Q3 2020: Focus on What You Know

The stock market rally may appear out of step with economics, yet a peek behind the curtain reveals both risk and opportunity. With an election looming, we remind investors to focus on what they know and not what they think.

Contributed by Doug Walters , Max Berkovich ,

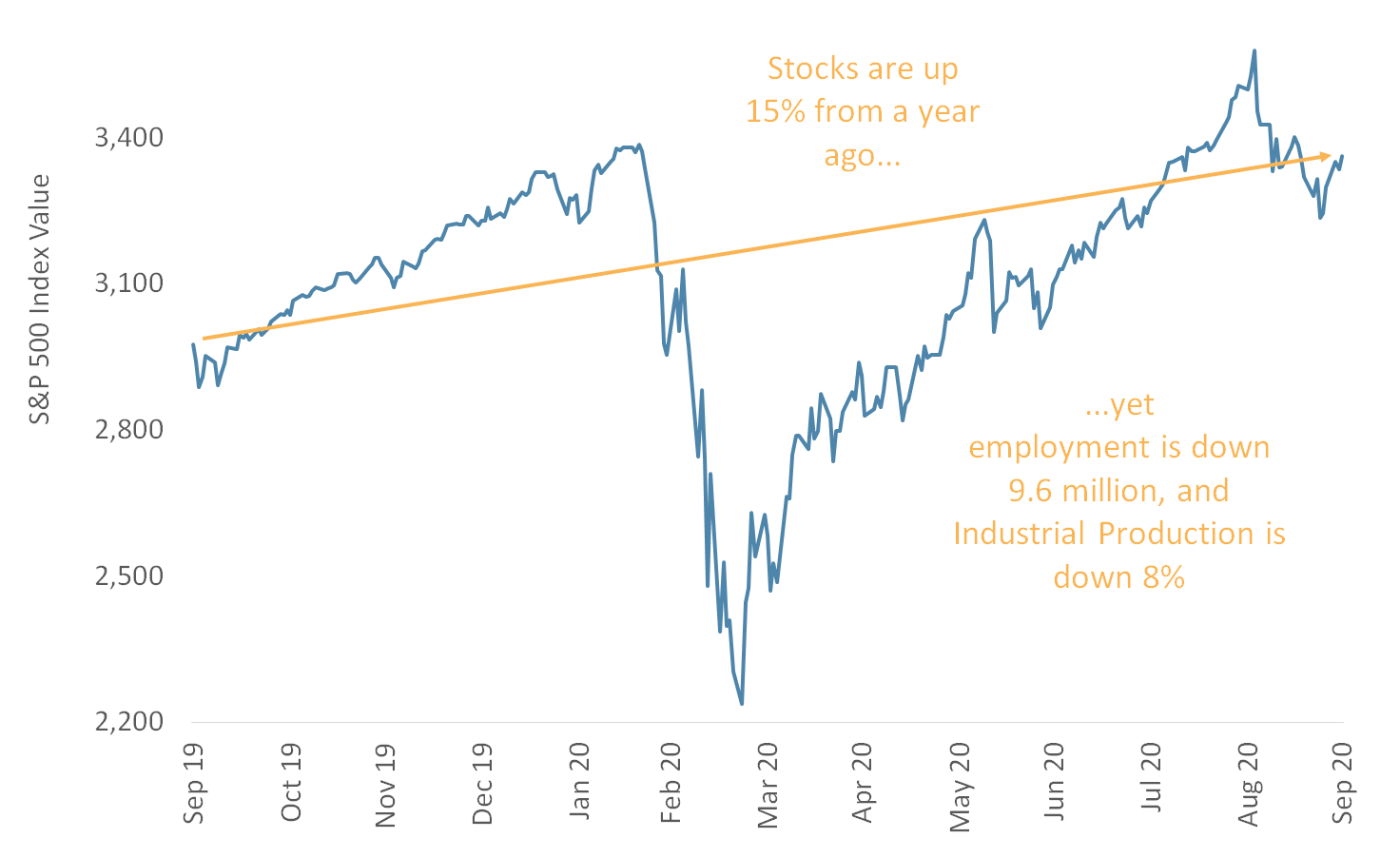

If you had told me a year ago that at the end of the third quarter of 2020 we would be in the midst of a global pandemic, unemployment would expand by 10 million people, and industrial production would have fallen by 8%, I would not have believed you. If you then told me the stock market would be up, I would have questioned your sanity. Yet here we sit, living through the most unlikely of scenarios, comforted only by the fact that we were prepared for it.

Dissecting Q3 2020

Thanks to the Federal Reserve (and to a lesser degree, Congress), the stimulus-driven equity market rally continued in the third quarter. This, despite the pandemic showing few signs of abating. There are always unintended consequences when massive stimulus is enacted. We see this creating both risk and opportunity for investors.

Stocks Advance in a Weak Economy

The U.S. economy is still reeling from the impact of the pandemic. While there has been a bounce-back in activity from the shutdown lows, industrial production and employment measures are well off their pre-COVID levels. Despite this, the stock market reached fresh all-time highs in the third quarter.

How is this possible? Stimulus. The Federal Reserve has lowered the Fed Funds Rate to near zero. The lower rate helps stimulate the economy, encouraging companies to borrow cheaply. The low rates have also driven down bond yields to historically low levels. Low bond yields make fixed income less attractive and push investors toward stocks (particularly large, well-funded companies) in search of higher returns. But this dynamic has created some significant dislocations visible when you pull back the curtain.

Chart 1: One-year performance of the S&P 500 Versus the Economy

Despite still weak economic indicators, like Employment and Industrial Production, the stock market managed to hit an all-time high in the third quarter.

Source: Factset

Peeking Behind the Curtain

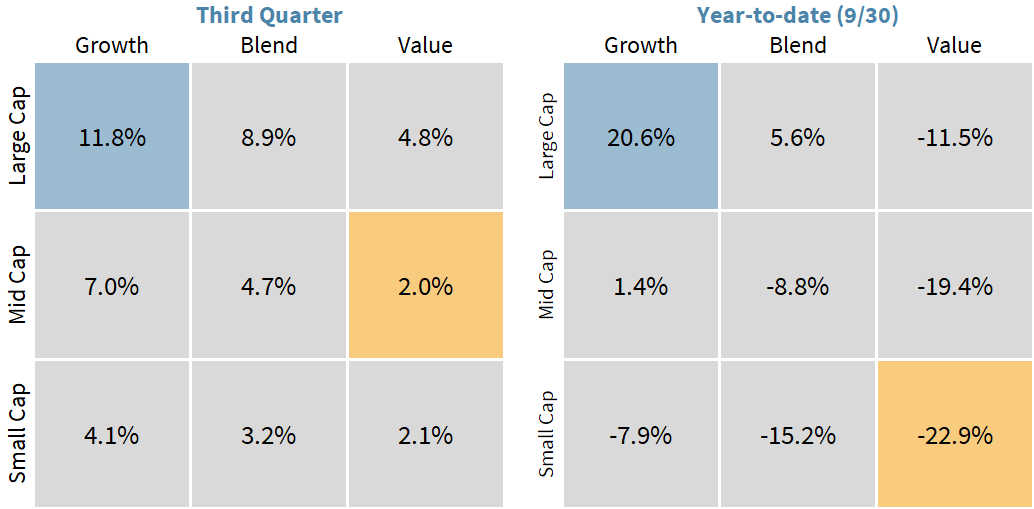

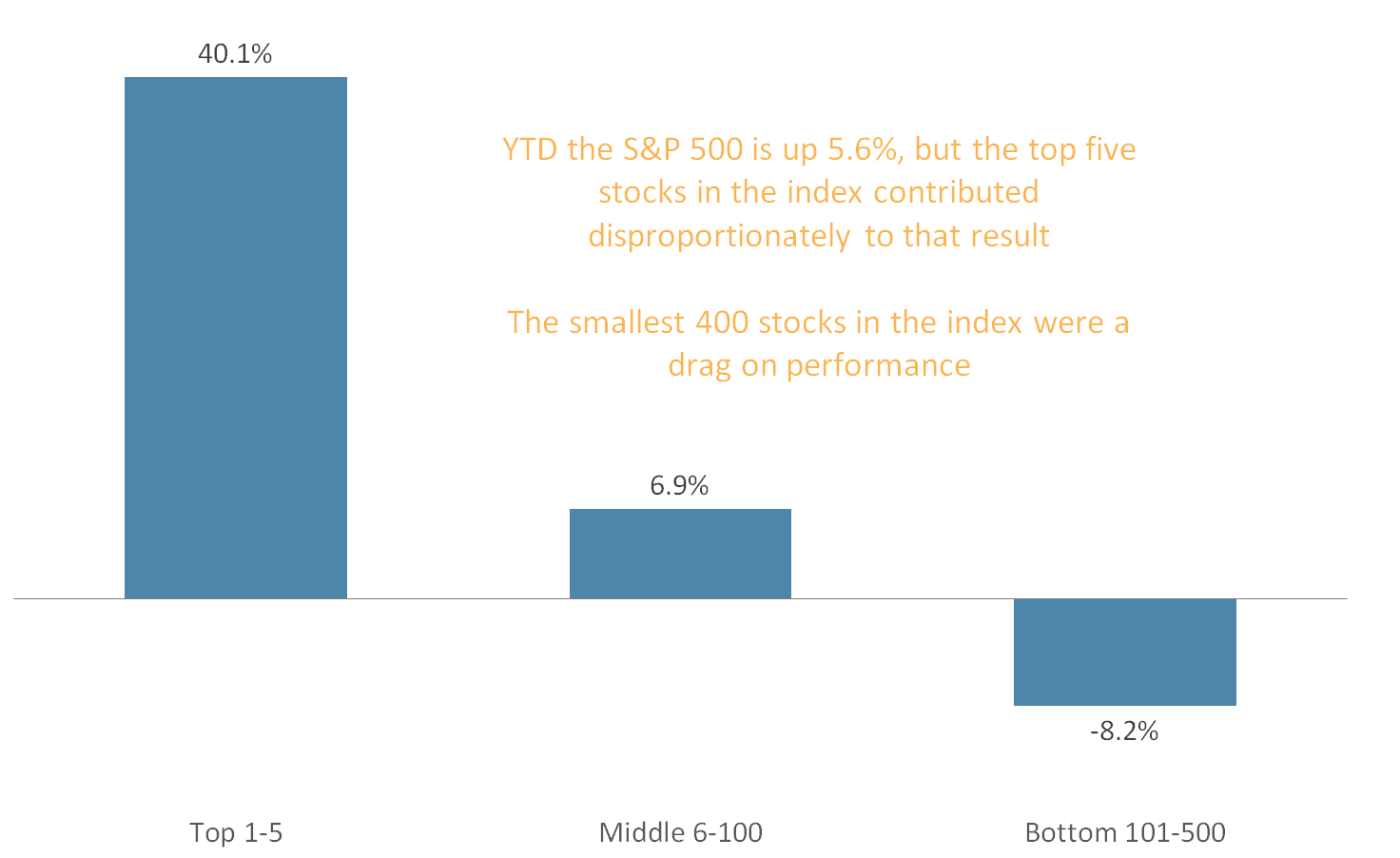

A look into the equity rally reveals a lopsided market recovery. Mega-cap Technology companies, like Apple, Alphabet, Microsoft, and Facebook, are responsible for the bulk of the market returns. While smaller companies which rely on face-to-face interaction, like retail, have struggled, the Tech behemoths were uniquely positioned to benefit from the pandemic. Not only did demand for their products rise as human interactions became increasingly virtual, but their strong balance sheets also allowed them to flourish in this low rate environment. We can visualize this in two different ways:

- The outsized performance of the largest companies in the stock market, and

- The divergence of Growth and Value stocks

Chart 2: YTD Performance of the S&P 500 by market cap

A handful of very large companies have driven the equity market higher, while most stocks are actually down on the year.

Source: Factset

Chart 3: Q3 and YTD returns for different segments of the market

Large-Cap stocks continue to outperform Small-Cap, while Growth extends its recent dominance over Value.

Source: Factset

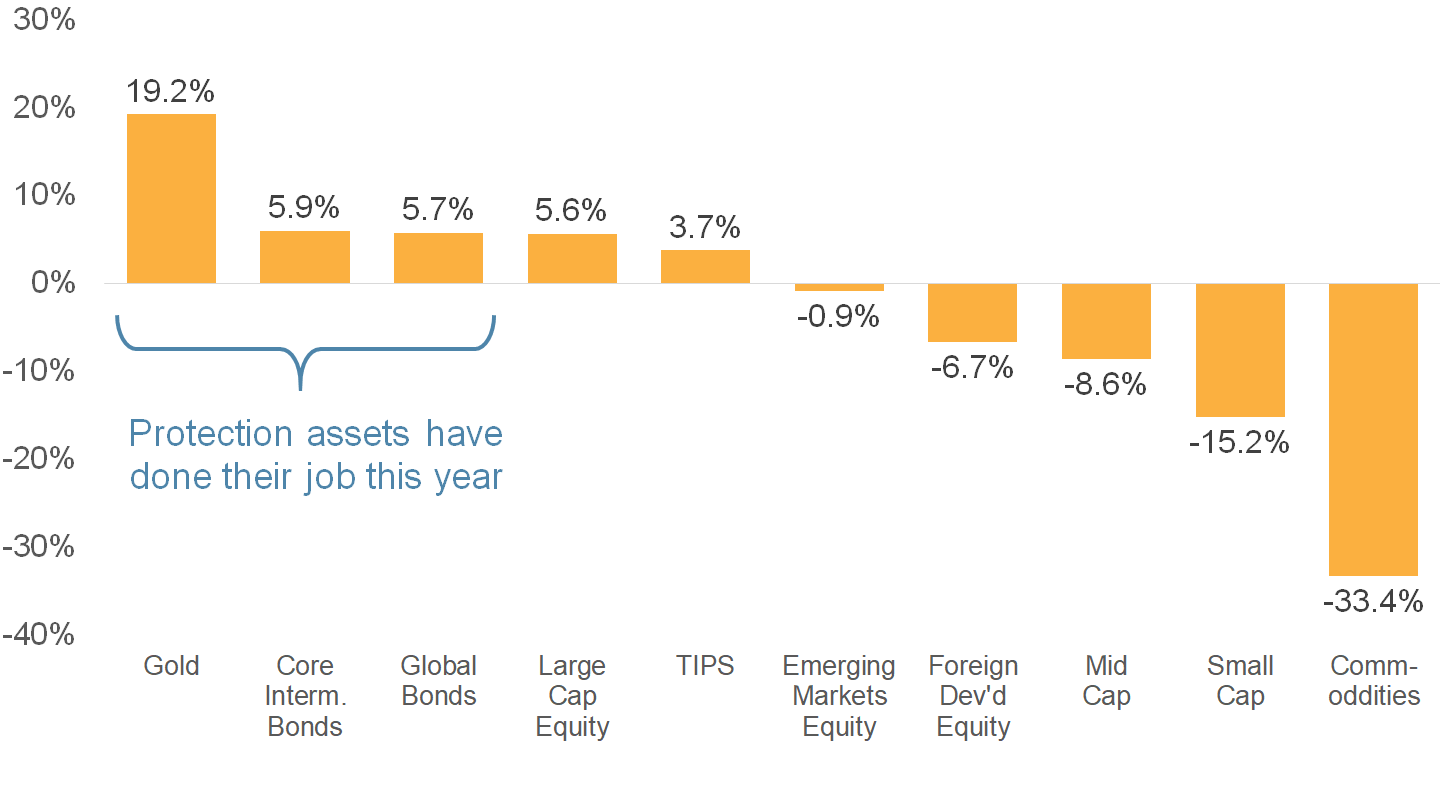

Year-to-Date Asset Roundup

Large-Cap Growth is not the only asset class performing well this year. Gold, which is often seen as a safe haven in times of stress, us up nearly 20% on the year. The importance of diversification has been on full display in 2020, as falling interest rates have helped produce positive returns for most fixed income categories.

Chart 4: year-To-Date returns across asset classes

Gold has lived up to its reputation as a safe haven, while other protection assets have also produced positive returns in a challenging year.

Source: Factset

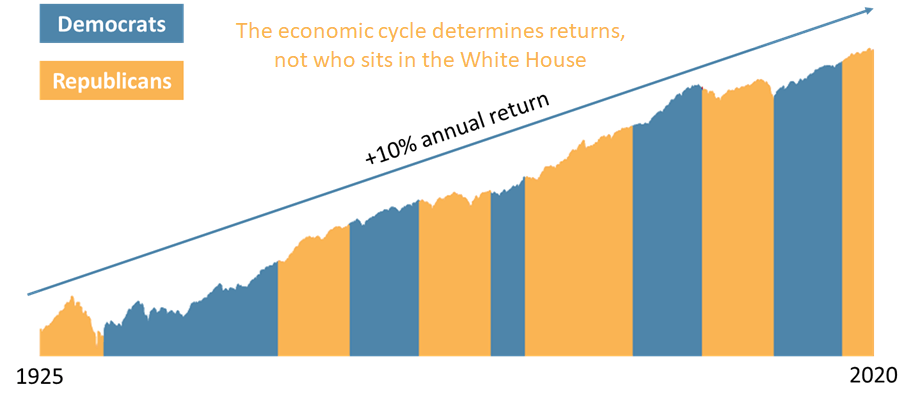

An Election Looms

Front of mind for investors is the upcoming Presidential election. We routinely hear concerns about the potential for election volatility and investor fears about what will happen if one party or the other wins. However, history shows that markets are much more sensitive to the economic cycle than which party is holding the White House. The U.S. stock market has been a great investment historically irrespective of politics.

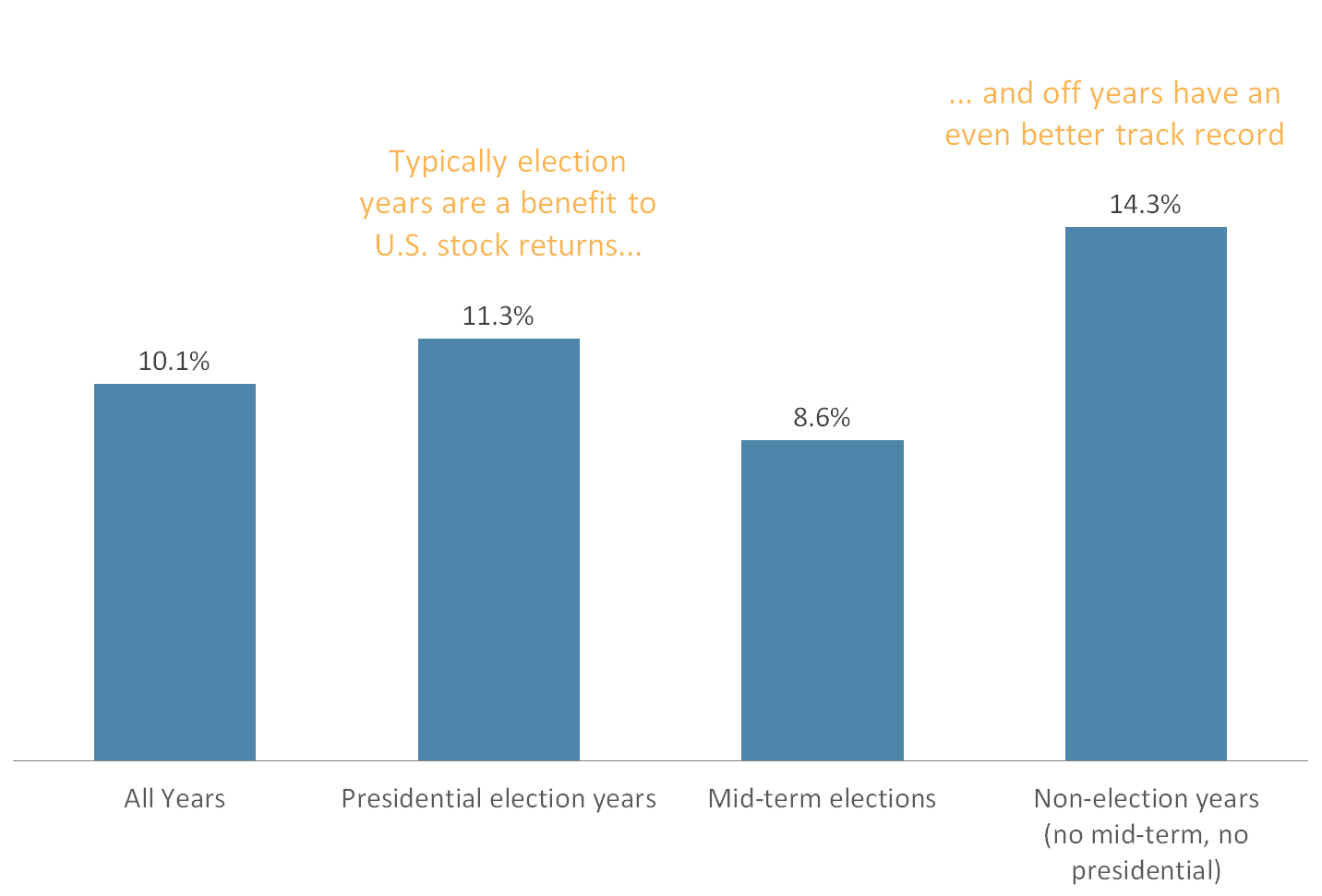

Also, history shows that election years tend to produce above-average stock market returns, while off years (like next year) are even better. We would caution against anyone trying to market time around the election (or anytime for that matter).

Chart 5: Historical Stock Performance and Political Party

The U.S. stock market has been a good investment over time, regardless of which party is sitting in the White House. The economy is a bigger driver of the stock market than the President.

Source: Blackrock

Chart 6: Average Stock Performance and The Election Cycle (1/1/26 – 12/31/2019)

Election years have historically produced above-average returns, as have the off years (no Presidential or mid-term elections).

Source: Blackrock (1/1/26 – 12/31/19)

The Q4 2020 Playbook

As we enter the final stretch of a very challenging year, it feels inevitable that volatility will be high. The country faces a contentious election, and the uncertainty of a lingering pandemic looms. Yet we see no reason for pessimism. Volatility often creates opportunity. The key as always is:

- Act on evidence, not emotion, and

- Focus on preparing for the future, rather than try to predict it.

When investing, any time you find yourself saying, “I think,” red flags should go up.

- “I think stocks will fall after the election.”

- “I think [fill in the blank] political party will be good for stocks.”

- “I think the pandemic will drag on and drive down stock prices.”

Each of these could be proved true in time, but this is speculation. We prefer to focus on evidence and what we know to be true. It is this approach that guides our Q4 2020 playbook. What do we know:

- Elections historically have not been a cause for market concern. Investors should stay invested at a level of risk appropriate for their unique situation. Market timing risks permanent damage to long-term returns and should always be avoided.

- Value has historically outperformed Growth, and Small-Cap has historically outperformed Large-Cap. The recent bucking of this trend creates an opportunity that is captured by our evidence-based, factor portfolio strategies. A Congressional stimulus bill or positive vaccine news both have the potential to accelerate the realization of this opportunity.

- Market dislocations often provide opportunities for changes in asset allocation. We are seeing that in fixed income. Historically low bond yields combined with massive stimulus are making inflation-protected securities (TIPS) a more attractive asset class.

- Harvesting tax losses are a silver-lining in down markets. Being prepared to take advantage of these situations enables tax relief on future gains.

- Monitoring regularly for the opportunity to rebalance through volatile markets systematically buys low and sells high, enhancing long-term returns. This is an important and often underappreciated best practice.

Thank you to our clients for entrusting us to help you navigate these unusual times. While we could not have predicted what 2020 had in store for us all, Strategic and your portfolios were prepared for it.

About Strategic

Founded in 1979, Strategic is a leading investment and wealth management firm managing and advising on client assets of over $2 billion.

OverviewDisclosures

Strategic Financial Services, Inc. is a SEC-registered investment advisor. The term “registered” does not imply a certain level of skill or training. “Registered” means the company has filed the necessary documentation to maintain registration as an investment advisor with the Securities and Exchange Commission.

The information contained on this site is for informational purposes and should not be considered investment advice or a recommendation of any particular security, strategy or investment product. Every client situation is different. Strategic manages customized portfolios that seek to properly reflect the particular risk and return objectives of each individual client. The discussion of any investments is for illustrative purposes only and there is no assurance that the adviser will make any investments with the same or similar characteristics as any investments presented. The investments identified and described do not represent all of the investments purchased or sold for client accounts. Any representative investments discussed were selected based on a number of factors including recent company news or earnings release. The reader should not assume that an investment identified was or will be profitable. All investments contain risk and may lose value. There is no assurance that any investments identified will remain in client accounts at the time you receive this document.

Some of the material presented is based upon forward-looking statements, information and opinions, including descriptions of anticipated market changes and expectations of future activity. Strategic Financial Services believes that such statements, information, and opinions are based upon reasonable estimates and assumptions. However, forward-looking statements, information and opinions are inherently uncertain and actual events or results may differ materially from those reflected in the forward-looking statements. Therefore, undue reliance should not be placed on such forward-looking statements, information and opinions.

No content on this website is intended to provide tax or legal advice. You are advised to seek advice on these matters from separately retained professionals.

All index returns, unless otherwise noted, are presented as price returns and have been obtained from Bloomberg. Indices are unmanaged and cannot be purchased directly by investors.

Doug Walters

Doug Walters