Q2 2021: Keep it Simple

The pandemic rally continues, and our advice for investors is to keep it simple. Too much money was left on the table in 2020 as investors went astray, trying to time an impossible market. In 2021, stick to the basics.

Contributed by Doug Walters , Max Berkovich ,

The improbable run the U.S. stock market has achieved during a global pandemic continued in the second quarter of 2021. Fiscal and monetary stimulus out of Washington helped to buoy the stock market last year. Now that unprecedented support is beginning to be supplemented by rising demand as covid restrictions lift and consumers begin the return to normality. Our advice to investors in this environment is to stick to the basics!

Disecting Q2 2021

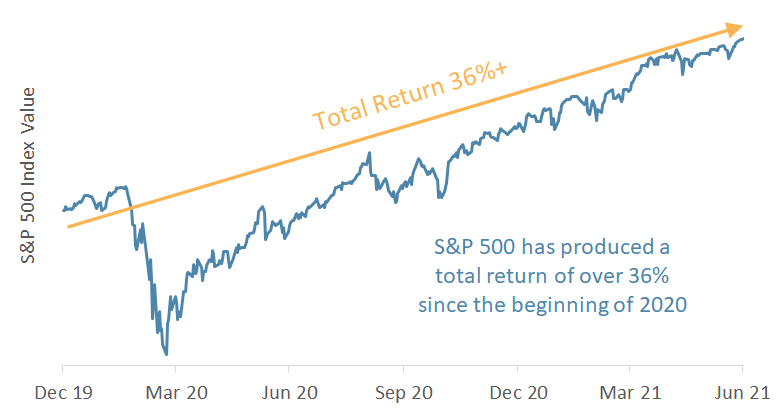

The run of the U.S. stock market from the depths of the pandemic to today has been nothing short of spectacular. From the beginning of 2020 through the end of the first half of 2021, the S&P 500 has produced a total return for investors of 36%. From the pandemic lows, the index is up almost 100%. What has driven this historic rally:

- Washington has done its part with low-interest rates from the Federal Reserve and six stimulus bills from Congress.

- Vaccinations are the latest stimulus, driving down U.S. covid infection rates and enabling economic reopening. There is tremendous pent-up demand amongst consumers who have been holed up at home and are increasingly free to return to normal activities.

- Also notable is that the savings rate in the U.S. jumped during covid, creating significant uninvested wealth. With bond yields so low, stocks remain a preferred asset class as excess cash is put to work.

chart 1: The pandemic rally continues undeterred

U.S. stocks are up nearly 100% from the lows of the pandemic, as Washington stimulus is now be supplemented by vaccine and reopening stimulus.

The Push and Pull of Value Versus Growth

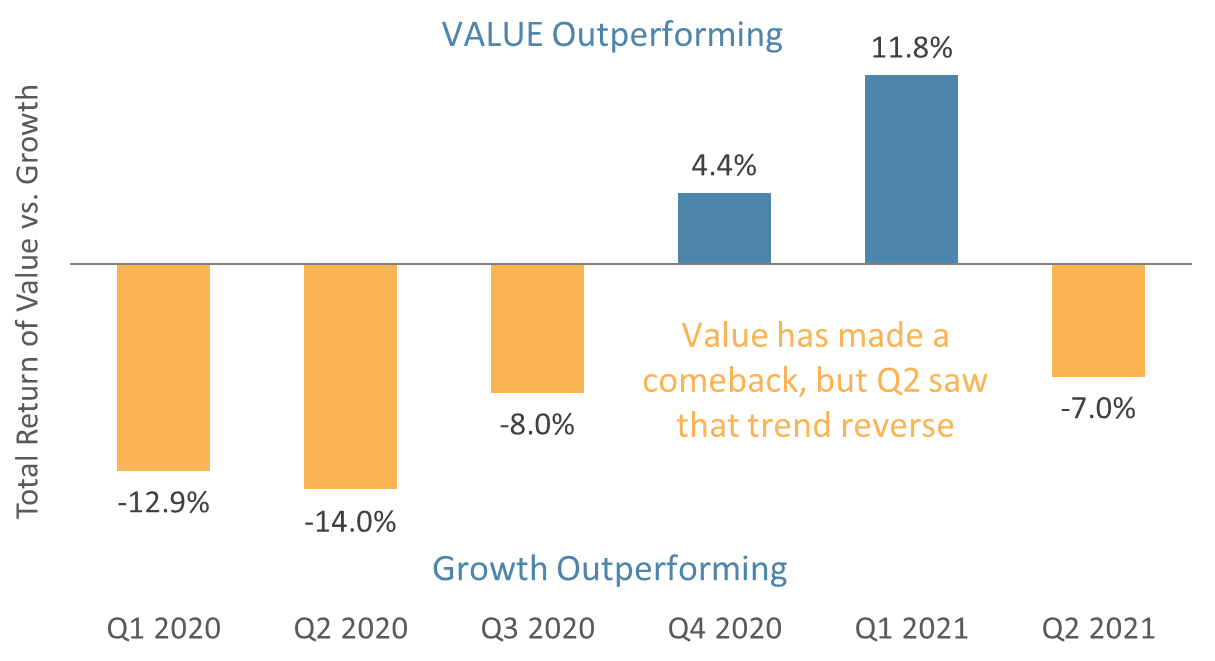

The pandemic has created an uneven playing field for Value and Growth stocks in the U.S. As a result, we have seen greater-than-normal shifts in performance between the two opposite ends of the stock market.

- Growth stocks have benefited from the fiscal and monetary stimulus of the pandemic disproportionately. Low interest rates drove valuations higher, while at the same time, many of these companies naturally benefited from the pandemic (consumers turned even more towards Tech as they were forced into their homes).

- Recovery, on the other hand, has favored Value stocks. Cyclical companies, like Financials and Industrials, benefit more from real economic improvement than from Fed stimulus. Vaccination rates have accelerated reopening, boosting economic activity, leading to Value outperformance.

- Now investors are at a crossroads. Have we already seen peak recovery growth, or will reopening continue to drive a strong and extended recovery? The answers to these questions are unknowable. What we do know is that historically, at this point in the economic cycle (recovery and expansion), portfolios have benefited from both Value and Momentum exposure, and that is how we have positioned our strategies.

Chart 2: value versus growth

Value has made a comeback in 2021, but Q2 saw that trend reverse.

Bond Backup Eases in Q2

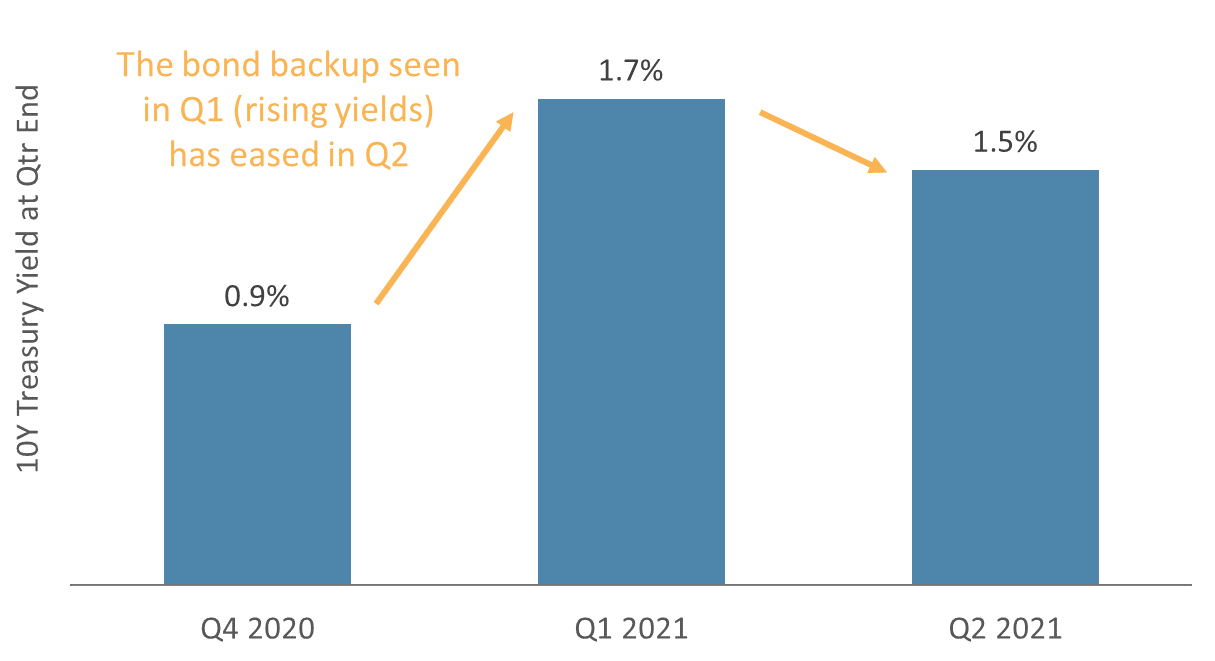

Big moves in bond yields have had implications for equity investors in 2021.

- Rising bond yields in Q1 put pressure on the most expensive segments of the stock market, namely Growth stocks, allowing Value to outperform. This move was in part driven by inflation fears.

- That trend has begun to reverse modestly in Q2. While the Fed has been saying all along that inflationary pressures will be transitory, investors appear to be gaining confidence in that message, allowing some relief for bond pricing in Q2.

Chart 3: Bond backup eases along with inflation fears

10Y Treasuries saw a significant increase in yields in Q1, but pricing pressures have abated somewhat in Q2.

Why Own Bonds if Yields Are so Low?

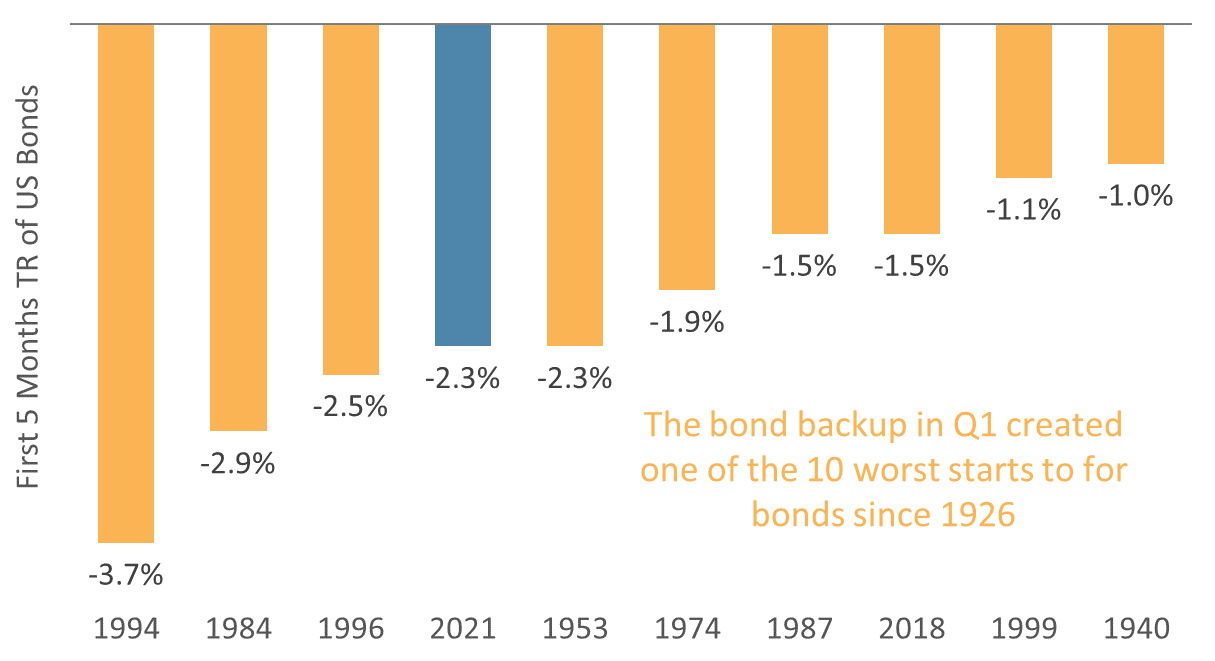

2021 has seen one of the worst starts to a year for bond returns, with the U.S. Agg down 2.3%. Making matters worse, bond yields remain historically low. In such an environment, we often get asked why own them?

- First and foremost, bonds are an important asset for maintaining portfolio risk a the right level. Bond yields may not be high, but that does not mean an investor should take on more risk. Matching portfolio risk to an investor’s ability and willingness to take on risk is critical.

- Second, bonds are an important rebalance lever when stocks come under pressure. One needs to only look back to March of last year to see an example where bonds played a vital role in enabling investment managers to sell a more stable asset (bonds) and buy a cheaper asset that had declined (stocks). Investors who rebalanced near the bottom in March better benefited from the 96% run that U.S. stocks have had since then.

- Third, historically, when bonds have had a challenging start to the year, they rebound afterward. The chart below shows the 10 worst starts to a year for bonds, which include 2021. The average return over the next seven months for these years was 5.5%. There is no reason why that has to be the case this time, but the data is nonetheless compelling.

Chart 4: the 10 worst starts for bonds since 1926 (first five months)

2021 can be counted amongst the 10 worst starts for bonds since 1926. The average return in the subsequent seven months was 5.5%.

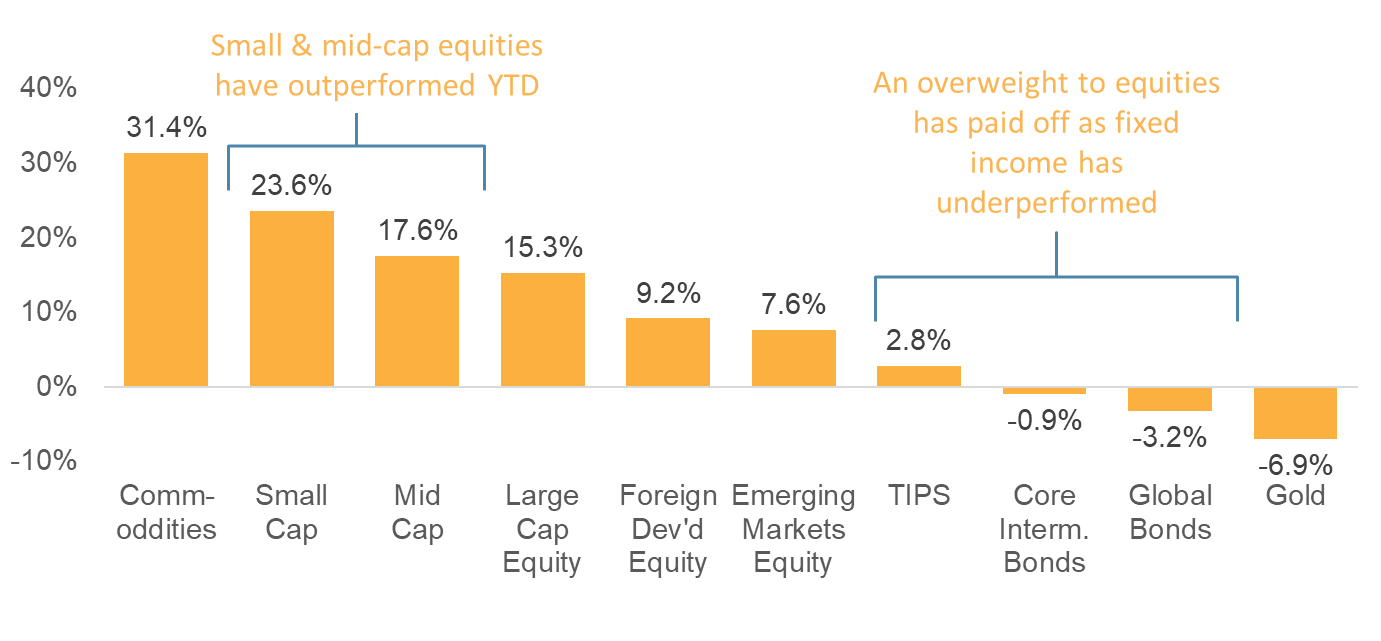

Year-to-Date Asset Roundup

Risk assets have had a very good first half of the year, while the protection side of portfolios (bonds and gold) were weak.

- Small and Mid-Cap equities continued the momentum they built at the end of 2020 as recovery prospects improved.

- As discussed above, bonds were weak in general, particularly in Q1. We have seen slightly positive returns in Q2 as yields weaken.

- Gold, which was an excellent source of protection in the downturn, has cooled off in 2021, though returns were positive in Q2.

Chart 5: Year-to-Date Asset Class Performance

A roundup of asset class performance in the first half of 2021 highlights the significant outperformance of equities versus bonds.

The Q3 2021 Playbook

Our message for Q3 and the second half of the year is to stick to the basics. The pandemic has been an extraordinary time for investors and one that has humbled many market participants. The book is still being written on 2020, but our read of peer data we have seen is that many investors fell short last year, and their underperformance was entirely avoidable. Two items caught our eye:

- Investors de-risked in 2020, moving assets out of equities and into fixed income and cash. We see this as market-timing, a proven losing strategy. Last year’s turmoil was challenging on investor’s nerves. But sticking with your risk allocation through thick and thin while systematically rebalancing to take advantage of market moves ensures you get all of the performance that the market has to offer.

- Investors strayed into alternative, less-liquid asset classes. Investments in things like private equity and hedge funds may sound exciting, but generally, these investments are not very liquid, meaning when you need them, you may not be able to access them. For example, let’s say your hedge fund value held up well in March of 2020. If you could not sell it to purchase equities that fell, then the diversification benefits you thought you were getting are essentially useless. In our experience, liquidity is critical. Keep it simple.

Regardless of what direction the markets take, we are excited for what the rest of 2021 has to offer as the country and world continue to reopen. Have a happy and healthy fourth of July!

About Strategic

Founded in 1979, Strategic is a leading investment and wealth management firm managing and advising on client assets of over $2 billion.

OverviewDisclosures

Strategic Financial Services, Inc. is a SEC-registered investment advisor. The term “registered” does not imply a certain level of skill or training. “Registered” means the company has filed the necessary documentation to maintain registration as an investment advisor with the Securities and Exchange Commission.

The information contained on this site is for informational purposes and should not be considered investment advice or a recommendation of any particular security, strategy or investment product. Every client situation is different. Strategic manages customized portfolios that seek to properly reflect the particular risk and return objectives of each individual client. The discussion of any investments is for illustrative purposes only and there is no assurance that the adviser will make any investments with the same or similar characteristics as any investments presented. The investments identified and described do not represent all of the investments purchased or sold for client accounts. Any representative investments discussed were selected based on a number of factors including recent company news or earnings release. The reader should not assume that an investment identified was or will be profitable. All investments contain risk and may lose value. There is no assurance that any investments identified will remain in client accounts at the time you receive this document.

Some of the material presented is based upon forward-looking statements, information and opinions, including descriptions of anticipated market changes and expectations of future activity. Strategic Financial Services believes that such statements, information, and opinions are based upon reasonable estimates and assumptions. However, forward-looking statements, information and opinions are inherently uncertain and actual events or results may differ materially from those reflected in the forward-looking statements. Therefore, undue reliance should not be placed on such forward-looking statements, information and opinions.

No content on this website is intended to provide tax or legal advice. You are advised to seek advice on these matters from separately retained professionals.

All index returns, unless otherwise noted, are presented as price returns and have been obtained from Bloomberg. Indices are unmanaged and cannot be purchased directly by investors.

Doug Walters

Doug Walters