Strategic Perspectives

As we all prepare to celebrate our nation’s birthday with picnics and fireworks, we take a look back at the most significant trends of the second quarter of the year. Britain’s declaration of EU independence was by no means the only notable story.

U.S. Economy

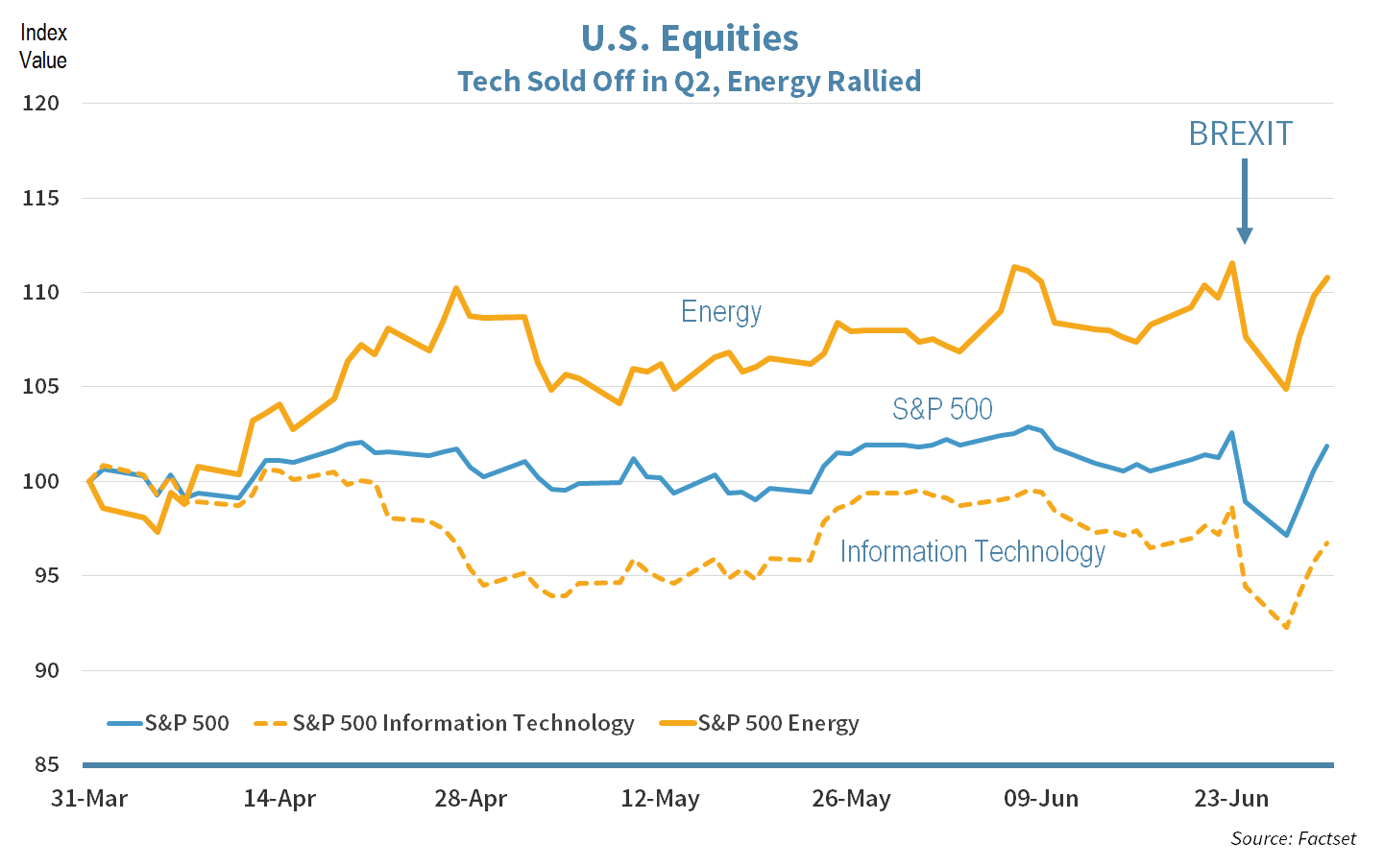

In Q2 the defining market factor was Brexit, with the sentiment shifting from “risk on” to “risk off” overnight on the exit vote.

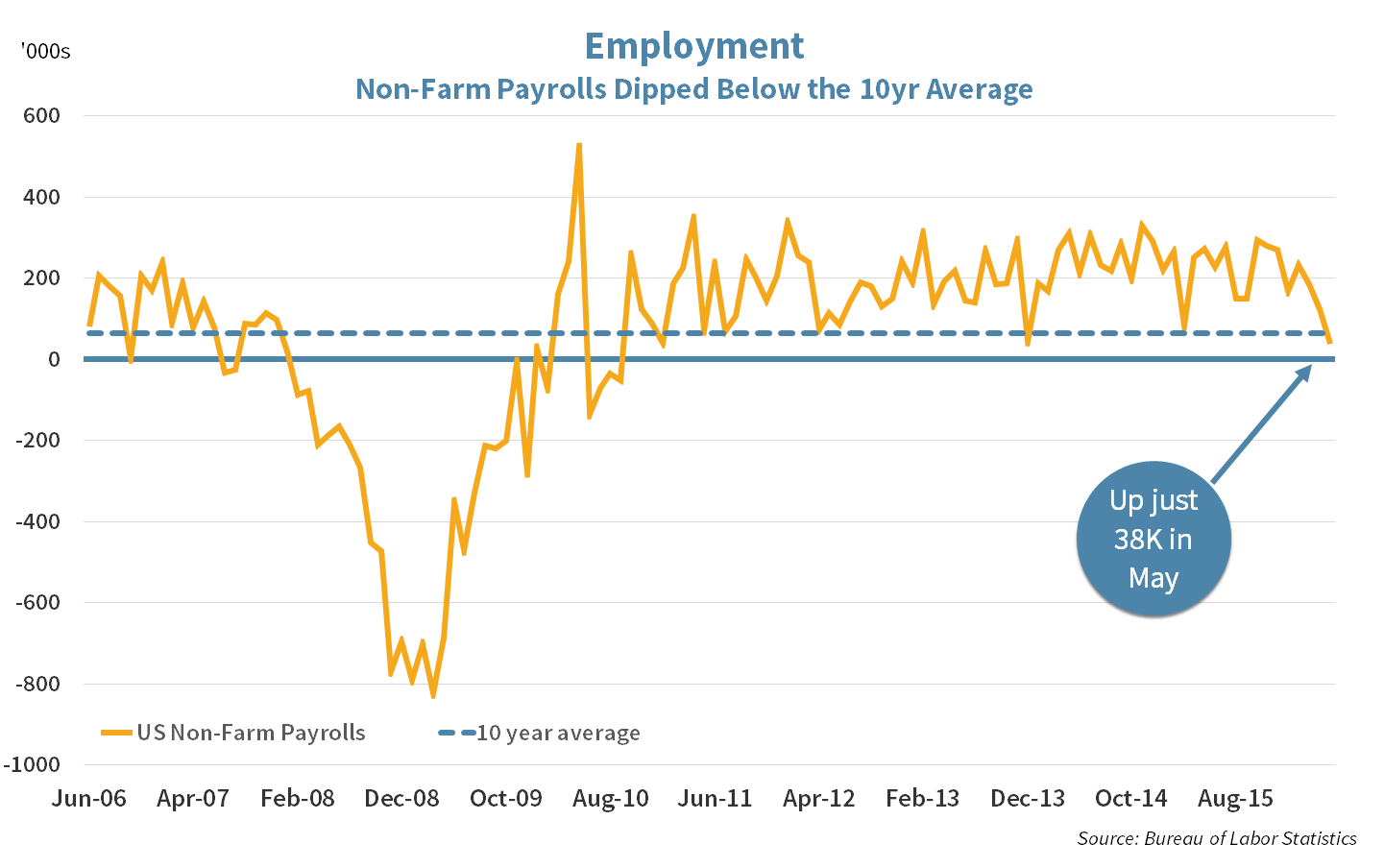

However, as the shock of the referendum fades, investors in the U.S. will likely turn their attention back to domestic matters, including signs of weakness in the employment data.

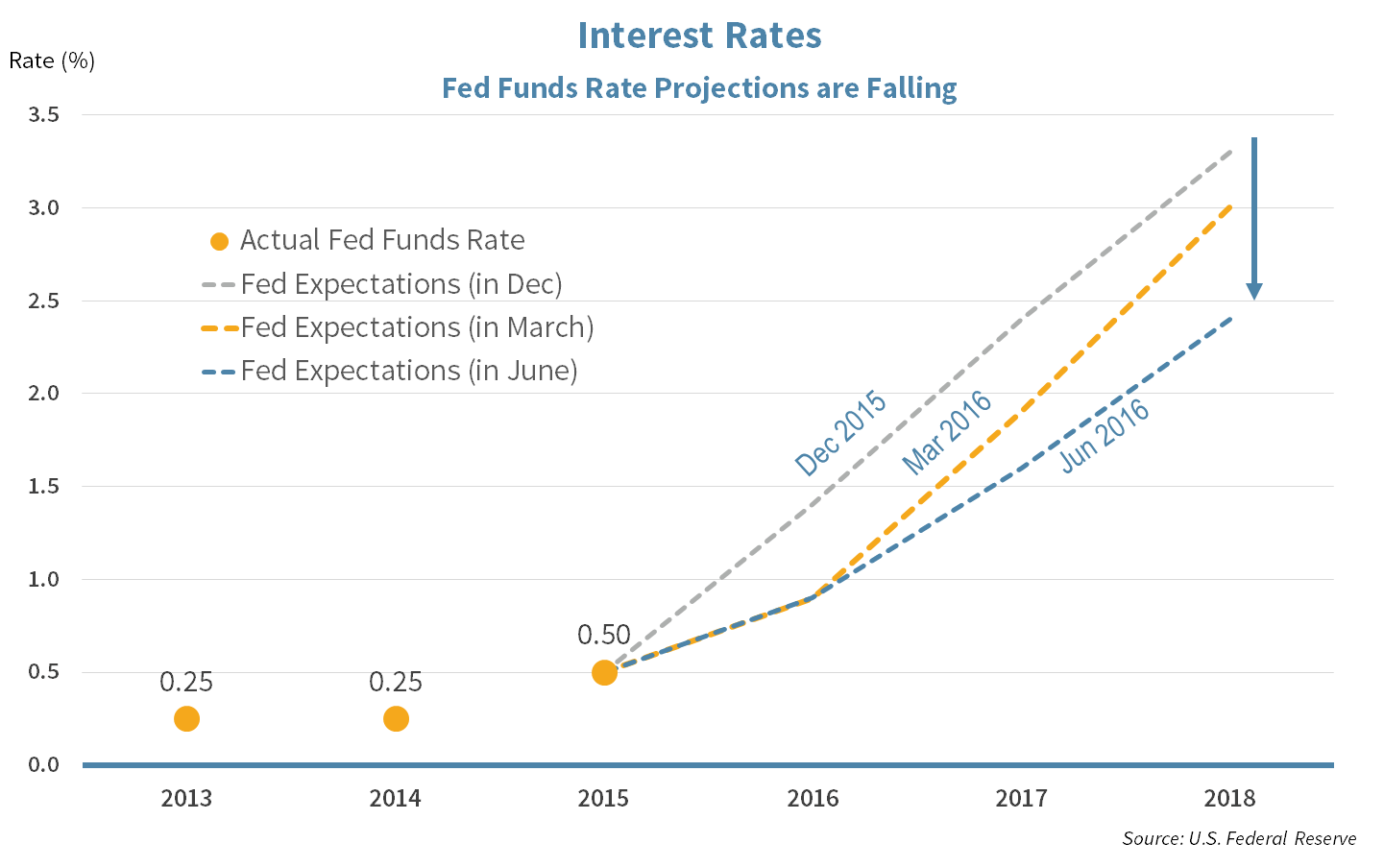

The Fed has already opined their belief that the employment weakness is temporary. Yet they were not confident enough in that assessment to proceed with a June rate rise. It was not too long ago that a June hike looked inevitable.

Following Brexit, and the uncertainty that that brings to the Economies of Europe, it is hard to imagine the U.S. Fed Funds rate rising in 2016, and even 2017 is in question.

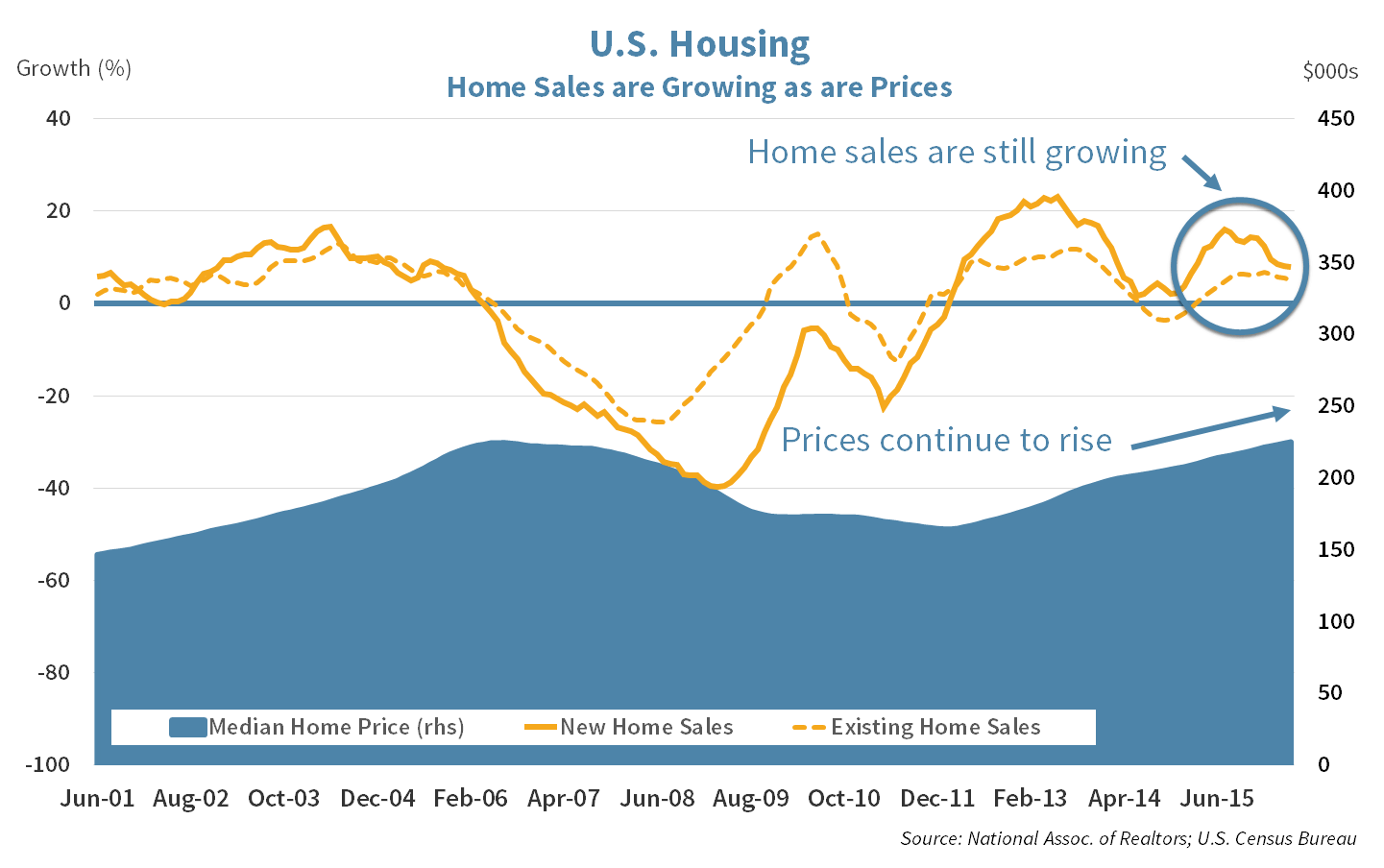

The bright spot in the U.S. economy has been housing. Sales of both existing and new homes are growing thanks in part to attractive mortgage rates. In addition median home prices continue to rise, providing consumers with a source of confidence.

International Economy

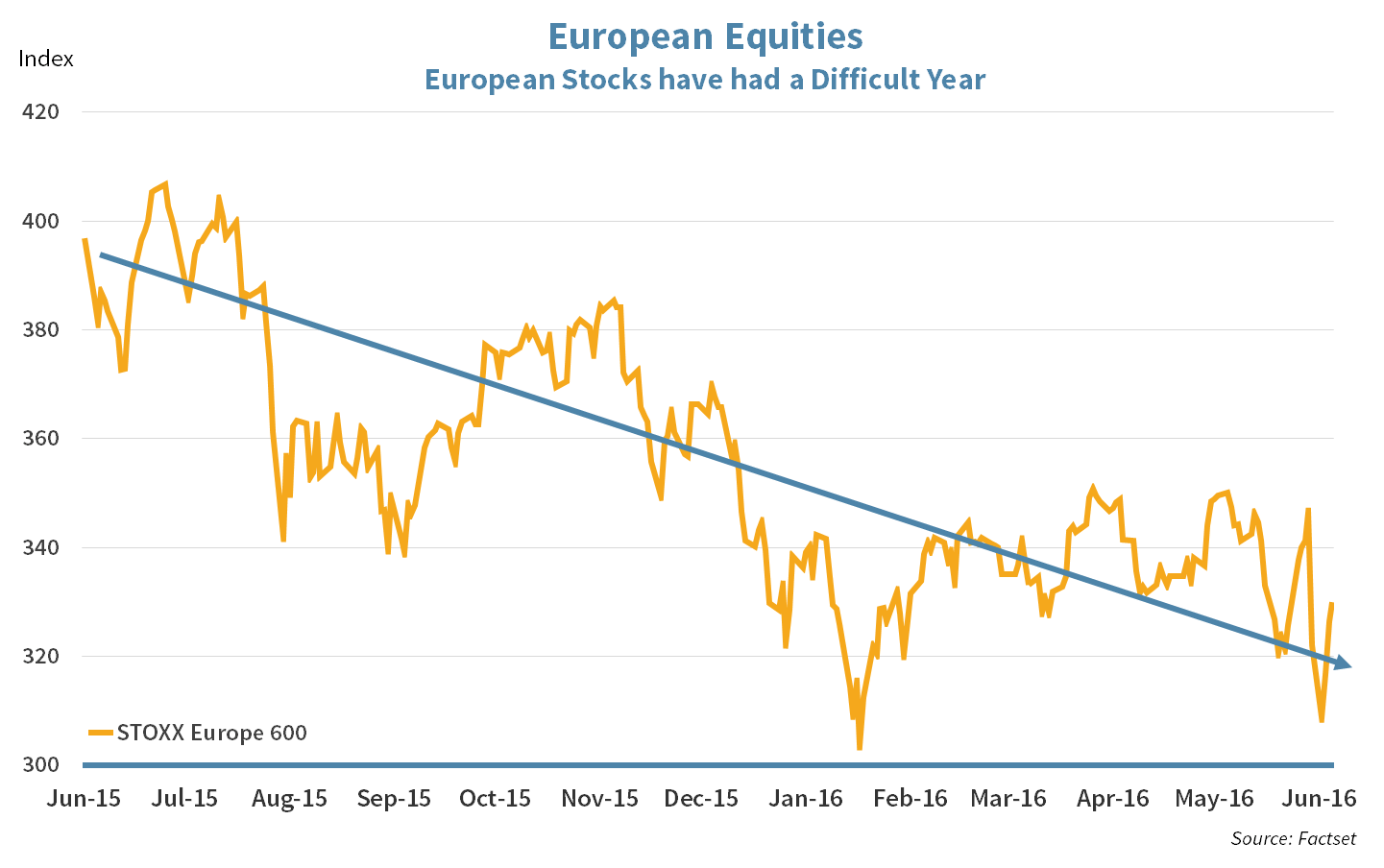

Global markets have been rattled by the uncertainty that comes with Britain’s decision to leave the European Union.

- The German stock index DAX was down 7% the day of Brexit and 19% over one year. With greater uncertainty and a possible domino effect of EU nations deciding leave, European weakness is set to continue. A domino effect would not only create economic risk but currency risk as well due to other EU members sharing a singular Euro currency.

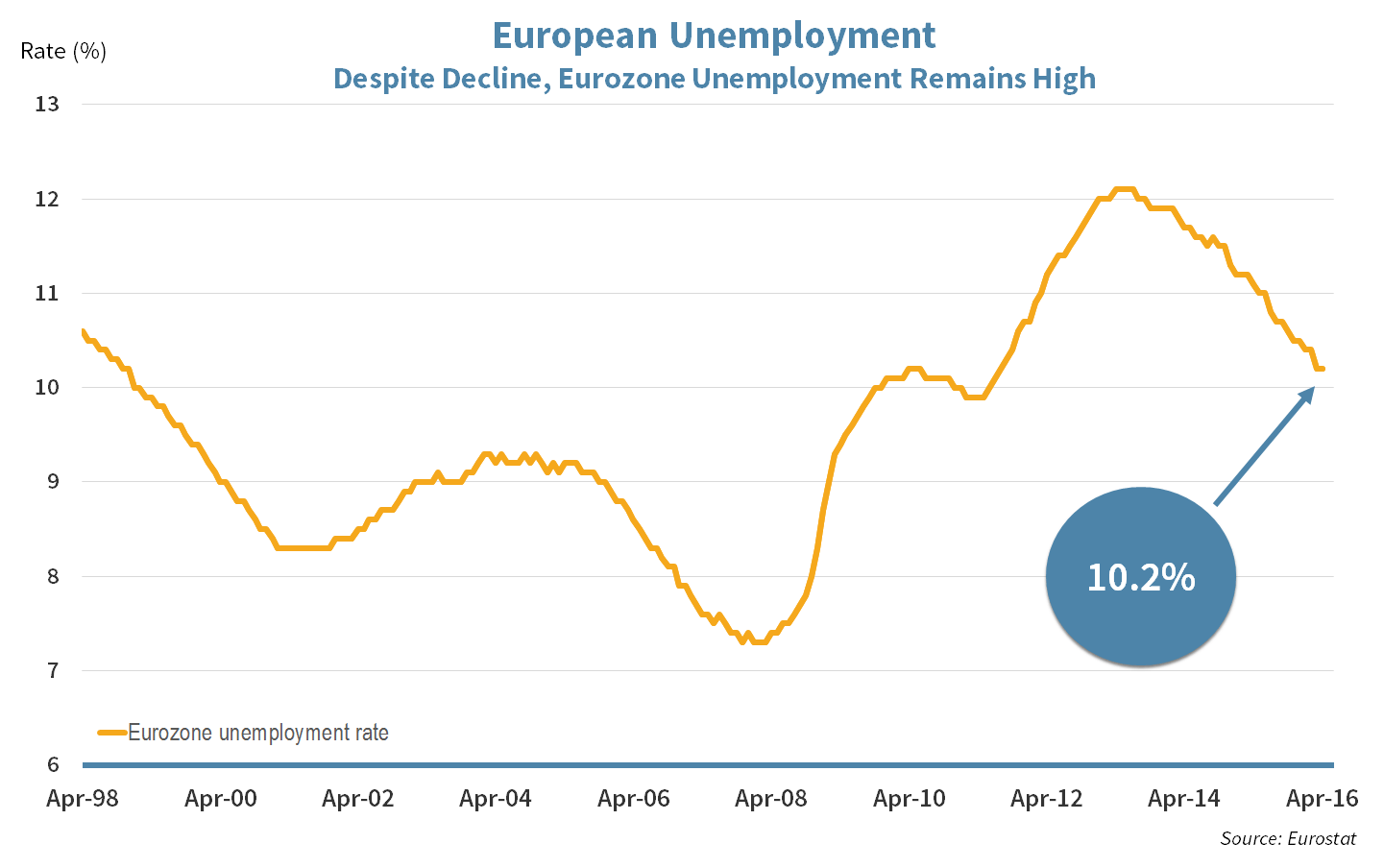

- Although below it’s peak of 12.1%, the Eurozone unemployment rate remains high at 10.2% creating anxiety within its societies and providing fuel for populist parties.

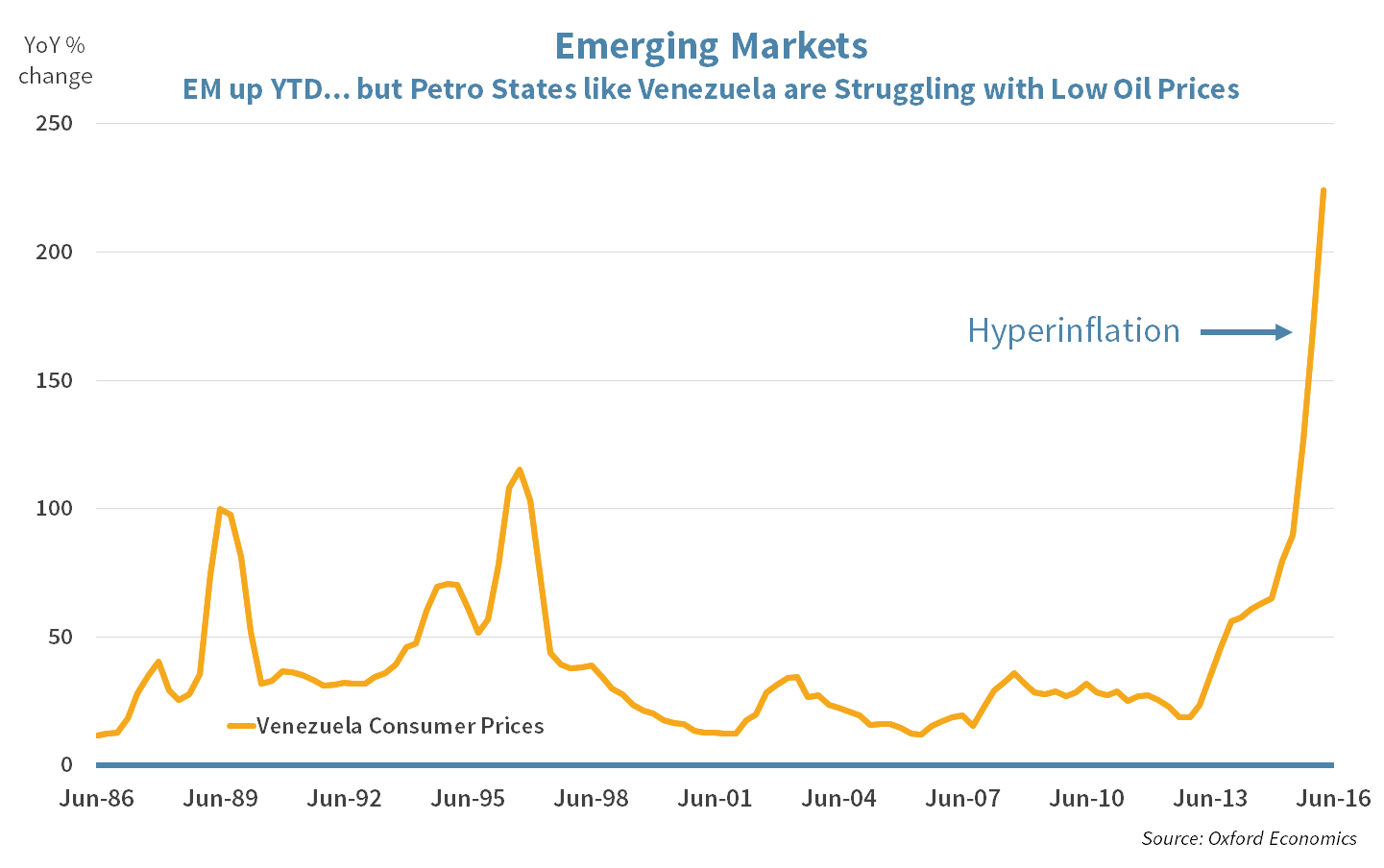

Meanwhile, petro-states around the world are feeling the impact from lower oil prices with OPEC countries reporting a 10 year low in revenue.

- The slump is most pronounced in Venezuela. While inflation has historically been a national problem, it has reached hyper levels with the lack of incoming foreign oil sales.

- India remains a bright spot as multinational companies continue to invest billions of USD in the emerging market.

Core Equities

Brexit derailed what was on track to be a decent quarter for equities. Prior to the announcement of the referendum results, the atypical pairing of Value and Small Cap were outperforming.

The Brexit vote came with just a few trading days remaining in Q2, however, its impact was felt broadly. Within Core Equities, the implications were:

- Underperformance of Value stocks. Financials make up the largest portion of the value index. Banks were disproportionately impacted by the Brexit vote, with many of them down 6-9% on the day after the vote.

- Pullback in the Technology sector. The impact of the decline in the Tech sector was almost as great as that of Financials. This appears to be a broad-brush “risk-off” shift, and could result in meaningful opportunities for active investors at the stock level.

Our thesis this year has been for elevated volatility with opportunities for disciplined active investors. While we did not see Brexit coming any more than anyone else did, the result fit well with our expectations.

Our focus remains on quality investments that we expect to weather the turbulence, combined with thoughtful rebalancing when volatility creates attractive valuation opportunities.

Core Fixed income

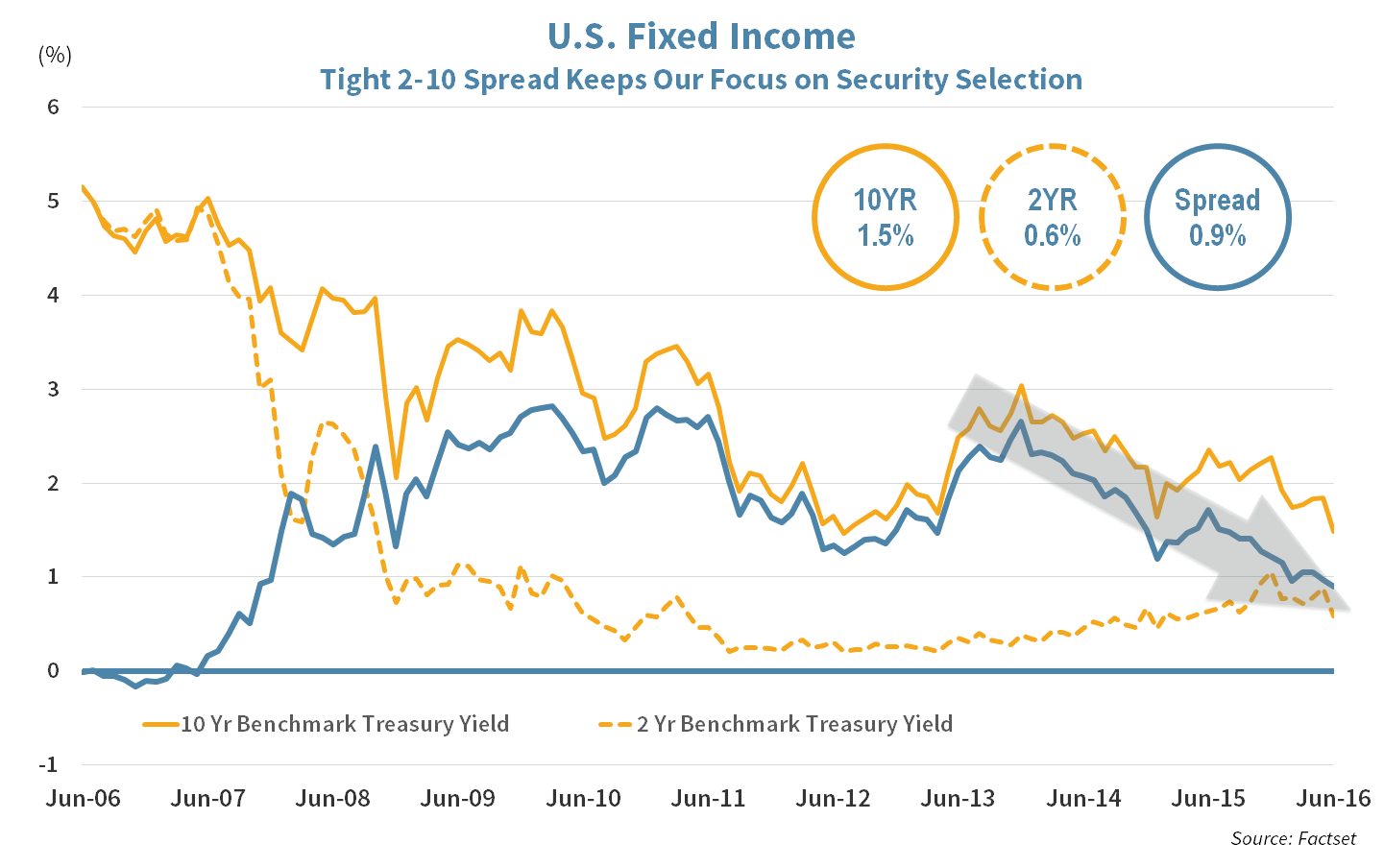

Market expectations for further rate hikes fizzled in Q2 thanks to a less than stellar non-Farm Payroll report for May. In fact the 10yr Treasury touched 1.47% yield after the “Brexit” vote. Expectations for the next rate rise have not only taken 2016 out of the equation, but put 2017 rate hike(s) into question as well.

- U.S. treasury ended the quarter at the year’s lows, flirting with the all-time lows of July 2012.

- The 2yr and 10yr spread, at around 0.90%, provides little incentive to extend maturities.

- While the U.S. rate hikes may be on hold for now, the rest of the world goes the other way. Negative interest rates continue to get even more negative. With the German 10 year Bund joining the club.

- Diversifying asset classes in Fixed Income continue to lead the way, with TIPS and International outpacing Core Bonds by a noticeable margin.

- The chase for yield continues as High Yield has outpaced Investment Grade. This continues despite an increase in defaults from weak energy and materials companies. We see neither quality nor value in the space.

We continue to focus on security selection within the highest echelon of credit to generate yield rather than extending duration.

Asset Allocation

Gold once again proved its value as a diversifier, rallying on the unexpected result of the British exit referendum, while other risk assets went into retreat.

- With the market entering a clear “risk off” environment in the wake of Brexit, investors preferred the relative certainty of income over growth. As a result, amongst equities, Value outperformed Growth, and REITs were a helpful source of diversification to core U.S. Large Cap Equities.

- The sell-off following the Brexit referendum had the greatest impact in our international diversifiers. Worst hit was Foreign Developed Equity. Although the biggest country exposure in this segment of our holdings is Japan, overall Europe is the dominate exposure, which has dragged the asset class down. Also keep an eye on Emerging Markets, as any slowdown in global activity as a result of Brexit will be a negative for these regions.

- Fixed Income outperformed equities as investors favored their relative safety. Core Bonds in particular did well, as well as Inflation Protected Securities.

Going forward, we favor the quality of U.S. Equities, but continue to watch the valuation of International Markets which has improved in the aftermath of the Brexit vote. The diversification allows us to capitalize on the current strength of fixed income and gold, and thoughtful rebalance into the recent weakness seen equities.

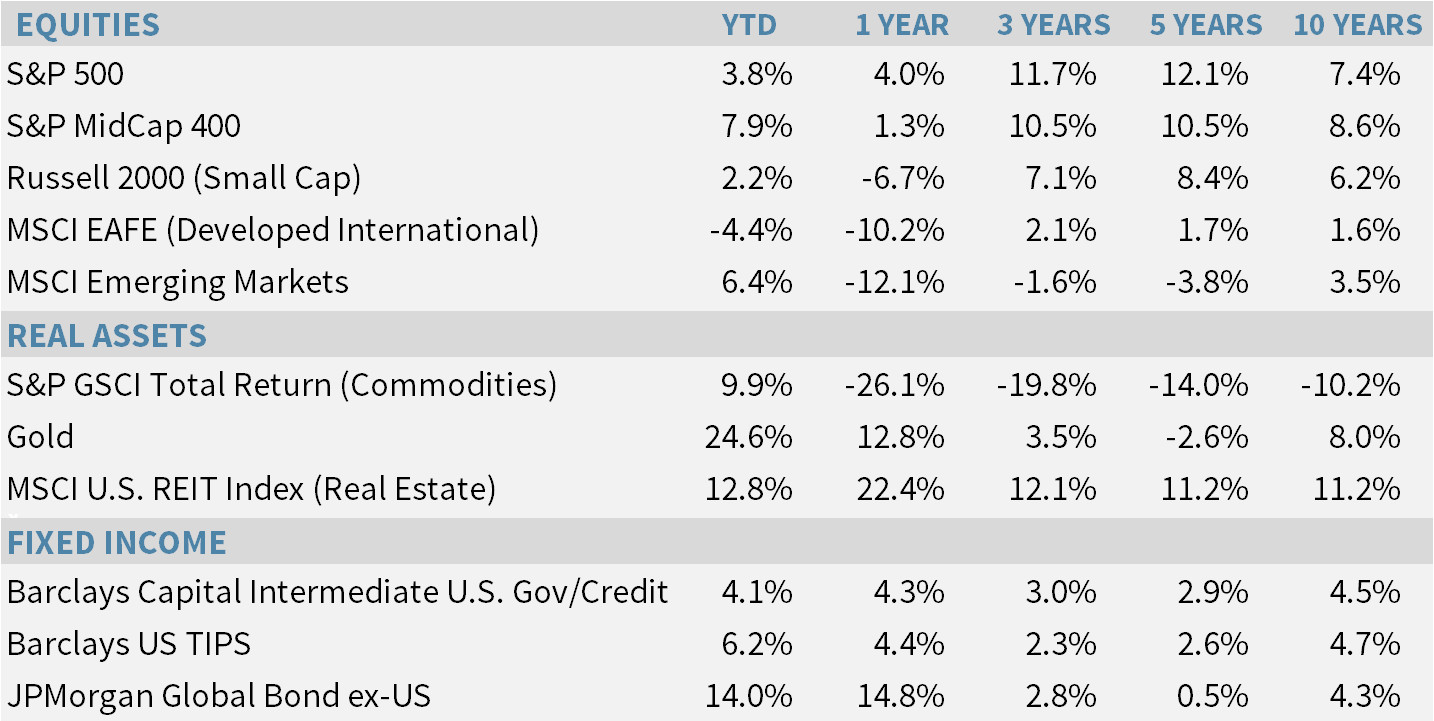

Market Indices

As of June 30, 2016

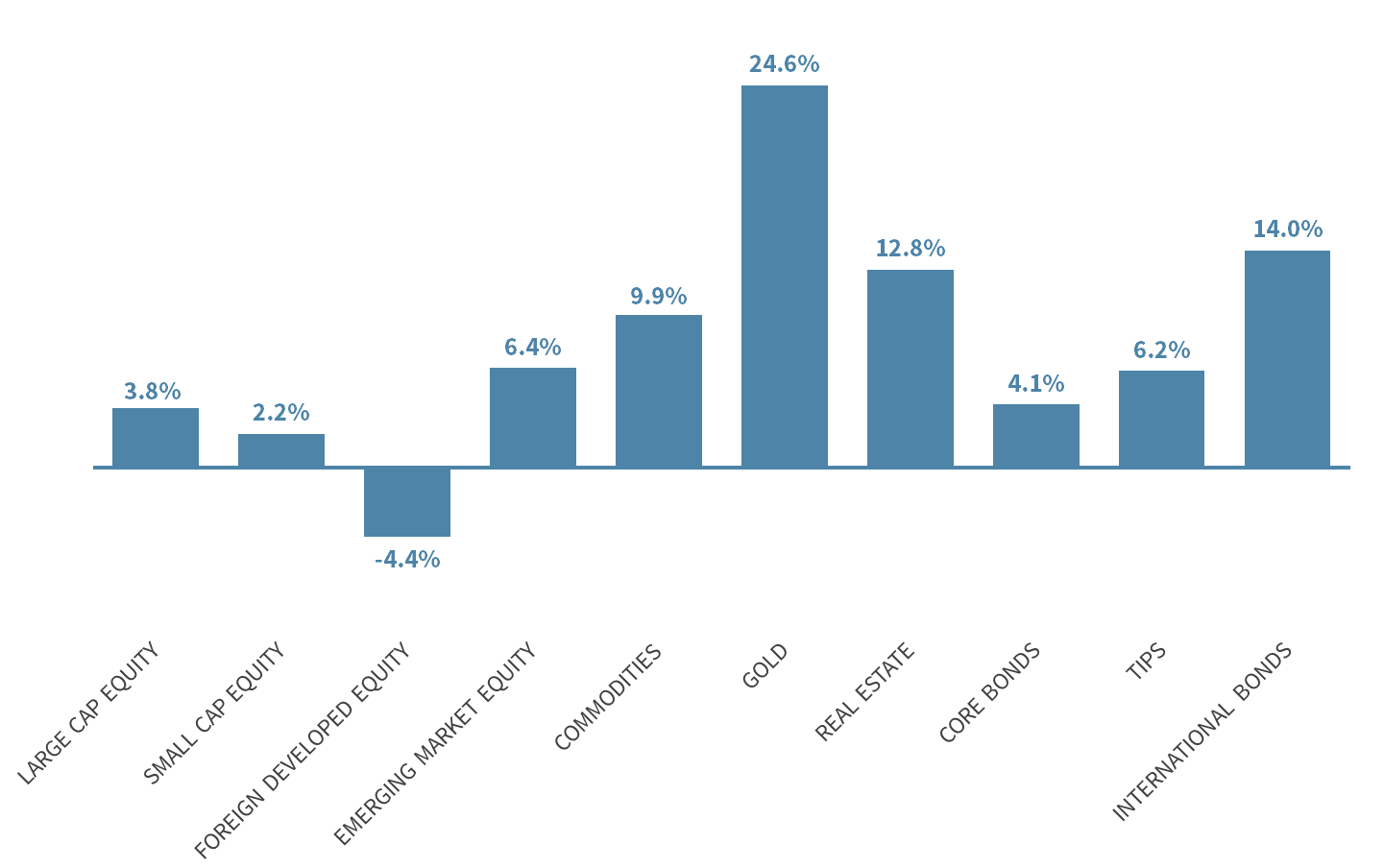

YTD Returns By Asset Class

AS OF JUNE 30, 2016

About Strategic

Founded in 1979, Strategic is a leading investment and wealth management firm managing and advising on client assets of over $2 billion.

OverviewDisclosures

Strategic Financial Services, Inc. is a SEC-registered investment advisor. The term “registered” does not imply a certain level of skill or training. “Registered” means the company has filed the necessary documentation to maintain registration as an investment advisor with the Securities and Exchange Commission.

The information contained on this site is for informational purposes and should not be considered investment advice or a recommendation of any particular security, strategy or investment product. Every client situation is different. Strategic manages customized portfolios that seek to properly reflect the particular risk and return objectives of each individual client. The discussion of any investments is for illustrative purposes only and there is no assurance that the adviser will make any investments with the same or similar characteristics as any investments presented. The investments identified and described do not represent all of the investments purchased or sold for client accounts. Any representative investments discussed were selected based on a number of factors including recent company news or earnings release. The reader should not assume that an investment identified was or will be profitable. All investments contain risk and may lose value. There is no assurance that any investments identified will remain in client accounts at the time you receive this document.

Some of the material presented is based upon forward-looking statements, information and opinions, including descriptions of anticipated market changes and expectations of future activity. Strategic Financial Services believes that such statements, information, and opinions are based upon reasonable estimates and assumptions. However, forward-looking statements, information and opinions are inherently uncertain and actual events or results may differ materially from those reflected in the forward-looking statements. Therefore, undue reliance should not be placed on such forward-looking statements, information and opinions.

No content on this website is intended to provide tax or legal advice. You are advised to seek advice on these matters from separately retained professionals.

All index returns, unless otherwise noted, are presented as price returns and have been obtained from Bloomberg. Indices are unmanaged and cannot be purchased directly by investors.

Doug Walters

Doug Walters