A Bronze Anniversary

The eighth anniversary of the low point for equities following the financial crisis, is a good opportunity to reflect on some lessons learned and help ensure that you capture the next 300% gain in equities.

Market Review

Contributed by Doug Walters

U.S. stocks were down this week, breaking a six-week positive streak. However, another streak has been far more important to investors. March 9th marked the eighth anniversary of the post financial crisis bull market.

A mental game

Since the bottom of the equity market in 2008, the S&P 500 has generated a total return of over 300%. That’s an annual return of about 19%. The rally has been fueled by a period of extraordinary low interest rates, which appears likely to be coming to an end as the Fed contemplates yet another rate increase.

- There are many who missed a portion of this rally. The dramatic market declines in 2008 scared many away at just the wrong time. In the subsequent 12 months following the trough, the S&P 500 returned 72%! Missing that first year, would have reduced an investor’s overall gain from about 300% to 140%.

- We will experience another significant market decline. Investors will not be able to predict the timing, but they can prepare for it… mentally. The stock market is volatile. If you are prepared to ride its ups and downs, you will benefit over time from the full extent of the total return that the market offers.

| Indices & Price Returns | Week (%) | Year (%) |

|---|---|---|

| S&P 500 | -0.4 | 6.0 |

| S&P 400 (Mid Cap) | -1.6 | 3.0 |

| Russell 2000 (Small Cap) | -2.1 | 0.6 |

| MSCI EAFE (Developed International) | 0.4 | 4.7 |

| MSCI Emerging Markets | -0.5 | 7.4 |

| S&P GSCI (Commodities) | -4.6 | -4.6 |

| Gold | -2.4 | 4.7 |

| MSCI U.S. REIT Index | -4.5 | -2.9 |

| Barclays Int Govt Credit | -0.4 | -0.4 |

| Barclays US TIPS | -0.8 | -0.2 |

Economic Commentary

Economic Curves

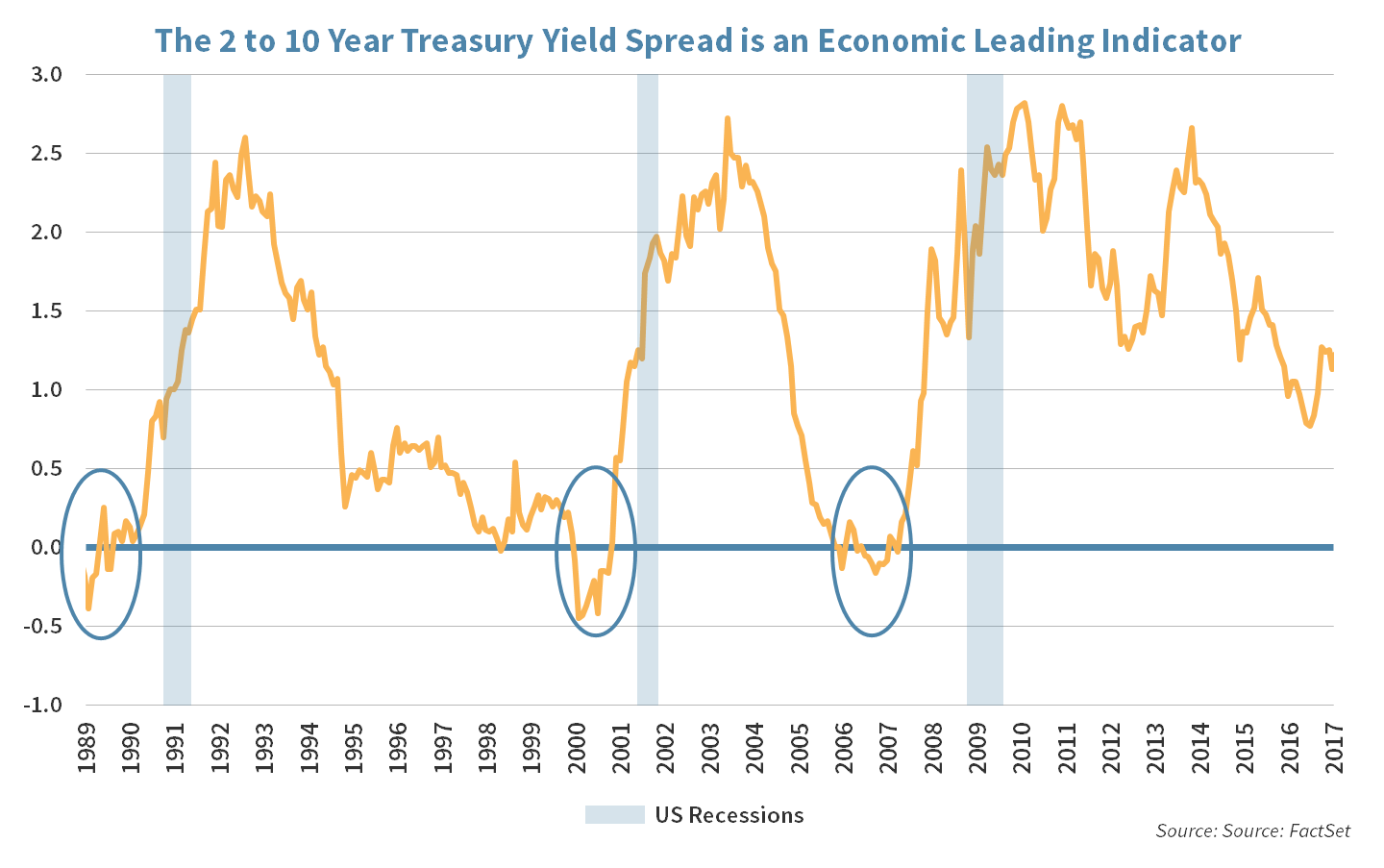

Yield curves are usually upward slopping as investors charge a premium to have their money locked up for a longer time. For example, if you take out a 2-year loan at the bank, you are more likely to get a lower interest rate than if you take out a 10-year loan. This is because your lender would need a premium for his or her money to be locked up for ten years instead of two. An exception to this rule is when the yield curve flattens and investors become indifferent between lending at short- or long-term durations. In the past, a flat yield curve has been an early indicator of an upcoming recession.

In fact, the past three U.S. recessions (1990, 2001 and 2008) could have been predicted by the presence of an inverted yield curve, where the short term 2-year Treasury rate was higher than the 10-year. As the Fed has increased rates recently with greater expectations of further rate hikes, the yield curve has become more flat and the 2 to 10-year yield spread has dropped from 2.7% in 2014 to 1.2% today. If this spread drops below zero, investor sentiment could change and the Strategic Investment team would consider adjusting our asset allocation accordingly.

Week Ahead

Chow down

Central Bank – A solid February jobs report may clear the way for the U.S. Federal Reserve to raise interest rates next week.

- The market is expecting a 0.25% hike in the Fed’s rate to 1%, a level not seen since 2009.

Holland and UK – Investors around the world will focus on the Dutch elections and possible triggering of Article 50 in the UK.

- In Holland, the polls show Geert Wilders and Mark Rutte to be in a tight race. A win by Wilder’s Party of Freedom might further strain the future of the EU, as the candidate has campaigned on the premise to an EU exit.

- In the UK, the House of Commons will debate on Monday on Article 50. If parliament gives its final approval, Prime Minister May could trigger Article 50 as early as March 14th. Article 50 is a major hurdle to clear for Britain to exit the EU.

Oracle – The database software giant is scheduled to report fiscal 3rd quarter results for 2017.

- Analysts are looking for flat growth in earnings per share (EPS) and 1% growth in sales over last year’s Q3 results.

- Investors will be listening closely to any commentary about: growth in their cloud business, customer’s transition to the cloud, and the company’s guidance.

William-Sonoma (WSM) – The company is scheduled to report 4th quarter results. Pottery Barn brands, which have recently been a drag on company’s growth, will be in the spotlight.

- Analysts expect a decline in Q4 EPS to $1.51 vs. the previous year’s 4th quarter EPS of $1.58.

- Competitor, Restoration Hardware (RH), has shown some growth in its preliminary earnings results. A frequent rumor is that William-Sonoma is looking to acquire the company.

Strategy Updates

Contributed by Max Berkovich ,

STRATEGIC ASSET ALLOCATION

Walking a tightrope

A positive surprise from Friday’s job report softened losses earlier in the week for U.S. Equities. While stocks finished slightly negative this week, large companies have shown resilience, claiming another week of outperformance over small companies. At this point, stocks are walking a tightrope and will be looking for direction from policy makers as well as geo-political news, especially from Europe.

- Small cap stocks declined nearly 2% this week vs. large cap’s decline of less than 0.5%.

- Investors will be watching the Netherlands election results closely to keep a finger on the pulse of populism.

Slick moves

The U.S. is making some moves in the oil market. So far, Saudi Arabia has kept their word on cutting production of 1.2 million barrels per day, but U.S. oil stock reserves are still increasing. It seems that U.S. oil producers are happy to produce some of the oil that OPEC worked so diligently to cut.

- Somewhat stable oil prices allows for U.S. oil shale (fracking) production to pick up as their costs continue to decline.

Kings & prophets

In January, bond king Bill Gross of Janus Funds, prophesied that crossing the 2.6% yield threshold on the 10-year U.S. Treasury bond would be the beginning of a secular bond bear market. The 2.6% level was breached on Thursday, but moved back down to 2.57% level on Friday.

STRATEGIC GROWTH

A cat’s meow

The Technology sector squeaked out a top finish for the week, while The Energy sector was a laggard as crude prices dipped under $50 per barrel. In other strategy news…

- Caterpillar Inc. (CAT) was caught in the headlines as last weeks’ office raid by various regulatory agencies including the IRS continues to stir fear for investors. The raid seems to focus on a tax issue for a parts business subsidiary in Switzerland. The company claims that it is “vigorously contesting” an approximately $2 Billion tax and penalty proposal from the IRS. The company is cooperating, but investors are spooked by the development. The stock has had a big run since U.S. elections on hopes for infrastructure spending.

Strategic EQUITY INCOME

A senior moment

Even though Energy had a rough week, rate sensitive sectors, Utilities, Telecom and REITs had an even worse one as rates crossed over 2.6% on the 10-year U.S. Treasury. The Health Care sector finished the week on top though. In mergers and acquisitions news…

- Ventas Inc. (VTR) a health care REIT specializing in health care properties came out to publicly deny a rumor that it would be acquiring some or all of Brookdale Senior Living (BKD). While Brookdale is a major tenant and an important partner, Ventas is not looking to acquire it.

- New Federal Communication Commission Chair Ajit Pai commented that the agency will not give the Time Warner Inc. (TWX) acquisition by AT&T (T) a tough review, making the odds of the deal closing look better. But will it occur before the July 16 premier of the 7th season of Game of Thrones?

About Strategic

Founded in 1979, Strategic is a leading investment and wealth management firm managing and advising on client assets of over $2 billion.

OverviewDisclosures

Strategic Financial Services, Inc. is a SEC-registered investment advisor. The term “registered” does not imply a certain level of skill or training. “Registered” means the company has filed the necessary documentation to maintain registration as an investment advisor with the Securities and Exchange Commission.

The information contained on this site is for informational purposes and should not be considered investment advice or a recommendation of any particular security, strategy or investment product. Every client situation is different. Strategic manages customized portfolios that seek to properly reflect the particular risk and return objectives of each individual client. The discussion of any investments is for illustrative purposes only and there is no assurance that the adviser will make any investments with the same or similar characteristics as any investments presented. The investments identified and described do not represent all of the investments purchased or sold for client accounts. Any representative investments discussed were selected based on a number of factors including recent company news or earnings release. The reader should not assume that an investment identified was or will be profitable. All investments contain risk and may lose value. There is no assurance that any investments identified will remain in client accounts at the time you receive this document.

Some of the material presented is based upon forward-looking statements, information and opinions, including descriptions of anticipated market changes and expectations of future activity. Strategic Financial Services believes that such statements, information, and opinions are based upon reasonable estimates and assumptions. However, forward-looking statements, information and opinions are inherently uncertain and actual events or results may differ materially from those reflected in the forward-looking statements. Therefore, undue reliance should not be placed on such forward-looking statements, information and opinions.

No content on this website is intended to provide tax or legal advice. You are advised to seek advice on these matters from separately retained professionals.

All index returns, unless otherwise noted, are presented as price returns and have been obtained from Bloomberg. Indices are unmanaged and cannot be purchased directly by investors.

Doug Walters

Doug Walters