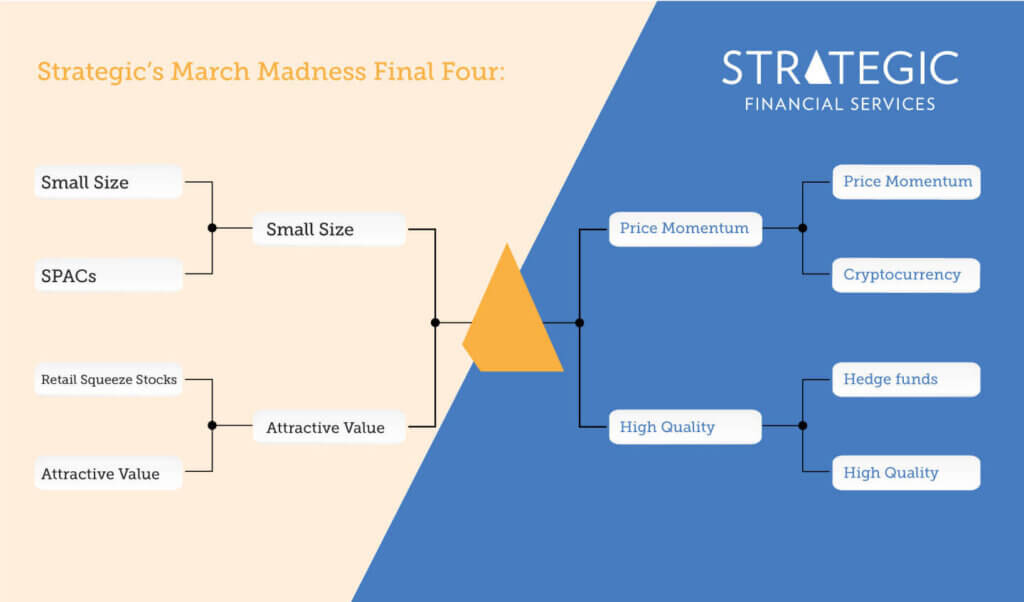

Strategic’s Final Four Picks

March Madness is back! After last year’s basketball tournament was cancelled due to the pandemic, it is sweet indeed to welcome bracketology back to our vernacular. And as much as we love our brackets here at Strategic, we nerd out over retirement planning

Tournaments and Retirement Plans are Not Won with Longshots

Contributed by Gregory Mattacola

March Madness is back! After last year’s basketball tournament was cancelled due to the pandemic, it is sweet indeed to welcome bracketology back to our vernacular. And as much as we love our brackets here at Strategic, we nerd out over retirement planning and sound investing even more. We cannot help but notice the obvious parallels between the NCAA tourney and investing for your retirement. Obvious? Yes indeed! Like Dickie V. has done for so many years, let us break it down.

The tournament loves a Cinderella story – it makes for great drama and story lines and keeps us all glued to the screen. Think Jim Valvano’s 1983 N.C. State Wolfpack triumphing over the heavily favored Phi Slamma Jamma of Houston. Think 10 seeded 2008 Davidson with Steph Curry who reached the Elite 8. Remember 2011 VCU who got in on an at-large bid and made it all the way the Final Four? And who can forget Sister Jean and the 2018 11 seed Loyola Chicago who also made their way to the Final Four? Great, fun stories that made us all feel good, and which also busted up our brackets beyond repair.

Yet, for every one of these, history is littered with Cinderellas whose carriages turned back to pumpkins long before the ball was over and whose feet never got near the glass slippers. When thinking of investing for your retirement, the goal is not just to make the tournament and survive a few rounds – the only acceptable outcome for us is for you to cut down the nets, having achieved every one of your retirement goals.

Sure, it’s fun to watch the Cinderellas and occasionally one does catch lightning in a bottle; but far more often, the trophy is raised by the blue bloods – Duke, North Carolina, Kentucky, UCLA, Indiana, Connecticut. Those six schools have thirty-nine championships between them! Think of them as the stalwart companies who have sound structures, strong financials, consistent earnings, and whose stock prices are in proportion to their value. Yes, Tesla is a great story, but it is a rare one.

Does this mean that we only go for the mega-cap dynasty investments when looking at your portfolio and bet your entire future on their success? Of course not – we make sure it is diversified across the board with exposure to all different sizes and sectors. No different than sprinkling in some mid-major teams to your bracket along with the occasional small school whose program is doing all the right things and is trending in the right direction. Diversity is crucial, for your bracket and for your portfolio.

So, as the madness of the pandemic somewhat subsides, we welcome back March Madness with open arms – all the while knowing tournaments and retirement goals are won not with the longshots, but with the tried and true. Enjoy the tourney!

About Strategic

Founded in 1979, Strategic is a leading investment and wealth management firm managing and advising on client assets of over $2 billion.

OverviewDisclosures

Strategic Financial Services, Inc. is a SEC-registered investment advisor. The term “registered” does not imply a certain level of skill or training. “Registered” means the company has filed the necessary documentation to maintain registration as an investment advisor with the Securities and Exchange Commission.

The information contained on this site is for informational purposes and should not be considered investment advice or a recommendation of any particular security, strategy or investment product. Every client situation is different. Strategic manages customized portfolios that seek to properly reflect the particular risk and return objectives of each individual client. The discussion of any investments is for illustrative purposes only and there is no assurance that the adviser will make any investments with the same or similar characteristics as any investments presented. The investments identified and described do not represent all of the investments purchased or sold for client accounts. Any representative investments discussed were selected based on a number of factors including recent company news or earnings release. The reader should not assume that an investment identified was or will be profitable. All investments contain risk and may lose value. There is no assurance that any investments identified will remain in client accounts at the time you receive this document.

Some of the material presented is based upon forward-looking statements, information and opinions, including descriptions of anticipated market changes and expectations of future activity. Strategic Financial Services believes that such statements, information, and opinions are based upon reasonable estimates and assumptions. However, forward-looking statements, information and opinions are inherently uncertain and actual events or results may differ materially from those reflected in the forward-looking statements. Therefore, undue reliance should not be placed on such forward-looking statements, information and opinions.

No content on this website is intended to provide tax or legal advice. You are advised to seek advice on these matters from separately retained professionals.

All index returns, unless otherwise noted, are presented as price returns and have been obtained from Bloomberg. Indices are unmanaged and cannot be purchased directly by investors.

Greg Mattacola

Greg Mattacola