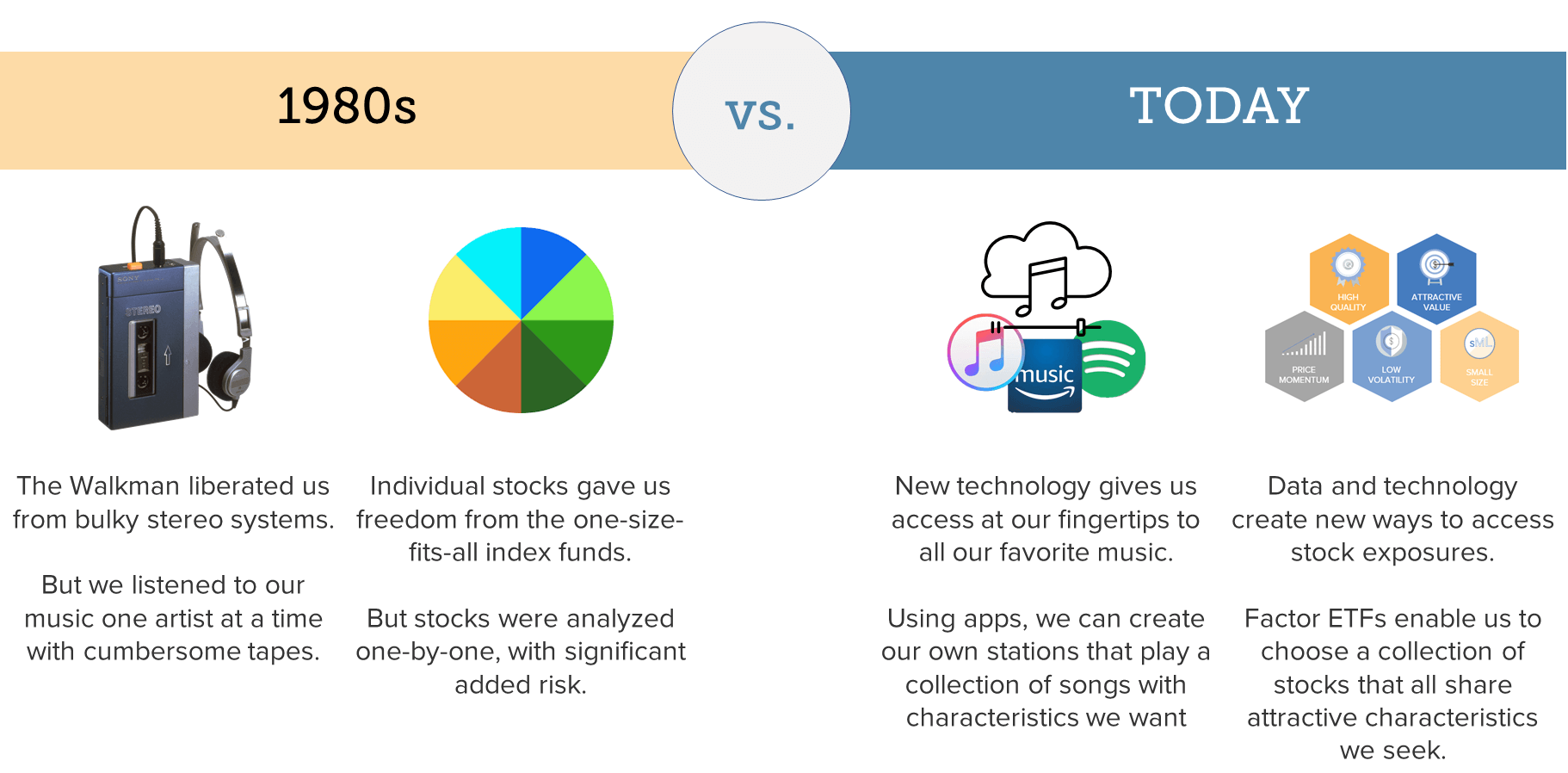

The Spotify of Investing

U.S. stocks held on to last week’s gains, but some notable decliners this quarter highlight why investors are increasingly taking their cues from the music industry.

Contributed by Doug Walters , Max Berkovich , ,

Stocks managed to hold on to recent gains in a lively week of corporate earnings. While equities are up in aggregate, this quarter, we have seen several big names like Twitter (TWTR), Expedia (EXPE), and Hasbro (HAS) lose a year’s worth of gains in a matter of days. Such is the risk when the market loses faith in their growth story. Historically, a portfolio of individual stocks was the best way to achieve your desired equity exposure. But investing is evolving and opening new avenues to gain market exposure.

There is a useful analogy in the music industry we detail below. Individual stocks are akin to the Sony Walkman, exceptional in its time, but now limiting. While advances in exchange-traded funds (ETFs) enable investors to dial in their equity exposure in the same way today’s cloud-based music services put your favorite music right at our fingertips. At Strategic, we are increasingly finding these new ETFs a more efficient way to express our investment philosophy.

Headlines This Week

Keep Winning

- U.S. equities advanced higher and are now on a five-week winning streak.

- We see rotation into value and some cyclical stocks, most likely at the expense of momentum and quality.

Steep Climb

- The long-term bond yields advanced higher, easing investors’ worries about economic recession, as the spread (yield difference) between the 2-year and 10-year U.S. Treasury expanded to over ¼ of a percent.

- Recent easing from Federal Reserve has helped to turn the U.S. economic outlook around.

Follow the Money

According to EPFR Global, international stocks saw the biggest increase in money flows since January of 2018. Optimism surrounding Brexit, a U.S.-China trade war resolution, and better than expected economic data are potential drivers of the money shift to both Developed and Emerging international markets. However…

- the relative discount in valuation to U.S. markets is probably the most significant driver, as cheapness is viewed as offering a margin of safety in case of a reversal of fortunes.

Earnings Update

- Almost 90% of the S&P 500 companies have reported their earnings.

- About 75% reported a positive earnings per share surprise, and around 60% reported a positive revenue surprise.

- The estimated earnings decline for the S&P 500 remains at around -2.4% for the quarter.

- More earnings from Consumer Staples, Consumer Discretionary, and Information Technology are expected before this earning season comes to an end.

The Week Ahead

Three companies in our portfolio report earnings next week: Skyworks Solutions (SWKS), Cisco Systems (CSCO), and Walmart (WMT).

- Walmart has seen investment in its online platform pay off as it continues to gain ground on Amazon in the lucrative e-commerce space.

- While Skyworks Solutions is expected to post a decline in earnings due to the tariff war, any meaningful agreement between the U.S. and China would be a boon for the chipmaker.

- Will Cisco Systems beat by a penny as we have grown accustomed to, or is this the quarter the company crushes expectations?

A few big events are coming out of the U.S. next week as well as Fed Chairman Jerome Powell testifying before Congress.

- The consensus is that CPI will remain unchanged at 1.7% for October.

- If the retail sales figure signifies strong consumer spending, this could give the economy some encouragement, especially heading into the holiday season.

- Powell is set to testify on the economy before the House Financial Services Committee and the Senate Banking Committee, and investors will be looking for any signals on future policy.

Last, but certainly not least, thank you to all our veterans as we celebrate Veteran’s Day, Armistice Day and Remembrance Day on Monday.

- The bond market is closed, but equity markets will be open.

Stock Highlights from Max

Still Trippin’

Another week of new highs in the market and stock-specific volatility due to earnings yielded many headlines. Sector performance was influenced by bonds though, Financials responded to higher interest rates and a steeper yield curve with a top finish. REITs and Utility holdings were the laggards for the same reason. In fact, those stocks even trailed the Consumer Discretionary sector, which was tripped up by…

- Expedia Group, Inc. (EXPE), the travel fare aggregator, reported a disappointing quarter. While sales missed consensus by a small margin and were 8.5% higher than last year, the company missed earning per share expectations by $0.43 per share. Room nights growth came in at 11%, a slight deceleration from last quarter, but the biggest culprit of the miss was expenses. Another strategy holding, Alphabet Inc. (GOOG, GOOGL), is moving into travel fare aggregation, causing Expedia to respond with heavy advertising spend. Expedia’s lowered guidance looks like the Google threat is here for good and not just one time. The other travel website company we own also reported earnings, but…

- Bookings Holdings Inc. (BKNG) beat earnings expectations and grew revenue by 3.9% year over year. Gross bookings were up 4.1% in the quarter, which was better than expected and room nights sold were 11% higher, but airline tickets were down 2.5%. The stock was dragged down by Expedia before releasing their results, but beating earnings expectations helped the stock recover some ground. Speaking of beating expectations…

- Qualcomm Inc. (QCOM) beat expectations, which were lowered last quarter. Investors cheered the better results and the boost from 5G opportunities and the settlement the company made with Apple Inc. (AAPL) in May. Also cheered by investors…

- The Walt Disney Co. (DIS) beat expectations. Revenue grew 34% year-over-year. Media Networks revenue was up 22%, Parks 8%, Studio Entertainment was up 52%, and the direct-to-consumer and International, while only 18% of the revenue pie, was up an incredible 312%. Some of these numbers are skewed a bit by the Fox acquisition, though. I am excited for next quarter: Frozen II movie and a Star Wars movie in December, and we are only days away from the launch of Disney+.

About Strategic

Founded in 1979, Strategic is a leading investment and wealth management firm managing and advising on client assets of over $2 billion.

OverviewDisclosures

Strategic Financial Services, Inc. is a SEC-registered investment advisor. The term “registered” does not imply a certain level of skill or training. “Registered” means the company has filed the necessary documentation to maintain registration as an investment advisor with the Securities and Exchange Commission.

The information contained on this site is for informational purposes and should not be considered investment advice or a recommendation of any particular security, strategy or investment product. Every client situation is different. Strategic manages customized portfolios that seek to properly reflect the particular risk and return objectives of each individual client. The discussion of any investments is for illustrative purposes only and there is no assurance that the adviser will make any investments with the same or similar characteristics as any investments presented. The investments identified and described do not represent all of the investments purchased or sold for client accounts. Any representative investments discussed were selected based on a number of factors including recent company news or earnings release. The reader should not assume that an investment identified was or will be profitable. All investments contain risk and may lose value. There is no assurance that any investments identified will remain in client accounts at the time you receive this document.

Some of the material presented is based upon forward-looking statements, information and opinions, including descriptions of anticipated market changes and expectations of future activity. Strategic Financial Services believes that such statements, information, and opinions are based upon reasonable estimates and assumptions. However, forward-looking statements, information and opinions are inherently uncertain and actual events or results may differ materially from those reflected in the forward-looking statements. Therefore, undue reliance should not be placed on such forward-looking statements, information and opinions.

No content on this website is intended to provide tax or legal advice. You are advised to seek advice on these matters from separately retained professionals.

All index returns, unless otherwise noted, are presented as price returns and have been obtained from Bloomberg. Indices are unmanaged and cannot be purchased directly by investors.

Doug Walters

Doug Walters