Volatility: Friend or Foe?

As volatility picks up, does your approach to investing need to change? In this edition of our quarterly Perspectives, we review a first quarter full of surprises and discuss how to approach what is likely to be an equally volatile second quarter.

Dissecting Q1 2018

Contributed by Doug Walters

Investors were put through the wringer in the first quarter of 2018, feeling the euphoria of an unfettered rally brought to an end by a heavy dose of realism. We dissect the quarter and then provide a playbook for a second-quarter rife with uncertainty.

Equities – what goes up, must come down

U.S. equities shot up nearly 8% in the first few weeks of the year only to give all of that back, and then some, as the quarter proceeded. With these dramatic moves came something we had not seen in earnest for some time – volatility (more on that later).

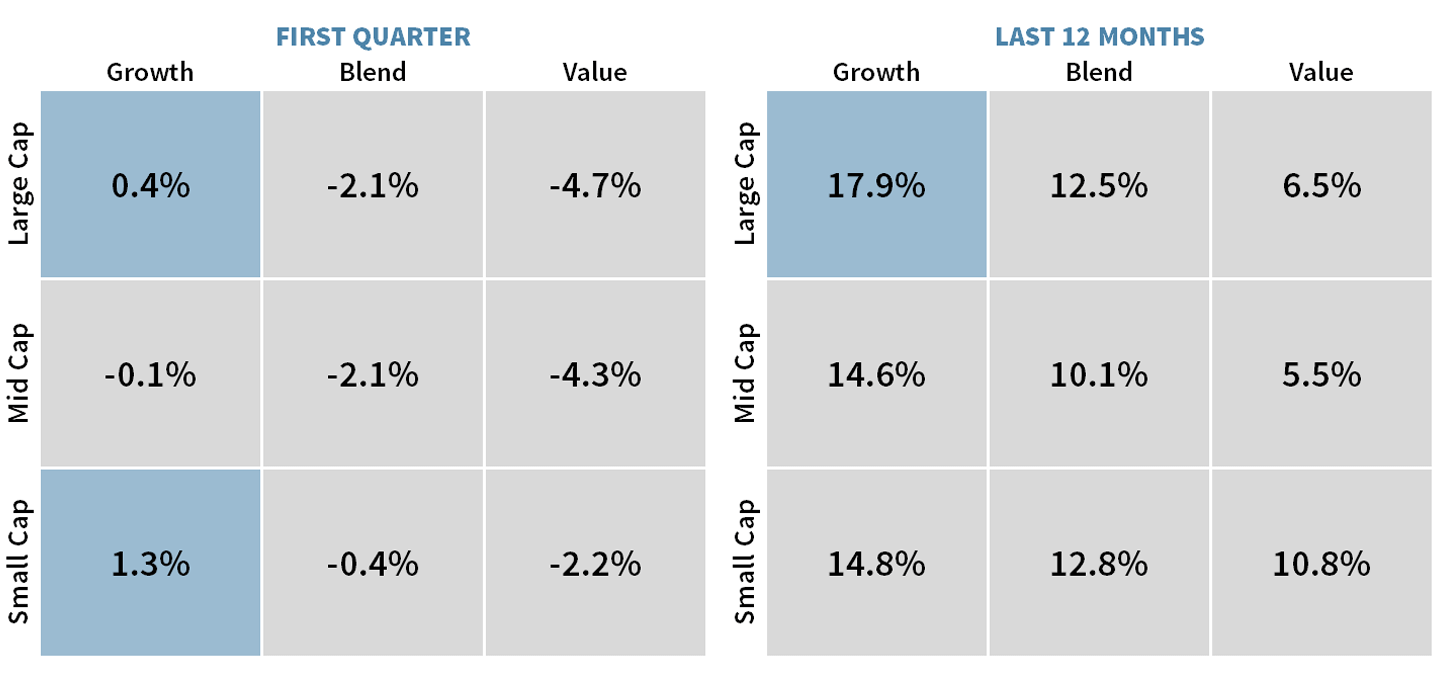

Growth stocks continued to outpace Value, though the seemingly unflappable momentum mega-caps (a.k.a. FAANG stocks), began to show some cracks towards the end of the quarter. Both Facebook and Amazon drew unwelcome headlines, which neither could afford given their lofty share prices. Perhaps investors are ready to focus on fundamental valuation again.

Chart 1: U.S. Equity Valuation; cracks forming in growth

Growth stocks continued their outperformance this quarter, but cracks appear to be forming, and investors may be preparing to rotate into value.

Growth is largely comprised of Technology stocks, so it is unsurprising that Tech was the leading sector again this quarter. While we appreciate the quality of the companies in this sector, we see that for many of them, valuation is getting too far ahead of fundamentals. The issues with the Facebook data breach and the President’s attacks on Amazon’s business model may force investors to re-evaluate the upside in these names.

On the other end of the spectrum was the Consumer Staples sector which is down the most year-to-date. These stocks are traditionally a safe haven and may offer decent value for those concerned about the market’s recent jitters.

Fixed Income – a tight situation

The Fed raised interest rates for the sixth time since it began its normalization efforts back in December 2015. The target rate, which began this tightening phase at 0.25% now stands at 1.75%. This was the first decision by the new Fed Chairman, Powell, who replaced Janet Yellen in February.

Rising rates have increased bond yields (particularly on the short end), putting negative pricing pressure on bonds (rates go up > bond prices go down). Investors who are accustomed to seeing modestly positive returns in their fixed income portfolios may see negative returns this year. Despite this potential drag on short-term performance, these securities remain a vital part of a healthy diversified portfolio (see the Playbook below for why).

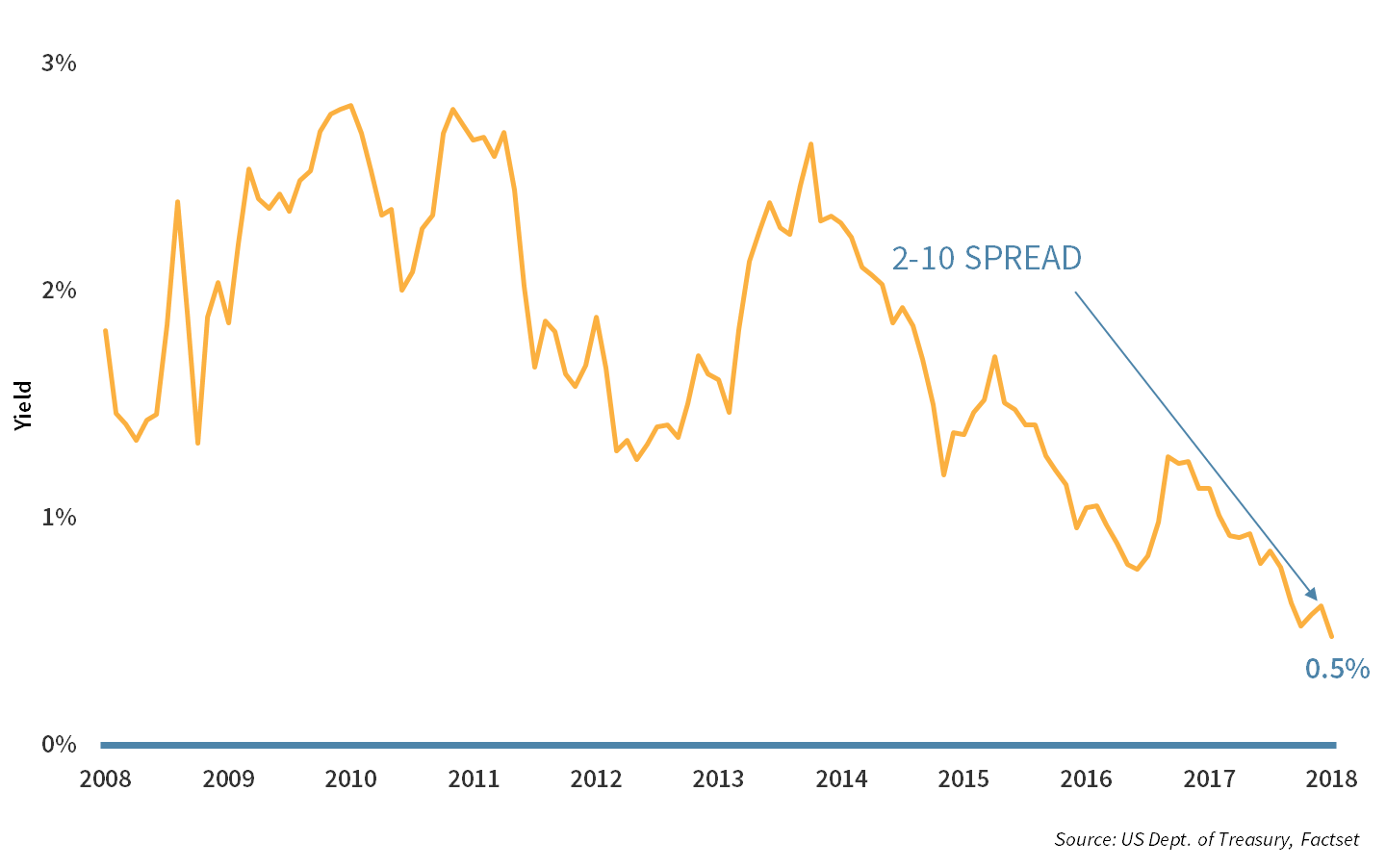

While yields have risen across the curve, short-dated bonds (like the 2-year) have seen yields rise faster than longer-dated bonds (like the 10-year). The result is a “flatter” yield curve. What does this mean in practice? The compensation for owning a 2-year is closer to a 10-year than it was before the flattening, making the 10-year incrementally less attractive. We continue to focus on owning shorter-dated bonds in this rising rate environment.

Chart 2: U.S. Bond spreads; the gap is closing

Although rates are rising, the spread between U.S. 10-year bonds and 2-year bonds is shrinking, making shorter-dated bonds incrementally more attractive.

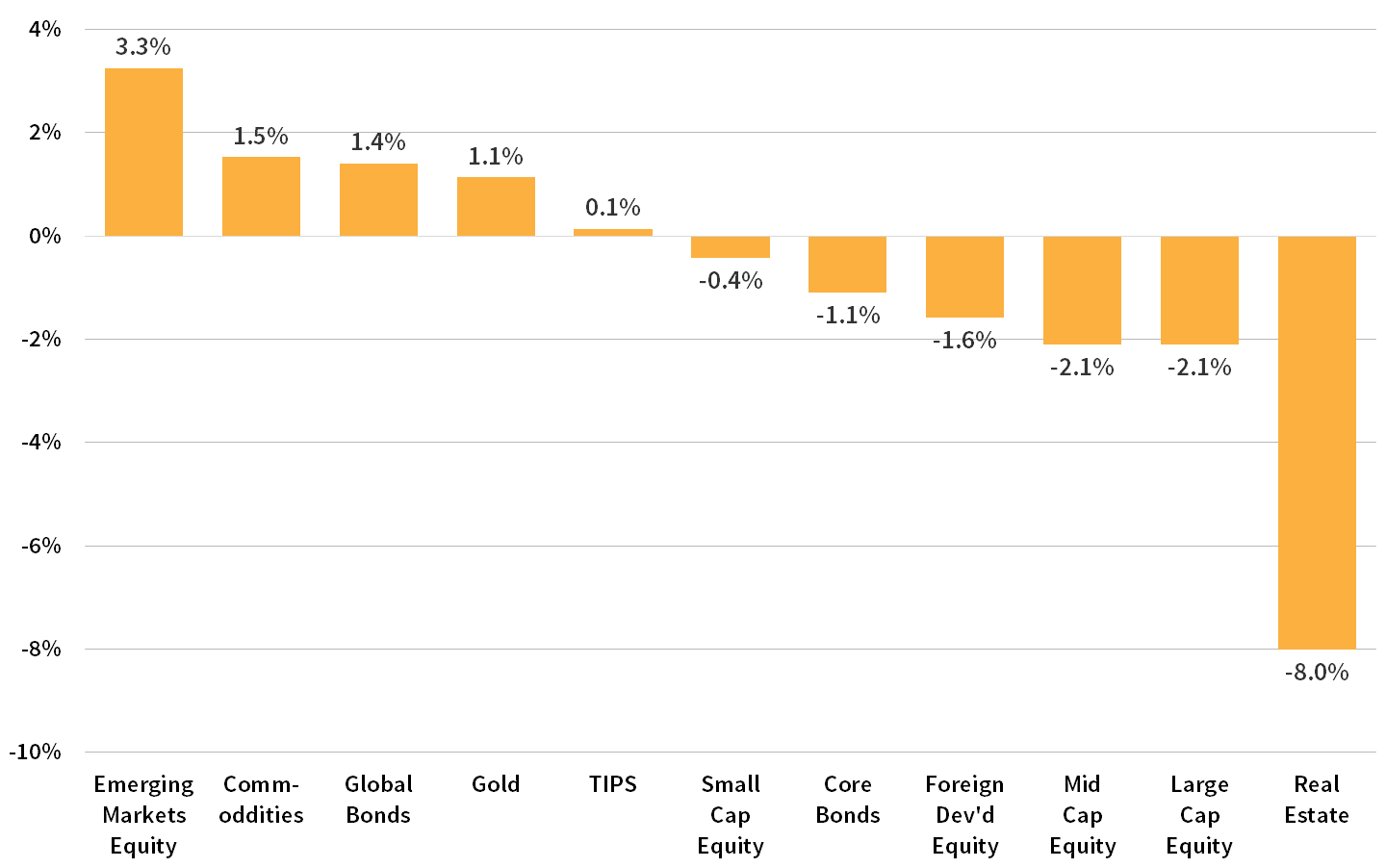

Asset Allocation – new leadership

The benefits of diversification were evident this quarter as non-core asset classes topped the leaderboard. Emerging Market Equity and Gold were the best performers overall, while Global Bonds provided a bright spot amongst Fixed Income.

Numerous studies show that asset allocation is one, if not the, most important driver of long-term performance, and we fundamentally believe that proper diversification allows an investor to capture much of this benefit. We discuss this in more detail in our Q2 2018 Playbook below.

Chart 3: Asset Allocation; diversifying assets shine

Several non-core assets were amongst the best performers in Q1, proving their worth in a well-diversified portfolio.

The Q2 2018 Playbook

At long last, volatility has returned to the markets. It’s about time! While economic fundamentals still look robust globally, we believe the U.S. equity market has exited its post-election, “blind euphoria” stage, and is now returning to a more normal state of operation. With the most impactful corporate-friendly actions of the new administration (like lower corporate taxes and reduced regulation) now priced in, investors appear ready to pay more attention to risks (rising trade tensions, the Russia investigation, Tech sector backlash).

Is this newfound volatility a friend or foe of investors? In the absence of volatility, an investor can look like a hero simply holding a passive index; but this is atypical. In normal, volatile markets, investors can add value by strategically capitalizing on the benefits of well-constructed diversification.

The Magic of Diversification

In investing, 2+2 can at times be much greater than 4. Such is the case in asset allocation. For example, since 1974, the S&P 500 has produced an annual return of about 8.8%, while an investment in gold would have generated a 5.5% return with much higher volatility. Yet when combined into a single portfolio, an investor would have been able to achieve a return higher than 8.8% with materially lower volatility. Magic! (not really… it’s actually math).

As investors we can capitalize on this “magic” by, 1) building a well-diversified portfolio allocation, and 2) thoughtfully rebalancing when volatility creates an imbalance. Why bring this up? In a volatile environment, we find clients are more likely to ask if they should take money “off the table.” Assuming your time horizon is long-term, and your goals and risk tolerance have not changed, then the answer is almost certainly “no”. Your asset allocation should be set to give you the right level of risk for your unique circumstances. Stay invested, and let diversification and rebalancing do its magic.

While good allocation discipline is at the heart of our portfolio strategy, we tilt the security weightings when we see fundamental opportunities. Our preferences going into Q2 are:

- Avoid the allure of expensive, high-growth, fast-moving, equities. These momentum stocks (primarily in the Tech sector) are starting to show cracks. Seek broad equity exposure, with a preference for Value and Dividend Growth.

- Favor small cap stocks which are less expensive than large-cap will benefit nicely from tax reform and are potential acquisition targets in this cash-rich environment.

- Keep fixed income exposure short-term and highly liquid in this rising rate environment. Despite the potential for low-to-negative returns, bonds remain an important piece of a healthy, diversified portfolio.

- Do not chase returns in the high yield market, which have performed well in recent years, but are of low quality, no longer offer a sizeable premium, and are beginning to underperform.

- Moderately overweight Emerging Markets and Gold which we currently see as attractive diversifiers.

About Strategic

Founded in 1979, Strategic is a leading investment and wealth management firm managing and advising on client assets of over $2 billion.

OverviewDisclosures

Strategic Financial Services, Inc. is a SEC-registered investment advisor. The term “registered” does not imply a certain level of skill or training. “Registered” means the company has filed the necessary documentation to maintain registration as an investment advisor with the Securities and Exchange Commission.

The information contained on this site is for informational purposes and should not be considered investment advice or a recommendation of any particular security, strategy or investment product. Every client situation is different. Strategic manages customized portfolios that seek to properly reflect the particular risk and return objectives of each individual client. The discussion of any investments is for illustrative purposes only and there is no assurance that the adviser will make any investments with the same or similar characteristics as any investments presented. The investments identified and described do not represent all of the investments purchased or sold for client accounts. Any representative investments discussed were selected based on a number of factors including recent company news or earnings release. The reader should not assume that an investment identified was or will be profitable. All investments contain risk and may lose value. There is no assurance that any investments identified will remain in client accounts at the time you receive this document.

Some of the material presented is based upon forward-looking statements, information and opinions, including descriptions of anticipated market changes and expectations of future activity. Strategic Financial Services believes that such statements, information, and opinions are based upon reasonable estimates and assumptions. However, forward-looking statements, information and opinions are inherently uncertain and actual events or results may differ materially from those reflected in the forward-looking statements. Therefore, undue reliance should not be placed on such forward-looking statements, information and opinions.

No content on this website is intended to provide tax or legal advice. You are advised to seek advice on these matters from separately retained professionals.

All index returns, unless otherwise noted, are presented as price returns and have been obtained from Bloomberg. Indices are unmanaged and cannot be purchased directly by investors.

Doug Walters

Doug Walters