Equity La La Land

A fifth week in a row of gains for U.S. equities has investors floating on air. Even bonds managed a rally. This performance was all the more impressive given the uncertain legislative environment.

Market Review

Contributed by Doug Walters

U.S. equities put in an Oscar-worthy performance this week, despite mixed messages coming from Washington. It was large caps that led the way, thanks in part to the latest developments (or lack thereof) on tax reform. 10-Year treasury yields continued their slide which started in the middle of last week.

A taxing decision

As we have discussed the past few weeks, corporate tax reform has enormous implications for companies, and we have seen the ever-changing narrative drive stock prices. Just a few weeks ago, Trump promised us something “phenomenal” on taxes was coming. However…

- This week he stated that a tax proposal would wait until after a healthcare reform proposal is presented next month.

- In addition, the “border tax” looks less certain. While Trump still says he is in favor of some form of border tax, his economic advisor has stated that the administration does not agree with Paul Ryan’s House version.

- Large cap retailers (many of whom Trump met with this week), were poised to be hit the worst by a border tax. In the wake of this week’s uncertainty, retailers are rallying.

The seesawing of the market with each change of direction of the political winds can be nauseating. As investors, we do not need to guess which way the wind is going to blow next. Rather, we diversify and focus our process on identifying quality and value.

| Indices & Price Returns | Week (%) | Year (%) |

|---|---|---|

| S&P 500 | 0.7 | 5.7 |

| S&P 400 (Mid Cap) | 0.1 | 4.6 |

| Russell 2000 (Small Cap) | -0.4 | 2.8 |

| MSCI EAFE (Developed International) | -0.3 | 3.9 |

| MSCI Emerging Markets | 0.5 | 9.4 |

| S&P GSCI (Commodities) | -0.3 | 0.9 |

| Gold | 1.7 | 9.2 |

| MSCI U.S. REIT Index | 1.9 | 3.2 |

| Barclays Int Govt Credit | 0.4 | 0.6 |

| Barclays US TIPS | 0.7 | 1.6 |

Economic Commentary

Contributed by Doug Walters

The silver screen

Hollywood’s big night is this weekend and Oscar nominees are putting the finishing touches on their acceptance speeches. Not present among the nominees for Best Picture are any films from Strategic holding Disney (DIS). In fact you have to go back a few years to find a Disney nominated film for Best Picture. Of course, Disney is ever-present in the Animated Feature Film category, and over the past decade has won it more often than not.

Hollywood faces headwinds domestically, where ticket sales have been trending down for the past 15 years. However, Disney is bucking these challenging industry trends. In terms of profits, Disney’s “Studio Entertainment” business has been dwarfed by “Media Networks” (primarily ESPN) and “Parks & Resorts”; however, that is changing. While Disney films may not dominate the Oscars, they do dominate what really matters to shareholders… the box office.

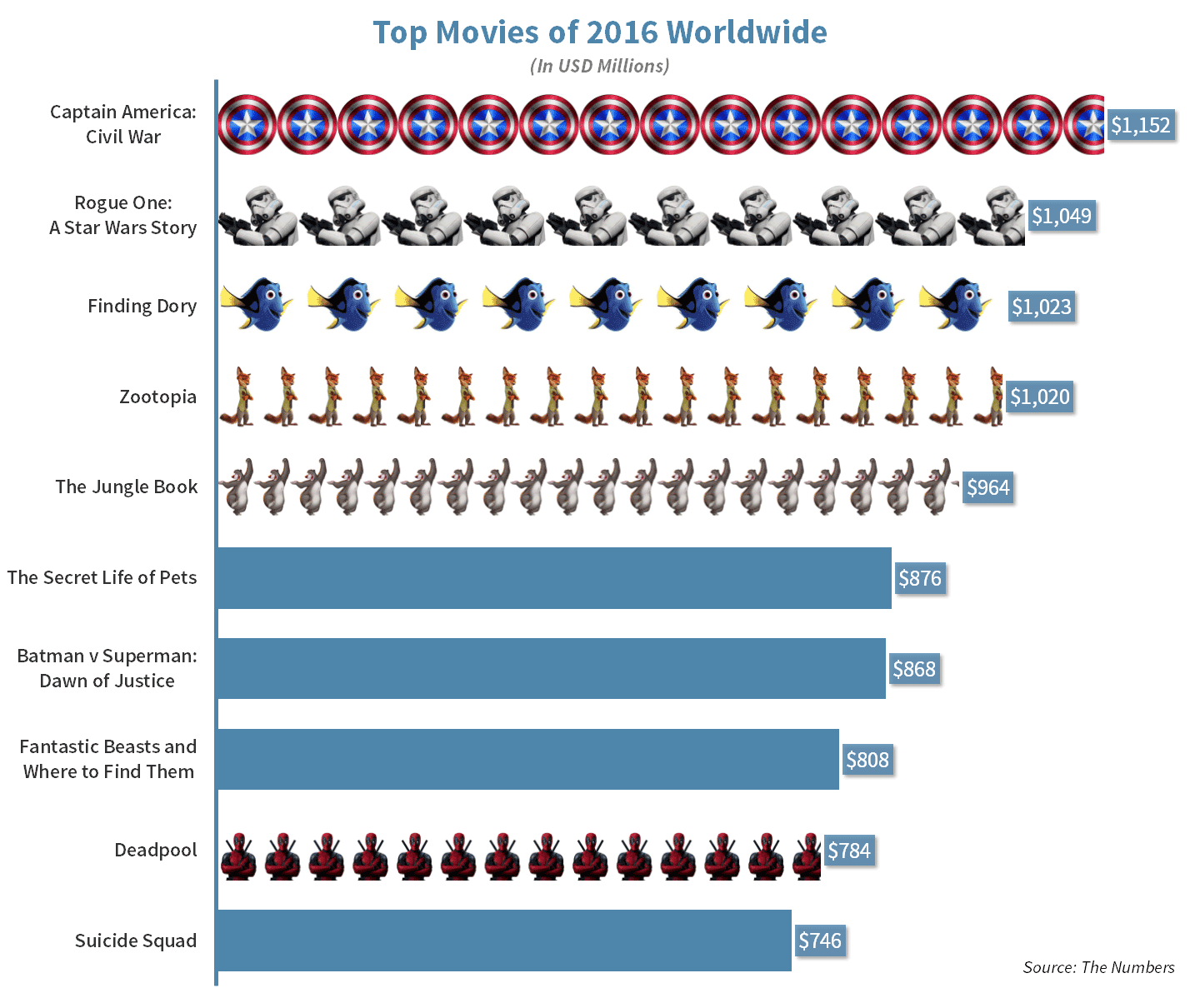

The chart below shows Disney had 6 of the top 10 grossing films in 2016 worldwide and amazingly held the top 5 spots (not to mention holding slots 11 and 12 as well). With franchises like the Marvel Cinematic Universe and Star Wars, plus its animated golden touch, Disney is poised to remain a major force at the box office in the coming years.

Week Ahead

A DEEP dive

Dollar Tree is scheduled to announce 4th quarter earnings next week.

- Analysts expect nearly 4% growth in sales and approximately 23% growth in EPS vs. Q4 in 2015.

- With a $1 price point, the company may have the most to lose with a border tax.

EOG is expected to post a 14 cent loss per share.

- We will be looking for color on not only oil, but also natural gas from the independent driller.

Economics

- Investors and the Fed will be closely watching February jobs report, January’s inflation data, personal income growth, the consumer confidence index and a revision to the preliminary GDP.

- Friday will bring the President’s first jobs report. Non-Farm payroll for February is expected to show 190,000 jobs created.

- Core Inflation for the month of January is expected to remain flat at 1.7%.

- Personal income growth is expected to remain flat at 0.3%.

- The consumer confidence measure for February is expected to tick down to 111 from previous figure of 111.8.

Priceline has remained strong despite earnings misses and lower guidance from their competitors Expedia and TripAdvisor.

- Investors are expecting sales growth for the quarter to come in around 16% with approximately 9% growth in earnings for the year.

Strategy Updates

Contributed by Max Berkovich ,

STRATEGIC ASSET ALLOCATION

Slow and steady

Corporate earnings continue to show some gains in growth, while companies remain cautious with their guidance for 2017. Investors are expecting S&P 500 earnings to grow 11% this year. Obstacles like U.S. tax reform, rising interest rates, Brexit, and elections in Europe might hinder investor’s expectations. While the equity “melt up” is here and large company stocks continue their slow but steady upward momentum, investors should stay vigilant.

Real deal

The U.S. 10-Year Treasury bond ended the week yielding 2.32%, down from nearly 2.50% a month ago, while the 2-Year note is yielding 1.15%, down from 1.20%. When longer rates go down faster than shorter rates, the yield curve is flattening. A flattening curve means there is less interest to be earned from extending the maturity of bonds. With inflation expectations of 2%, real bond yields (after inflation) would produce negative real yield all the way out to 7 years.

Goldilocks

With Gold flirting with a double-digit percentage run-up for the year and global monetary debasing slowing, the precious metal does not appear to be an obvious placeholder for investor’s cash. Valuations of both bonds and equities are above average as well. It may be that the best place for excess cash is… cash, until value opportunities reveal themselves once again.

STRATEGIC GROWTH

Skip and a hop

The Energy sector skipped over the Industrial sector to finish last for the week, while Consumer Staples hopped over Consumer Discretionary to land at the top, despite a hot week from…

- Carters Inc. (CRI) topped estimates on both the top and bottom line. The company shined with a 6% jump in annual sales and 11% in earnings despite all the headwinds for the retail sector. The company increased its dividend by 12% to a $1.48 annual payout. The company’s 2017 guidance is calling for 4-6% sales growth and 8-10% earnings growth. This guidance could get a boost from an acquisition of Skip Hop Holdings, an e-commerce retailer of children’s clothing and other merchandise. The company purchased the online property for $140 Million from a private equity group.

EQUITY INCOME

More behind The Great Wall

Thanks to a notable drop in interest rates,Utilities, REITs and Telecom sectors rose to the top. The Energy sector came in last. In other strategy news…

- Retail behemoth Wal-Mart Stores (WMT) reported an in-line quarter. While last quarter’s numbers look boring on the cover, a few nuggets did catch our attention: eCommerce grew 31% for the year and 29% for the quarter, the company produced $11.9 Billion of operating cash flow for the quarter and comparable sales increased by 1.8% for the quarter. The company also announced it will open 40 new stores in China this year, adding to their 400 existing stores and their 9% stake in JD.com, a major online shopping site in China.

About Strategic

Founded in 1979, Strategic is a leading investment and wealth management firm managing and advising on client assets of over $2 billion.

OverviewDisclosures

Strategic Financial Services, Inc. is a SEC-registered investment advisor. The term “registered” does not imply a certain level of skill or training. “Registered” means the company has filed the necessary documentation to maintain registration as an investment advisor with the Securities and Exchange Commission.

The information contained on this site is for informational purposes and should not be considered investment advice or a recommendation of any particular security, strategy or investment product. Every client situation is different. Strategic manages customized portfolios that seek to properly reflect the particular risk and return objectives of each individual client. The discussion of any investments is for illustrative purposes only and there is no assurance that the adviser will make any investments with the same or similar characteristics as any investments presented. The investments identified and described do not represent all of the investments purchased or sold for client accounts. Any representative investments discussed were selected based on a number of factors including recent company news or earnings release. The reader should not assume that an investment identified was or will be profitable. All investments contain risk and may lose value. There is no assurance that any investments identified will remain in client accounts at the time you receive this document.

Some of the material presented is based upon forward-looking statements, information and opinions, including descriptions of anticipated market changes and expectations of future activity. Strategic Financial Services believes that such statements, information, and opinions are based upon reasonable estimates and assumptions. However, forward-looking statements, information and opinions are inherently uncertain and actual events or results may differ materially from those reflected in the forward-looking statements. Therefore, undue reliance should not be placed on such forward-looking statements, information and opinions.

No content on this website is intended to provide tax or legal advice. You are advised to seek advice on these matters from separately retained professionals.

All index returns, unless otherwise noted, are presented as price returns and have been obtained from Bloomberg. Indices are unmanaged and cannot be purchased directly by investors.

Doug Walters

Doug Walters