Q3 2021 – Ask the Right Questions

Q3 2021 raised more questions than answers, but the questions were the wrong ones. Rather than pontificating about the future, investors should be asking if they are prepared for it.

Contributed by Doug Walters , Max Berkovich ,

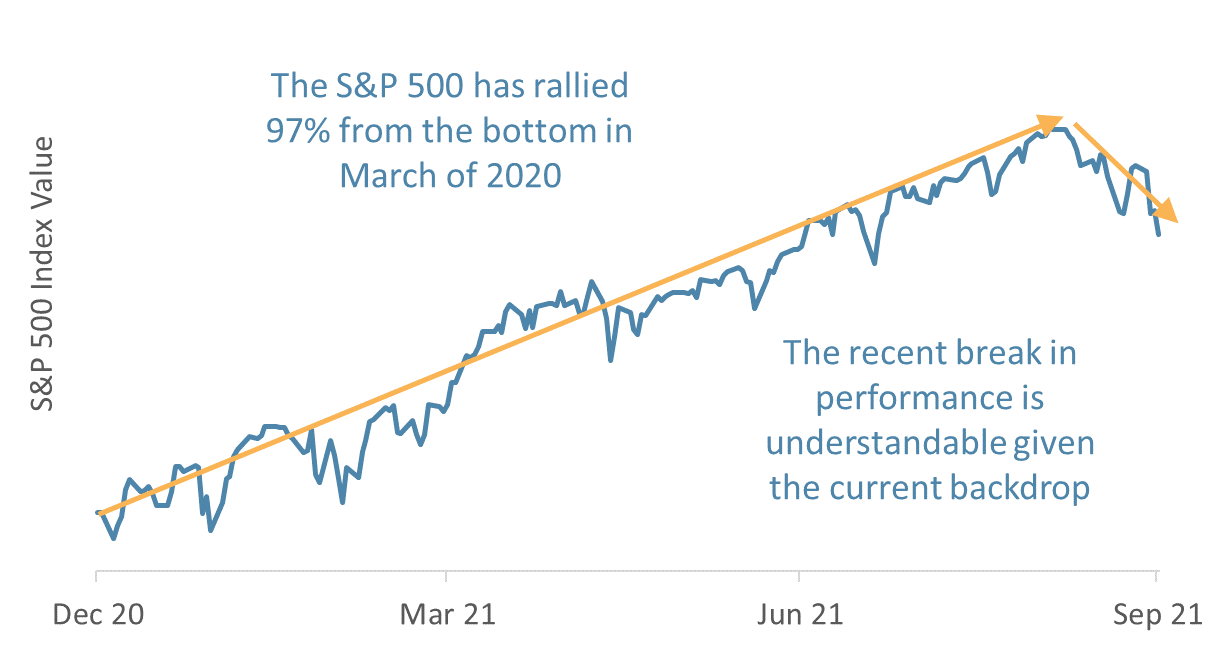

The third quarter of 2021 saw the equity rally pause, with the S&P 500 falling around 5% in the last few weeks. It was one of those quarters where there appeared to be more questions than answers. In particular, investors were questioning stock valuations, Fed tapering, and inflation. But the questions were the wrong ones. Rather than wondering how the future will play out, investors should ask if their portfolio is prepared for the inevitable uncertainty.

Dissecting Q3 2021

U.S. stocks have produced a total return of over 97% from their pandemic lows. That comes despite a 5% drop to end the third quarter. As we look forward to the end of the pandemic, investors are trying to balance numerous dynamics:

- Are stocks too expensive to continue to rally?

- What happens when the Fed begins unwinding stimulus?

- Do we need to be concerned about inflation?

These questions weigh on the minds of investors, and unfortunately, our crystal ball is just as cloudy as the next. Yet investors will find they are not helpless once they learn to ask the right questions.

Chart 1: The Pandemic Rally Takes a Break in Q3

U.S. stocks have produced a total return of over 97% from their pandemic lows, despite a 5% drop to end the third quarter.

Are stocks too expensive to continue to rally?

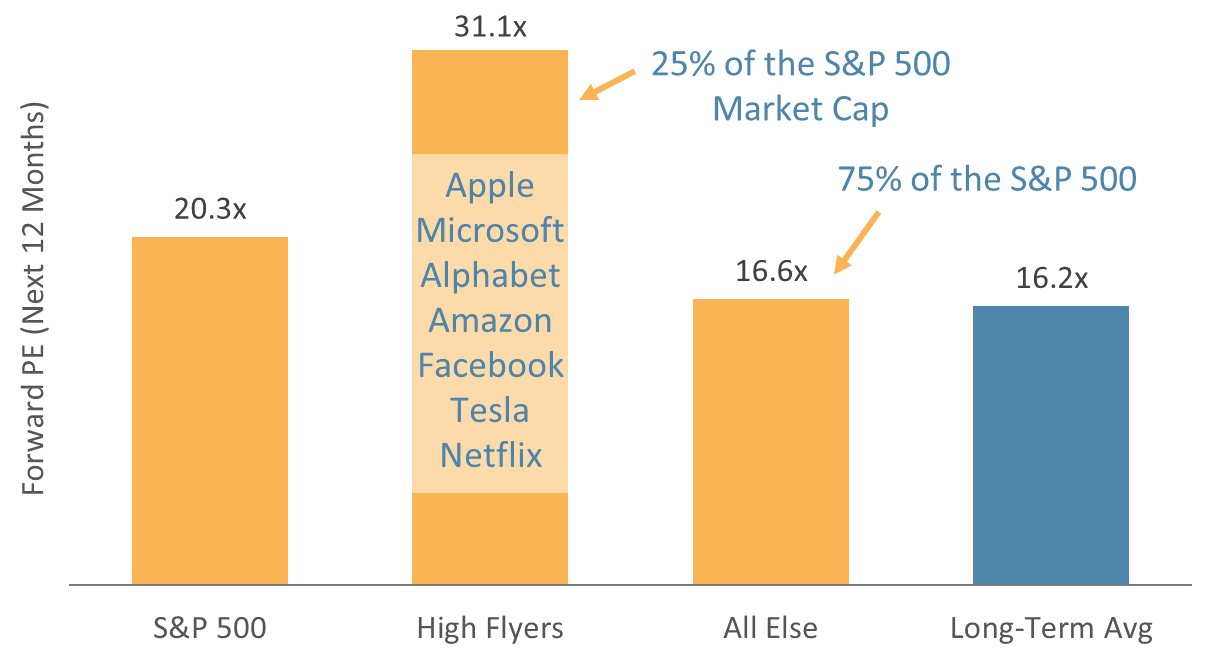

The short answer is no. Expensive stocks can always become more expensive. But let us take a closer look at what is going on under the hood. The Fed stimulus has boosted stocks, particularly the more expensive growth stocks (e.g. Amazon, Tesla, Netflix). Expensive growth stocks may be at more risk as the stimulus is weaned. As the chart below shows:

- Seven growth stocks represent 25% of the market cap of the S&P 500 and have an average forward price-to-earnings (PE) ratio of 31.1x (the higher the PE, the more expensive the stock).

- The remaining 490+ stocks have an average forward PE of just 16.6x, which is in line with the long-term average PE of the index.

We cannot predict what will happen from here, but we can prepare. With risk so concentrated in a handful of expensive stocks, diversification is all the more critical, particularly away from market-cap-weighted indexes.

Chart 2: Are Stocks Too Expensive?

Stocks have been boosted by Fed stimulus, particularly the more expensive growth stocks. These stocks may be at risk as stimulus is weaned.

What happens as the Fed unwinds stimulus?

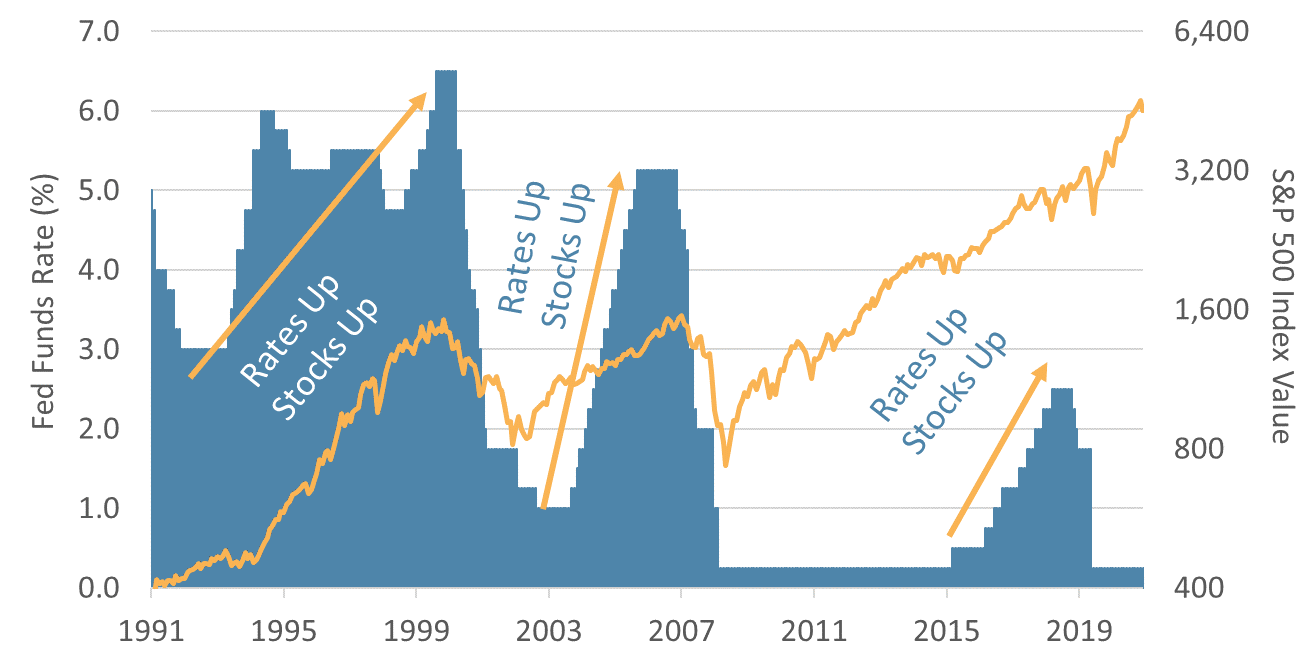

The Fed is expected to begin tapering its asset purchases this year and begin raising rates next year. Both actions are an attempt to move toward “normalization” in response to improving economic fundamentals.

- All else equal, we would expect to see interest rates and bond yields rise, which is a headwind for equities – particularly expensive equities.

- But tapering does not necessarily mean stocks will fall. We experienced tapering in late 2017 to mid-2019, a time when stocks returned about 18%.

- A rising Fed Funds rate is also not necessarily a negative. Rate increases tend to occur as the economy is heating up and often correlate with rising stock prices.

It is a balancing act for the Fed. If they get it right, they can pull back on stimulus at a pace fast enough to ensure the economy does not overheat but slow enough to allow economic growth to create natural support for equity and bond markets.

Chart 3: What Happens as the Fed Unwinds Stimulus?

Historically, rate increases have correlated well with rising stocks, for the simple fact that the Fed raises rates to pump the brakes on a hot economy.

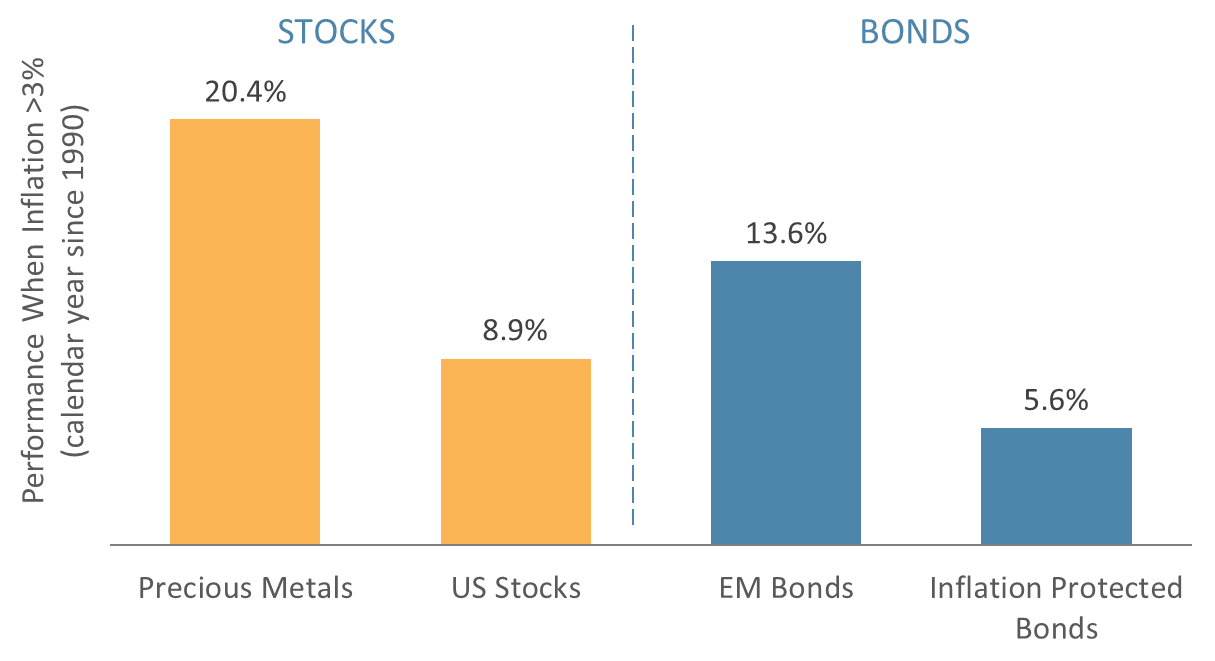

Do we need to be concerned with inflation?

With the pandemic driving short-term inflation higher, investors are debating whether or not the rise is transitory or permanent. No one knows the answer. Even the experts at the Fed cannot agree (though the consensus is for “transitory” inflation). But here is what we do know:

- Inflation has been too low in recent years. A modest increase could be healthy.

- Historically, stocks have provided investors with some inflation protection.

- Diversification into precious metals (gold), emerging markets debt, and inflation-protected bonds have also helped prepare for inflation.

With inflationary pressures tangible to any consumer who has recently bought meat, gas, or a used car, it is easy to see why concern is rising. Yet, the consensus is still that this effect will be transient. Time will tell. What we can do as investors is construct portfolios that are designed with some built-in inflationary protection.

Chart 4: Do We Need to be Concerned with Inflation?

Certain assets such as stocks, precious metals, TIPS, and emerging market bonds can provide some degree of protection in inflationary environments.

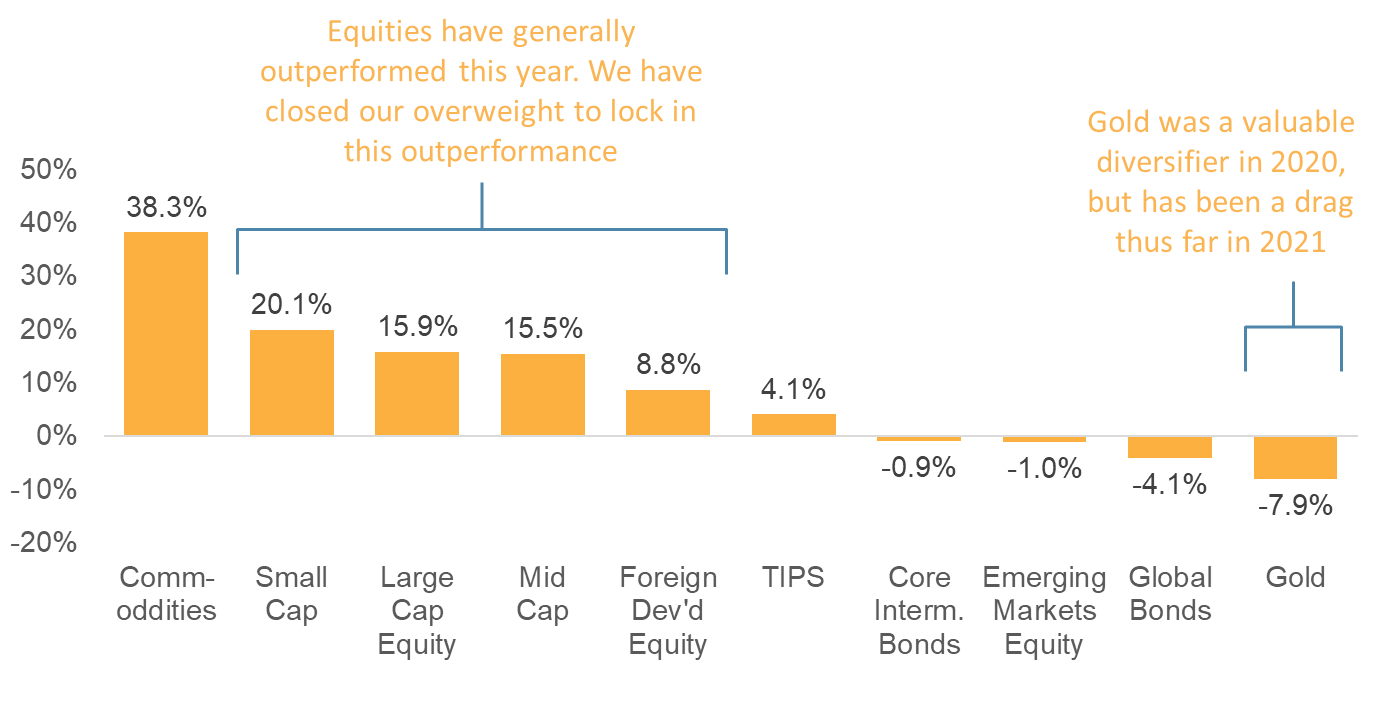

A Q3 pause masked by year-to-date strength

Before we move on to Q4, let us take one last look at how assets have performed thus far this year. Risk assets, such as US equities, have had an excellent year thus far, but Q3 saw some of that strength wane.

- While Small-Cap equities have had an excellent year, they did pullback in Q3 as the delta coronavirus variant slowed the hoped-for quick recovery from the pandemic, and investors began worrying about the Fed and inflation.

- Emerging Markets was the weakest of the asset classes in Q3, as Chinese stocks were hit by government intervention.

- Gold, which was an excellent source of protection in the 2020 downturn, has cooled off in 2021 despite historically being a good inflation hedge.

Chart 5: A Q3 Pause Masked by YTD Strength

Risk assets, such as US equities, have had an excellent year thus far, but Q3 saw some of that strength wane.

The Q4 2021 Playbook

The questions investors are asking are good ones but at the same time irrelevant. Stocks (particularly some) do appear expensive. Federal Reserve stimulus has a considerable influence on security prices. Inflation is high and has a history of wreaking havoc on economies. Yet, we do not know the future. Would any of us have predicted that the stock market would have stellar performance through one of the worst global pandemics in history? Not likely. So what questions should investors be asking? It is simple:

- Is my portfolio well-diversified? What do we mean by “well-diversified”? It is more than just owning stocks and bonds. Do you have some protection from inflation through other assets such as gold, emerging markets debt, and TIPS? Do you have exposure to proven equity factors (Attractive Value, Good Quality, Strong Momentum, and Small Size) which perform well at different times in the economic cycle?

- Does my portfolio match my risk profile? Each investor has a unique combination of ability, willingness, and need to take on risk, which should be reflected in their portfolio’s asset allocation. Your risk profile should drive your portfolio allocation, not predictions and pontifications about an unknowable future.

As we look to Q4, our mantra, which we have repeated often over the past year, is to focus on preparation, not prediction. With any luck, the next quarter will see us begin to put the pandemic in the rearview mirror and free us to pursue our best lives. A well-prepared portfolio will help bring peace of mind to that pursuit.

About Strategic

Founded in 1979, Strategic is a leading investment and wealth management firm managing and advising on client assets of over $2 billion.

OverviewDisclosures

Strategic Financial Services, Inc. is a SEC-registered investment advisor. The term “registered” does not imply a certain level of skill or training. “Registered” means the company has filed the necessary documentation to maintain registration as an investment advisor with the Securities and Exchange Commission.

The information contained on this site is for informational purposes and should not be considered investment advice or a recommendation of any particular security, strategy or investment product. Every client situation is different. Strategic manages customized portfolios that seek to properly reflect the particular risk and return objectives of each individual client. The discussion of any investments is for illustrative purposes only and there is no assurance that the adviser will make any investments with the same or similar characteristics as any investments presented. The investments identified and described do not represent all of the investments purchased or sold for client accounts. Any representative investments discussed were selected based on a number of factors including recent company news or earnings release. The reader should not assume that an investment identified was or will be profitable. All investments contain risk and may lose value. There is no assurance that any investments identified will remain in client accounts at the time you receive this document.

Some of the material presented is based upon forward-looking statements, information and opinions, including descriptions of anticipated market changes and expectations of future activity. Strategic Financial Services believes that such statements, information, and opinions are based upon reasonable estimates and assumptions. However, forward-looking statements, information and opinions are inherently uncertain and actual events or results may differ materially from those reflected in the forward-looking statements. Therefore, undue reliance should not be placed on such forward-looking statements, information and opinions.

No content on this website is intended to provide tax or legal advice. You are advised to seek advice on these matters from separately retained professionals.

All index returns, unless otherwise noted, are presented as price returns and have been obtained from Bloomberg. Indices are unmanaged and cannot be purchased directly by investors.

Doug Walters

Doug Walters