Q2 2020: A Juxtaposition

With stocks signaling recovery while a health and economic crisis drags on, investors need to be prepared both physically and mentally for whatever the future may hold.

Contributed by Doug Walters , Max Berkovich , ,

Much has changed in the past three months, and much has not. On the one hand, the stock market has rallied off its March lows and is within striking distance of February’s peak. On the other, the economy is still reeling from COVID-19, which continues to spread in the U.S., leaving many Americans out of work or working from home. This juxtaposition is ever-present as we present our take on the second quarter of 2020 and provide the playbook going forward.

Dissecting Q2 2020

The only thing as breathtaking as the decline of equities in the first quarter was the sharp rebound in the second. Stocks fell 30% from the beginning of the year to the March trough, only to rise 40% by the end of the second quarter. Investors breathed a collective sigh of relief, though not all segments of the market had as much reason to cheer.

Challenges for Small-Cap Value

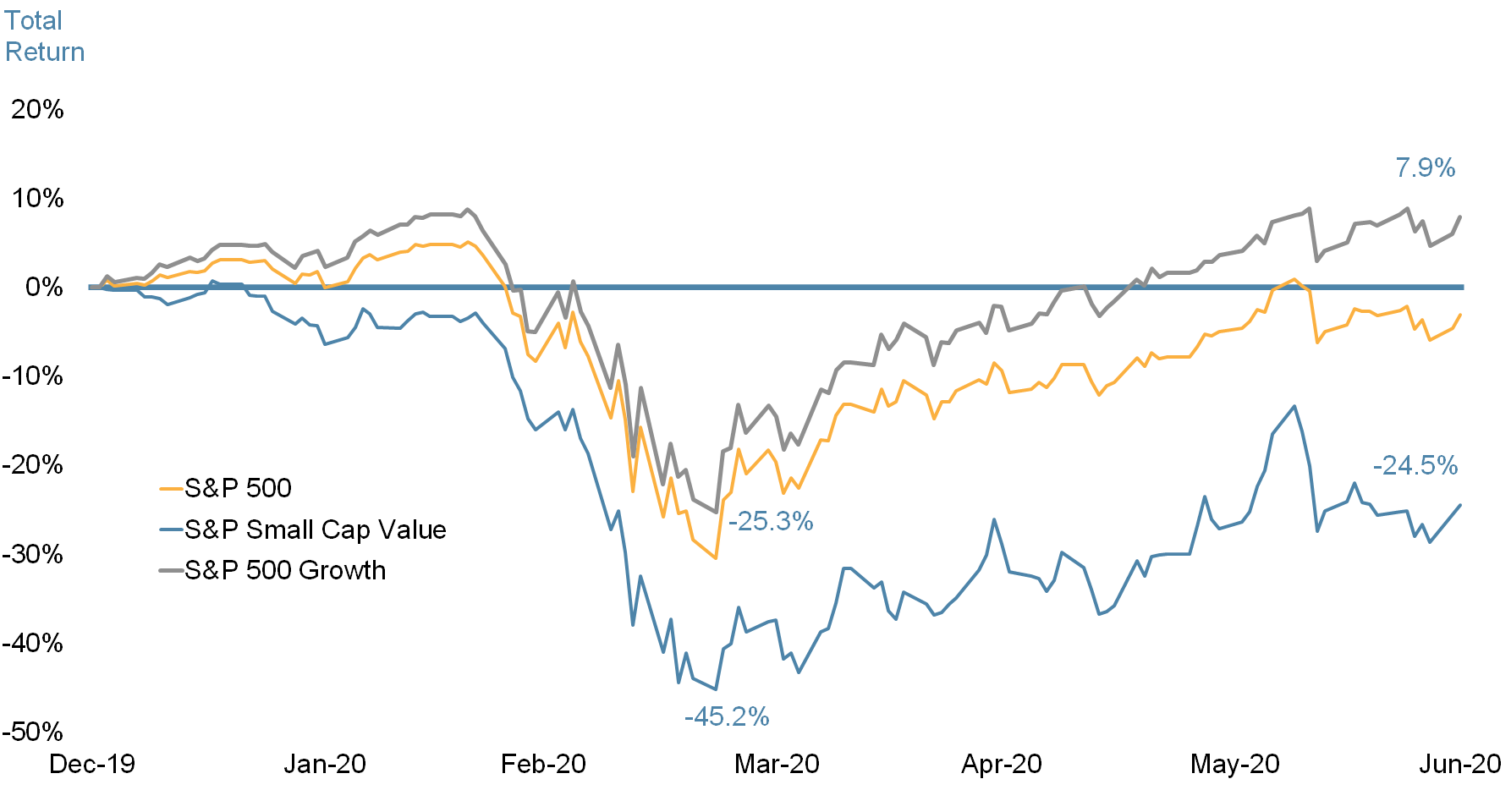

During the first quarter market decline, we saw a 20% gap open between Large-Cap Growth performance and Small-Cap Value. Investors were likely concerned that the COVID-19 crisis would disproportionately hurt smaller, more poorly capitalized companies. Even though Small-Cap Value stocks rose in the second quarter, they again lagged their Large-Cap Growth counterparts leading to a first half of the year underperformance of 32%!

CHART 1: STOCKS REBOUND, LED BY LARGE CAP GROWTH

As markets rebounded from the March 23rd trough, the performance gap between Large Cap Growth and Small Cap Value widened further.

Source: Factset

Good Momentum

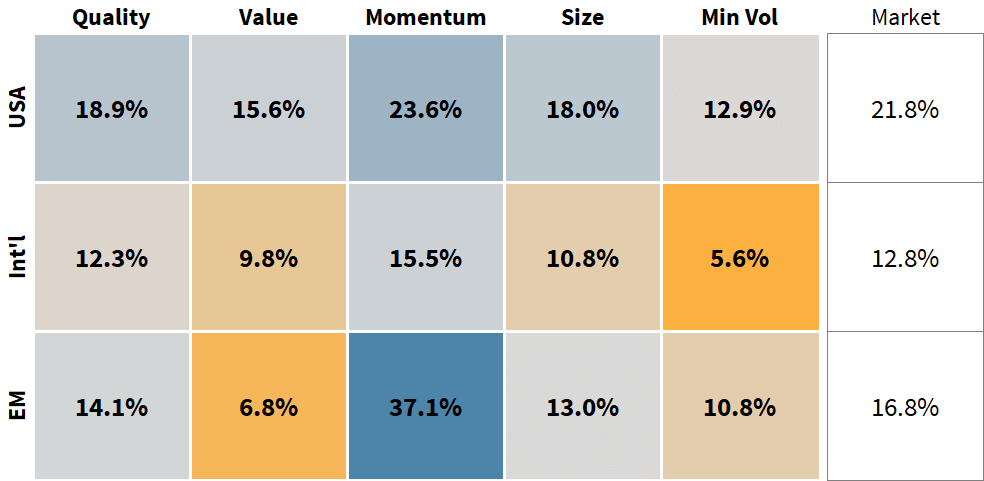

Historically, five stock factors have been persistently rewarded: Good Value, High Quality, High Momentum, Small Size, and Minimum Volatility. As the market rebounded, Momentum was the only factor to outperform the broader market. What do we mean by “Momentum” stocks? These are equities that have recently outperformed. Historically, recent success has been a reliable predictor of future success. As Newton might say, a stock in motion tends to stay in motion.

In a typical recovery, we would also expect Small-Cap and Value stocks to benefit, but they have yet to come into favor as COVID-19 newsflow remains challenging.

The chart below shows these factor dynamics were consistent across the globe. It also highlights that U.S. stocks meaningfully outperformed developed and emerging international stocks.

Chart 2: Momentum was the best performing factor

The Momentum factor outperformed across the globe as the market rebound picked up the pace. U.S. equities significantly outperformed International.

Source: Factset

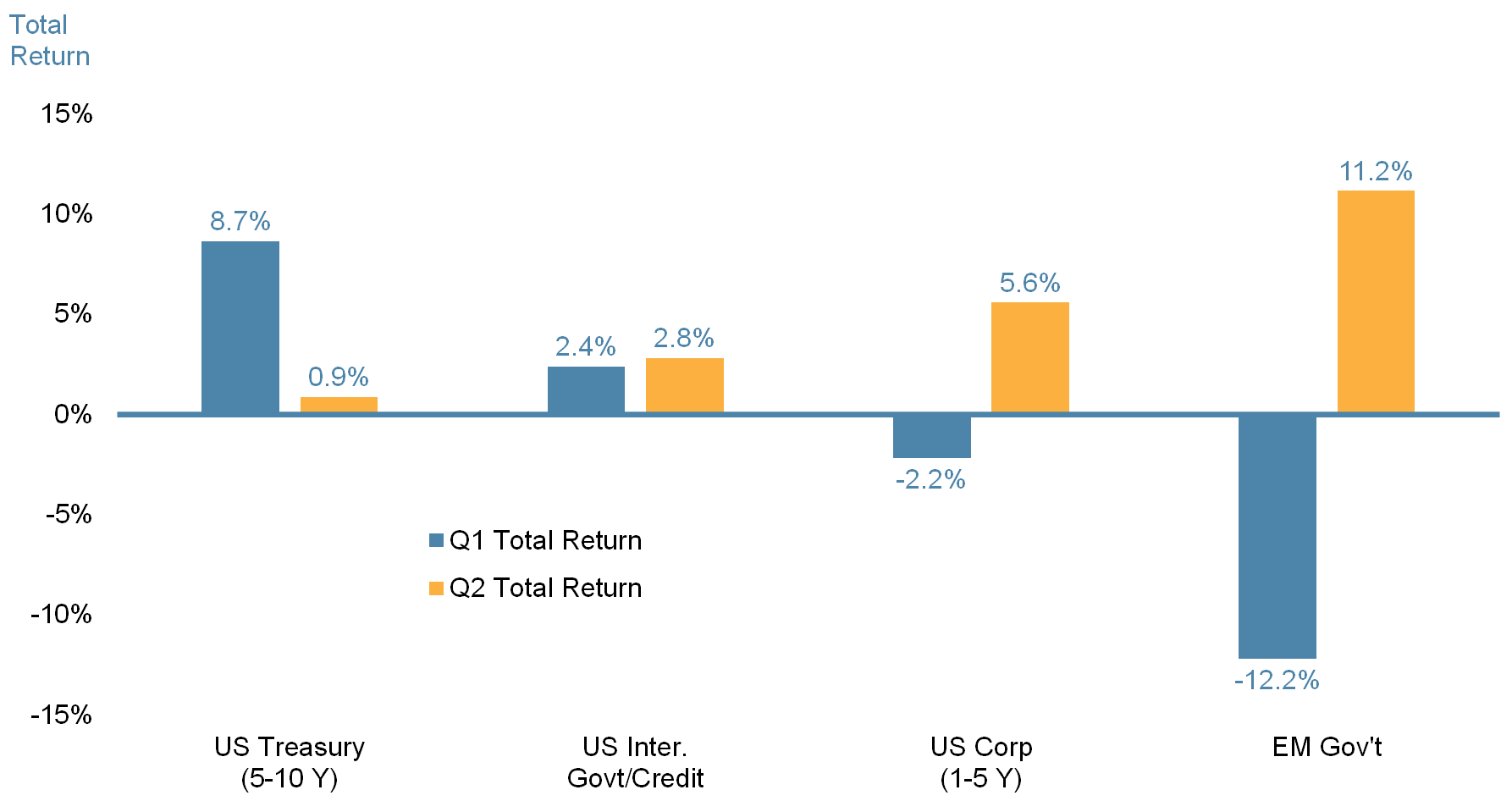

Getting Credit

Treasuries had a stellar first quarter, but it was riskier bond categories that outperformed in the second, clawing back returns as pandemic fears eased. In particular, corporate bonds were notably strong, as were emerging market bonds. Longer duration issues were in favor, thanks to continued low interest rates.

The Fed did its part to maintain civility in the markets. In addition to keeping the Fed Funds Rate near zero, they were able to restore liquidity through direct bond purchases and purchases of corporate bond ETFs.

CHART 3: RISKIER BONDS REBOUNDED

Bond returns were generally positive, with risker bonds, such as Emerging Markets and High Yield, outperforming. Treasuries could not repeat the stellar returns of Q1 but held onto first quarter gains.

Source: Bloomberg Barclays Indices

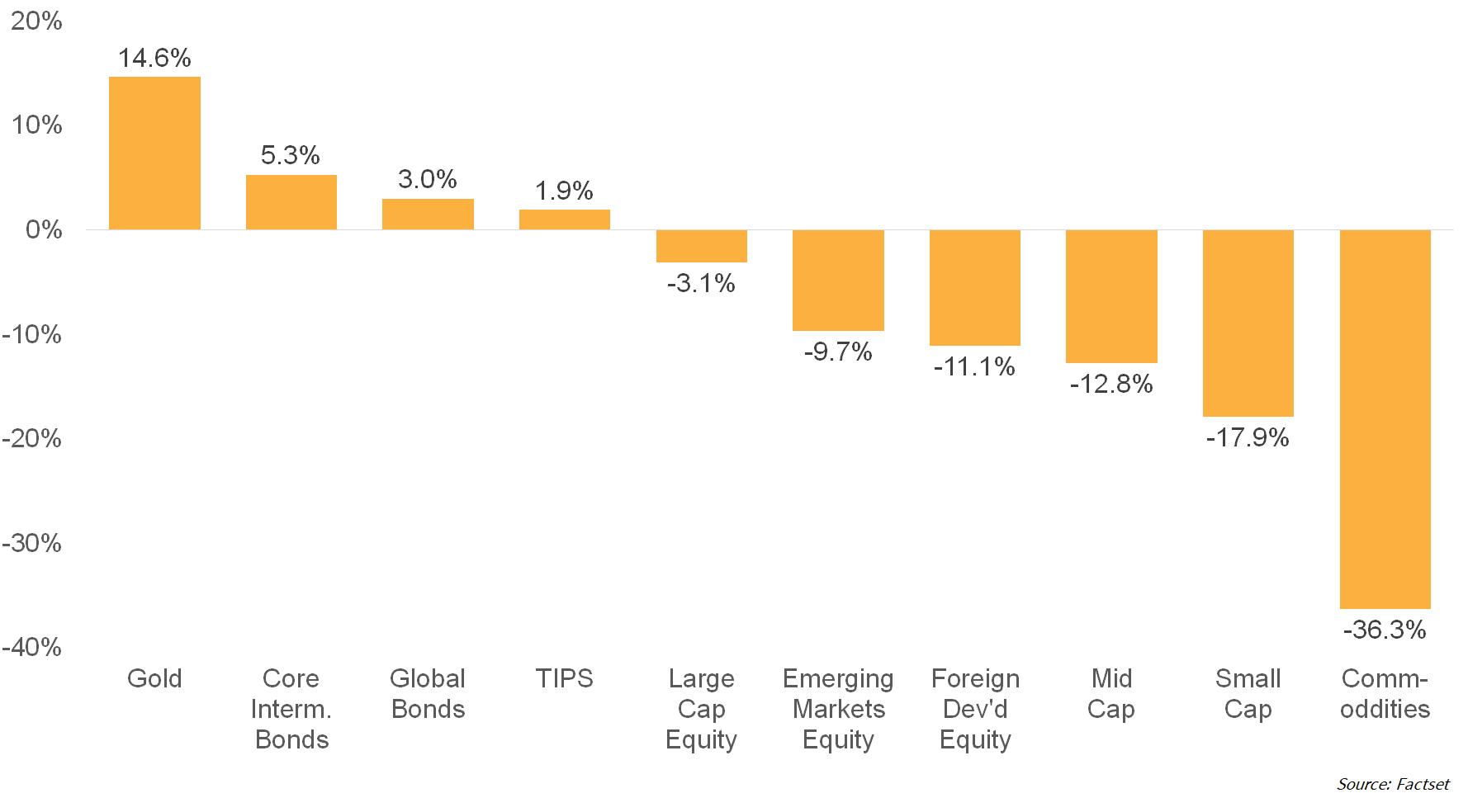

Year-to-Date Asset Roundup

Despite the second quarter rally in equities, it is “Protection” assets that top the year-to-date performance leaderboard. Gold is the best performing asset, with several bond categories also putting in a positive performance. During equity bull markets, investors often begin to question the value of the other diversifying assets in their portfolio. It is times like these that their value shines.

CHART 4: GROWTH ASSETS ARE TRAILING PROTECTION YEAR-TO-DATE

Gold and bonds provided protection and a rebalancing lever for diversified portfolios. Commodities remained challenged.

Source: Factset

“Those who have knowledge, don’t predict. Those who predict, don’t have knowledge.”

– Lao Tzu

The Q2 2020 Playbook

We started with the juxtaposition of a stock market near all-time highs and a health and economic crisis whose outcome is far from clear. We sit amidst these two conflicting signals with the sense that uncertainty is high. But if there is one lesson that the COVID-19 crisis can teach investors it is that we are always in a heightened state of uncertainty. Even when the economy is strong and the outlook rosy, another crisis could be hidden just out of sight, looming on the horizon. Likewise, today’s crisis could end in short order with the announcement of a pharmaceutical breakthrough. The point is uncertainty reigns.

Given that the future is unknowable, we believe an investor’s energy is always best spent preparing for it, not predicting it. As we discussed in our recent webinar (replay below), preparation comes in two forms, physical and mental.

Physical Preparation

- Construct a well-diversified portfolio consistent with your risk tolerance

- Fill the portfolio with evidence-based rewarded factors at the core

- Institute well-researched processes to systematically rebalance, identify allocation opportunities and harvest tax losses

Mental Preparation

- Understand and become comfortable with the risks inherent in your portfolio, so market declines come as no surprise

- Be aware of the behavioral biases that plague humans as investors and are proven to damage long-term returns. Some examples:

- Risk aversion: can lead to panic selling in market downturns

- Overconfidence: can lead to market timing and speculation

- Disposition effect: can lead to unsubstantiated selling of winners and holding on to losers too long

- Confirmation bias: can lead to failure to see evidence contrary to your beliefs

We are here to help our clients with both the physical and mental preparation needed to give them the best chance for long-term investing success.

The stock market may have rallied significantly in recent weeks, but we recognize these are very challenging times for many. We thank our clients for the trust you have put in us, and we look forward to continuing to partner with you through whatever the future holds.

About Strategic

Founded in 1979, Strategic is a leading investment and wealth management firm managing and advising on client assets of over $2 billion.

OverviewDisclosures

Strategic Financial Services, Inc. is a SEC-registered investment advisor. The term “registered” does not imply a certain level of skill or training. “Registered” means the company has filed the necessary documentation to maintain registration as an investment advisor with the Securities and Exchange Commission.

The information contained on this site is for informational purposes and should not be considered investment advice or a recommendation of any particular security, strategy or investment product. Every client situation is different. Strategic manages customized portfolios that seek to properly reflect the particular risk and return objectives of each individual client. The discussion of any investments is for illustrative purposes only and there is no assurance that the adviser will make any investments with the same or similar characteristics as any investments presented. The investments identified and described do not represent all of the investments purchased or sold for client accounts. Any representative investments discussed were selected based on a number of factors including recent company news or earnings release. The reader should not assume that an investment identified was or will be profitable. All investments contain risk and may lose value. There is no assurance that any investments identified will remain in client accounts at the time you receive this document.

Some of the material presented is based upon forward-looking statements, information and opinions, including descriptions of anticipated market changes and expectations of future activity. Strategic Financial Services believes that such statements, information, and opinions are based upon reasonable estimates and assumptions. However, forward-looking statements, information and opinions are inherently uncertain and actual events or results may differ materially from those reflected in the forward-looking statements. Therefore, undue reliance should not be placed on such forward-looking statements, information and opinions.

No content on this website is intended to provide tax or legal advice. You are advised to seek advice on these matters from separately retained professionals.

All index returns, unless otherwise noted, are presented as price returns and have been obtained from Bloomberg. Indices are unmanaged and cannot be purchased directly by investors.

Doug Walters

Doug Walters