A Good Deal

Value outperformed in another impressive week for stock returns. As cheap stocks gain momentum, is now the time to go all-in on bargain hunting?

Contributed by Doug Walters , Max Berkovich , ,

U.S. stocks had another good week, finishing up near 3%. Last week we highlighted small-cap outperformance and how that should be expected in a recovery scenario. This week it was value stocks that outperformed. Like small-cap, value stocks tend to outperform in recovery. This behavior makes intuitive sense and is backed by data. At the bottom of a downturn, there is always going to be a subset of stocks whose valuation has become particularly cheap as investors question their ability to manage the downturn. When their economic fortunes turn, the stock price reaction on the upside can be significant and swift.

But value investing requires patience. Historically, a value strategy has outperformed growth. However, most of that outperformance has come within the first few months of recovery from a significant market downturn (like in the wake of the Tech Bubble bursting and the 2008 Financial Crisis). After that initial burst of outperformance, value tends to lag.

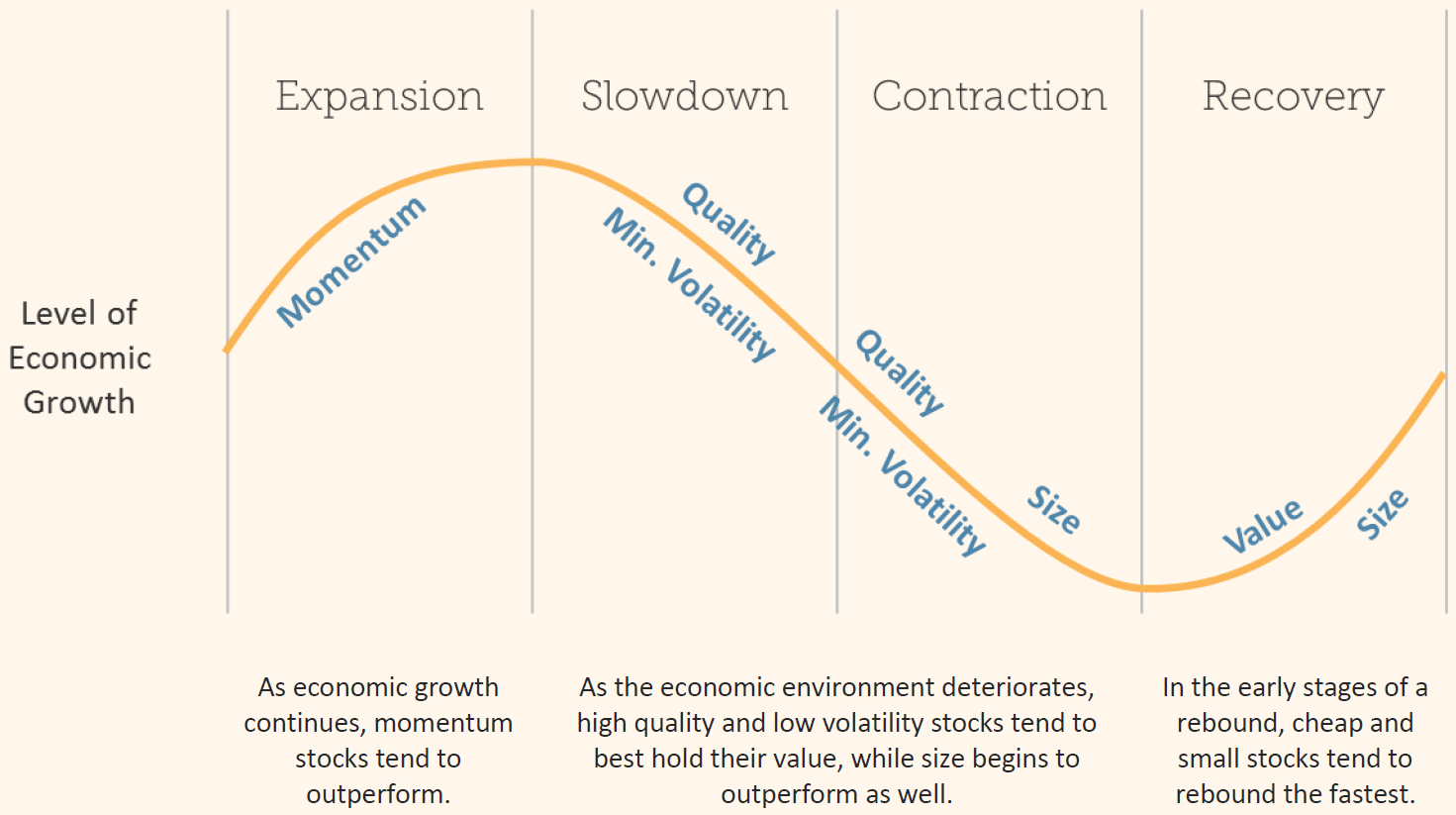

So, why not just own value at the bottom of a market downturn? Market timing is a losing game. It is never apparent where the market bottom is until it is past, and by then, you may have missed the boat on recovery. Instead of gambling on the market cycle, we prefer to place securities with multiple rewarded factors at the core of our portfolios. Along with value, we also favor equities displaying quality, momentum, small size, and in some cases, minimum volatility. These factors, as we call them, give us positive exposure across the economic cycle. Small size and value work in recovery; momentum in expansion; quality and minimum volatility in a slowdown and contraction.

This approach is driven by our philosophy favoring science, not speculation.

Headlines This Week

Easy Does It

Easy money, provided by central banks and fiscal stimulus around the world, is keeping investors calm, with countries spreading confidence that economies can stabilize and eventually return to growth.

- Germany and the United Kingdom are discussing the second round of stimulus.

- The European Union is discussing the potential to add around 750 billion Euros to the pandemic emergency program, making the total spending about $2 trillion.

- Japan added another round of $1 trillion in stimulus spending.

Back to work!

For the first time in what feels like a century, Americans are returning to work.

- Almost 4 million Americans came off unemployment benefits thus far in May.

- While there were still about 2.1 million more workers who filed unemployment claims, the net unemployment numbers are now declining.

The Week Ahead

Several key economic reports headline a busy week.

- Friday’s Non-Farm Payrolls figure is likely to be the biggest story next week. Experts are forecasting a nearly 7.5 million drop in payroll for May, which would push the unemployment rate just below 20%.

- The Initial Jobless Claims report (Thursday) and the ADP Employment Change report (Wednesday) could provide some additional insight ahead of the payroll figures on Friday.

- The Manufacturing PMI for May, released on Monday, may not have its usual influence given the job-related reports slated for later in the week.

Brexit makes its way back into our lives, as the UK needs to decide by June 30th, whether it wants an extension to the transition period.

- Prime Minister Boris Johnson has stated he will not seek an extension.

- If the deadline passes without an extension, a No-Deal Brexit at the end of the year becomes the default option.

A few Central Banks release their decisions next week regarding interest rates and quantitative easing programs.

- The European Central Bank is expected to agree to pump more money into the economy when it meets next Thursday.

- The current 750 billion Euro quantitative easing (QE) package is projected to run out by September/October.

- A decision to expand the program could happen Thursday, with experts taking more of a “when, not if” mindset.

- Neither the Bank of Canada nor the Reserve Bank of Australia is expected to make changes to their current policies when each holds its meetings next week.

About Strategic

Founded in 1979, Strategic is a leading investment and wealth management firm managing and advising on client assets of over $2 billion.

OverviewDisclosures

Strategic Financial Services, Inc. is a SEC-registered investment advisor. The term “registered” does not imply a certain level of skill or training. “Registered” means the company has filed the necessary documentation to maintain registration as an investment advisor with the Securities and Exchange Commission.

The information contained on this site is for informational purposes and should not be considered investment advice or a recommendation of any particular security, strategy or investment product. Every client situation is different. Strategic manages customized portfolios that seek to properly reflect the particular risk and return objectives of each individual client. The discussion of any investments is for illustrative purposes only and there is no assurance that the adviser will make any investments with the same or similar characteristics as any investments presented. The investments identified and described do not represent all of the investments purchased or sold for client accounts. Any representative investments discussed were selected based on a number of factors including recent company news or earnings release. The reader should not assume that an investment identified was or will be profitable. All investments contain risk and may lose value. There is no assurance that any investments identified will remain in client accounts at the time you receive this document.

Some of the material presented is based upon forward-looking statements, information and opinions, including descriptions of anticipated market changes and expectations of future activity. Strategic Financial Services believes that such statements, information, and opinions are based upon reasonable estimates and assumptions. However, forward-looking statements, information and opinions are inherently uncertain and actual events or results may differ materially from those reflected in the forward-looking statements. Therefore, undue reliance should not be placed on such forward-looking statements, information and opinions.

No content on this website is intended to provide tax or legal advice. You are advised to seek advice on these matters from separately retained professionals.

All index returns, unless otherwise noted, are presented as price returns and have been obtained from Bloomberg. Indices are unmanaged and cannot be purchased directly by investors.

Doug Walters

Doug Walters