interest rates are already negative in several member nations.

The Week Ahead

Another quiet week as we head into the holiday season as just two companies in our portfolio report earnings: Dollar Tree (DLTR) and Deere & Co. (DE).

- Dollar Tree has recently made news for allegations of importing potentially unsafe over-the-counter drugs from China.

- Deere continues to deal with the repercussions that the Trade War and extreme weather have caused the agricultural industry.

U.S. economic reports next week:

- The second round of preliminary Q3 GDP figures come out on Wednesday, with no expected changes from the first reading.

- The Personal Consumption Expenditure (PCE) release, on Wednesday as well, measures consumers’ spend and inflation in the month.

- The Fed will also release the last iteration of its Beige Book for 2019, which contains thoughts on current economic conditions from each regional Reserve Bank.

Markets will be closed on Thursday as the U.S. celebrates Thanksgiving.

- Markets will also close early the following day as millions of people gear up for Black Friday deals.

Stock Highlights from Max

Solid is Not Good Enough

Health Care was the top sector this week. The biggest laggard was Technology. The semiconductor equipment stocks took a step back this week after an impressive year as UBS analyst Timothy Arcuri decided to drop cold water on the space. He thinks the stocks have run up too hard, too fast. Consumer Discretionary was in close competition for the biggest laggard as the mixed picture from retail companies weighed down the sector. The murky picture was evident from earnings reports by…

![]()

- William-Sonoma Inc. (WSM) matched earnings expectations and exceeded sales numbers, but investors were not enthused by the results nor the guidance. The West Elm business grew sales by 14% for the quarter compared to the year-ago period. Only the namesake brand William-Sonoma had a decline, with overall sales up 5.5%, which was better than expectations. Another retailer that reported earnings was…

- TJX Companies (TJX) exceeded consensus estimates on both earnings and sales. Comparable sales growth of 4% also topped the expected 2.3% growth rate. The company boosted guidance for the full year by a bit. While the results were solid from both retailers, investors need to see lights-out numbers to help overcome ugly reports from other struggling retailers. We look for more volatility from retailers next week as Black Friday data will be used to gauge the health of the space.

About Strategic

Founded in 1979, Strategic is a leading investment and wealth management firm managing and advising on client assets of over $2 billion.

OverviewDisclosures

Strategic Financial Services, Inc. is a SEC-registered investment advisor. The term “registered” does not imply a certain level of skill or training. “Registered” means the company has filed the necessary documentation to maintain registration as an investment advisor with the Securities and Exchange Commission.

The information contained on this site is for informational purposes and should not be considered investment advice or a recommendation of any particular security, strategy or investment product. Every client situation is different. Strategic manages customized portfolios that seek to properly reflect the particular risk and return objectives of each individual client. The discussion of any investments is for illustrative purposes only and there is no assurance that the adviser will make any investments with the same or similar characteristics as any investments presented. The investments identified and described do not represent all of the investments purchased or sold for client accounts. Any representative investments discussed were selected based on a number of factors including recent company news or earnings release. The reader should not assume that an investment identified was or will be profitable. All investments contain risk and may lose value. There is no assurance that any investments identified will remain in client accounts at the time you receive this document.

Some of the material presented is based upon forward-looking statements, information and opinions, including descriptions of anticipated market changes and expectations of future activity. Strategic Financial Services believes that such statements, information, and opinions are based upon reasonable estimates and assumptions. However, forward-looking statements, information and opinions are inherently uncertain and actual events or results may differ materially from those reflected in the forward-looking statements. Therefore, undue reliance should not be placed on such forward-looking statements, information and opinions.

No content on this website is intended to provide tax or legal advice. You are advised to seek advice on these matters from separately retained professionals.

All index returns, unless otherwise noted, are presented as price returns and have been obtained from Bloomberg. Indices are unmanaged and cannot be purchased directly by investors.

Doug Walters

Doug Walters