Retail (in need of) Therapy

U.S. equities breached new all-time highs following the French election and strong corporate earnings, before being brought back to earth by the firing of FBI Director Comey and retail concerns.

Market Review

Contributed by Doug Walters

After hitting fresh highs, the S&P 500 gave up ground this week. The magic number for the index was 2,399, a level which it closed at three of the past six trading days. Supporting stocks early in the week were the conclusion of the French election, with centrist Emmanuel Macron winning easily, and the continuation of a better than expected corporate earnings season. Weighing on equities toward the end of the week was the surprise firing of FBI Director Comey. The ensuing questions surrounding his departure have investors wondering whether this will make it more difficult for Trump to push forward his corporate-friendly policies, particularly tax reform.

The New eParadigm

While the first quarter corporate earnings reporting season is winding down, many retailers have yet to report. Nordstrom (JWN) and Macy’s (M) released results and received a cold reception, with the shares down a staggering 16% and 19% respectively for the week. However, this is not a story of a weak consumer.

- In fact, retail sales figures for April, which came out Friday, continue to point to a resilient consumer, with sales up nearly 5% over last year.

- The issue for department stores is the intense pressure from online retailers such as Amazon (AMZN).

- In the next few weeks, the remaining retailers will report their results for the first quarter, providing additional insight into the winners and losers in this new paradigm of retail.

| Indices & Price Returns | Week (%) | Year (%) |

|---|---|---|

| S&P 500 | -0.3 | 6.8 |

| S&P 400 (Mid Cap) | -1.1 | 3.5 |

| Russell 2000 (Small Cap) | -1.0 | 1.9 |

| MSCI EAFE (Developed International) | -0.3 | 10.4 |

| MSCI Emerging Markets | 2.3 | 16.0 |

| S&P GSCI (Commodities) | 1.9 | -5.0 |

| Gold | -0.2 | 6.6 |

| MSCI U.S. REIT Index | -1.3 | -1.9 |

| Barclays Int Govt Credit | 0.1 | 0.7 |

| Barclays US TIPS | 0.0 | 0.5 |

Economic Commentary

Low Vol in a Volatile World

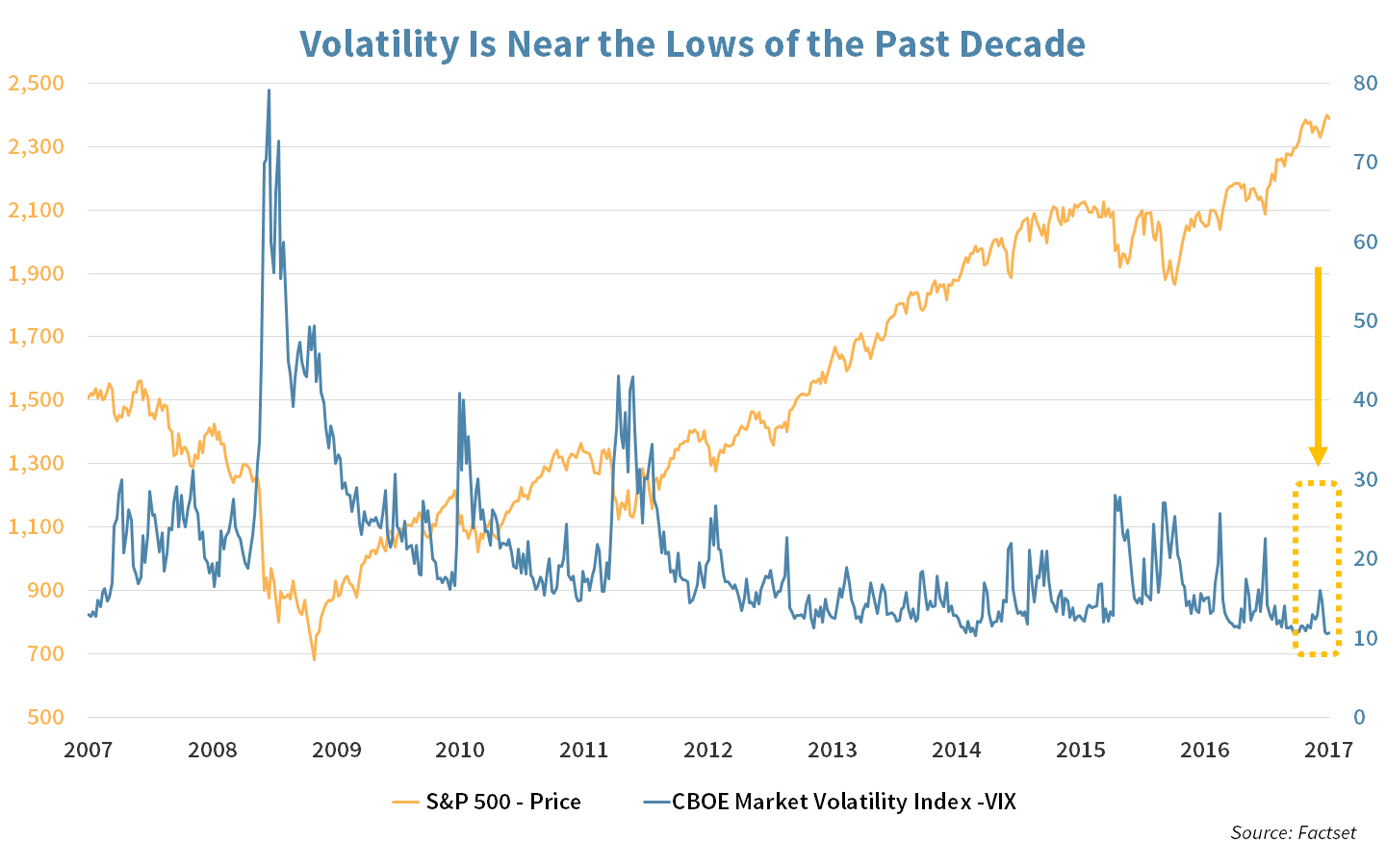

Volatility has been particularly low in U.S. equity markets as stocks continue to push towards new highs. This week’s low point rivals the lowest readings on record over the past 25 years. What is volatility and why does it matter? Let’s explore.

The volatility most often referred to is, “implied volatility” with the VIX being the most popularly quoted index. Its value is derived from complex option pricing models, but its meaning is simple. It is a market measure of investor complacency. Low vol indicates investors expect the stock market to be relatively stable, while high vol indicates the expectation for big price swings.

The chart below shows the S&P 500 versus the VIX volatility index. In general, we can see periods of high volatility have correlated with big market sell-offs.

The conundrum we face today is that uncertainty and risk feel high, yet investors seem to disagree. The market has shrugged off an enormous amount of uncertainty, including Brexit, the surprise Trump election, domestic political turmoil, and heightened geopolitical tensions to name a few.

One of two scenarios could play out:

- Investors are right, and none of these risks matter because economic strength/monetary stimulus/accommodative government policies will trump their impact.

- Or, investors are too complacent, and we are at risk of a correction if any of these risks (or more likely, a risk no one is currently thinking about) impacts corporate profitability.

Either way, our game plan does not change. We are forever on the lookout for the best long-term investments based on Quality and Value. This is every bit as true during a rally as it is during a correction.

Week Ahead

On WATCH

Walmart’s (WMT) recent efforts to ramp up their eCommerce muscle, acquiring Jet.com and partnering with JD.com (JD), was well received by Wall Street.

- Investors will be focused on the company’s progress in their efforts to integrate Jet.com and JD.com and to see if it has benefited from the stumbles of its peers.

Applications for mortgages, tracked by the Mortgage Bankers Association, will be closely watched as the number of newly built houses has slightly declined in March. Additional growth in mortgage applications could drive house prices to new highs this year.

TJX Companies (TJX), the owner of T.J. Maxx, Marshalls, and HomeGoods, is scheduled to report earnings on Tuesday.

- The stock was recently added to Strategic’s Equity Income Strategy with the belief that its discount model is more resistant to Amazon (AMZN) than are its department store peers.

Cisco Systems (CSCO) is expected to post slight growth in earnings on modestly declining sales.

- The company’s sales continue to remain under pressure, as Cisco is transitioning their focus from routers and switches towards the more profitable cloud and cyber security businesses.

Health Care has been under pressure, as Washington is seeking to reduce the cost of health services. Thus far, the main target has been pharmaceuticals, weighing on drug distributor McKesson’s (MCK) stock price.

- Investors will be looking for future guidance from McKesson’s earnings report and commentary on drug pricing, especially under the currently proposed health care legislation.

Strategy Updates

Contributed by Max Berkovich ,

STRATEGIC ASSET ALLOCATION

Around the World

The iShares Core MSCI Emerging Markets ETF (IEMG) has gained over 17% in 2017, while the S&P 500 has advanced about 6.5% and the iShares Core MSCI EAFA ETF (IEFA), representing foreign developed markets, was up 12.9%. Investors are pouring money into Emerging Markets as the BRIC economies (Brazil, Russia, India, China) continue to improve. EM’s attractive equity valuations relative to U.S. stocks is the main contributor for this shift. However, other notable drivers for BRIC equity markets are higher commodity prices and depreciation of the U.S. Dollar.

- According to Hedge Fund Research, Emerging Market hedge fund assets increased by 5.6% in April.

- The ICE U.S. Dollar Index (DXY), an index of the value of the U.S. dollar relative to a basket of foreign currencies, is down almost 3% year-to-date.

- Our preferred Emerging Markets ETF pick (IEMG) is about 45% allocated to the BRIC countries (Brazil 7.2%, Russia 3.4%, India 9.3%, China 24.8%).

STRATEGIC GROWTH

The Mouse Chewing the Cord

Technology continues to charge ahead, while Consumer Discretionary keeps getting the rug pulled from under it by poor results from traditional multi-line retailers. In other strategy news…

- Walt Disney Corp. (DIS) reported a mostly in-line quarter. Results included healthy reports from Parks & Resorts as well as the film business, but bad news from ESPN overshadowed the good news. Not only did content cost for sporting events go up, but subscriber losses continues to mount. Pressure is building for Disney to spin off the cable networks into a separate company.

STRATEGIC EQUITY INCOME

A Spectrum of Spectrum

The Technology sector keeps getting a boost from Apple Inc.’s (AAPL) impressive run. Telecom, on the other hand, has been the laggard. Speaking of Telecom…

- Verizon Inc. (VZ) continues to feel the pain of price pressure for mobile subscriptions. In addition, moves into media by competitors cast a shadow over the company’s future direction. In response, Verizon entered a very pricey bidding war with AT&T (T) for Straight Path Communications Corp. (STRP). In the end, Verizon paid the top price $3.1 Billion. Last fiscal quarter Straight Path’s market capitalization was a just under $438 Million. Straight Path owns spectrum (millimeter bandwidth) which is necessary for next generation 5G networks.

About Strategic

Founded in 1979, Strategic is a leading investment and wealth management firm managing and advising on client assets of over $2 billion.

OverviewDisclosures

Strategic Financial Services, Inc. is a SEC-registered investment advisor. The term “registered” does not imply a certain level of skill or training. “Registered” means the company has filed the necessary documentation to maintain registration as an investment advisor with the Securities and Exchange Commission.

The information contained on this site is for informational purposes and should not be considered investment advice or a recommendation of any particular security, strategy or investment product. Every client situation is different. Strategic manages customized portfolios that seek to properly reflect the particular risk and return objectives of each individual client. The discussion of any investments is for illustrative purposes only and there is no assurance that the adviser will make any investments with the same or similar characteristics as any investments presented. The investments identified and described do not represent all of the investments purchased or sold for client accounts. Any representative investments discussed were selected based on a number of factors including recent company news or earnings release. The reader should not assume that an investment identified was or will be profitable. All investments contain risk and may lose value. There is no assurance that any investments identified will remain in client accounts at the time you receive this document.

Some of the material presented is based upon forward-looking statements, information and opinions, including descriptions of anticipated market changes and expectations of future activity. Strategic Financial Services believes that such statements, information, and opinions are based upon reasonable estimates and assumptions. However, forward-looking statements, information and opinions are inherently uncertain and actual events or results may differ materially from those reflected in the forward-looking statements. Therefore, undue reliance should not be placed on such forward-looking statements, information and opinions.

No content on this website is intended to provide tax or legal advice. You are advised to seek advice on these matters from separately retained professionals.

All index returns, unless otherwise noted, are presented as price returns and have been obtained from Bloomberg. Indices are unmanaged and cannot be purchased directly by investors.

Doug Walters

Doug Walters