Debatable

On the eve of the first U.S. presidential debate, the S&P 500 finished the week in positive territory. The upcoming candidate faceoff is not the only debate on investors’ minds (eg. rates, valuations). A focus on the long-term is as important as ever.

Market Review

On the forefront

U.S. Equities ended the week higher after the Fed decided to leave rates on hold in September. While Monday’s presidential debate is likely to be the focus of attention, other deliberations remain on the forefront for investors. The big question remains the timing of the next Fed rate hike. But investors are also debating the sustainability of equity valuations, as we push toward all-time highs.

- Rates: The Fed decision is a double-edged sword. A rate hike would act to slow down the economy, and equity prices would likely be negatively impacted. On the other hand, if rates are raised it should be an indication that the Fed has confidence in the strength of the US economy.

- Valuation: Equity valuation using PE multiples is higher than average, providing an indication that the market may be getting stretched. Yet, valuation using cash flow looks more reasonable and cash flow is on the rise. On top of that, we are seeing forecast earnings increase. If earnings pick up meaningfully, valuation may soon look more attractive.

Don’t be left behind

With such uncertainty, investors may be wondering how they can possibly get ahead of the curve on these debates. The reality is that they do not have to, and in fact, trying to market time in an unpredictable environment could be detrimental to long term returns.

- Need proof? A study by the Business Insider of 20 years of data (1995-2014) showed that missing just the 10 best days over those 20 years, cut the final value of an initial $10,000 investment in half. Miss those 10 days because you were nervous about valuation, and you just cut your retirement fund in half.

- If your advisor has properly identified your unique risk profile and your investment team has built you a portfolio aligned with those needs, then there is no need to try and time big swings in and out of the equity market. You should be able to ride out any inevitable market volatility, and over the long-term enjoy the full extent of returns that the market has to offer.

| Indices & Price Returns | Week (%) | Year (%) |

|---|---|---|

| S&P 500 | 1.2 | 5.9 |

| S&P 400 (Mid Cap) | 2.0 | 10.9 |

| Russell 2000 (Small Cap) | 2.4 | 10.5 |

| MSCI EAFE (Developed International) | 3.8 | 0.7 |

| MSCI Emerging Markets | 4.0 | 16.0 |

| S&P GSCI (Commodities) | 3.1 | 15.2 |

| Gold | 2.1 | 25.8 |

| MSCI U.S. REIT Index | 3.9 | 11.0 |

| Barclays Int Govt Credit | 0.3 | 2.9 |

| Barclays US TIPS | 1.1 | 6.0 |

Economic Commentary

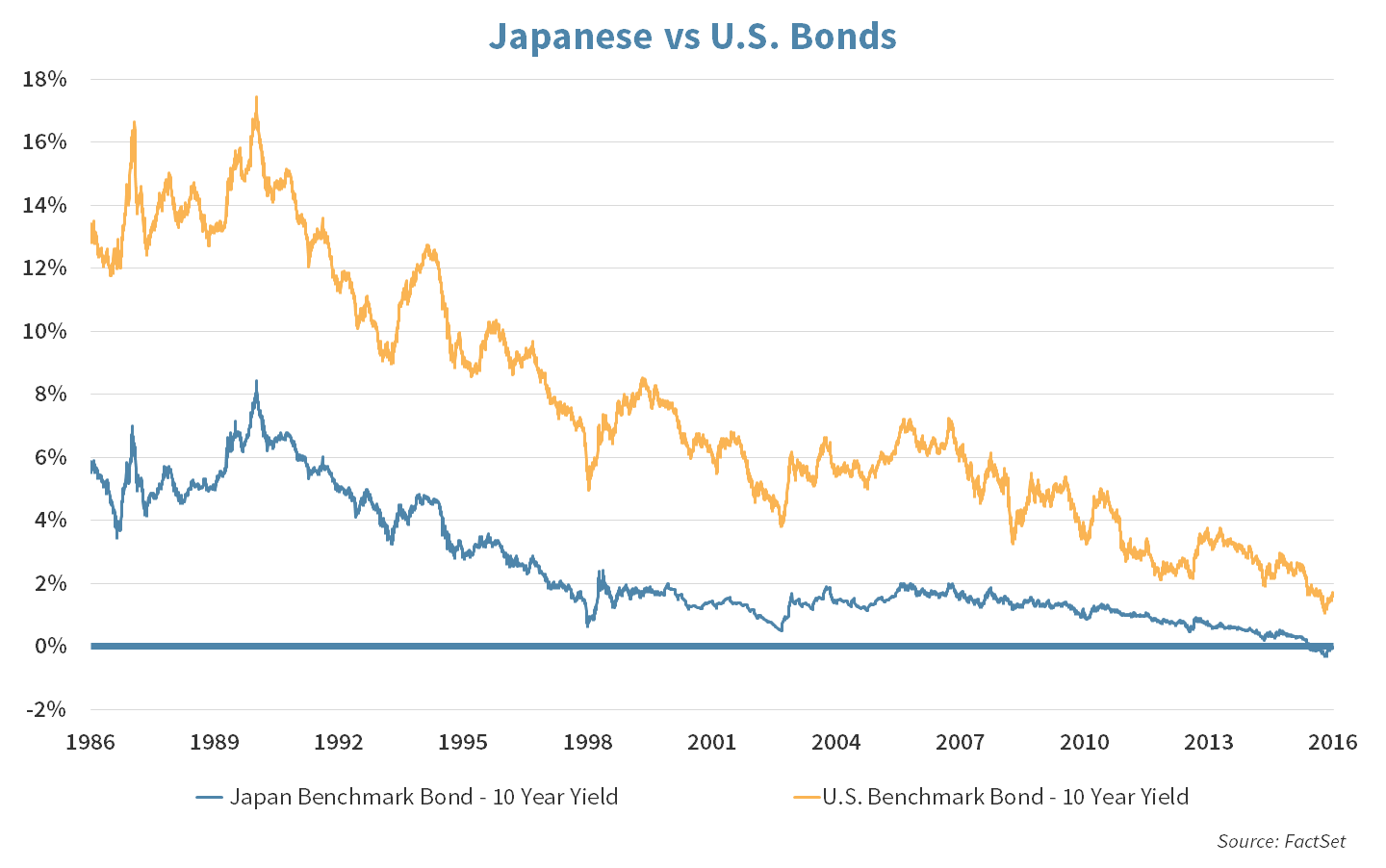

U.S. Treasury bonds have historically yielded higher interest rates than their Japanese equivalent. Recently, yields on Japanese medium term bonds have fallen into negative territory. As a result, an investor in these will receive fewer Yen back than his or her initial investment amount for the right to lend to the Japanese government. While US Treasury medium term bonds are also very low, the nominal return on investment is still positive.

The Bank of Japan declared this week they will guide their 10-year bond interest rate towards 0%. This makes the U.S. 10-year bond, with a 1.62% interest rate, look relatively attractive and puts less pressure on the U.S. Federal Reserve to raise rates.

The goal of the Bank of Japan is to spark inflation as it views deflation as the key risk to economic expansion. As the country’s economy is heavily driven by exports, the demand for Yen is naturally strong and they do not need to rely on foreigners purchasing their Yen denominated bonds. Their hope is that a 0% return on their 10-year bond will decrease demand for their bonds as well as their currency. A devalued Yen could help expand the Japanese economy by making their exports more competitively priced.

Week Ahead

Round One

The first presidential debate will take place on Monday evening from 9-10:30 p.m. ET. The debate between Hillary and Trump will take place at Hofstra University in Hempstead, New York on Long Island. The moderator will be an NBC anchor Lester Holt. The debate will be focused on three major topics: “America’s Direction,” “Achieving Prosperity,” and “Securing America.”

- All indications are that this will be the most viewed debate in history.

- The Clinton camp has invited Mark Cuban, the billionaire businessman, Dallas Maverick’s owner and outspoken Trump critic to a front row seat.

- A Monday debate spells trouble for Disney owned ESPN. The Monday Night Football matchup between the New Orleans Saints and Atlanta Falcons will probably lose many loyal Football Fans.

OPEC Struggles

On Thursday, OPEC will hold a meeting in Algeria where 14 nations will discuss output controls. This is not the first time the nations have discussed the matter. In the past, members of OPEC would agree to restrict the output of oil in their countries but failed to follow through.

- Few if any expect anything of substance from this get-together.

- Venezuela, Ecuador and Kuwait would like to take another stab at cooperating with non-OPEC member Russia. The Russian minister indicated Russia would play ball if oil prices fell further, but to what level is the big question.

Consumer Check-in

- Strategic Growth holdings and consumer bellwethers Nike. Inc. (NKE, Tuesday) and Costco Wholesale Corp. (COST, Thursday) report this week.

- The Consumer Confidence Index for September will be released on Tuesday. A 101.1 reading for August is expected to drop to 98.5 in September.

- Also on Tuesday, Personal Income and Consumer Spending will be released. Analysts expect growth of .2% for the month of August in both.

Strategy Updates

Contributed by Max Berkovich ,

Strategic Asset Allocation

Sitting the bench

Equity markets around the world finished the week strong, with Emerging Markets, Developed Markets and REITs leading the pack higher. There are some investors sitting on the sidelines holding cash. While they are approaching the markets with caution, US Equity markets are enjoying near all-time highs. Earnings season is less than two weeks away. Perhaps it will provide some clarity about the growth of corporate earnings and whether or not the current premium equities are trading at is justified.

Currency Wars

The global currency wars ramped up this week. Despite the Fed’s decision to keep rates unchanged, which acts to depreciate the US dollar against other currencies, the Japanese Yen finished lower against dollar. This move was caused by the Bank of Japan’s decision to target the 10-year interest rate at zero (see our Economics section). The British Pound also finished lower against the U.S. dollar after UK’s Boris Johnson commented that he is expecting Brexit to formally begin early next year.

STRATEGIC Growth

Two better than one

The Consumer Discretionary sector found itself as a laggard this week, while Health Care was the leader thanks to a specific subsector…

- The Biotechnology subsector of Health Care had a strong week. It may have a lot to do with several smaller companies reporting positive trial results. We have exposure to the sector by owning two different exchange trade funds; The SPDR S&P Biotech ETF (XBI) and the VanEck Vectors Biotech ETF (BBH). While BBH holds the top 25 companies on a market capitalization weighted basis, XBI on the other hand invests equally in 85 Biotechnology companies in the total market composite. The two combined give us exposure to the future of medication, while favoring the more diversified companies without ignoring the smaller companies with higher growth potential.

STRATEGIC Equity Income

OnCor, giving them more

Utilities and REITs were quick to respond to no rate increase from the Federal Reserve, the two sectors clawed back some of the weakness leading up to the decision. In other strategy news…

- NextEra Energy, Inc. (NEE) parent company of Florida Power & Light utility, took a big step in securing its long pursuit of the OnCor energy transmission business owned by the bankrupt Energy Future Holdings (EFH). NextEra increased the cash portion of its $18.4 Billion offer to $4.4 Billion, about a $300 Million bump from the original offer. The extra cash is necessary to get the previous owner EFH out of bankruptcy. Closing this deal is a big priority for the company since they walked away from an acquisition of a Hawaii Utility in order to make this offer in July.

About Strategic

Founded in 1979, Strategic is a leading investment and wealth management firm managing and advising on client assets of over $2 billion.

OverviewDisclosures

Strategic Financial Services, Inc. is a SEC-registered investment advisor. The term “registered” does not imply a certain level of skill or training. “Registered” means the company has filed the necessary documentation to maintain registration as an investment advisor with the Securities and Exchange Commission.

The information contained on this site is for informational purposes and should not be considered investment advice or a recommendation of any particular security, strategy or investment product. Every client situation is different. Strategic manages customized portfolios that seek to properly reflect the particular risk and return objectives of each individual client. The discussion of any investments is for illustrative purposes only and there is no assurance that the adviser will make any investments with the same or similar characteristics as any investments presented. The investments identified and described do not represent all of the investments purchased or sold for client accounts. Any representative investments discussed were selected based on a number of factors including recent company news or earnings release. The reader should not assume that an investment identified was or will be profitable. All investments contain risk and may lose value. There is no assurance that any investments identified will remain in client accounts at the time you receive this document.

Some of the material presented is based upon forward-looking statements, information and opinions, including descriptions of anticipated market changes and expectations of future activity. Strategic Financial Services believes that such statements, information, and opinions are based upon reasonable estimates and assumptions. However, forward-looking statements, information and opinions are inherently uncertain and actual events or results may differ materially from those reflected in the forward-looking statements. Therefore, undue reliance should not be placed on such forward-looking statements, information and opinions.

No content on this website is intended to provide tax or legal advice. You are advised to seek advice on these matters from separately retained professionals.

All index returns, unless otherwise noted, are presented as price returns and have been obtained from Bloomberg. Indices are unmanaged and cannot be purchased directly by investors.

Doug Walters

Doug Walters