Your Money Journey: Part 1

Financial milestones occur at different stages for everyone. Being able to track your progress towards each one can offer a powerful confidence boost.

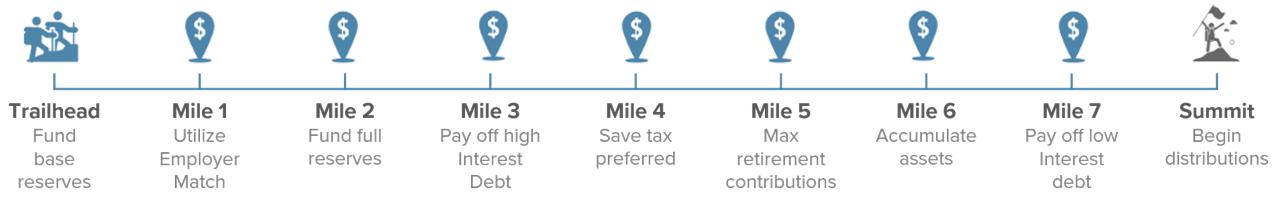

You may be asking yourself, “Now that I have money, what should I be doing?”. We have created Your Money Journey to answer this and help track your financial progress throughout life. In this article, we will discuss progressing to Mile 3. This grouping captures the beginning of your journey before diving into maximizing your investments.

Trailhead – Base Reserves

At the beginning of Your Money Journey, you will focus on building your base reserves. This can be viewed as an “initial” emergency fund. The focus is to save enough money to cover your medical deductibles or have a minimum of $1,000. This fund can help cover your healthcare risks and smaller, unexpected expenses. Keep in mind, you should avoid using a credit card to cover these emergencies.

Mile 1 – Utilizing Employer Match

While there is no such thing as a “free lunch,” this is as close as it gets. Many companies offer a match up to a certain percentage in employer-sponsored retirement accounts. Maximizing your contributions to attain the full match is a great starting point when it comes to saving for retirement. Failing to take advantage of this perk means leaving “free money” on the table.

Mile 2 – Fully Funded Emergency Account

This milestone is a continuation from the trailhead mentioned above. The best practice is to have 3-6 months of non-discretionary expenses in cash reserves. Examples of these expenses are mortgage/rent, loan payments, taxes, utilities and food. If you’re in a dual income household, three months of expenses saved may be sufficient. If you only have one income source, six months may be better. The primary use for your emergency fund is to cover job loss, car repair, home fixes and other similar expenses. If you are interested in learning more about emergency funds, click here.

Mile 3 – Pay Off High-Interest Debt

“High” interest is debatable, but we define any rate above the prevailing mortgage rate as “high”. You will typically see credit cards and consumer or student loans have “high” rates. Remember, debt (typically) does not go away. Paying the minimum can cause these types of debt to spiral out of control. If you are interested in learning more about debt management, click here.

__________________________________________________________________

Completing these milestones creates a powerful foundation for your financial plan. Choosing to ignore them can lead to unwanted consequences and ultimately lower your chances for a successful future.

About Strategic

Founded in 1979, Strategic is a leading investment and wealth management firm managing and advising on client assets of over $2 billion.

OverviewDisclosures

Strategic Financial Services, Inc. is a SEC-registered investment advisor. The term “registered” does not imply a certain level of skill or training. “Registered” means the company has filed the necessary documentation to maintain registration as an investment advisor with the Securities and Exchange Commission.

The information contained on this site is for informational purposes and should not be considered investment advice or a recommendation of any particular security, strategy or investment product. Every client situation is different. Strategic manages customized portfolios that seek to properly reflect the particular risk and return objectives of each individual client. The discussion of any investments is for illustrative purposes only and there is no assurance that the adviser will make any investments with the same or similar characteristics as any investments presented. The investments identified and described do not represent all of the investments purchased or sold for client accounts. Any representative investments discussed were selected based on a number of factors including recent company news or earnings release. The reader should not assume that an investment identified was or will be profitable. All investments contain risk and may lose value. There is no assurance that any investments identified will remain in client accounts at the time you receive this document.

Some of the material presented is based upon forward-looking statements, information and opinions, including descriptions of anticipated market changes and expectations of future activity. Strategic Financial Services believes that such statements, information, and opinions are based upon reasonable estimates and assumptions. However, forward-looking statements, information and opinions are inherently uncertain and actual events or results may differ materially from those reflected in the forward-looking statements. Therefore, undue reliance should not be placed on such forward-looking statements, information and opinions.

No content on this website is intended to provide tax or legal advice. You are advised to seek advice on these matters from separately retained professionals.

All index returns, unless otherwise noted, are presented as price returns and have been obtained from Bloomberg. Indices are unmanaged and cannot be purchased directly by investors.

Justin Hearty

Justin Hearty