Grinding Higher

The third quarter has ended on a positive note for equities, with the S&P 500 finishing up about 3% for the quarter. Stocks were buoyed by a strong Tech sector, and largely unfazed by the struggles of one of the globe’s largest financial institutions.

Market Review

Contributed by Doug Walters

High Technology

As we close out the third quarter, we find US equities in positive territory over the past three months by about 3%. The S&P 500 has been grinding out 1-3% per quarter this year, putting equity holders in a good position year-to-date. The Fed dragging their feet on a rate increase, combined with decent economic trends, has been a steady tailwind for equities this year, and Q3 was no exception.

- The standout performer this quarter was the Technology sector, which was up over 12%. Much of that is attributed to the big four: Apple (AAPL), Alphabet (GOOGL), Microsoft (MSFT) and Facebook (FB) which together account for over 40% of the sector.

- While we have seen pockets of value in the Tech space, we view the margin of safety on these mega-caps as narrow. With the exception of AAPL, we recommend remaining underweight these stocks.

Sprechen Sie Deutsch?

It has been eight years since Lehman Brothers filed for bankruptcy, but for many investors, those wounds are still sensitive. It is therefore not surprising that the recent drama surrounding Deutsche Bank, a major global financial institution, has investors on edge.

- Shares of Deutsche Bank have lost two thirds of their value in the last year and half. On top of the regional economic challenges, Deutsche Bank has faced a series of fines from regulators which are stretching the company’s balance sheet and putting into question their solvency.

- Their most recent fine stems from the company’s role in the financial crisis and the sale of residential mortgage-backed securities (RMBS). The US Department of Justice has fined the bank $14bn. Deutsche Bank contests that this is the DoJs opening bid in the negotiation and that they expect the eventual fine to be much less. They are probably right.

- While the problems for Deutsche Bank equity holders are real, we believe they have the capacity to stay solvent, and if push comes to shove, the German government would likely step in to insure stability.

- While serious, we do not see this as a “Lehman moment” or anything close to it. Any weakness in US equities should be looked at as a long-term opportunity.

| Indices & Price Returns | Week (%) | Year (%) |

|---|---|---|

| S&P 500 | 0.2 | 6.1 |

| S&P 400 (Mid Cap) | 0.1 | 11.0 |

| Russell 2000 (Small Cap) | -0.2 | 10.2 |

| MSCI EAFE (Developed International) | -0.6 | -0.6 |

| MSCI Emerging Markets | -0.4 | 15.0 |

| S&P GSCI (Commodities) | 3.4 | 16.6 |

| Gold | -1.6 | 23.8 |

| MSCI U.S. REIT Index | -2.2 | 8.6 |

| Barclays Int Govt Credit | 0.0 | 2.9 |

| Barclays US TIPS | 0.2 | 6.2 |

Economic Commentary

OPEC Agreement Moves the Market

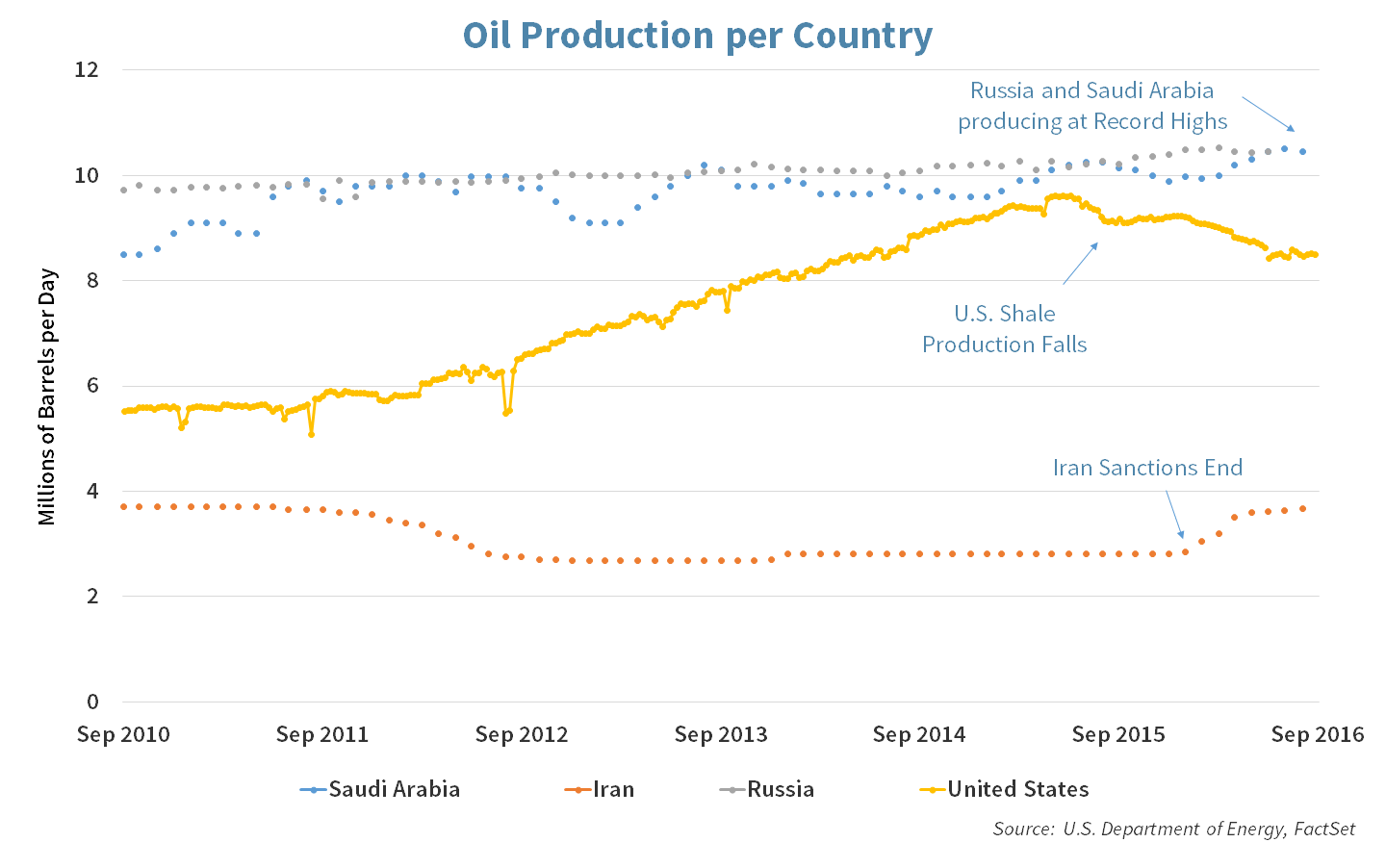

This week, the Organization of the Petroleum Exporting Countries (OPEC) surprised most analysts by announcing they have agreed to cut their oil production. They currently produce 33.2 million barrels a day collectively and plan a cut for a range of 32.5 to 33 million barrels of production. The half million-barrel reduction would be intended to rebalance an oversupplied market and oil prices did spike up on the news.

The next step for the cartel is implementation. There has been internal tension between some of the biggest producers, mainly Iran and Saudi Arabia on where the cuts should come from. Saudi Arabia would like Iran to freeze their production at 3.7 million barrels per day while Iran intends to increase it to 4.3 million as they have under-produced for half a decade due to international sanctions. Saudi Arabia, as the biggest OPEC producer at 10.5 million barrels, really does have the capacity to cut and boost the price even with other players ramping up production. The oil bulls are counting on them to do this.

At the end, the announcement may be self-defeating. With Russia continuing to produce at record highs, Libya and Nigeria gaining internal security allowing them to add a million barrels per day of oil to the market and U.S. producers such as EOG lowering their costs of production, Saudi Arabia may be forced into backing out or cheating on any OPEC quota.

Week Ahead

The Undercard

The debate between presidential running mates, Democrat Tim Kaine and Republican Mike Pence will commence on Tuesday October 4th at 9:00 pm. The debate will take place at Longwood University in Farmville, Virginia. The moderator of the debate will be Elaine Quijano of CBS News.

- The most watched vice presidential debate to date was in 2008 between Senator Joe Biden and Governor Sarah Palin.

- The first round of the Presidential Debate drew 84 Million viewers, topping the 80.6 Million who tuned in for the Reagan-Carter 1980 debate.

Payday

Nonfarm Payrolls data will be released on Friday. According to FactSet, analysts are expecting 172,000 new jobs.

- US Economists are monitoring the U.S. employment data to see if growth in hiring can accelerate.

- The US economy has been on average adding 194,000 jobs each month, despite the anomaly in May, where only 24,000 jobs were created.

The view from Mount View

Google is set to make big announcements on Oct. 4th. The company will unveil its Pixel and Pixel XL smartphones, the Google Home speaker, a Chromecast model that can support 4K video and an in-house design for a viewer of Daydream VR.

- Pixel will be a 5.0-inch device, while Pixel XL will be 5.5-inch device. For these new devices, Google has dropped Nexus as manufacturer in favor of HTC.

- The Google Home speaker is a voice-enabled device and will compete with Amazon Echo’s Alexa.

Strategy Updates

Contributed by Max Berkovich ,

Strategic Asset Allocation

The Ups and Downs

The last 3 months were fairly quiet but not sleepy. The markets shook off Brexit worries in July, had a nearly flat month in August, and were on edge in September thanks to the U.S. Fed rate hike decision.

- The winning asset classes for the quarter were Emerging Markets, up nearly 8%, Small Caps up almost 7%, and Developed International Markets with a nearly 6% jump.

- The laggards for the quarter were Bonds, Gold, and REITs.

- REITs had been losing ground slowly since July, but had a nice comeback after U.S. Fed stood still on rates. Quarter-to-date, REITs have lost nearly 2%, but are still up almost 15% for the year.

- Just like REITs, Gold have been losing some steam since July, but year-to-date Gold is still the best performing asset class, which is up nearly 17%.

- The continued relatively high correlation across asset classes has kept rebalancing activities to a minimum.

Strategic Growth

Tech Attack

Consumer Staples was a laggard for the quarter while the Technology sector was the undisputed leader. The last few days of the quarter were heavy on Tech news …

- Cognizant Technology Solutions Corp. (CTSH) announced it was “conducting an internal investigation” in regards to the U.S. Foreign Corrupt Practices Act. The company also announced resignation of its president.

- FactSet Research Systems, Inc. (FDS) reported a slight miss in the quarter. It was the company’s guidance that was light compared to expectations that caught investor’s eye.

- Finally, QUALCOMM, Inc. (QCOM) was rumored to be lining up an offer to purchase fellow strategy holding NXPI, Ltd. (NXPI) for $30 Billion. While it’s only a rumor, the deal makes a lot of sense and would allow Qualcomm to become more diversified. Qualcomm’s dominance is in the Telecom space.

Strategic Equity Income

AMP’d Up

Technology was the big mover for the quarter. Utilities and Telecom were left behind as interest rates marched higher and rates increased a bit. In other news…

- PepsiCo. Inc. (PEP) reported 3rd quarter earnings, blowing away expectations. The company had organic revenue growth of 4.2%, which included growth in all segments except for Quaker North America. The snack and beverage goliath benefited from lower raw materials cost as well. The solid quarter also allowed the company to increase full year forecasts. North American beverage volume grew 2% for the quarter, expectations were for a slight decline. The beat may be due to energy drinks Mountain Dew Kickstart, RockStar, SoBe and AMP.

About Strategic

Founded in 1979, Strategic is a leading investment and wealth management firm managing and advising on client assets of over $2 billion.

OverviewDisclosures

Strategic Financial Services, Inc. is a SEC-registered investment advisor. The term “registered” does not imply a certain level of skill or training. “Registered” means the company has filed the necessary documentation to maintain registration as an investment advisor with the Securities and Exchange Commission.

The information contained on this site is for informational purposes and should not be considered investment advice or a recommendation of any particular security, strategy or investment product. Every client situation is different. Strategic manages customized portfolios that seek to properly reflect the particular risk and return objectives of each individual client. The discussion of any investments is for illustrative purposes only and there is no assurance that the adviser will make any investments with the same or similar characteristics as any investments presented. The investments identified and described do not represent all of the investments purchased or sold for client accounts. Any representative investments discussed were selected based on a number of factors including recent company news or earnings release. The reader should not assume that an investment identified was or will be profitable. All investments contain risk and may lose value. There is no assurance that any investments identified will remain in client accounts at the time you receive this document.

Some of the material presented is based upon forward-looking statements, information and opinions, including descriptions of anticipated market changes and expectations of future activity. Strategic Financial Services believes that such statements, information, and opinions are based upon reasonable estimates and assumptions. However, forward-looking statements, information and opinions are inherently uncertain and actual events or results may differ materially from those reflected in the forward-looking statements. Therefore, undue reliance should not be placed on such forward-looking statements, information and opinions.

No content on this website is intended to provide tax or legal advice. You are advised to seek advice on these matters from separately retained professionals.

All index returns, unless otherwise noted, are presented as price returns and have been obtained from Bloomberg. Indices are unmanaged and cannot be purchased directly by investors.

Doug Walters

Doug Walters