A War of Words

U.S. stocks took notice of the rising geopolitical tensions, selling off on Thursday and pushing equity volatility to post-election highs. A lackluster inflation report added to the poor sentiment.

Market Review

Contributed by Doug Walters

Geopolitics got the better of equities this week, as the war of words between President Trump and North Korea spooked investors. The S&P 500 fell nearly 1.5% on Thursday and volatility spiked to its highest level since the election. Not helping matters was a weak inflation reading. Fed Chairwoman Yellen expects inflation to rise to their 2% target, but boosting inflation has been harder than expected.

Fire and Fury

Tensions escalated this week between the U.S. and North Korea, as the leaders of both countries ratcheted up the rhetoric. Investors have been fairly relaxed about all of the domestic drama in Washington, but the potential for conflict with North Korea has not gone over well. With North Korea planning to fire missiles near the U.S. territory of Guam, stocks sold off, and equity volatility rose to levels not seen in nine months. President Trump is a conundrum for Wall Street. Investors like the idea of corporate-friendly policies driven by an administration full of corporate executives. However, moves in the stock market this week indicate that investors are less comfortable with the diplomatic acumen of the Trump team.

Deflating Inflation Report

The Federal Reserve, led by Chairwoman Janet Yellen, is pleased with the continued improvement in unemployment, content with GDP, and is adamant that inflation will soon move up to their 2% target. However, this month’s Consumer Price Index (CPI, a measure of inflation) disappointed analysts and weakens the case for another Fed rate hike this year. However, there is a silver lining. First, CPI inflation did rise from 1.6% in June to 1.7% in July. Secondly, CPI is not the Fed’s preferred measure of inflation. They prefer Personal Consumption Expenditures (PCE) inflation which is a broader measure of inflation and does not come out until the end of the month and could bring better news.

| Indices & Price Returns | Week (%) | Year (%) |

|---|---|---|

| S&P 500 | -1.4 | 9.0 |

| S&P 400 (Mid Cap) | -2.3 | 3.0 |

| Russell 2000 (Small Cap) | -2.7 | 1.3 |

| MSCI EAFE (Developed International) | -1.6 | 13.8 |

| MSCI Emerging Markets | -2.3 | 20.9 |

| S&P GSCI (Commodities) | -0.4 | -3.8 |

| Gold | 2.6 | 12.0 |

| MSCI U.S. REIT Index | -2.2 | -0.9 |

| Barclays Int Govt Credit | 0.1 | 1.2 |

| Barclays US TIPS | 0.6 | 1.0 |

Economic Commentary

The Failed State

While the South Korean economy developed at impressive speed after the Korean War, its communist neighbor to the North is a failed state. In the 1990s, North Korea suffered from a famine crisis that resulted in 240,000 to 420,000 deaths and the country continues to struggle with food production. North Korea has 25 million citizens with 9.5 million of them registered to the military and 1.2 million on active duty. The active duty number is the fourth largest in the world after China, the United States, and India. With a Songun (military first) policy, the country has done a better job of developing its fighting might than it has in feeding its people.

Seventy percent of the North Korean population is without electricity as the country ranks 197th in the world with a GDP per capita of $1,800 per year. About 10% of the country’s GDP comes from exports, mainly to China, which gives the Chinese government leverage in managing the belligerence coming from its neighbor.

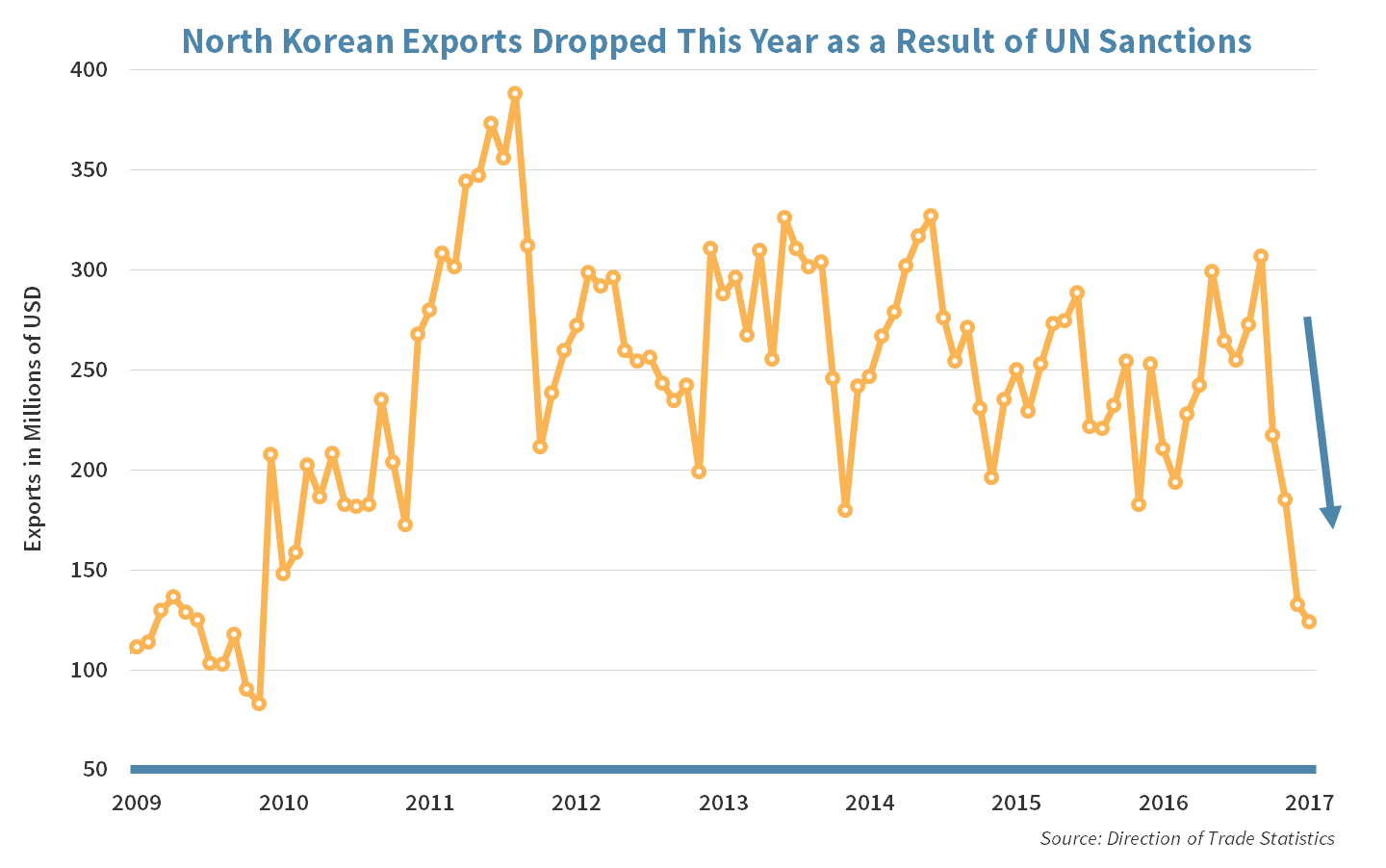

In response to the North Korea nuclear development, the United Nations passed Resolution 2321 in November of last year limiting the country’s coal exports and banning copper, nickel, zinc, and silver exports. In February, China went a step further and announced it would ban all coal for the rest of the year.

North Korean leader Kim Jong Un seems to like the attention and in fact, uses it to bargain for increased humanitarian aid. His objective now is to gain the upper hand in trade sanction negotiations through the development of nuclear capabilities. Analysts believe that North Korea may have 60 nuclear weapons including some that fit into missiles. As the rest of their economy is debilitated with rampant poverty and inflation, Kim Jong Un is betting that military might will save the country. Hopefully, he knows not to cross any line that would lead to a devastating military conflict.

Percent of North Korean Population living without electricity. Source: International Energy Agency

Week Ahead

Gone FISH-ing

FOMC minutes will be released next Wednesday. While investors do not think a Fed rate hike in August is probable (see inflation discussion in the Market Review), it is still possible.

- Investors will be focused on information regarding the winding down of the Fed’s $4.5 trillion portfolio.

Industrial Production growth remains positive but is expected to slow down in July as compared to June.

- If analysts are correct, this would be the sixth straight month of growth.

Sales of retail goods are expected to improve in July and post slight growth vs. the decline experienced in June.

- Consumer confidence remains high and might help retail sales growth to accelerate.

Housing starts and building permits are expected to remain strong for the month of July, at a rate of around 1.2 million for both.

- Building permits are a leading indicator, which last peaked in September 2005 with a reading of 2.26 million.

- Between 2006 and 2008 building permits fell nearly 70% to a low of 554,000 in December of 2008.

Strategy Updates

STRATEGIC ASSET ALLOCATION

Proceed With Caution?

Gold had a good week as investors, spooked by military rhetoric and chatter of nuclear warfare, moved into safe-haven assets. Treasury bonds also did very as the 10-year yield fell from 2.28% on Monday to 2.19% by Friday as priorities shifted from yield to safety.

Meanwhile, risk-on asset classes such as Emerging Markets, Developed International and Small Cap stocks lagged due to the political tensions. The Indian and Chinese markets sold off after having an impressive year-to-date run. However, these are two of the fastest growing economies in the world. Familiar growth themes for both countries are urbanization, a rising middle class, and increasing consumer spending.

- China is betting on infrastructure investments that will link Southeast Asia to Europe, as well as open its economy further to foreign businesses.

- India has demonetized its currency (to fight “black money”) and introduced a Goods and Services Tax. Also, India’s middle-class households are expected to more than double by 2025 to around 114 million (or nearly 550 million people). India’s current total population is about 1.3 billion.

Despite the weakness in Emerging Markets this week, as growth reignites, investors may find them an attractive alternative to the lofty valuations of U.S. large cap stocks.

STRATEGIC GROWTH

Slow Down

It was a poor week for growth stocks in general as the asset class had room for contraction given above average valuations. Amongst the biggest movers were…

- Dentsply Sirona Inc. (XRAY) fell 10% week-to-date as the manufacturer of dental products lowered revenue and earnings guidance. High expectations from the merger with Sirona have subdued as synergies have proved elusive.

- Albemarle Corp. (ALB) missed earnings expectations due to their Refining and Bromine segments and guided conservatively. The company’s lithium segment did very well, thanks to demand for electric vehicle lithium ion batteries. Tesla (TSLA) has been ramping up production to meet a backlog of orders which bodes well for the lithium producer. We saw the miss as an opportunity to add the stock to our Strategic holdings.

STRATEGIC EQUITY INCOME

Show Me the Cash!

Financials and Energy were a drag this week, as Schlumberger (SLB), Enbridge Inc. (ENB), M&T Bank Corp. (MTB), and HSBC Holdings plc (HSBC) dropped 4-5%. On the other hand…

- CVS Health Corp. (CVS) stock led the strategy in performance as the pharmacy increased earnings guidance and confirmed free cash flow expectations. With a 9% free cash flow yield, the company is well positioned to increase future dividend payments.

About Strategic

Founded in 1979, Strategic is a leading investment and wealth management firm managing and advising on client assets of over $2 billion.

OverviewDisclosures

Strategic Financial Services, Inc. is a SEC-registered investment advisor. The term “registered” does not imply a certain level of skill or training. “Registered” means the company has filed the necessary documentation to maintain registration as an investment advisor with the Securities and Exchange Commission.

The information contained on this site is for informational purposes and should not be considered investment advice or a recommendation of any particular security, strategy or investment product. Every client situation is different. Strategic manages customized portfolios that seek to properly reflect the particular risk and return objectives of each individual client. The discussion of any investments is for illustrative purposes only and there is no assurance that the adviser will make any investments with the same or similar characteristics as any investments presented. The investments identified and described do not represent all of the investments purchased or sold for client accounts. Any representative investments discussed were selected based on a number of factors including recent company news or earnings release. The reader should not assume that an investment identified was or will be profitable. All investments contain risk and may lose value. There is no assurance that any investments identified will remain in client accounts at the time you receive this document.

Some of the material presented is based upon forward-looking statements, information and opinions, including descriptions of anticipated market changes and expectations of future activity. Strategic Financial Services believes that such statements, information, and opinions are based upon reasonable estimates and assumptions. However, forward-looking statements, information and opinions are inherently uncertain and actual events or results may differ materially from those reflected in the forward-looking statements. Therefore, undue reliance should not be placed on such forward-looking statements, information and opinions.

No content on this website is intended to provide tax or legal advice. You are advised to seek advice on these matters from separately retained professionals.

All index returns, unless otherwise noted, are presented as price returns and have been obtained from Bloomberg. Indices are unmanaged and cannot be purchased directly by investors.

Doug Walters

Doug Walters