A Taxing Situation

U.S. equities have had a good start to the year, but we expect significant volatility as the new legislature, which is now in session, begins implementing their agenda.

Market Review

Contributed by Doug Walters

Despite being down modestly on the week, it has been a good start to the year for U.S. Equities, with the S&P 500 already up 1.6% on the year. But this is no time for complacency, and investors should be prepared for volatility, with Washington as the catalyst.

Legislation nation

The Republican controlled legislature is wasting no time trying to push forward with its agenda while it holds the majority of the seats in both houses. High on their checklist is the Affordable Care Act and corporate taxes. Both issues have implications for stocks and sectors. However, with the final form of any changes still uncertain, it will be difficult for investors to predict winners and losers.

- Full repeal and replacement of the Affordable Care Act will be impossible without Democratic support, but steps have already been take to repeal portions of the law using the budget reconciliation process. Depending on the ultimate approach, there could be implications for the Health Care sector, which has outperformed the broader market through much of Obama’s tenure.

- For corporate taxes, there is a plan proposed by the House of Representatives that would effectively tax companies for importing goods, while at the same time lowering the base tax rate. The implications for companies that sell imported goods is huge, and could result in large price increases to consumers. We discuss taxes more in the Economics section.

At Strategic, we will be monitoring these legislative changes closely and will look to take advantage of any market dislocations they may create.

| Indices & Price Returns | Week (%) | Year (%) |

|---|---|---|

| S&P 500 | -0.1 | 1.6 |

| S&P 400 (Mid Cap) | 0.3 | 1.6 |

| Russell 2000 (Small Cap) | 0.3 | 1.1 |

| MSCI EAFE (Developed International) | 0.8 | 2.6 |

| MSCI Emerging Markets | 1.7 | 3.9 |

| S&P GSCI (Commodities) | 0.4 | 0.4 |

| Gold | 2.2 | 4.2 |

| MSCI U.S. REIT Index | -2.0 | 0.1 |

| Barclays Int Govt Credit | 0.1 | 0.2 |

| Barclays US TIPS | 0.5 | 0.7 |

Economic Commentary

The economics of manufacturers

Manufacturing jobs were a key election issue that President-elect Trump used to his advantage as he blamed the establishment for not doing enough to protect them. Free trade agreements such as NAFTA and the TPP were routinely attacked as American job killers. Now, there is discussion of a “border tax” that would be used to discourage U.S. manufacturers from moving plants to lower labor cost nations, such as Mexico and China.

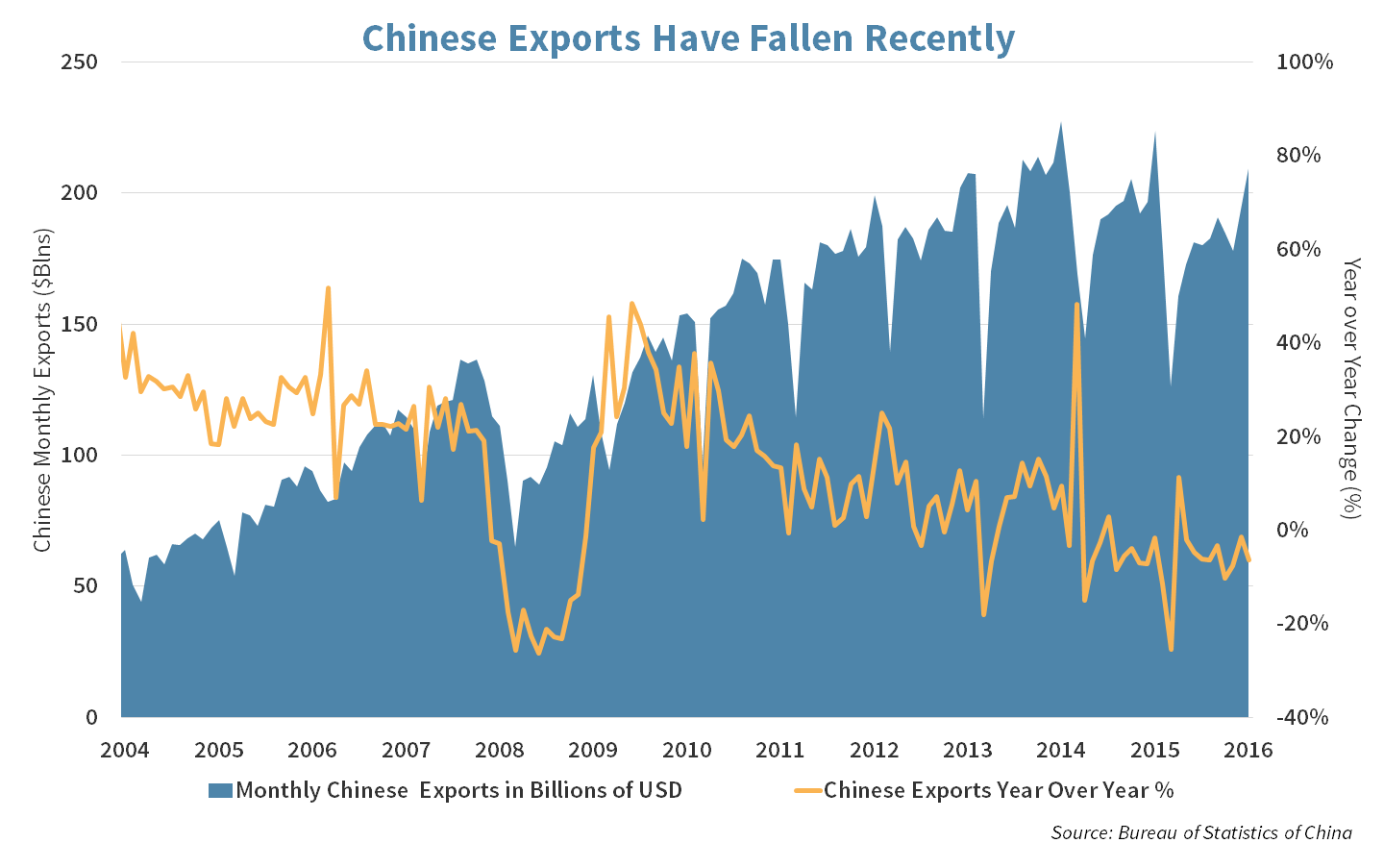

Therefore, Chinese exports may come under pressure from the increased protectionism. This week, the Chinese Ministry of Commerce warned that their exports may weaken from possible tariff taxes as well as sluggish demand. In China, rising costs in labor, land and other resources are diminishing its advantage as a low-cost manufacturer. Weaker Chinese growth would hurt the world economy, especially commodity producers that have enjoyed rising Chinese demand for decades.

The robots are coming

In addition to competition from low labor cost nations, manufacturing jobs are under pressure from advancements in automation. According to a McKinsey Global Institute study released this week, only 5% of all jobs can be fully replaced by automation technology but almost every job has tasks that can be automated. The study states that 45% of work activities could be automated using already available technology.

This automation could boost production growth through efficiency. However, the labor force would need to shift its skill set to work with this new technology. That shift can be compared to the agriculture industry of the last century. Agriculture was incredibly labor intensive early in the last century before shifting to more reliance on machines, such as those made by Deere. Robotic engineering jobs could come at the expense of assembly line workers.

Week Ahead

Looking back

4th Quarter earnings kicked off and next week’s focus will be on traditional Banks, with Strategic holdings BB&T Bank, M&T Bank, US Bancorp and Bank of New York Mellon all set to report.

- 2016 is now in the books and investors will be looking for commentary on 2017. With the Federal Reserve’s interest rate increase coming in the final week of the year, 2016 results may not be as important as the outlook going forward. Investors will have to judge whether the results and the outlook justify the tremendous run these banks have witnessed since the election.

Inflating expectations

Inflation numbers will be watched closely by the Fed and investors. Any signs of a jump in inflation could likely result in a swift adjustment in the fixed income market. Inflation running over 2% has been mentioned as a trigger point. Though, Chairwomen Yellen and her cohorts have hinted that they may want that number to run slightly hotter than the 2% figure.

- Between 2004 and 2005, the Fed raised interest rates 13 consecutive times.

- Inflation based on the Consumer Price Index jumped by 6.8% for the period.

Building confidence

In the last two months, equity markets moved quickly to price in the expected policies of the president-elect. Analysts expect an increase in construction. Builder permits could provide insight into home builder’s confidence.

- Building permits for December are forecast at 1,220,000 vs. November permits of 1,212,000.

Inauguration day

The 58th presidential inauguration will commence on January 20, 2017 with Donald J. Trump and Michael R. Pence swearing in as President and Vice President of the United States of America. The ceremony will be followed by a parade where the new President will walk along Pennsylvania Avenue followed by parade participants.

Here are some fun facts from past Presidential Inaugurations:

- In 1953, Texas-born Dwight D. Eisenhower was lassoed in the reviewing stand by a cowboy who rode up to him on horse.

- Ronald Reagan was the oldest man inaugurated, just 17 days short of his 70th birthday. Donald Trump is older by half a year.

- At just 135 words, the shortest speech was given by George Washington.

Strategy Updates

Contributed by , Max Berkovich

Strategic Asset Allocation

Shopping in different aisles

Bargain hunting may have forced investors to take profits in Biotech and snap up some traditional pharmaceutical names. Energy names pulled back, while some attention shifted to Technology. The Retail sector faced pressure as uncertain tax plans seem to be a major headwind on top of softer holiday sales and continued market share to online. Retail analyst Ike Boruchow of Wells Fargo, declared retail sector “uninvestable”.

Along for a ride

Improvements in the U.S. economy lifted expectations for Emerging Markets. Emerging Markets are expected to benefit from the rise in consumer and corporate investment as global trade heats up. World Bank predicts global growth of 2.7% in 2017 despite heightened uncertainty in global commerce. Higher commodity prices should help emerging economies the most.

- Foreign goods are cheaper for U.S. consumers as the U.S. dollar rises to a 14-year high against a basket of major currencies.

- However, should a “Border Tax” could cause a decline in foreign goods consumption.

No action needed

While stocks were a bit volatile this week, there were no strong signals that would prompt us to make any significant changes in asset weighting at this point.

Strategic Growth

Like a surgeon

The Materials sector was the top performer this week, while Consumer Staples joined Financials at the bottom of the stack. In other strategy news…

- United Health Group (UNH) started the week by announcing an acquisition. Surgical Health Care Affiliates (SCAI) owns a network of over 200 outpatient surgery centers. The $2.3 Billion dollar acquisition is a modest one for UNH, whose market cap is $154 Billion. The deal is not supposed to translate into earnings growth. It appears like a long term investment in their transition from a health insurer to a diversified health service company. The company reports earnings on Tuesday.

Strategic Equity Income

Steady as a rock

The Energy sector took a breather this week and was the biggest laggard, while Health Care was the top performer. Earnings kicked off on Friday with two financial names leading off…

- JP Morgan & Co. (JPM) reported a sizable beat for the quarter, which was skewed by a few extraordinary items. While the report failed to inflate further enthusiasm for bank stocks, it did offer several positives for JP Morgan including: improving credit, continued downtrend in expenses, and a 14% increase in core loans.

- BlackRock, Inc. (BLK), an asset manager with over $5.15 trillion under management, also reported earnings Friday. The report was mostly uneventful, but the company did increase its dividend by over 9%, bringing its annual distribution to $5 per share. In addition, its stock buyback authorization was increased by 6 million shares to 9 million. The company’s assets under management increased 11% for the year, 7% from inflows.

About Strategic

Founded in 1979, Strategic is a leading investment and wealth management firm managing and advising on client assets of over $2 billion.

OverviewDisclosures

Strategic Financial Services, Inc. is a SEC-registered investment advisor. The term “registered” does not imply a certain level of skill or training. “Registered” means the company has filed the necessary documentation to maintain registration as an investment advisor with the Securities and Exchange Commission.

The information contained on this site is for informational purposes and should not be considered investment advice or a recommendation of any particular security, strategy or investment product. Every client situation is different. Strategic manages customized portfolios that seek to properly reflect the particular risk and return objectives of each individual client. The discussion of any investments is for illustrative purposes only and there is no assurance that the adviser will make any investments with the same or similar characteristics as any investments presented. The investments identified and described do not represent all of the investments purchased or sold for client accounts. Any representative investments discussed were selected based on a number of factors including recent company news or earnings release. The reader should not assume that an investment identified was or will be profitable. All investments contain risk and may lose value. There is no assurance that any investments identified will remain in client accounts at the time you receive this document.

Some of the material presented is based upon forward-looking statements, information and opinions, including descriptions of anticipated market changes and expectations of future activity. Strategic Financial Services believes that such statements, information, and opinions are based upon reasonable estimates and assumptions. However, forward-looking statements, information and opinions are inherently uncertain and actual events or results may differ materially from those reflected in the forward-looking statements. Therefore, undue reliance should not be placed on such forward-looking statements, information and opinions.

No content on this website is intended to provide tax or legal advice. You are advised to seek advice on these matters from separately retained professionals.

All index returns, unless otherwise noted, are presented as price returns and have been obtained from Bloomberg. Indices are unmanaged and cannot be purchased directly by investors.

Doug Walters

Doug Walters