A Political Strategy

Geopolitics will likely remain a prominent feature in the second half of the year. In this edition of our quarterly Perspectives, we review Q2 and discuss how to position your portfolio to cope with the growing influence of international tariff squabbles.

Dissecting Q2 2018

Contributed by Doug Walters

Geopolitics were the dominant day-to-day driver of market moves in 2018. However, it was the continued growth in economic activity which allowed equities to make further progress and put fixed income under pressure.

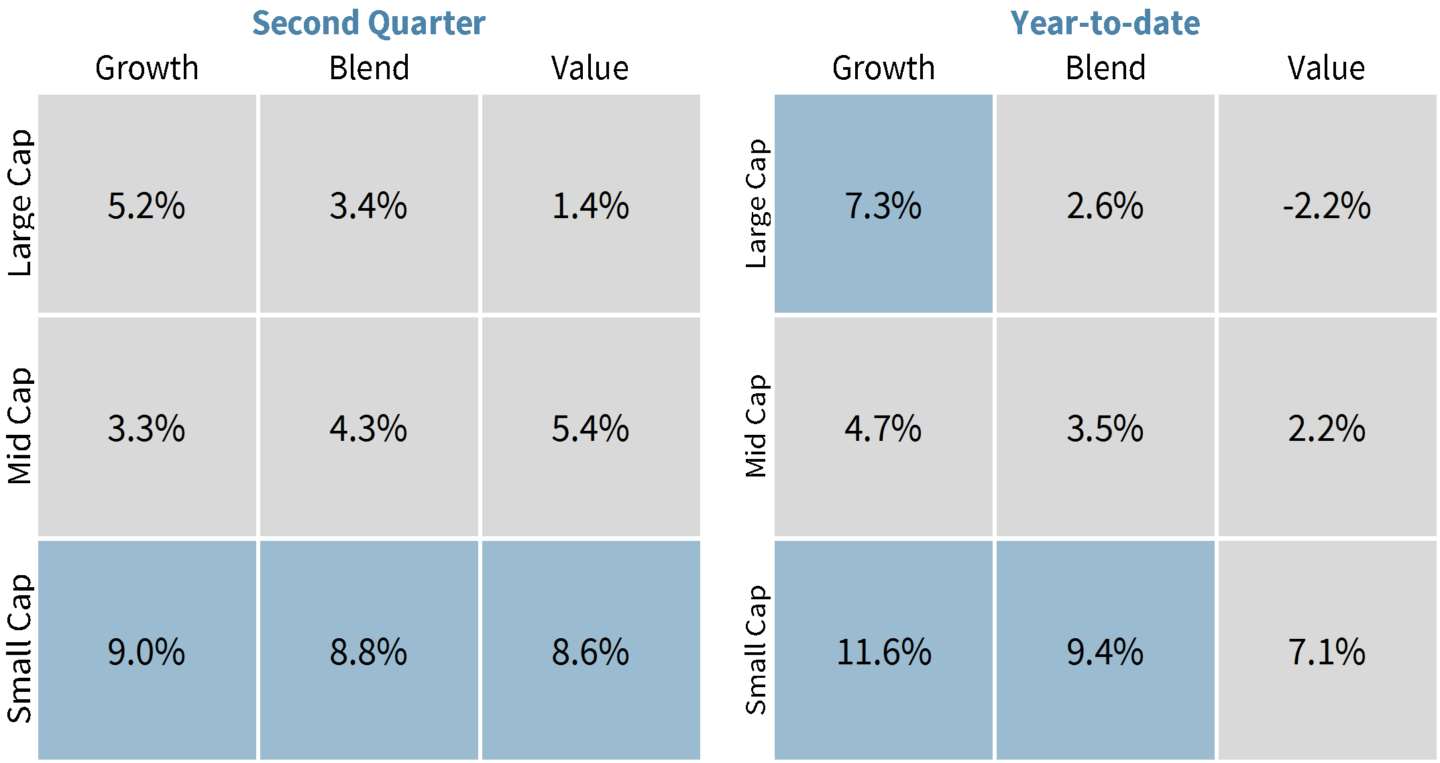

Equities – good things in small packages

The S&P 500 produced a total return of 3.4% in the second quarter, more than making up for the losses in the first quarter of the year. Growth outpaced value, but it was small-cap stocks that were the real winners this past quarter, up around 9%. Small-cap stocks tend to be more domestically focused and are therefore viewed as being the greatest beneficiaries of the current administration’s protectionist tendencies. Also, in an active environment for mergers and acquisitions, these smaller companies make attractive targets for acquirers.

Chart 1: U.S. equity performance; small caps dominate

Small-cap stocks have had a good year, while growth has outperformed value.

At the sector level, Energy dominated as the price of oil continued to rise. The increase comes as OPEC and Russia squeeze supply, compounded by troubles in Venezuela and the potential for Iran sanctions as the U.S. leaves the nuclear deal. Consumer Discretionary was the next best sector led by stock-specific stories in Amazon (AMZN) and Netflix (NFLX). Both stocks have valuations that rival those of the dot-com era.

Industrials were the worst performing sector as investors question whether the peak of the cycle is in sight.

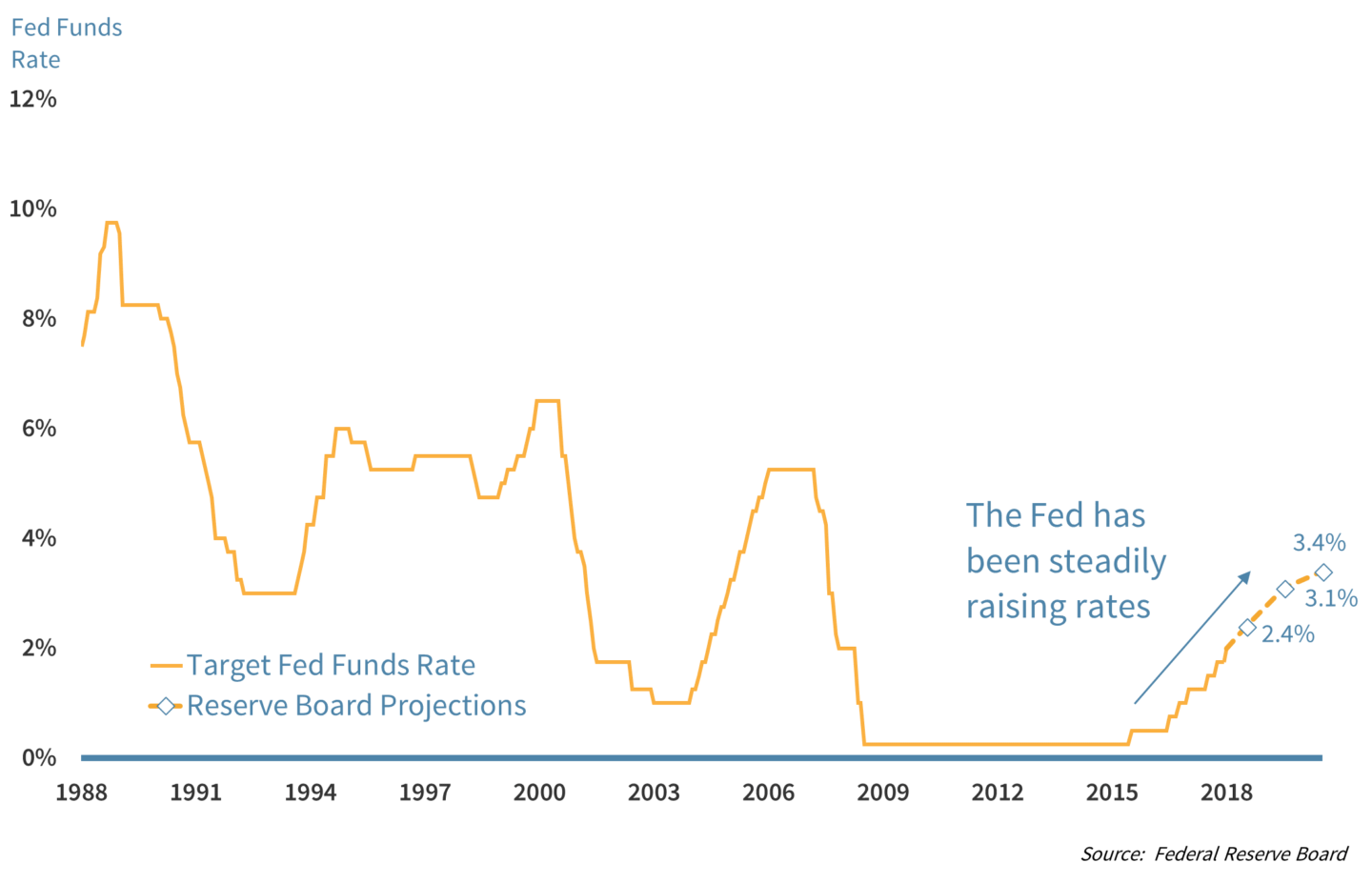

Fixed Income – rate increases are starting to bite

The Fed raised interest rates again in June, marking the seventh increase since tightening began back in December 2015. Two more moves higher are expected before the end of the year.

Rising rates have had two main impacts for investors. First, higher rates have pushed up bond yields (particularly shorter duration bonds), resulting in bond prices going down. Negative returns on bonds are something investors have not had to contend with in recent years. Second, with rates on shorter duration securities (like a 2-year treasury) rising faster than longer duration securities (like a 10-year treasury), investors are getting less reward for holding longer-dated bonds. As a result, we continue to favor keeping portfolio duration low.

Despite the potential for negative returns, bonds play an important role for those wishing to reduce risk in their portfolios. With that said, we have added an investment grade floating rate allocation to our models. Unlike traditional bonds, these instruments benefit when rates rise.

Chart 2: U.S. fed funds rate; rate increases pushing bond yields higher

The seventh increase in rates since December 2015 has put downward pressure on bond prices and made short-term bonds relatively more attractive.

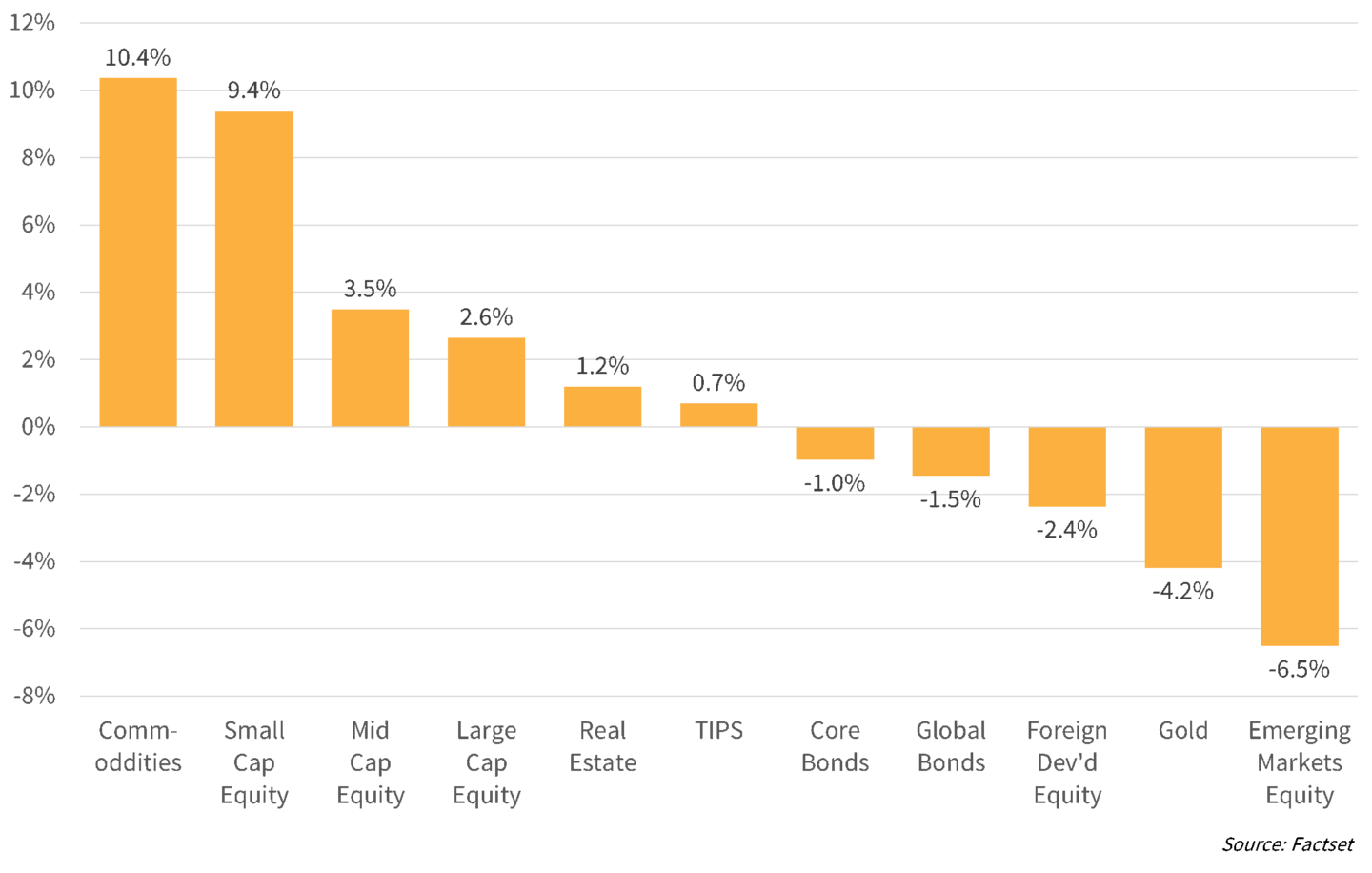

Asset Allocation – a currency headwind

Emerging Markets went from first in Q1 to last in Q2. Currency was a significant drag for EM performance as well as Foreign Developed as the U.S. dollar generally strengthened against other global currencies. Gold was another casualty of the strong dollar.

Oil prices rose for the reasons we discussed within equities above, helping commodities take the top spot. The oil market continues to be manipulated by OPEC making it difficult to have a fundamental view in the short run. However, in the long run, we see an acceleration in alternative energy sources as a secular headwind for oil-dependent companies.

Small-cap stocks outpaced their larger peers in the second quarter. Historically, small-cap stocks have outperformed large-cap, but with greater year-to-year variability. In recent years, we have tactically over-weighted small-cap stocks as we see the current environment as particularly attractive for them (protectionist policies, lower taxes, reduced bureaucracy, and active mergers and acquisitions).

Chart 3: YTD performance; Small-cap shines as the dollar strengthens

Small-cap stocks and commodities stood out, while dollar strength took a bite out of Gold and Emerging Markets.

The Q3 2018 Playbook

The first half of 2018 was marked by the significant influence of the geopolitical environment. Whether it was trade disputes, tariff talk, nuclear negotiations, or other international relations the political climate always seemed to be front and center on investor’s minds. We see no abatement in the second half. In fact, with the mid-term elections approaching, we might see an escalation as we enter the final quarter of the year.

What is interesting about the geopolitics of the first half is that the impact on the market, while ever-present, was both positive and negative (and not always predictably so). For example, equities sold off on concerns of a tariff war, only to later rally under the belief the U.S. administration was posturing to get a better deal. This sort of dynamic seemed to play out weekly (if not daily).

The other dynamic we will have on our radar is the economy. Continued positive economic momentum helped stocks gain ground in the first half despite the challenging geopolitical environment. Any hint of cracks in the economy could see a negative reaction from the stock market. While the economy is showing few signs of weakness, the underperformance of the Industrials sector over the past few months could be reflecting investor expectations of a weakening macro environment.

No time for heroics

The above outlook, in our view, has the potential to drive increased market volatility. As we discussed in our last perspectives (Volatility: Friend or Foe?), proper diversification and rebalancing will take advantage of this dynamic. This quarter we take the opportunity to remind investors that this is no time to be a market timing hero.

We have referenced the perils of market timing often this year, and take this opportunity to put an explanation point on those discussions. Our white paper on the subject (Market Timing: Investing or Gambling?) provides evidence that market timers tend to either get lucky or get burned. In the words of the legendary portfolio manager Peter Lynch, “Far more money has been lost by investors preparing for corrections, or trying to anticipate corrections than has been lost in the corrections themselves.”

So if market timing is off the table, what should an investor do in a time of geopolitical and economic uncertainty? Our preferences going into Q3 are:

- Do not chase performance. High momentum stocks like Netflix and Amazon are trading at dot-com level valuations. Instead, seek broad equity exposure, with a preference for Value and Dividend Growth.

- Keep fixed income exposure short-term in this rising rate environment. Add exposure to investment grade floating rate notes which are not hurt by rising rates.

- Overweight small-cap U.S. stocks which will are benefiting from tax reform and protectionist policies and are potential targets with merger and acquisition activity high.

About Strategic

Founded in 1979, Strategic is a leading investment and wealth management firm managing and advising on client assets of over $2 billion.

OverviewDisclosures

Strategic Financial Services, Inc. is a SEC-registered investment advisor. The term “registered” does not imply a certain level of skill or training. “Registered” means the company has filed the necessary documentation to maintain registration as an investment advisor with the Securities and Exchange Commission.

The information contained on this site is for informational purposes and should not be considered investment advice or a recommendation of any particular security, strategy or investment product. Every client situation is different. Strategic manages customized portfolios that seek to properly reflect the particular risk and return objectives of each individual client. The discussion of any investments is for illustrative purposes only and there is no assurance that the adviser will make any investments with the same or similar characteristics as any investments presented. The investments identified and described do not represent all of the investments purchased or sold for client accounts. Any representative investments discussed were selected based on a number of factors including recent company news or earnings release. The reader should not assume that an investment identified was or will be profitable. All investments contain risk and may lose value. There is no assurance that any investments identified will remain in client accounts at the time you receive this document.

Some of the material presented is based upon forward-looking statements, information and opinions, including descriptions of anticipated market changes and expectations of future activity. Strategic Financial Services believes that such statements, information, and opinions are based upon reasonable estimates and assumptions. However, forward-looking statements, information and opinions are inherently uncertain and actual events or results may differ materially from those reflected in the forward-looking statements. Therefore, undue reliance should not be placed on such forward-looking statements, information and opinions.

No content on this website is intended to provide tax or legal advice. You are advised to seek advice on these matters from separately retained professionals.

All index returns, unless otherwise noted, are presented as price returns and have been obtained from Bloomberg. Indices are unmanaged and cannot be purchased directly by investors.

Doug Walters

Doug Walters