Positing on Positioning

Following an epic quarter for equities, investors are pondering how best to position portfolios for late cycle success.

Dissecting Q1 2019

Contributed by Doug Walters , Max Berkovich ,

2019 started with a bang, as equities had one of their best quarters in recent memory and fixed income managed to post positive returns as well. We attribute the rebound in equities to the combination of solid earnings and an overdone selloff in the fourth quarter of 2018. We highlighted this oversold condition in our December report “Why We Are Buying (Reprise).” We do not subscribe to market timing but feel pretty good about calling the bottom of the market (okay… we were a day off). While we attribute the timing more to luck than skill, it does highlight the fact the over time, fundamentals trump sentiment, and in the long-run, the market should reward the patient investor.

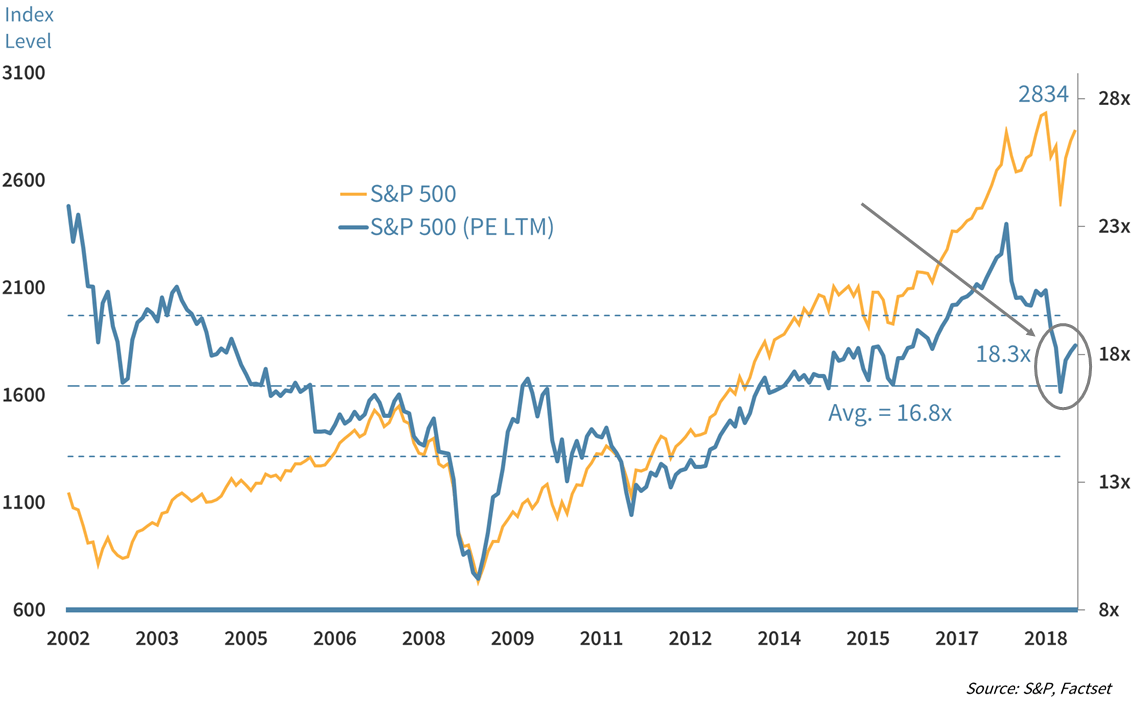

Equities up but not stretched

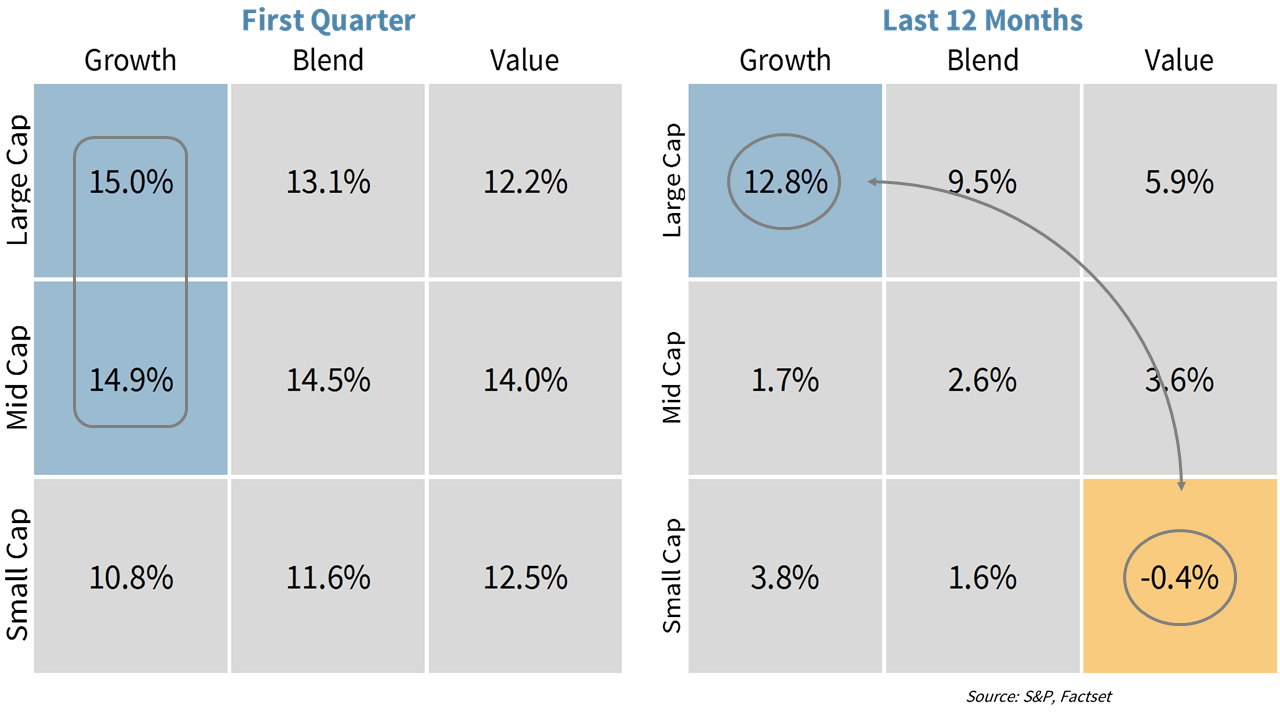

Stocks rallied in Q1 with 90% of companies in the S&P 500 up. Growth outpaced Value and Domestic stocks outpaced International. The rally came despite the challenging backdrop of weakening economies globally, uncertain progress with Chinese trade talks, and a disruptive Brexit process.

The rally boosted stock valuations, but they remain well within the normal historical range. Small Cap and Value stocks are two of the cheapest segments of the market in our opinion.

Chart 1: Equity valuations not stretched

The Q1 rebound in stocks has pushed up valuations only modestly. We see the lowest valuations in Value and Small Cap stocks.

It was hard to find a segment of the market that did not go up in the first quarter of 2019, but there were some relative winners. The continued dominance of Growth over Value was the most notable trend. Looking back over the past year, we also see Large Cap meaningfully outpacing Small Cap.

Chart 2: Growth is still dominating

Most segments of the market went up in Q1, but it was Growth that saw the greatest gains. That is a continuation of the trend of the past year, where Large Cap Growth has far outpaced Small Cap Value.

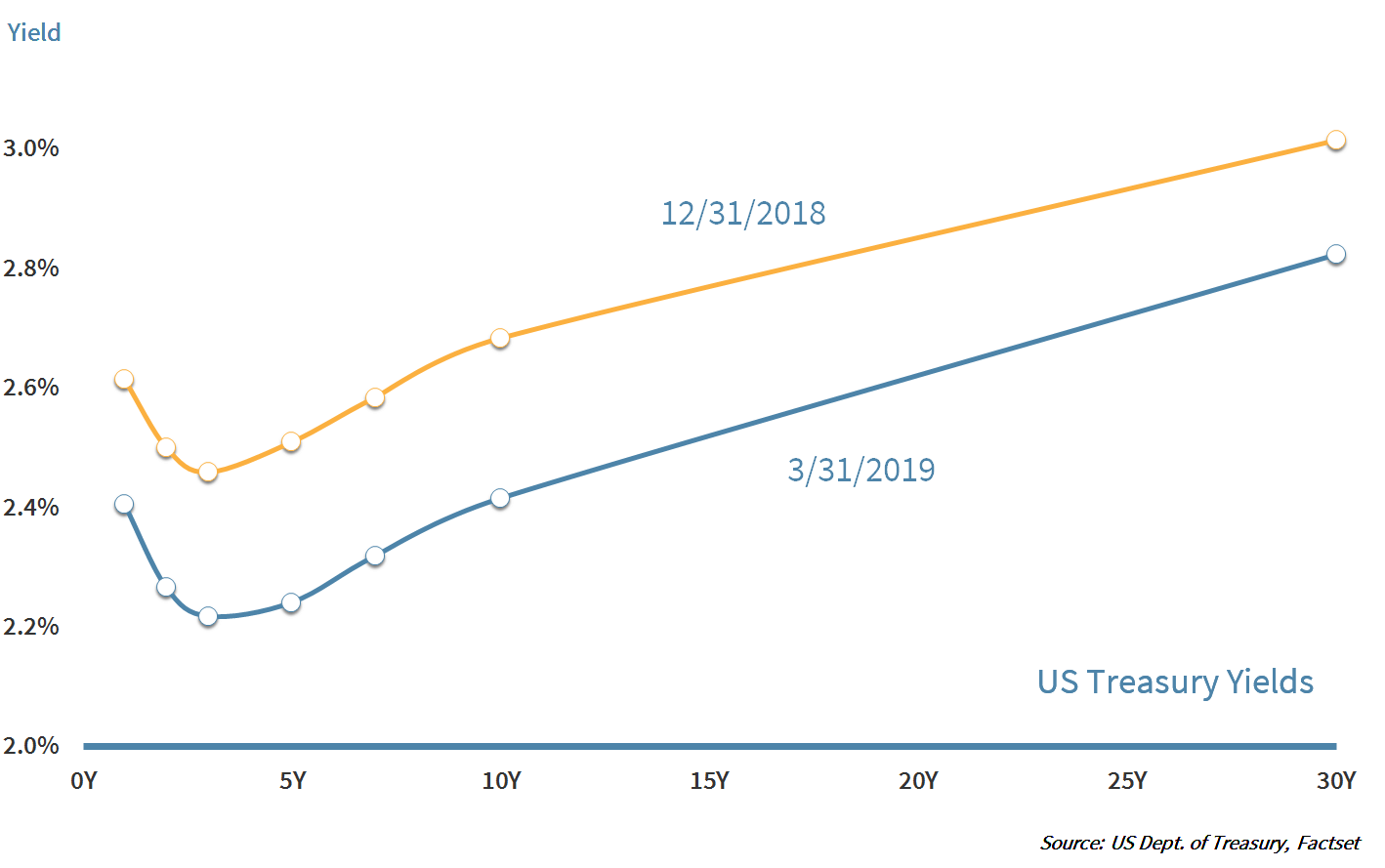

The Fed is getting soft

The Federal Reserve softened its language on plans for increasing the Funds Rate. The change pushed interest rates back down, boosting bonds. The yield curve remains inverted at the short end, which we do not yet see as an immediate recession signal, but instead a caution flag to keep an eye on.

Internationally, the story in fixed income is historically low yields. Nearly 20% of global investment grade debt trades with a negative yield. Most bonds with negative yields originate in the EU and Japan.

Chart 3: Yields down and still inverted

The Fed put rates on hold in Q1 and opened the door to fewer (if any) increases throughout the rest of the year. The softer language boosted bonds. The short end of the yield curve remains inverted, but we do not see this as a clear recession signal.

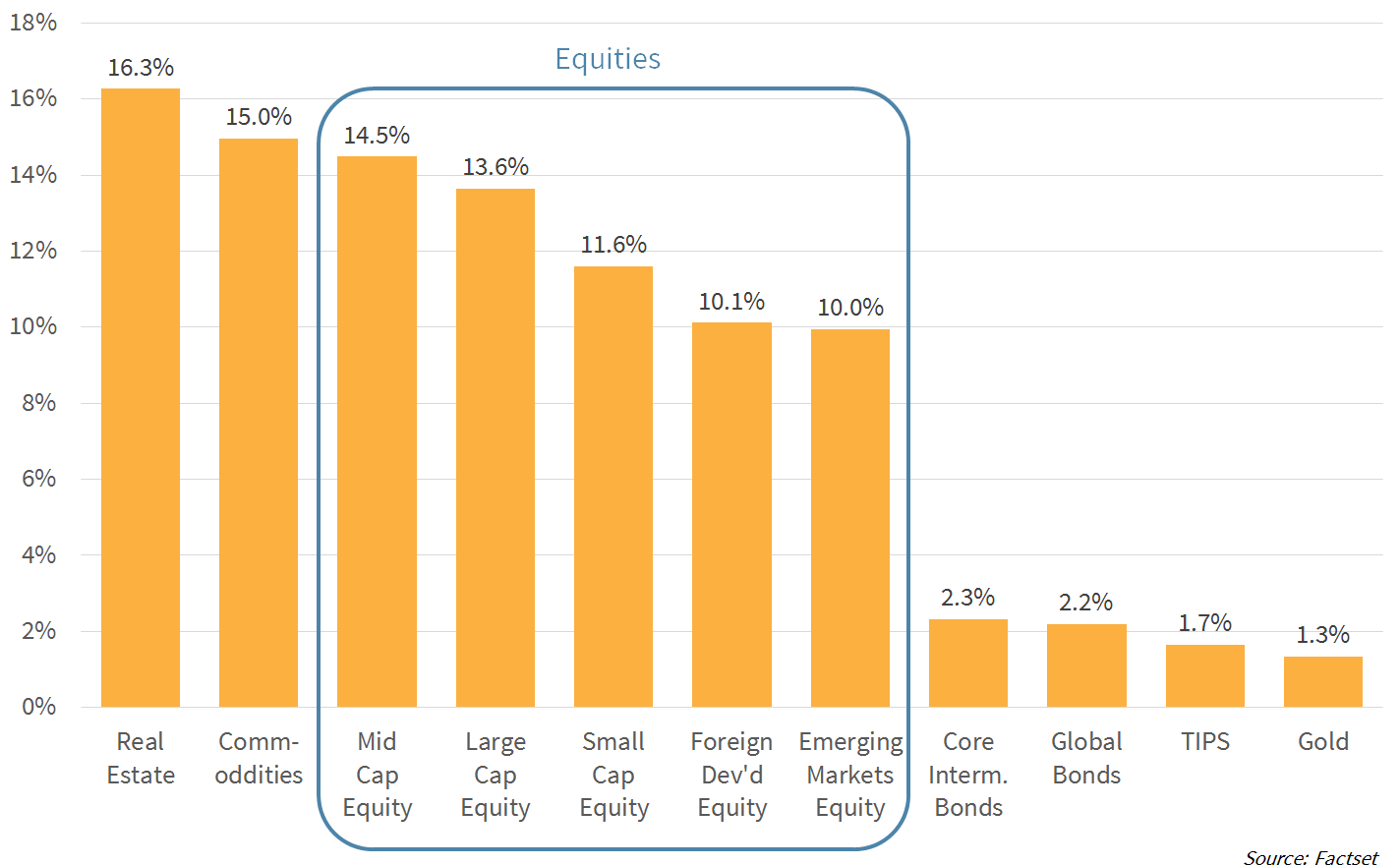

Asset allocation – up, up, and away

Markets were in “risk-on” mode, as all major assets classes were up in the first quarter. Real Estate and Commodities were on top of the leaderboard, followed by Domestic and International Equities. Even Fixed Income and Gold managed positive returns, though far more modest than what we saw from the other asset classes.

Chart 4: Assets up across the board

Returns were positive across many assets in the first quarter. Real Estate and Commodities topped the charts, followed by Domestic and International Equities. Fixed Income and Gold also managed positive, though more modest, returns.

The Q2 2019 Playbook

With equity markets near all-time highs, global economies showing cracks, and the yield curve inverted (a traditional recession indicator), how should investors be positioned as we enter the second quarter of 2019?

Our take on the current environment

- The U.S. economy is still growing. While growth is not accelerating, it is fairly stable, and the Fed showed in March, with their softer language, that they are still comfortable remaining accommodative.

- The latest data out of China was more encouraging, and a U.S./China trade deal could boost confidence and activity more broadly. Brexit is still a wildcard, but nobody wants a hard exit, so we believe somehow that the worst case scenario will be avoided.

- The inverted yield curve cannot be ignored, as it has historically been a recession precursor. However, in the past it has been the inversion of the 2-year and 10-year yields that has been used as a recession flag. That portion of the curve is not inverted.

Taking the above into account, we do not foresee a near-term end to the current economic expansion. Yes, we are likely in the latter part of the economic cycle, but we could be here for some time, and we see no reason to be overly conservative. Also, our philosophy is evolving in a way that should enable us to capture more advantageous market exposure across the business cycle.

So what are we doing?

- Focusing on a broader array of investment “factors” that have been shown over time to advantage portfolios. Not just Quality (profitable companies) and Value (cheap stocks), which have always been staples of our process, but also Size (small market cap), Momentum (stock price rising), and Minimum Volatility (low price variability).

- Increasingly moving our models towards an equal split between Large, Mid, and Small Cap equities. We believe our search for positive investment “factors” is best achieved by searching equally across the full investible market.

- Adding extra exposure to “Momentum” in our more aggressive model portfolios where maximizing returns takes priority over reducing risks.

- Adding extra exposure to “Minimum Volatility” for more conservative portfolios, where near-term market weakness is more concerning.

- Maintaining well-diversified asset allocation which includes exposure to international markets and hard assets, like Gold

The Strategic team would like to thank all of our clients for your confidence and input. Enjoy the Spring!

About Strategic

Founded in 1979, Strategic is a leading investment and wealth management firm managing and advising on client assets of over $2 billion.

OverviewDisclosures

Strategic Financial Services, Inc. is a SEC-registered investment advisor. The term “registered” does not imply a certain level of skill or training. “Registered” means the company has filed the necessary documentation to maintain registration as an investment advisor with the Securities and Exchange Commission.

The information contained on this site is for informational purposes and should not be considered investment advice or a recommendation of any particular security, strategy or investment product. Every client situation is different. Strategic manages customized portfolios that seek to properly reflect the particular risk and return objectives of each individual client. The discussion of any investments is for illustrative purposes only and there is no assurance that the adviser will make any investments with the same or similar characteristics as any investments presented. The investments identified and described do not represent all of the investments purchased or sold for client accounts. Any representative investments discussed were selected based on a number of factors including recent company news or earnings release. The reader should not assume that an investment identified was or will be profitable. All investments contain risk and may lose value. There is no assurance that any investments identified will remain in client accounts at the time you receive this document.

Some of the material presented is based upon forward-looking statements, information and opinions, including descriptions of anticipated market changes and expectations of future activity. Strategic Financial Services believes that such statements, information, and opinions are based upon reasonable estimates and assumptions. However, forward-looking statements, information and opinions are inherently uncertain and actual events or results may differ materially from those reflected in the forward-looking statements. Therefore, undue reliance should not be placed on such forward-looking statements, information and opinions.

No content on this website is intended to provide tax or legal advice. You are advised to seek advice on these matters from separately retained professionals.

All index returns, unless otherwise noted, are presented as price returns and have been obtained from Bloomberg. Indices are unmanaged and cannot be purchased directly by investors.

Doug Walters

Doug Walters