In a Fixed Income Fix

U.S. stocks had their first tough week since the election, with the S&P 500 giving back about 1%. Perhaps the post-election honeymoon has ended. Bonds yields rose in dramatic fashion, which could be just the beginning of bond weakness.

Market Review

Contributed by Doug Walters

Lost in the Shuffle

For the first time since the election, U.S. stocks ended the week in the red. The 1% slippage in the S&P 500 is perhaps signaling the end of the Presidential honeymoon period. If so, future moves in equities may be driven more by actual action rather than speculation. Lost in the buzz of the post-election equity rally is a significant move downward in fixed income.

- Over the past few weeks, bond yields have been pushed higher as a result of: 1) expectations of a Fed rate hike in two weeks, and 2) a belief that inflationary pressures will rise due to the increased fiscal spend of the new administration. Rising bond yields = declining bond prices.

- Bonds have been a tremendous asset class for the past 35 years, as yields have steadily fallen, driving up the value of bonds. That incredible run may be over.

- Since the election, the 10-year U.S. Treasury yield has risen from 1.83% to 2.45%. In the Treasury world, that is a very large move, and could be just the beginning.

The Case for Fixed Income

If interest rates are poised to rise, driving down bond prices, why should we own bonds at all? There are some very compelling reasons to continue to hold bonds as a part of a well-diversified portfolio.

- First and foremost, capital preservation. Even though a bond’s price may go down, if held to maturity the investor in that bond will still receive the full value of the principle.

- Secondly, diversification. Bonds can help smooth portfolio volatility and provide a stable source of funds which can be used to capitalize on opportunities in other more volatile asset classes.

- We should also not forget that none of us has a crystal ball, and while the prevailing wisdom is for rates and inflation to rise… there is a chance they don’t.

“There are some very compelling reasons to continue to hold bonds as a part of a well-diversified portfolio.”

Doug Walters, CFA, Chief Investment Officer

At Strategic, for qualified investors, we typically institute a relatively short maturity laddered portfolio of individual bonds. In a rising rate environment, as bonds mature, we can reinvest those proceeds in higher yielding bonds. Investors in bond funds need to use caution, as not all funds are created equal. For our fund-based clients, we seek funds that we believe come closest to our laddered investment style.

| Indices & Price Returns | Week (%) | Year (%) |

|---|---|---|

| S&P 500 | -1.0 | 7.2 |

| S&P 400 (Mid Cap) | -1.0 | 16.2 |

| Russell 2000 (Small Cap) | -2.4 | 15.7 |

| MSCI EAFE (Developed International) | -0.2 | -5.0 |

| MSCI Emerging Markets | -0.3 | 7.4 |

| S&P GSCI (Commodities) | 5.8 | 24.0 |

| Gold | -0.4 | 10.5 |

| MSCI U.S. REIT Index | -0.2 | -0.3 |

| Barclays Int Govt Credit | -0.2 | 0.2 |

| Barclays US TIPS | -0.2 | 3.0 |

Economic Commentary

Dollar for Dollar

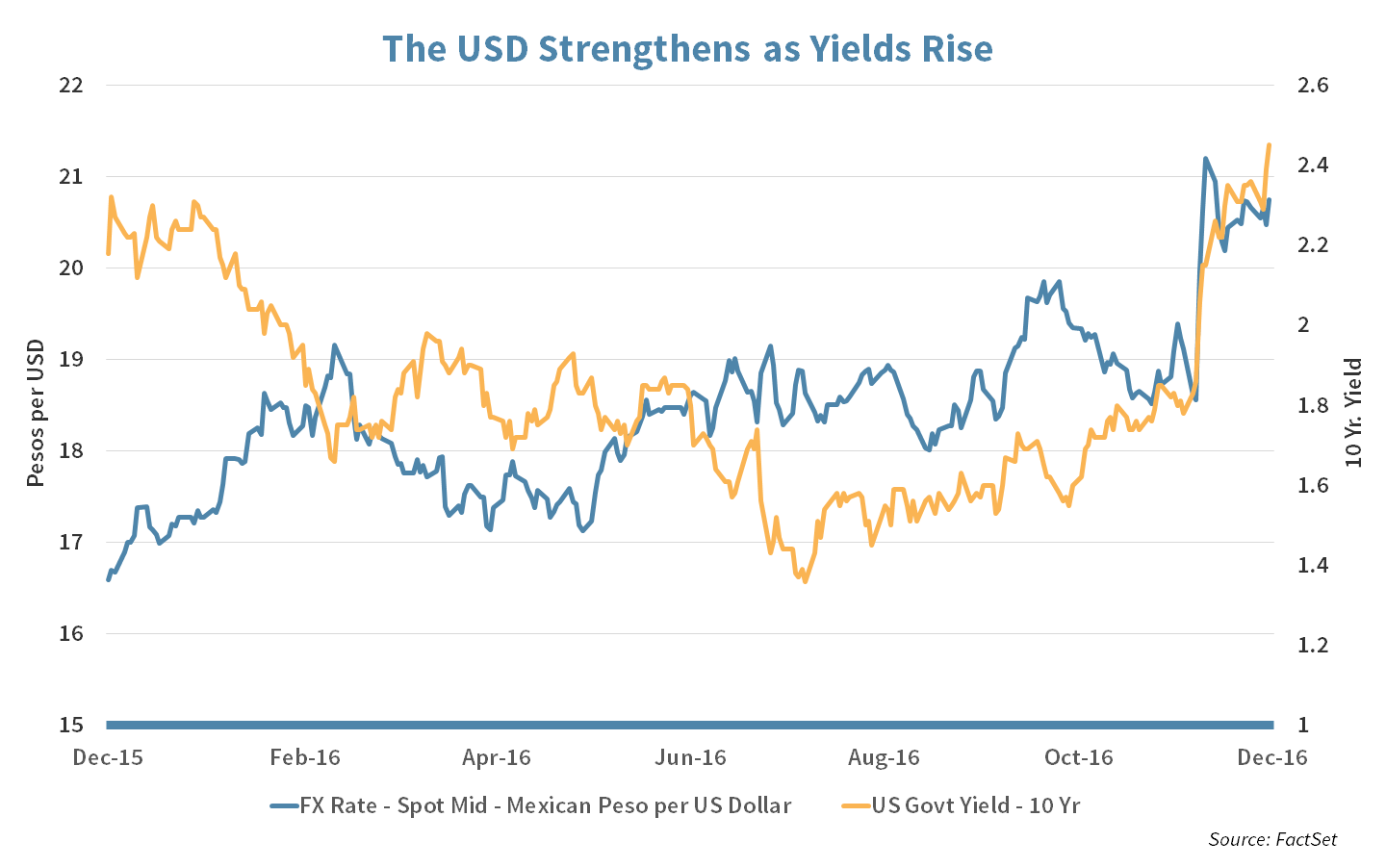

The U.S. Dollar has strengthened since election day with money flowing out of international markets and into the United States. The 10-Year U.S. Government Treasury yield has increased 34% during that time as investors expect the Federal Reserve to raise rates and potentially have to fight rising inflation. Higher interest rates in the United States has bolstered the U.S. Dollar as savings abroad transfer to a domestic bank now paying a more attractive rate.

Emerging market currencies such as the Mexican Peso and Chinese Yuan have been especially weakened as potential protectionist policies under President-elect Trump would hurt their export driven economies. Ironically, it is these countries that will benefit from a strengthened Dollar as their exports become more price competitive.

A stronger U.S. Dollar will give American consumers more purchasing power as the money they have is worth more in terms of goods they can buy. It also gives them more incentive to travel abroad as a vacation to Mexico is now cheaper in dollars. It does however hurt American manufactures that export abroad as these companies will now receive less revenue after the currency conversion.

Week Ahead

Contributed by Max Berkovich

Will the Boot Peninsula Give the Prime Minister the Boot?

Italy will face a historic referendum vote on Sunday. Voters will decide whether or not to reform the country’s constitution, reduce the size and power of its senate and reduce the power of regional politicians.

- In simple terms, the proposal aims to reduce the size of the senate, which is being blamed for being a hindrance to passing legislation.

- The surprise outcomes of both Brexit and the U.S. Presidential election has cast a larger shadow of uncertainty on the Italian vote than would otherwise exist.

- This vote matters to the rest of the world as a “No” vote will be treated as a no confidence vote for 41 year-old Prime Minister Matteo Renzi. This would lead to his resignation, which would most likely mean that the reforms he started would end, if not reverse. Also, a major fear is that a recapitalization plan for big Italian bank Monte de Paschi would be scrapped and lead to a run on Italian banks that would spread to the rest of the European Union (EU). Finally, there is fear that Italy would also vote to leave the EU down the road.

- Morgan Stanley had a 35% chance of a “Yes” vote on Friday.

Are We Sick of Brexit Yet?

For most of next week the U.K. Supreme court will hear arguments about weather the parliament has to trigger Article 50 to exit the EU or Prime Minister Theresa May.

- The court’s decision may be used to delay if not reverse the decision to exit the European Union.

- This court is not equivalent to the Supreme Court in the U.S. This is a fairly new institution established by Prime minister Tony Blair. The U.K. does not yield power to courts to overrule the government.

Earnings focus

Two holdings in Strategic’s Growth strategy report earnings next week – Costco Wholesales Corp. (COST) and Dell Technologies Corp. (DVMT).

- We will be looking for a little color from Costco on retail trends leading up to Christmas.

- This will be Dell’s first report since it’s $60 Billion acquisition of EMC Corp. Focus will be on the progress integrating the new purchase and in their plan’s for VMWare Inc. (VMW) of which Dell now owns 80%.

The End for Renzi?

Likelihood of a “Yes” vote in Italy’s upcoming crucial referendum according to Morgan Stanley

Strategy Update

Contributed by Max Berkovich

Strategic Asset allocation

“’Cause nothin’ lasts forever even cold November rain” – Guns N’ Roses

The month of November may be a month bond investors will want to forget almost as much as holders of Gold.

- Bloomberg Barclays U.S. Aggregate Bond Index lost 2.42% for the month, giving up more than half the gain for the first 10 months of the year.

- Gold lost over 8% for the month, chipping away a significant part of 2016’s returns, and is now up just shy of 9% on the year.

Size Did Matter

Small Capitalization stocks, measured by the Russell 2000 index, had a better than 11% run last month, significantly outpacing the S&P 500’s 3.7% return.

- The S&P MidCap 400, which measures companies that fall in between the small and large capitalization companies, was up 7.9% for the month.

- Year-to-date, the Small Cap Index is up over 21%, while the S&P 500 just shy of 10%.

Coming Home

While domestic indices may have reached new all-time highs in November, both the MSCI Developed International and Emerging Markets gave up ground. The good news is that Emerging Markets are still up over 10% for the year.

Strategic Growth

Oiled up

Consumer Staples were the clear laggard on the week, while OPEC’s decision to curb oil supply gave a noticeable boost to the Energy sector. Speaking of oils…

- The much anticipated quarterly earnings from Ulta Salon, Cosmetics & Fragrances, Inc. (ULTA) proved to be much ado about nothing. The company reported slight beats on both the top and bottom lines, but the stock’s tremendous run has set expectations too high. The shares already ran up 51% for the year before the report and a 17% gain in quarterly sales was a bit light. The good news was that eCommerce revenue was 59% higher for the quarter.

Strategic Equity Income

Driving Forward

The Health Care and Technology sectors continue to find themselves at the bottom of the list, yet Financials continue to charge higher. In other strategy news…

- Intel Corp. (INTC) announced that it has entered into a partnership with auto parts maker Delphi Automotive Plc (DLPH) and advanced driver assistance systems developer Mobileye N.V. (MBLY) to produce self-driving cars. The move signals Intel’s desire to catch up in the self-driving car space so it doesn’t miss an opportunity as it did with mobile phones. The company also named Senior VP Douglas Davis head of the automated driving unit. Davis was previously running the internet of things (IoT) unit.

Elevate Your Trajectory

Don't wait another day to build a successful, secure future with Strategic.

About Strategic

Founded in 1979, Strategic is a leading investment and wealth management firm managing and advising on client assets of over $2 billion.

OverviewDisclosures

Strategic Financial Services, Inc. is a SEC-registered investment advisor. The term “registered” does not imply a certain level of skill or training. “Registered” means the company has filed the necessary documentation to maintain registration as an investment advisor with the Securities and Exchange Commission.

The information contained on this site is for informational purposes and should not be considered investment advice or a recommendation of any particular security, strategy or investment product. Every client situation is different. Strategic manages customized portfolios that seek to properly reflect the particular risk and return objectives of each individual client. The discussion of any investments is for illustrative purposes only and there is no assurance that the adviser will make any investments with the same or similar characteristics as any investments presented. The investments identified and described do not represent all of the investments purchased or sold for client accounts. Any representative investments discussed were selected based on a number of factors including recent company news or earnings release. The reader should not assume that an investment identified was or will be profitable. All investments contain risk and may lose value. There is no assurance that any investments identified will remain in client accounts at the time you receive this document.

Some of the material presented is based upon forward-looking statements, information and opinions, including descriptions of anticipated market changes and expectations of future activity. Strategic Financial Services believes that such statements, information, and opinions are based upon reasonable estimates and assumptions. However, forward-looking statements, information and opinions are inherently uncertain and actual events or results may differ materially from those reflected in the forward-looking statements. Therefore, undue reliance should not be placed on such forward-looking statements, information and opinions.

No content on this website is intended to provide tax or legal advice. You are advised to seek advice on these matters from separately retained professionals.

All index returns, unless otherwise noted, are presented as price returns and have been obtained from Bloomberg. Indices are unmanaged and cannot be purchased directly by investors.

Doug Walters

Doug Walters