In Like a Lion

A big day for stocks to begin March helped U.S. equities post their sixth straight week of positive returns. The Fed signaled that conditions are favorable for another rate rise this month, while the IPO market got a boost from a rising star in social media.

Market Review

Contributed by Doug Walters

March came in like a lion, with the S&P 500 posting its best one-day performance since the election. The rest of the week was less stellar, but U.S. equities still managed their sixth straight positive week. The IPO market got a boost from social media star Snap, while the Fed raised the probability of a March rate hike.

A Siren’s song

Snap Inc., creator of the popular Snapchat app, went public on Thursday with much fanfare. The IPO (initial public offering) market has been languishing for a couple of years, so investment bankers are hoping this latest launch can snap that streak.

- The initial day of trading for Snap was a success, with the closing price implying a $24bn valuation. Not bad for a company that had no revenues two years ago and is currently highly unprofitable and bleeding cash.

- Tech IPOs are alluring, but risky. There have been some enormous successes (think Microsoft, Google), but failures are common. Recent Tech IPOs that have so far been a bust include: GoPro, Fitbit, Groupon and Twitter.

- At Strategic, we plug our ears to the songs of the IPO sirens and focus on quality stocks with a measurable and reasonable value, which is often lacking in IPOs.

| Indices & Price Returns | Week (%) | Year (%) |

|---|---|---|

| S&P 500 | 0.7 | 6.4 |

| S&P 400 (Mid Cap) | 0.2 | 4.8 |

| Russell 2000 (Small Cap) | 0.0 | 2.7 |

| MSCI EAFE (Developed International) | 0.5 | 4.4 |

| MSCI Emerging Markets | -0.8 | 8.6 |

| S&P GSCI (Commodities) | -1.4 | -0.5 |

| Gold | -1.8 | 7.2 |

| MSCI U.S. REIT Index | -1.4 | 1.7 |

| Barclays Int Govt Credit | -0.7 | 0.0 |

| Barclays US TIPS | -1.0 | 0.6 |

Economic Commentary

Tax refund season

According the Internal Revenue Service agency, the average tax refund was $3,120 last year with 50 million returns processed, of which 40 million resulted in refunds. This year, IRS refunds have been delivered later than usual as the agency has stepped up its due diligence detecting tax refund fraud. The agency estimates that it rejected about $6.6 billion in fraudulent refund claims last year.

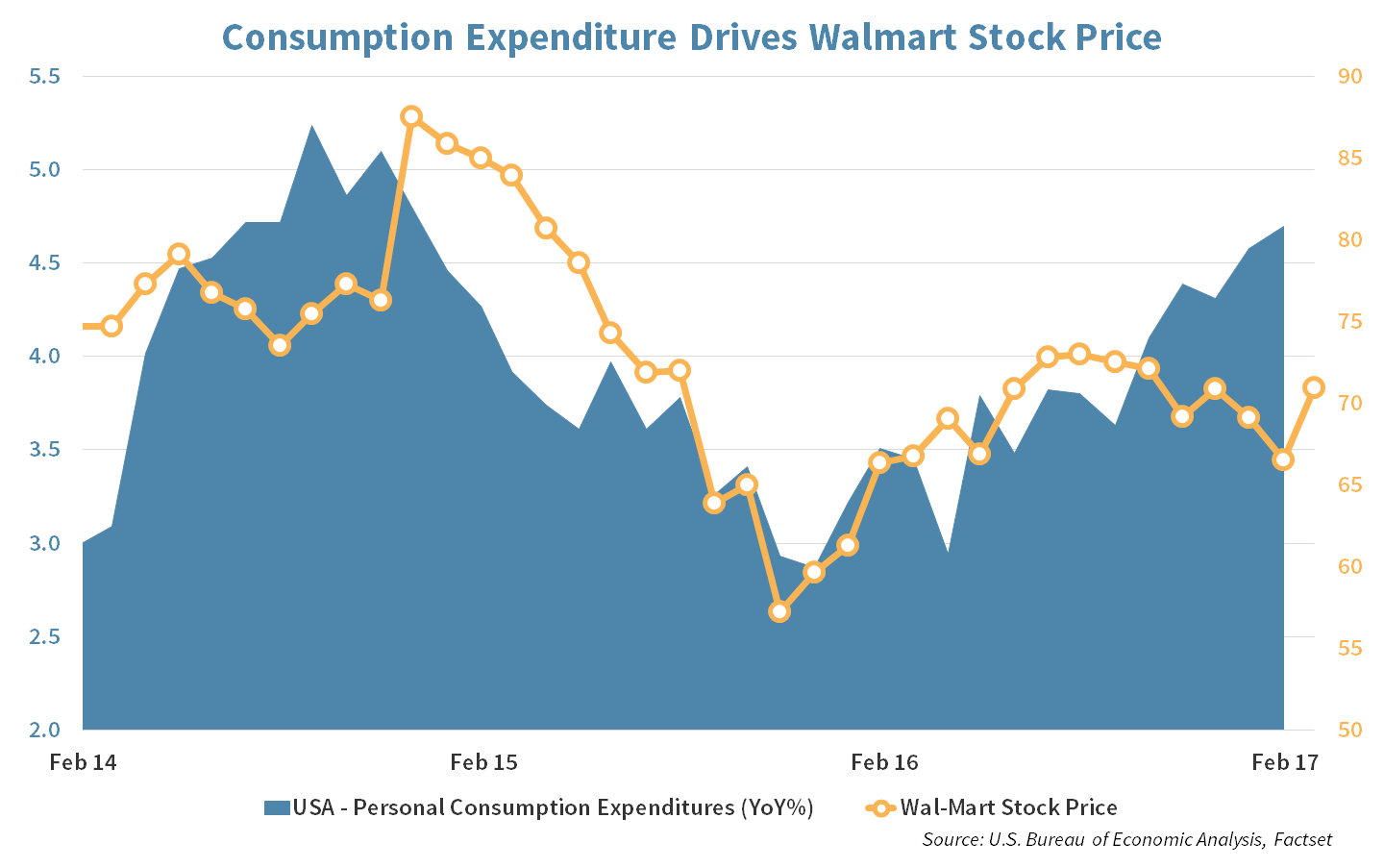

The IRS has delayed refunds for Americans claiming the Earned Income Tax Credit or the Additional Child Tax Credit. These tax credits benefit low and middle income households with children, who tend to spend their rebates quickly. The refund delay may therefore result in a slowdown in retail spending at stores and restaurants. As consumers account for more than two-third of total economic output, it is important to factor in this headwind in personal consumption expenditure.

As the chart shows, Personal Consumption Expenditure has been on the rise. A delay in tax refunds could impact this positive trend and hurt large retail stores, such as Walmart, in the short run.

Week Ahead

JAM on it

Jobs – Economists are expecting robust employment growth to continue, projecting Non-farm Payrolls to increase by 186,000 jobs in February.

- Unemployment is expected to decline to 4.7% vs. the prior month’s 4.8%.

Abroad – The ECB is expected to leave policy unchanged, while remaining vigilant of any changes in guidance as inflation in Europe is above the target rate. In addition, many countries within the European Union will report key economic data with focus on the UK’s industrial production, trade balance and house prices, and Germany’s factory orders, industrial production and trade balance.

- The ECB has noted that the increase in the EU’s inflation rate is unsustainable, attributing the majority of the inflation growth to the rise in energy prices.

Manufacturing – Factory orders are projected to decline to 1.0% in January from the 1.3% growth previously reported. Along with durable orders, which are expected to remain flat at 1.8%, manufacturing growth has boosted the demand for commodities.

- Higher commodity prices benefit Emerging Market countries like Brazil, Russia, India, and China.

Strategy Updates

Contributed by Max Berkovich ,

STRATEGIC ASSET ALLOCATION

Looking for guidance

The equity markets continue their strong run in 2017, extending share prices to new highs. U.S. large cap is up nearly 7% while Emerging Markets is up over 9%. While quarterly earnings have shown noticeable growth, many companies remain cautious in their guidance for the remainder of the year.

Keepin’ it real

We halved our Real Estate allocation this week. We provided exposure to the space using a portfolio of REITs (Real Estate Investment Trusts). A REIT is a company that owns and/or operates properties. While historically Real Estate provided diversification to a portfolio, we find it now to be closely tied to the performance and direction of stocks. This, combined with rising interest rates, justifies our reduced allocation and removal of the assets class from client long-term targets.

Seeking opportunity

We have increased our cash position as we continue to trim exposure in investments with record high valuations. Disciplined profit taking is prudent when we see parts of the market where the value case has weakened. With interest rate increases in the cards, we prefer to keep liquidity available in the event that better value presents itself.

STRATEGIC GROWTH

Members Only

The leader this week, the Health Care sector, received a boost from a hot week for biotech companies, while Consumer Staples was a laggard due to…

- Costco Wholesale Corp. (COST) the membership-only warehouse club reported a quarter that failed to meet consensus estimates. Though comparable quarterly sales in the U.S. were 3% higher and Canada was 8%, international sales were down 2%. Overall, net sales growth was 6% for the quarter. The company announced it will increase membership fees by $5 for U.S. and Canada Goldstar members. Other membership types will have various increases as well.

Strategic EQUITY INCOME

The new guy

Consumer Discretionary had a standout week as pressure from a border adjustment tax eased. On the other hand, Telecom and Utilities sectors felt the winds of higher interest rates. In other strategy news…

- Spectra Energy (SE) was acquired by Canadian energy infrastructure company Enbridge, Inc. (ENB) this week. This was an all-stock deal where holders received 0.984 shares of Enbridge for each share of Spectra. The merger will create North America’s largest energy infrastructure company. The stock yields 4.35%, in-line with what Spectra paid. The company has increased its dividend by 10% for the past 5 years.

About Strategic

Founded in 1979, Strategic is a leading investment and wealth management firm managing and advising on client assets of over $2 billion.

OverviewDisclosures

Strategic Financial Services, Inc. is a SEC-registered investment advisor. The term “registered” does not imply a certain level of skill or training. “Registered” means the company has filed the necessary documentation to maintain registration as an investment advisor with the Securities and Exchange Commission.

The information contained on this site is for informational purposes and should not be considered investment advice or a recommendation of any particular security, strategy or investment product. Every client situation is different. Strategic manages customized portfolios that seek to properly reflect the particular risk and return objectives of each individual client. The discussion of any investments is for illustrative purposes only and there is no assurance that the adviser will make any investments with the same or similar characteristics as any investments presented. The investments identified and described do not represent all of the investments purchased or sold for client accounts. Any representative investments discussed were selected based on a number of factors including recent company news or earnings release. The reader should not assume that an investment identified was or will be profitable. All investments contain risk and may lose value. There is no assurance that any investments identified will remain in client accounts at the time you receive this document.

Some of the material presented is based upon forward-looking statements, information and opinions, including descriptions of anticipated market changes and expectations of future activity. Strategic Financial Services believes that such statements, information, and opinions are based upon reasonable estimates and assumptions. However, forward-looking statements, information and opinions are inherently uncertain and actual events or results may differ materially from those reflected in the forward-looking statements. Therefore, undue reliance should not be placed on such forward-looking statements, information and opinions.

No content on this website is intended to provide tax or legal advice. You are advised to seek advice on these matters from separately retained professionals.

All index returns, unless otherwise noted, are presented as price returns and have been obtained from Bloomberg. Indices are unmanaged and cannot be purchased directly by investors.

Doug Walters

Doug Walters