A Personal Best

The Olympics games in Rio are now officially underway. While athletes around the world strive for new highs, the S&P 500 set its own personal best this week. A standout employment report and news of more stimulus globally helped give equities a push.

Market Review

Contributed by Doug Walters

Race to the Bottom

A stellar jobs report gave U.S. Equities a second wind, helping the S&P 500 to finish the week at a fresh all-time high. The Olympics are underway, but there are races going on elsewhere. The obvious one is the U.S. presidential race. However, there is also the international race to lower interest rates.

- This week Britain made a move on the leaders, with the Bank of England cutting interest rates in half to 25 bps, and increasing its QE by £70 Billion. The rate cut spotlights Britain’s concern over the near-term impact of Brexit. However, both British and European equity indices rallied on the news.

- Japan ranks number one in attempts to stimulate with fiscal policy. The latest attempt has the country spending ¥28 Trillion ($274.4 Billion). The money is targeted towards upgrading its ports and building new food processing facilities. Both are obvious attempts to increase exports, yet the market judged the plan as not enough.

Olympic Glory

If history is any guide (and honestly there is no reason it should be), the next couple of weeks could be positive for U.S. equity markets. Since the end of World War II, the stock market has had positive returns about two thirds of the time during the Olympic Games. A possible driver of this trend is the tangible sense of global optimism that accompanies the competition.

- The host country, Brazil, has had a good run in the stock market in 2016, up 30% year-to-date. This, despite significant economic and political hardships.

- Another asset class having almost as good of a 2016 is gold, up 26%. Perhaps it is the demand for all of those Olympic medals.

| Indices & Price Returns | Week (%) | Year (%) |

|---|---|---|

| S&P 500 | 0.4 | 6.8 |

| S&P 400 (Mid Cap) | 0.2 | 11.7 |

| Russell 2000 (Small Cap) | 0.9 | 8.4 |

| MSCI EAFE (Developed International) | -1.4 | -3.0 |

| MSCI Emerging Markets | 1.4 | 11.5 |

| S&P GSCI (Commodities) | 0.8 | 9.7 |

| Gold | -1.1 | 25.7 |

| MSCI U.S. REIT Index | -2.3 | 13.2 |

| Barclays Int Govt Credit | -0.4 | 2.9 |

| Barclays US TIPS | -1.0 | 5.5 |

Economic Commentary

US Jobs Report Wins the Gold

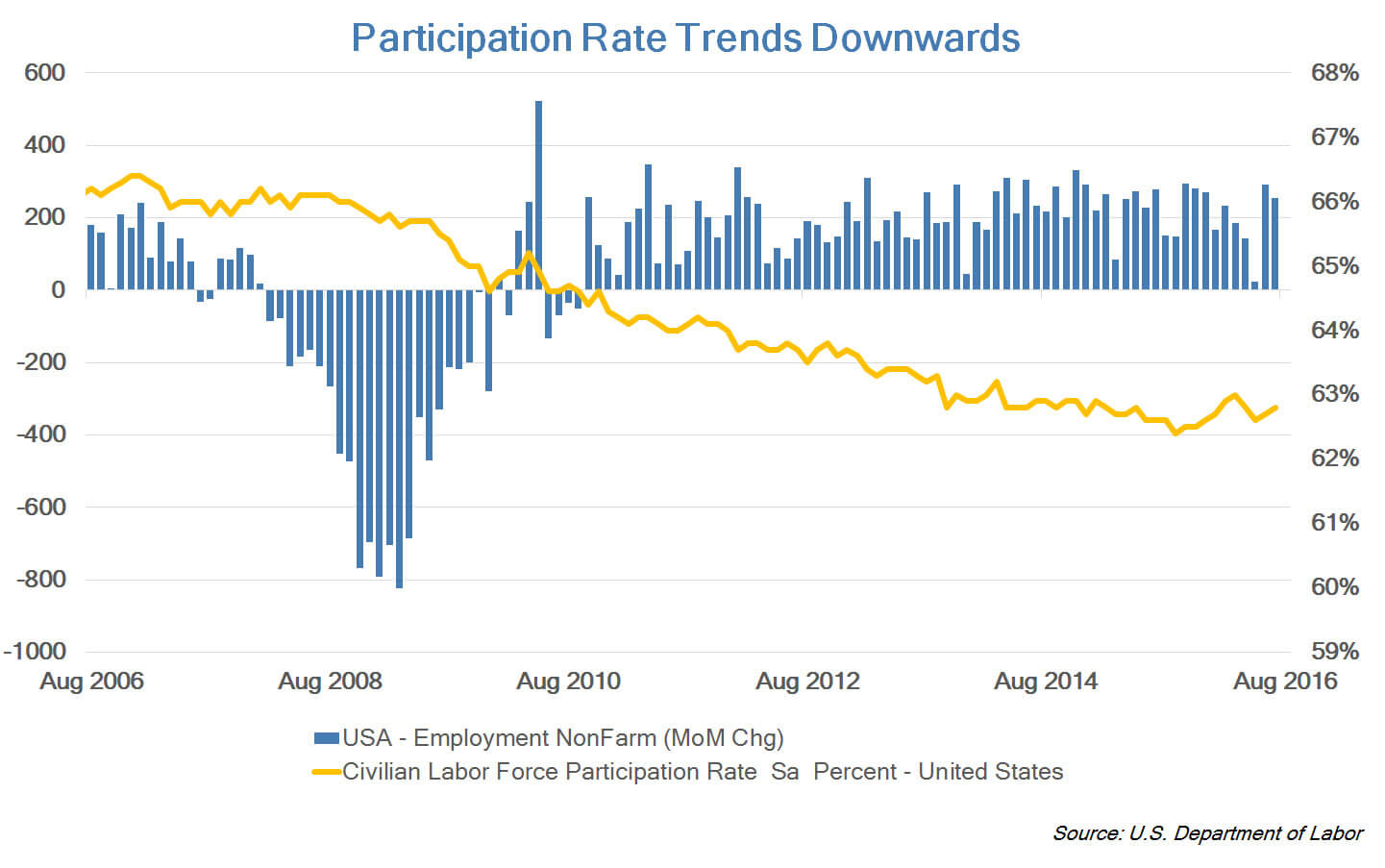

Employers shrugged off global headwinds, weak corporate profits as well as political uncertainty and instead hired 255,000 people last month, easily beating economist expectations of 180,000. In addition, the previous month’s jobs number was revised upwards by 5,000. The unemployment rate held steady at 4.9% while the labor force participation rate bucked the long-term downward trend, ticking upwards to 62.8%.

The best sectors in which to look for a job in July were within Professional Services and Leisure/Hospitality, where 46,000 and 36,000 jobs were added respectively. Unsurprisingly, the worst sector was Mining, which includes Oil & Gas and was the only sector to lose jobs, having shed 8,000 of them.

One long-term headwind on the labor force has been people opting out of the workforce. This has been evident by the labor force participation rate which has declined since 2001 and will most likely continue to do so as baby boomers retire. Americans aged 65 years and older account for 14.9% of the population but the Census Bureau projects this percentage to increase towards 20% by 2060. As the demographics shift, the labor force will have to adjust as fewer employees are available to drive economic growth.

Week Ahead

Retail Run

Earnings season is winding down for most industries, but the Retail sector is just kicking into high gear, with stocks like Macy’s (M), Kohl’s (KSS), J.C. Penney (JCP) and Nordstrom (JWN) reporting.

- In addition to earnings, additional clues as to the health of the consumer will come this week from the U.S. Retail Sales report and the initial University of Michigan Consumer Confidence index.

A Cinderella Story

Disney reports earnings this week. The company has been seeing top line improvement, but faces challenges in its network businesses of ABC and ESPN, as customer consumption preferences shift.

- Analysts expect to see further revenue growth and insight on possible decisions to spin off certain parts of their non-core businesses.

- This will be the first results since the opening of Disney’s new China theme park, and investors will be watching for signs of early success.

Strategy Update

Contributed by , Max Berkovich

Strategic Asset Allocation

A Strong Finish

US equity markets finished the week on a high, though were outpaced by Emerging Markets. We remain underweight in Developed International, which was the laggard this week.

Dropped Baton

REITs declined 2.3% this week, but are still up 13% year-to-date. Bad news for REITs could be good news for the broader economy. According to Bloomberg’s World Interest Rate Probability measure for the US, the likelihood of a December rate hike has increased to 48%. Rising rates signal economic optimism, but make high-yielding REITs relatively less attractive.

Medaling

Gold finished lower for the week, losing its recent upward momentum. Despite this, the beloved metal has proven its value as a diversifier this year.

Strategic Growth

Torch Relay

The Energy sector had a strong bounce this week, placing it at the top of the medal standings. Consumer Discretionary came in last despite a late push from…

- Priceline Group, Inc. (PCLN), the online travel site, reported a strong quarter, topping earnings expectations. The company indicated that year-over-year hotel bookings increased by 24%. Overall gross bookings came in 19.4% higher than last year. Year-to-date, Priceline has taken the torch back from rival and fellow strategy holding Expedia Inc. (EXPE) which had a huge year last year, but is trailing its much larger rival in 2016.

Strategic Equity Income

Winners and losers

High dividend yielding sectors fell behind the competition, but Financials, especially the Banks, are making up for it. In other strategy news…

- Pharmaceutical giant Merck & Co. Inc. (MRK) found itself the beneficiary of a rival’s misfortune. A failed clinical trial of a blockbuster lung cancer drug by Bristol-Myers Squibb (BMY) has elevated Merck to the new leader in the lucrative lung cancer drugs space. Merck was also in the news earlier in the week as a rumored acquirer of biotech firm Biogen (BIIB). Nothing new to report there for now.

About Strategic

Founded in 1979, Strategic is a leading investment and wealth management firm managing and advising on client assets of over $2 billion.

OverviewDisclosures

Strategic Financial Services, Inc. is a SEC-registered investment advisor. The term “registered” does not imply a certain level of skill or training. “Registered” means the company has filed the necessary documentation to maintain registration as an investment advisor with the Securities and Exchange Commission.

The information contained on this site is for informational purposes and should not be considered investment advice or a recommendation of any particular security, strategy or investment product. Every client situation is different. Strategic manages customized portfolios that seek to properly reflect the particular risk and return objectives of each individual client. The discussion of any investments is for illustrative purposes only and there is no assurance that the adviser will make any investments with the same or similar characteristics as any investments presented. The investments identified and described do not represent all of the investments purchased or sold for client accounts. Any representative investments discussed were selected based on a number of factors including recent company news or earnings release. The reader should not assume that an investment identified was or will be profitable. All investments contain risk and may lose value. There is no assurance that any investments identified will remain in client accounts at the time you receive this document.

Some of the material presented is based upon forward-looking statements, information and opinions, including descriptions of anticipated market changes and expectations of future activity. Strategic Financial Services believes that such statements, information, and opinions are based upon reasonable estimates and assumptions. However, forward-looking statements, information and opinions are inherently uncertain and actual events or results may differ materially from those reflected in the forward-looking statements. Therefore, undue reliance should not be placed on such forward-looking statements, information and opinions.

No content on this website is intended to provide tax or legal advice. You are advised to seek advice on these matters from separately retained professionals.

All index returns, unless otherwise noted, are presented as price returns and have been obtained from Bloomberg. Indices are unmanaged and cannot be purchased directly by investors.

Doug Walters

Doug Walters