Funding a Deficit

U.S. stocks ended the week little changed, while the U.S. Treasury tested the bond market’s appetite for funding increased spending.

Market Review

Contributed by Doug Walters

Stocks tracked sideways in a holiday-shortened week of trading. The real action this week was in the bond market where the U.S. is trying to fund its plans for more spending. The Winter Olympics may be closing this weekend, but this is just the opening ceremony for bond market auctions.

Spending Spree

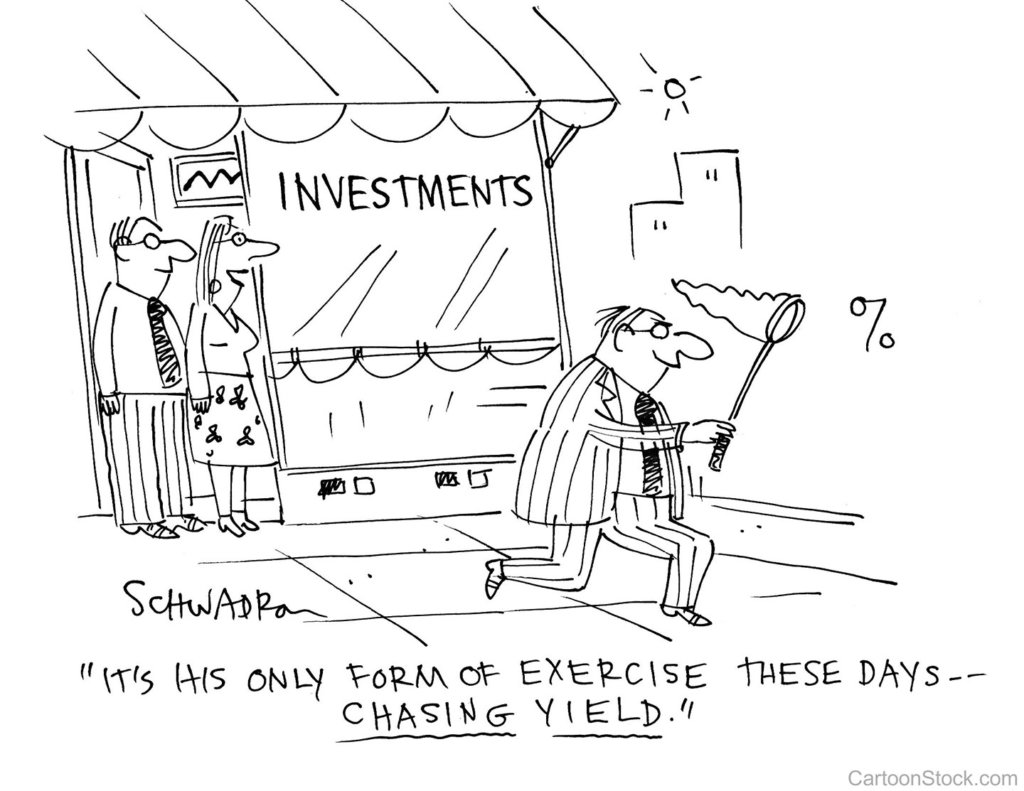

Bonds were in focus this week. If the topic of bonds makes you want to cringe, yawn, or hide, you are not alone. We promise to keep it light. Remember how elated stock investors were about tax cuts, expanded budget caps, and talk of a $1.5 Trillion infrastructure plan? Somehow the government must produce the money to cover these plans. The solution is for the Treasury Department to issue bonds.

This week marked the start of what are likely to be ever bigger Treasury bond auctions. Traders did not have trouble finding buyers, but yields did have to rise to entice them. 2-year Treasury yields temporarily rose to levels not seen in nearly a decade (bad for bond prices – see our Spotlight section).

At Strategic we are positioned to take advantage of rising rates. By owning relatively short-dated bonds, we can reinvest the proceeds from bonds that mature into bonds with higher yields. With auctions increasing in size, and the Fed continuing to raise rates at the short end, rising yields are likely to remain a theme throughout the year.

Spotlight: Decade-High 2-Year Rates

The U.S. 2-Year Treasury yield peaked at 2.27% this week; the highest level in nearly a decade. Is that good or bad for portfolios? It depends. Recall that as yields go up, bond prices go down. Why? Imagine you bought a 1-Year bond for $1000 which pays you a 2% coupon ($20 per year). Now assume the next day yields rise such that a newly issued bond can be bought for $1000 and pays a 3% coupon ($30 per year). Is anyone going to pay you $1000 for your 2% coupon bond now? No. You would only be able to get around $990 for it. That is bad for you right? Only if you actually have to sell the bond. If you hold your bond to maturity, you will get your 2% and $1000 back. Assuming rates are still at 3%, you can now buy a new bond for $1000 and get a 3% yield. That’s good!

Strategy Update

Contributed by Max Berkovich ,

STRATEGIC ASSET ALLOCATION

A Growing Gap

The 10-year U.S. Treasury finished nearly unchanged for the week, but not without a fair share of volatility due to the large auction. On the equity side, investors remain optimistic about growth. The Russell 1000 Value Index is barely positive on the year, while Russell 1000 Growth Index is up over 4% and is up just shy of 27% on total return basis in the past 12 months. Value is up roughly 6% for the same period. Speaking of wide gaps …

- In the last five years, the Russell 1000 Growth has outperformed the Russell 1000 Value by nearly 40 percentage points.

- There is also a wide gap between the BRIC (Brazil, Russia, India, and China) countries. MSCI Brazil and Russia Indices are up nearly 15% year-to-date while MSCI India is down around 3% despite higher growth expectations.

- The Vanguard Dividend Appreciation Index Fund (VIG), which tracks an index of stocks that have consistently grown their dividends for ten consecutive years is outperforming the Russell 1000 Value Index by nearly eight percentage points over the past 12 months. It may have something to do with the fact that companies growing dividends also tend to grow their earnings.

STRATEGIC GROWTH

Corporate Developments

The Consumer Staples sector was the big laggard for the week. The Technology sector was the leader. Several stocks had a noteworthy week including…

- Qualcomm Inc. (QCOM) raised its bid for fellow strategy holding NXP Semiconductors (NXPI) from $110 to $127.50. Unfortunately, in response, Broadcom (AVGO) dropped their offer for Qualcomm from $82 to $79 a share, claiming the higher NXPI offer reduces the value of the combined company.

- United Technologies Corp. (UTX) is exploring splitting the company into three; an aerospace company with sales between $45-50 Billion, Otis Elevator group with $12-13 Billion of sales, and a climate control company with $12-13 Billion in sales.

- EQT Corp. (EQT) is going to separate its upstream (exploration) and midstream (pipes) businesses by creating a separate company for the midstream assets.

- Lastly, Priceline Group (PCLN) will change its name to Booking Holding and its symbol to BKNG on February 27th. The change is to reflect Booking.com becoming the bigger part of its business.

STRATEGIC EQUITY INCOME

Hitting a Wall

The Technology sector was the leader this week while Consumer Staples were a laggard due to…

- Walmart Inc. (WMT) reported a disappointing quarter and lackluster guidance. The company faces margin pressure and a surprising deceleration in e-commerce growth. Lofty expectations of 40% growth in e-commerce were met with “only” 23% growth. The CEO, Doug McMillon did state that they expect growth of e-commerce at the 40% rate after Q1.

| Indices & Price Returns | Week (%) | Year (%) |

|---|---|---|

| S&P 500 | 0.6 | 2.8 |

| S&P 400 (Mid Cap) | 0.2 | 0.2 |

| Russell 2000 (Small Cap) | 0.4 | 0.9 |

| MSCI EAFE (Developed International) | -0.9 | 0.3 |

| MSCI Emerging Markets | 0.1 | 3.7 |

| S&P GSCI (Commodities) | 1.2 | 1.4 |

| Gold | -1.4 | 2.0 |

| MSCI U.S. REIT Index | -0.6 | -10 |

| Barclays Int Govt Credit | 0.0 | -1.4 |

| Barclays US TIPS | 0.1 | -1.9 |

The Week Ahead

Next Week GEMS

GDP growth for the fourth quarter 2017 is expected to come in at 2.6%, pushing full-year growth to around 2.5%.

Earnings in focus for the week will be on Priceline (PCLN), TJ Maxx (TJX) and Carter’s (CRI).

- The consumer economy will be spotlighted with this trio discretionary stocks.

Manufacturing data will be released during the week along with multiple housing data points.

- Manufacturers’ Shipments and Orders are expected to decline in January vs. the prior month but remain near 3-year highs.

- Housing data will be important since we have witnessed significant move in mortgage rates.

Speeches from the Fed’s James Bullard on Tuesday and Dudley on Thursday along with Chairman Powell’s testimony in front of Congress on Wednesday and Thursday may create volatility as investors digest every word for signs of increased hawkishness.

About Strategic

Founded in 1979, Strategic is a leading investment and wealth management firm managing and advising on client assets of over $2 billion.

OverviewDisclosures

Strategic Financial Services, Inc. is a SEC-registered investment advisor. The term “registered” does not imply a certain level of skill or training. “Registered” means the company has filed the necessary documentation to maintain registration as an investment advisor with the Securities and Exchange Commission.

The information contained on this site is for informational purposes and should not be considered investment advice or a recommendation of any particular security, strategy or investment product. Every client situation is different. Strategic manages customized portfolios that seek to properly reflect the particular risk and return objectives of each individual client. The discussion of any investments is for illustrative purposes only and there is no assurance that the adviser will make any investments with the same or similar characteristics as any investments presented. The investments identified and described do not represent all of the investments purchased or sold for client accounts. Any representative investments discussed were selected based on a number of factors including recent company news or earnings release. The reader should not assume that an investment identified was or will be profitable. All investments contain risk and may lose value. There is no assurance that any investments identified will remain in client accounts at the time you receive this document.

Some of the material presented is based upon forward-looking statements, information and opinions, including descriptions of anticipated market changes and expectations of future activity. Strategic Financial Services believes that such statements, information, and opinions are based upon reasonable estimates and assumptions. However, forward-looking statements, information and opinions are inherently uncertain and actual events or results may differ materially from those reflected in the forward-looking statements. Therefore, undue reliance should not be placed on such forward-looking statements, information and opinions.

No content on this website is intended to provide tax or legal advice. You are advised to seek advice on these matters from separately retained professionals.

All index returns, unless otherwise noted, are presented as price returns and have been obtained from Bloomberg. Indices are unmanaged and cannot be purchased directly by investors.

Doug Walters

Doug Walters