Wishful Thanking 2017

The S&P 500 is up 18% and investors have much to be thankful for this year. We take a moment to give thanks and, at the risk of being greedy, put pen to our investor holiday wish list.

Giving Thanks

Contributed by Doug Walters

There is much to be thankful for as we wrap up the Thanksgiving festivities and begin preparing for the upcoming holiday season. 2017 has been particularly kind to investment portfolios. It is useful to take a moment to reflect on and appreciate this, as positive returns should never be taken for granted. While we are very thankful, we cannot help but feel there is more that we, as investors, need as we approach the new year. As such, we have also put together our holiday wish list.

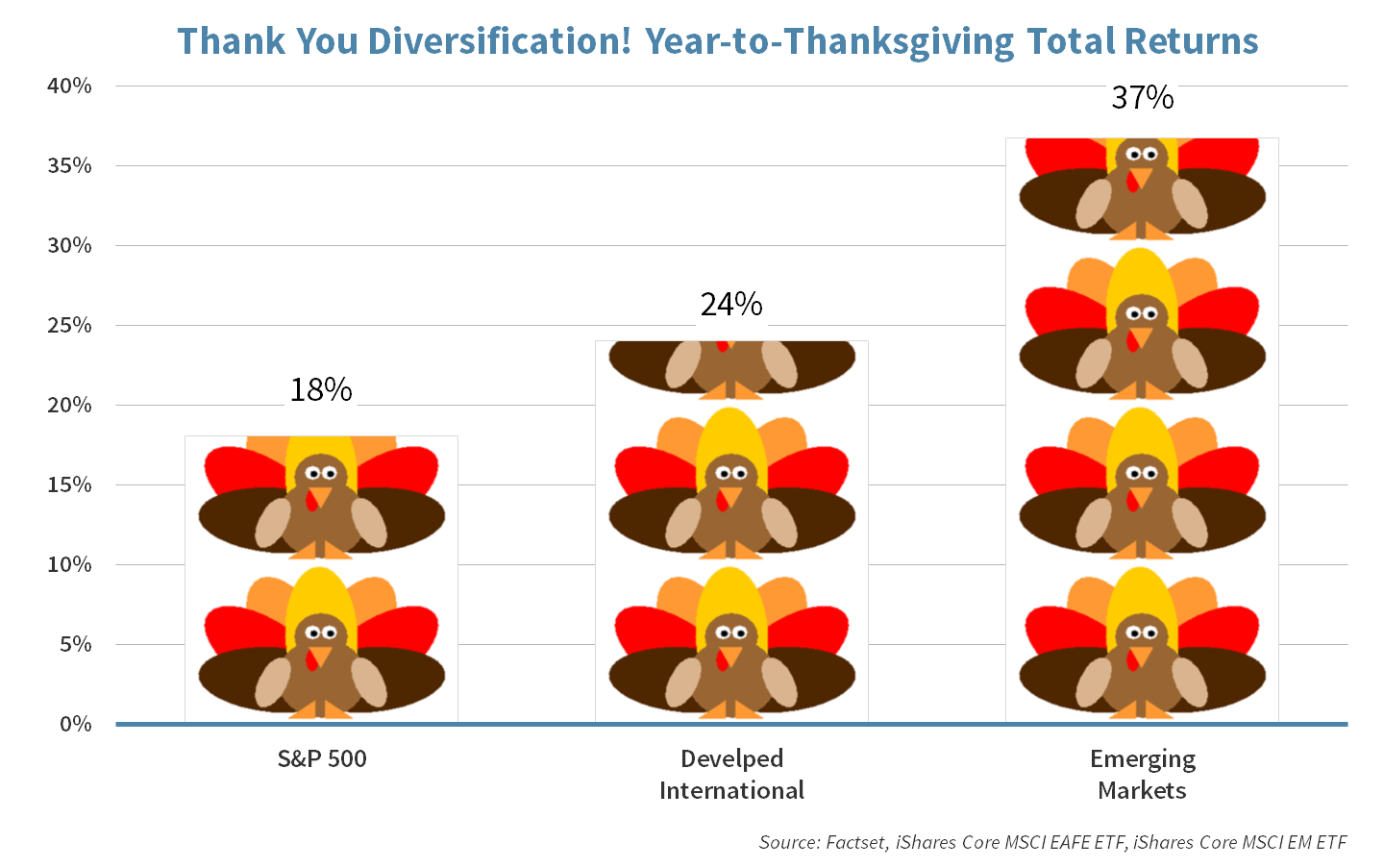

- Thank you international stocks… your exceptional year-to-date performance is a reminder as to why portfolio diversification is essential.

- Thank you U.S. stocks… you did not outperform international, but we are still happy with the 18% year-to-date performance of the S&P 500.

- Thank you rising economic activity… cyclical stocks and sectors like Caterpillar (CAT) and Materials are enjoying the ride.

- Thank you Janet Yellen… for being so accommodative with slow and deliberate Fed rate increases. We hope to be thanking your successor this time next year.

- Thank you reduced corporate regulation… small cap stocks and the Financials sector should be able to spend less time cutting through red tape and more time winning.

- Thank you tax reform process… you are giving equities hope to rally on, and providing a steady stream of Strategic Insights material.

- Thank you technology innovation… consumers and investors have a seemingly insatiable appetite for both your tech gadgets and tech stocks.

- Thank you Disney (DIS)… consistently releasing your new Star Wars movies on my birthday weekend in December gives me a reason to look forward to getting older.

- Thank you Insights readers… your patronage keeps the Strategic Investment Team energized!

Holiday Wish List

With U.S. stocks up 18%, we cannot help but feel that wishing for more would be perceived as greedy. Nonetheless, we have begun to put together an investor wish list for the holidays and beyond.

- Monopoly… Rising corporate earnings to help justify elevated stock valuations. Advance to Go (collect $200).

- Legos… More bipartisanship on no-brainer legislation like an infrastructure bill. Let’s get building!

- A Crisp New Bill… Passage of a tax reform legislation that strikes the right balance for corporations and individuals. Cha-ching!

- Ski Vacation… A steepening slope of the yield curve to better incentivize banks to lend and help fend off an economic downturn. Time to move on from the bunny slope.

- Air Compressor… Rising wage inflation and a modest rise in personal consumption expenditure inflation. Pump up these missing ingredients of a healthy economy.

- Fingerlings®… Need a distraction from market volatility? Why not attach a little robo-monkey to your finger! (official website)

Happy Thanksgiving,

The Strategic Investment Team

About Strategic

Founded in 1979, Strategic is a leading investment and wealth management firm managing and advising on client assets of over $2 billion.

OverviewDisclosures

Strategic Financial Services, Inc. is a SEC-registered investment advisor. The term “registered” does not imply a certain level of skill or training. “Registered” means the company has filed the necessary documentation to maintain registration as an investment advisor with the Securities and Exchange Commission.

The information contained on this site is for informational purposes and should not be considered investment advice or a recommendation of any particular security, strategy or investment product. Every client situation is different. Strategic manages customized portfolios that seek to properly reflect the particular risk and return objectives of each individual client. The discussion of any investments is for illustrative purposes only and there is no assurance that the adviser will make any investments with the same or similar characteristics as any investments presented. The investments identified and described do not represent all of the investments purchased or sold for client accounts. Any representative investments discussed were selected based on a number of factors including recent company news or earnings release. The reader should not assume that an investment identified was or will be profitable. All investments contain risk and may lose value. There is no assurance that any investments identified will remain in client accounts at the time you receive this document.

Some of the material presented is based upon forward-looking statements, information and opinions, including descriptions of anticipated market changes and expectations of future activity. Strategic Financial Services believes that such statements, information, and opinions are based upon reasonable estimates and assumptions. However, forward-looking statements, information and opinions are inherently uncertain and actual events or results may differ materially from those reflected in the forward-looking statements. Therefore, undue reliance should not be placed on such forward-looking statements, information and opinions.

No content on this website is intended to provide tax or legal advice. You are advised to seek advice on these matters from separately retained professionals.

All index returns, unless otherwise noted, are presented as price returns and have been obtained from Bloomberg. Indices are unmanaged and cannot be purchased directly by investors.

Doug Walters

Doug Walters