Why We Are Buying (Reprise)

Market unease continued this week. We take a break from our usual commentary to provide investors with our perspective on how to navigate the correction of 2018…

The 2018 Stock Market Correction

Contributed by Doug Walters

In February of 2016, armed with spreadsheets, fundamental research, and a keyboard we made our case for adding to stocks in the face of weakness (Why We Are Buying, 2/16). Today, as we watch stocks fall into correction territory, we see another opportunity for long-term investors to take advantage of increasingly attractive stock prices.

The Correction by the Numbers

From their September 24th highs, the S&P 500 has fallen 18%. Year-to-date, stocks are down about 8%. From September of last year, stock returns are zero, so equity investors have seen over a year’s worth of returns disappear.

Why the Sell-off

The primary concern for investors is that the economic cycle has peaked. Media outlets are flush with other explanations, such as:

- U.S. budget and the potential for a government shutdown,

- weakness abroad (France, BREXIT, etc.),

- the Federal Reserve raising rates, and

- trade and tariff wars with China.

While these events are meaningful, we believe the underlying concern is that the economy is peaking and that some combination of the above headwinds could be the tipping point for the U.S. which has enjoyed over nine years of expansion.

Under the covers, there are other factors that have market watchers on edge. Unemployment is very low. While this is generally a good thing, if the labor market is too constrained it will likely lead to higher wages and therefore lower profitability for companies.

Adding to the peak cycle argument is the all-too-often-heard logic that after nine years of growth we are “due” for a recession. The memories of the 2008 financial crisis are still burned in the mind of investors, and many have been waiting for the next shoe to drop ever since. Thankfully economies do not work this way. Just ask Australians who have not seen a recession since 1992!

The Facts

The economy is strong and expanding

- Year-on-year growth of GDP has been rising for the past two years, giving no indication of an impending slowdown.

- U.S. economic leading indicators (which are designed to foreshadow cycle moves) are high and trending upwards.

- U.S. companies are expected to report 6% sales growth and 12% earnings growth in Q4.

Stocks are entering value territory

- The robust economic growth paired with the declines in the stock market have resulted in sharply lower stock valuations.

- Large-cap are the cheapest they have been since 2013, while small-cap stocks have not been this cheap since 2010.

- Large and small cap stocks are trading below their 20-year median valuations.

What Now

As an investor it is important to submit to the following facts:

- We have no crystal ball. We cannot predict the future; we can only prepare for it.

- We cannot control the market. It may continue to fall, and that is okay (it will eventually go back up).

- It is human nature to run in the face of loss. Trying to time the market by exiting equities is gambling not investing.

In times like this, we take comfort knowing our clients are well-positioned for the ups and downs of the market. A diversified portfolio, set to the investor’s unique risk tolerance, grounded in quality and value, is designed to survive market sell-offs, and flourish when stocks rebound.

We see opportunity in the current market weakness and are adding to U.S. equities, and particularly small-cap stocks. It is possible, despite robust fundamentals, that the market continues to slide. There is no reason to fear that scenario. We are content to own more stocks at an attractive valuation knowing that sticking to a disciplined process, grounded in fundamentals, is in the best interest of the long-term goals of our clients.

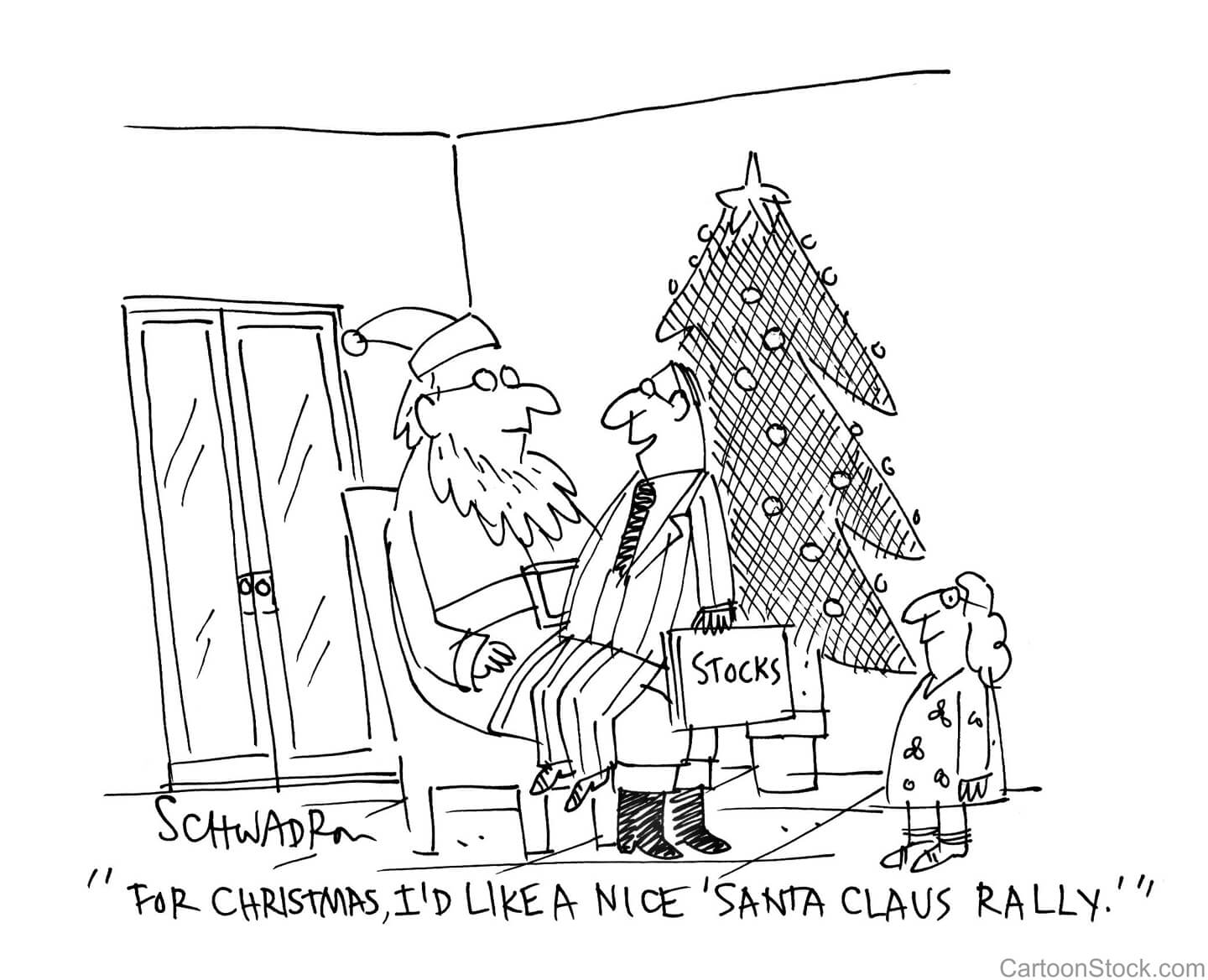

Happy Holidays from the Strategic Investment Team!

About Strategic

Founded in 1979, Strategic is a leading investment and wealth management firm managing and advising on client assets of over $2 billion.

OverviewDisclosures

Strategic Financial Services, Inc. is a SEC-registered investment advisor. The term “registered” does not imply a certain level of skill or training. “Registered” means the company has filed the necessary documentation to maintain registration as an investment advisor with the Securities and Exchange Commission.

The information contained on this site is for informational purposes and should not be considered investment advice or a recommendation of any particular security, strategy or investment product. Every client situation is different. Strategic manages customized portfolios that seek to properly reflect the particular risk and return objectives of each individual client. The discussion of any investments is for illustrative purposes only and there is no assurance that the adviser will make any investments with the same or similar characteristics as any investments presented. The investments identified and described do not represent all of the investments purchased or sold for client accounts. Any representative investments discussed were selected based on a number of factors including recent company news or earnings release. The reader should not assume that an investment identified was or will be profitable. All investments contain risk and may lose value. There is no assurance that any investments identified will remain in client accounts at the time you receive this document.

Some of the material presented is based upon forward-looking statements, information and opinions, including descriptions of anticipated market changes and expectations of future activity. Strategic Financial Services believes that such statements, information, and opinions are based upon reasonable estimates and assumptions. However, forward-looking statements, information and opinions are inherently uncertain and actual events or results may differ materially from those reflected in the forward-looking statements. Therefore, undue reliance should not be placed on such forward-looking statements, information and opinions.

No content on this website is intended to provide tax or legal advice. You are advised to seek advice on these matters from separately retained professionals.

All index returns, unless otherwise noted, are presented as price returns and have been obtained from Bloomberg. Indices are unmanaged and cannot be purchased directly by investors.

Doug Walters

Doug Walters