Getting Ahead of Wall Street

Stocks were up for the second week in a row thanks in part to renewed optimism around corporate tax reform. However, the real story for us is Q1 earnings, which are coming in well ahead of Wall Street expectations.

Market Review

Contributed by Doug Walters

Stocks put in a good performance this week, with the S&P 500 up over 1.7%. A rough tax reform outline by the Trump administration provided a reason for corporate optimism (see our Economics section). But companies are not sitting idle awaiting government handouts. The strong first quarter earnings thus far, indicate their underlying businesses are improving.

Surprise!

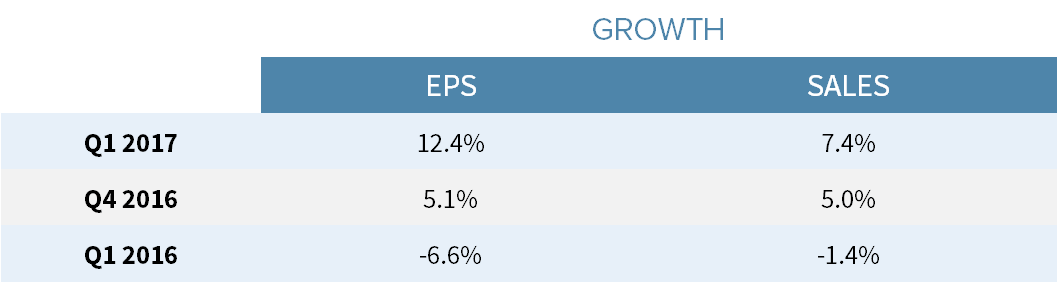

With 57% of the S&P 500 having reported their first quarter financials, the picture unfolding is that of a robust quarter. Compared to Q1 last year, earnings are up 12.4%, while sales are up 7.4%. Below we can see that this is a marked improvement from what was reported both last quarter and in the first quarter of 2016.

What does this mean for investors? We have been talking for some time about how equity valuations are above average. With stocks up 1.7% this week, and Q1 earnings up over 10%, the stock market just got marginally more attractive. Wall Street analysts appear to be surprised. While these experts do not have a good track record for predicting earnings, they have been off more than usual this quarter. A whopping 77% of companies reporting thus far have beaten the Street’s expectations for earnings. While earnings are relatively easy for companies to massage (and thus hard to predict), revenues are not. Even so, 67% have had positive revenue surprises versus expectations. That compares to just 57% this time last year.

| Indices & Price Returns | Week (%) | Year (%) |

|---|---|---|

| S&P 500 | 1.5 | 6.5 |

| S&P 400 (Mid Cap) | 0.9 | 4.3 |

| Russell 2000 (Small Cap) | 1.5 | 3.2 |

| MSCI EAFE (Developed International) | 3.1 | 9.0 |

| MSCI Emerging Markets | 1.9 | 13.6 |

| S&P GSCI (Commodities) | -0.7 | -4.5 |

| Gold | -1.3 | 10.2 |

| MSCI U.S. REIT Index | -2.7 | 0.0 |

| Barclays Int Govt Credit | -0.1 | 0.9 |

| Barclays US TIPS | 0.3 | 1.6 |

Percent of companies reporting thus far that have surpassed Wall Street’s expectations for earnings.

Economic Commentary

“Huge” Tax Cuts

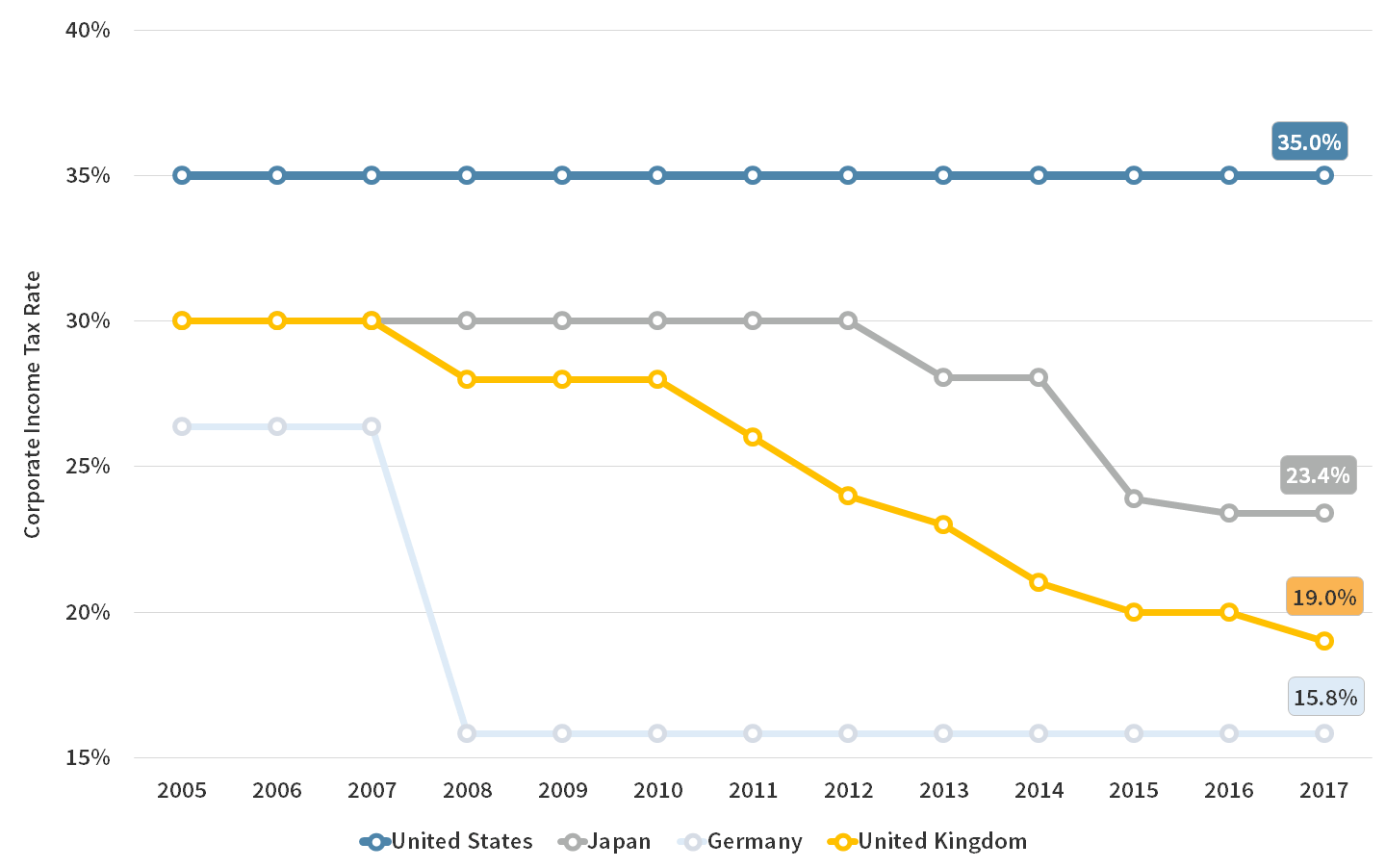

President Trump proposed sweeping tax reforms this past Wednesday that most analysts categorized as heavy on ambition, light on technical detail and likely to drive up the budget deficit. The proposal includes a 15% tax rate for all businesses, down from 35%, which would incentivize companies to invest more and stimulate the economy. Most developed nations have already reduced corporate taxes on the advice of their economists.

Corporate Tax Rates have been flat in the United States while they Dropped in Other Developed Nations

The proposal also lowers rates for individuals, increases standard deductions for middle-income households and repeals the estate as well as the alternative minimum taxes. The hope is that these tax cuts would stimulate consumer spending. The details of the plan are yet to come out, but most analysts assume the cuts will come at the risk of a widening budget deficit and ballooning government debt.

Perhaps the most contentious aspect of the tax plan is the proposed repeal of a provision that allows individuals to deduct their state and local taxes from reportable income. This repeal will hurt residents of high-tax states such as New York and may receive pushback from blue state Congressional Republicans. The repeal is estimated to raise more than $1 trillion over a decade and help to pay for the rate reduction but getting it passed through Congress may prove to be tricky.

Week Ahead

SPRING Has Sprung

- Spending, as measured by Personal Consumption, is expected to grow slightly for the month of March.

- In theory, the high current consumer confidence should lead to increased consumer spending.

- Personal Income is expected to remain nearly flat as wage growth slowed in the previous month.

- Rising rates in U.S. have been well accepted by stocks so far, but investors will be looking for any change in language coming out of the FOMC meeting on Wednesday.

- ISM Manufacturing, an index that measures changes in new orders, production, and inventories, is expected to decline slightly to 56.2 in April from 57.2 in March.

- An index reading above 50 indicates expansion.

- Non-farm payroll might be the most anticipating economic data point of the week; the economy is expected to have added 187,500 jobs in April.

- Only 98,000 jobs were added last month, which was well below economists’ expectations and well below trend.

- Growth of earnings should continue for S&P 500 companies, as another busy week of earnings reports is on deck.

- Strategic holdings Merck (MRK), CVS (CVS), Pfizer (PFE), Mondelez (MDLZ), Prudential (PRU), and Apple Inc. (AAPL) are among those scheduled to report.

Strategy Updates

Contributed by Max Berkovich ,

STRATEGIC ASSET ALLOCATION

French Connection

Equity markets around the world have celebrated the initial French elections results. A pro-European Union candidate Emmanuel Macron and anti-EU candidate Marine Le Pen have advanced to run in the head-to-head May 7th elections.

- The results matched early poll predictions and eased some fears over the survival of the European Union because the centrist Macron is a heavy favorite versus Le Pen. While equity markets and the Euro did rally, the biggest winners were major French and European lenders like BNP Paribas (BNPQY), Societe Generale (SCGLY) and Deutsche Bank (DB).

The Comeback Plan

The reveal of the President’s tax plan has reignited small capitalization stocks. The small cap index notched the best one-week performance year-to-date. Lower corporate tax rates not only help the bottom line for small companies but also boosts domestic spending, which should help smaller companies to outperform their larger global peers.

Muni-pilation

Any Federal tax reform talk tends to spook the municipal bond market, and this time is no different. Will lower tax rates lead to less demand for tax sheltered income? Will the revocation of the dreaded Alternative Minimum Tax lead to a boon for the AMT Muni Bonds? Will the retraction of the local and state tax deduction result in stronger demand for in-state bonds versus out of state bonds?

- The vagueness of the administration’s proposal leaves many questions, and we caution investors not to overreact. Some of the biggest fears might not pass negotiations with Congress.

- We invest based on what we know, not speculation. Right now, tax-exempt bonds offer tax-free income and, in our opinion, relative value (versus taxable bonds), especially for those in the top tax brackets.

STRATEGIC GROWTH

Isn’t That Special?

During a busy week of earnings, the Consumer Discretionary and Industrial sectors were in a heated battle for top dog, while Energy was the undisputed laggard. In other strategy news…

- Costco Wholesale Corp. (COST) stole headlines from companies reporting earnings by announcing an 11% boost of its dividend to a $2 annual rate and, more importantly, a special dividend of $7 per share. The special dividend is rare as only one other S&P 500 company has announced one this year. The company will use debt to finance the payout on May 26th. The CFO in a statement said that it is the company’s strong balance sheet and access to favorable debt terms that allows the company to make this move.

STRATEGIC EQUITY INCOME

Express Line

Telecom was the biggest laggard on the week, while the leader was the Health Care sector thanks to news from…

- Anthem Inc. (ANTM), the health insurer formerly known as Wellpoint, Inc. reported a strong quarter. The company topped the consensus by a wide margin. Revenue was up 11%, and earnings were up 44%, with medical enrollment up 2.6% to 40.6 million enrollees. During the conference call, Anthem did indicate that if the Affordable Care Act subsidies were to disappear, the company could raise rates by 20%. Anthem was also in the news when a pharmaceutical benefits manager (PBM), Express Scripts, Inc. (ESRX), announced that Anthem was not renewing its PBM relationship that ends in 2019. Anthem claims the partnership has not amounted to promised savings. The move might open the door for another strategy holding, CVS Health Corp. (CVS), to secure the PBM relationship.

About Strategic

Founded in 1979, Strategic is a leading investment and wealth management firm managing and advising on client assets of over $2 billion.

OverviewDisclosures

Strategic Financial Services, Inc. is a SEC-registered investment advisor. The term “registered” does not imply a certain level of skill or training. “Registered” means the company has filed the necessary documentation to maintain registration as an investment advisor with the Securities and Exchange Commission.

The information contained on this site is for informational purposes and should not be considered investment advice or a recommendation of any particular security, strategy or investment product. Every client situation is different. Strategic manages customized portfolios that seek to properly reflect the particular risk and return objectives of each individual client. The discussion of any investments is for illustrative purposes only and there is no assurance that the adviser will make any investments with the same or similar characteristics as any investments presented. The investments identified and described do not represent all of the investments purchased or sold for client accounts. Any representative investments discussed were selected based on a number of factors including recent company news or earnings release. The reader should not assume that an investment identified was or will be profitable. All investments contain risk and may lose value. There is no assurance that any investments identified will remain in client accounts at the time you receive this document.

Some of the material presented is based upon forward-looking statements, information and opinions, including descriptions of anticipated market changes and expectations of future activity. Strategic Financial Services believes that such statements, information, and opinions are based upon reasonable estimates and assumptions. However, forward-looking statements, information and opinions are inherently uncertain and actual events or results may differ materially from those reflected in the forward-looking statements. Therefore, undue reliance should not be placed on such forward-looking statements, information and opinions.

No content on this website is intended to provide tax or legal advice. You are advised to seek advice on these matters from separately retained professionals.

All index returns, unless otherwise noted, are presented as price returns and have been obtained from Bloomberg. Indices are unmanaged and cannot be purchased directly by investors.

Doug Walters

Doug Walters