Q1 2021: A Cautionary Tale

There is much for investors to celebrate as we exit the first quarter of 2021. But we caution against those that are turning that euphoria into irrational exuberance.

Contributed by Doug Walters , Max Berkovich , ,

The resilience of the stock market rally has continued into 2021 much to the delight of investors. That euphoria has started to spill over into other tangential assets, creating potential mines for the errant investor to step on. As we look toward a pandemic recovery, we encourage investors to stay the course and enjoy all that a well-diversified, evidence-based, portfolio has to offer.

Disecting Q1 2021

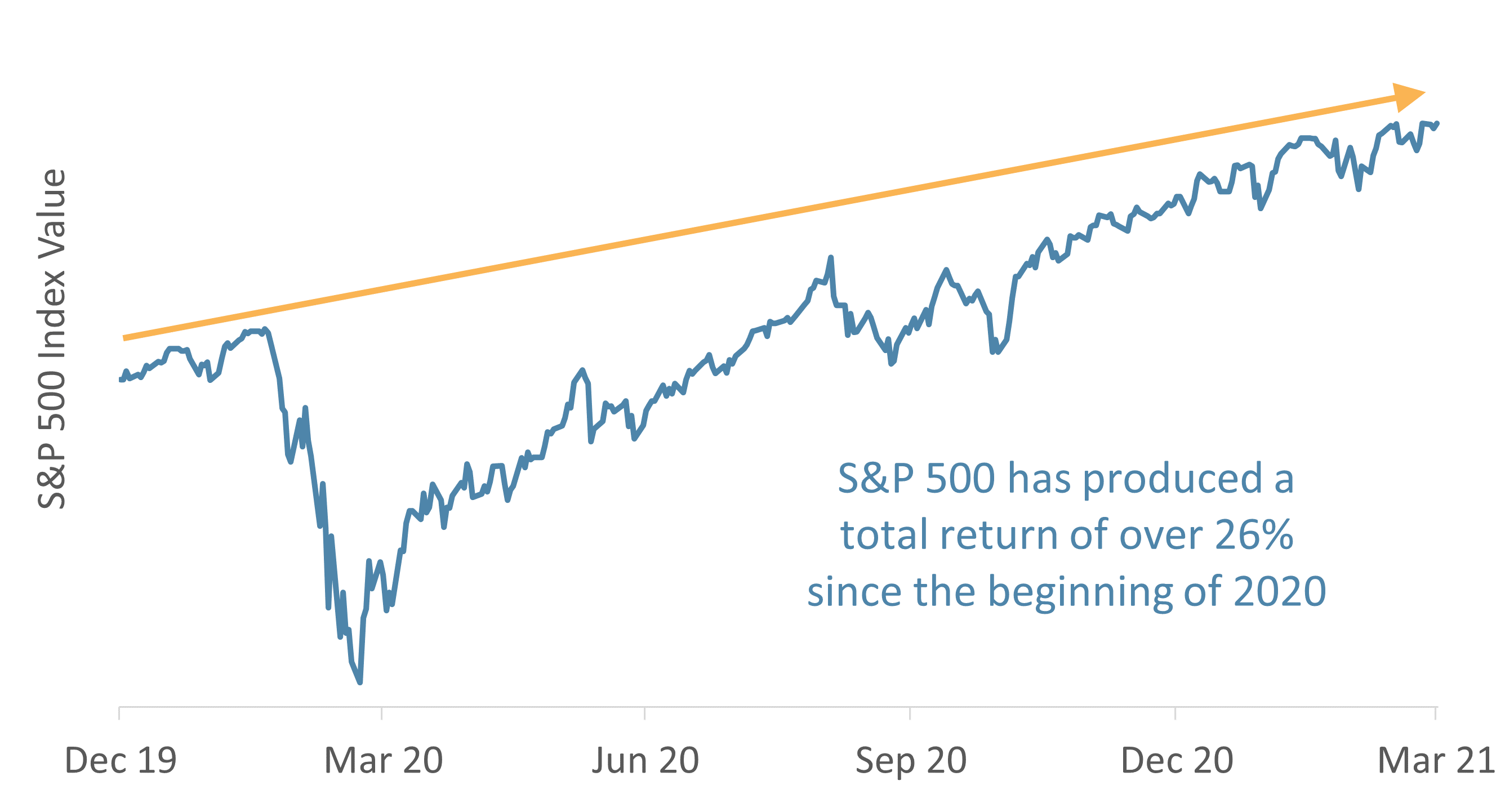

It is hard to look at the first quarter of 2021 without putting into perspective where we have come from in 2020. U.S. stocks are up over 80% from their pandemic lows, and since the beginning of last year, stocks are up over 26%. Not bad considering the massive damage imparted on the economy from the pandemic. Investors can thank stimulus, which has been a constant wind at the back of investors, coming in the form of:

- Liquidity injections and historically low-interest rates from the Federal Reserve,

- Six stimulus bills from Congress, putting money in the hands of those most impacted by the pandemic, and

- The promise of a large infrastructure stimulus bill from the White House.

chart 1: A resilient rally thanks to stimulus

U.S. stocks are up over 80% from their pandemic lows, as stimulus has been a constant wind at the back of investors.

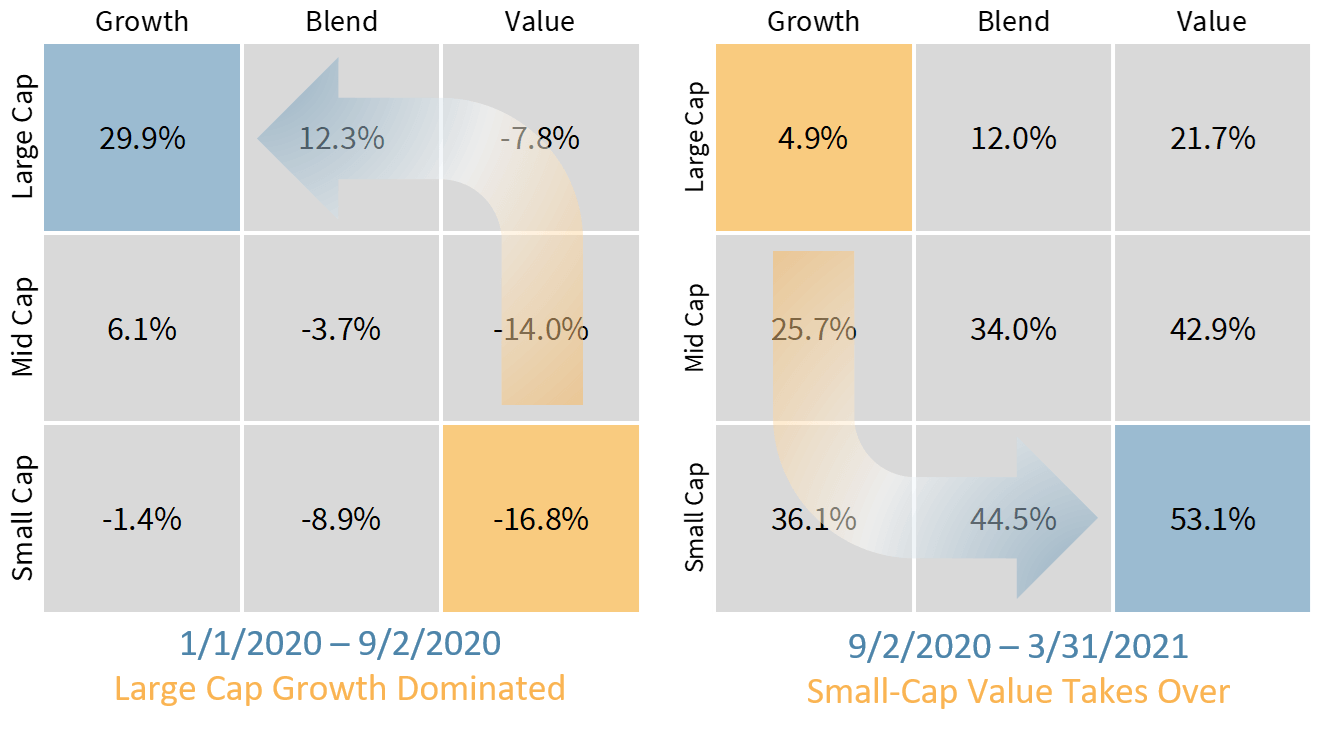

An Epic Rotation into Small-Cap Value

The pandemic has brought on stock rotations of epic proportions. Through most of 2020, Large-Cap growth stocks like Microsoft (MSFT), Amazon (AMZN), and Apple (AAPL) dominated performance. These stocks were benefiting from the dynamics of the pandemic as consumers and companies replaced in-person interactions with digital.

Beginning near the end of the third quarter of last year, market dominance rotated dramatically. As recovery from the pandemic gained steam, smaller companies, which were damaged and left behind in the economic fallout, are now showing signs of life. That momentum is continuing into 2021.

chart 2: an epic rotation

The dominance of Large-Cap Growth stocks in 2020 has been replaced by an equally impressive rotation into Small-Cap Value for the past two quarters.

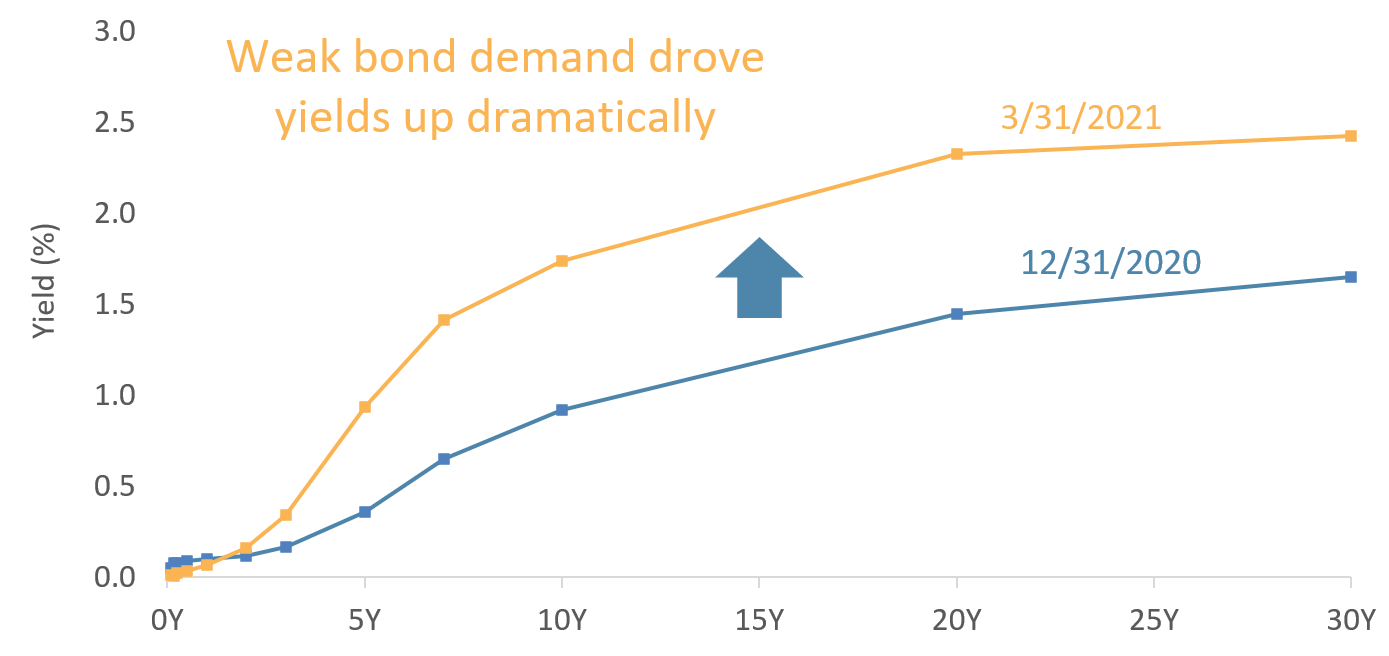

Bond Backup Challenges Stock Valuations

Bonds have been in the backseat through much of the pandemic but jumped in the driver’s seat for a time this quarter. A weak 7-Year Treasury auction kicked off a bond backup, driving up yields in a fairly dramatic fashion. Rising bond yields may be a sign of a healthier economy, but they also pressure stock valuations.

It is a balancing act for stock investors, who, on the one hand, are concerned about rising bond yields, but on the other are excited about:

- additional fiscal stimulus,

- an improving covid environment, thanks to vaccines,

- a strengthening economy, and

- a still dovish Federal Reserve.

In the end, optimism won out as stocks continued to outperform in Q1.

Chart 3: Big bond backup

Bonds have taken a turn in the driver’s seat in 2021, with weak demand driving up yields, and at times spooking equity investors.

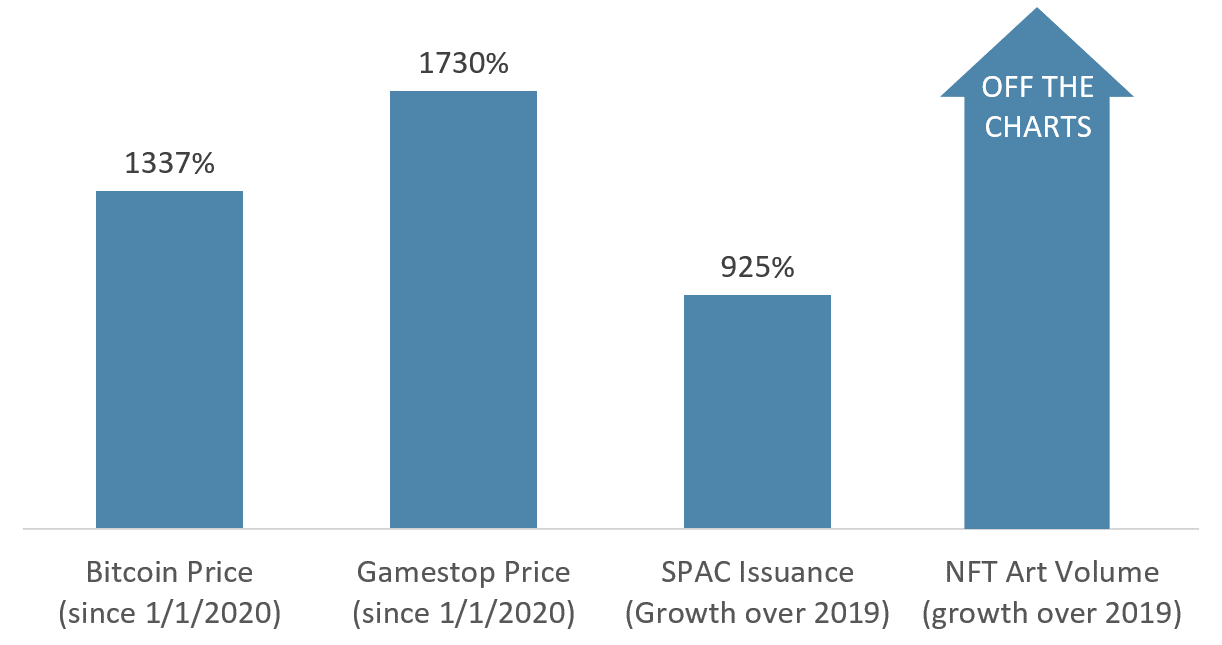

Micro Bubbles Forming in Areas of Exuberance

Despite the pandemic, easy-money policies from the Fed have created pockets of bubbles, generating euphoria for some and angst for others. Investors appear to be increasingly distracted by a growing number of “shiny objects,” including:

- SPACs,

- Retail squeeze stocks,

- Cryptocurrencies, and

- Non-fungible token (NFT) art and tradables.

At the moment, none of these appear to be a source of systemic risk for well-diversified portfolios, but it is certainly reminiscent of times past, like the dot com era. None of the above items are legitimate investments, and we caution anyone who is treating them as such.

Chart 4: Areas of exuberance

Despite the pandemic, easy money policies have created pockets of bubbles of which investors should steer clear.

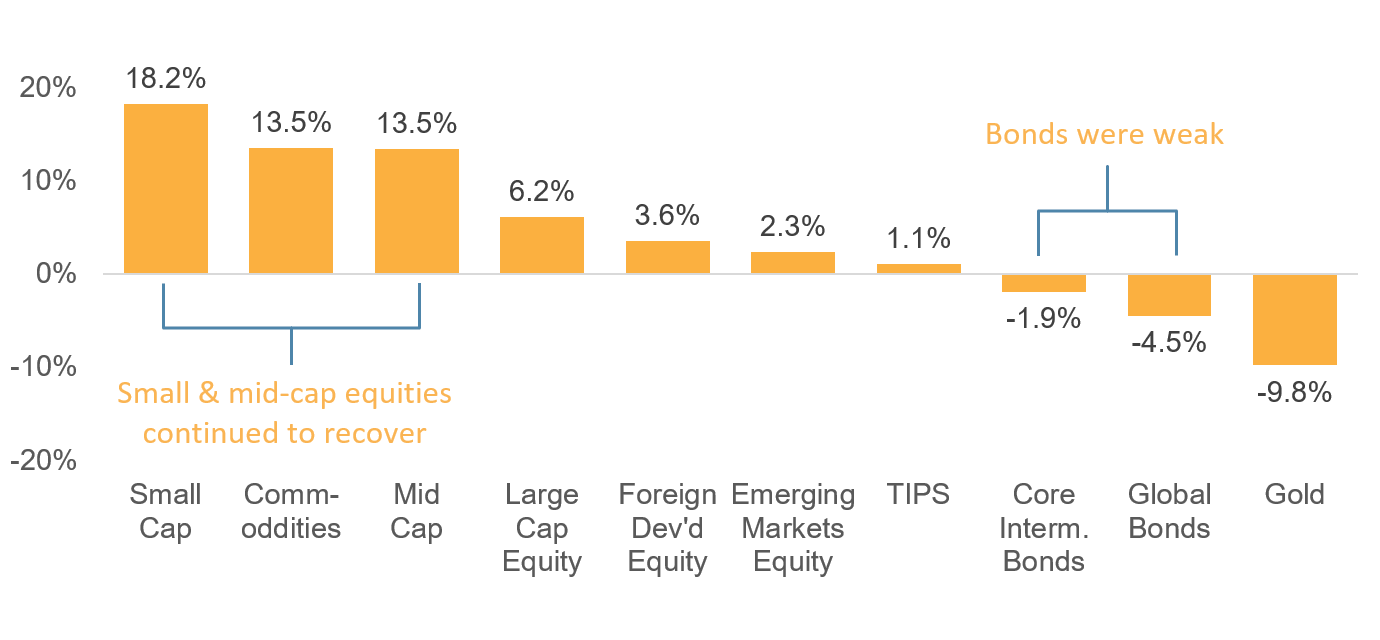

Year-to-Date Asset Roundup

Risk assets had a very good quarter, while the protection side of portfolios (bonds and gold) were weak.

- Small and Mid-Cap equities continued the momentum they built at the end of 2020 as recovery prospects improved.

- Bonds were weak in general, driving the dramatic backup in yields that we have witnessed this year.

- Gold, which was an excellent source of protection in the downturn, has cooled off in 2021.

Chart 5: Q1 2021 Asset Class Performance

A roundup of asset class performance in Q1 highlights a continued rotation into smaller equities.

The Q2 2021 Playbook

We enter 2021 with a warning: avoid the Siren’s song being sung by a growing chorus of shiny objects vying for investor’s attention. We have seen this before. We only need to go back to the dot com bubble to recall the lessons of irrational exuberance. History may not repeat itself, but it often rhymes.

The difference today, compared to 2001, is that most of these shiny objects are easily avoidable in a well-diversified portfolio. We take an evidence-based approach to investing, and none of these hold up as investments under scrutiny. For example:

- SPACs are called blank check companies for a reason. You do not know what you are buying, and the economics are tilted heavily in favor of the wealthy private equity funds and celebrities that issue them.

- Cryptocurrencies are largely unregulated, have no insurance safeguards, and have no fundamental underpinning value.

- Retail squeeze stocks are market manipulation with a value not justified by the economics of the underlying businesses.

- NFT art and tradables are nothing more than speculative hobbies, not investments.

As we look forward to the rest of the year, we encourage investors to stay focused on science, not speculation. Act on evidence, not emotion. This year is likely to be full of cautionary tales as risk appetites continue to rise. We have already seen one in Archegos Capital Management. One of the country’s wealthiest individuals appears to have lost everything in a matter of a few days through leverage and greed.

Avoiding this fate is not hard. We believe in taking a simple approach to investing. Simple does not mean unsophisticated, but it does mean:

- Knowing what you own,

- Knowing how much it is worth, and

- Being able to sell it whenever you need it.

The past year has been challenging on many fronts, but we have enjoyed the strength of the partnerships with our clients. Brighter days are ahead, and we look forward to being able to meet with many of you in person again.

About Strategic

Founded in 1979, Strategic is a leading investment and wealth management firm managing and advising on client assets of over $2 billion.

OverviewDisclosures

Strategic Financial Services, Inc. is a SEC-registered investment advisor. The term “registered” does not imply a certain level of skill or training. “Registered” means the company has filed the necessary documentation to maintain registration as an investment advisor with the Securities and Exchange Commission.

The information contained on this site is for informational purposes and should not be considered investment advice or a recommendation of any particular security, strategy or investment product. Every client situation is different. Strategic manages customized portfolios that seek to properly reflect the particular risk and return objectives of each individual client. The discussion of any investments is for illustrative purposes only and there is no assurance that the adviser will make any investments with the same or similar characteristics as any investments presented. The investments identified and described do not represent all of the investments purchased or sold for client accounts. Any representative investments discussed were selected based on a number of factors including recent company news or earnings release. The reader should not assume that an investment identified was or will be profitable. All investments contain risk and may lose value. There is no assurance that any investments identified will remain in client accounts at the time you receive this document.

Some of the material presented is based upon forward-looking statements, information and opinions, including descriptions of anticipated market changes and expectations of future activity. Strategic Financial Services believes that such statements, information, and opinions are based upon reasonable estimates and assumptions. However, forward-looking statements, information and opinions are inherently uncertain and actual events or results may differ materially from those reflected in the forward-looking statements. Therefore, undue reliance should not be placed on such forward-looking statements, information and opinions.

No content on this website is intended to provide tax or legal advice. You are advised to seek advice on these matters from separately retained professionals.

All index returns, unless otherwise noted, are presented as price returns and have been obtained from Bloomberg. Indices are unmanaged and cannot be purchased directly by investors.

Doug Walters

Doug Walters