When the Honeymoon Ends

U.S Equities found themselves near all-time highs, while bonds fell. Stocks appear to be in a honeymoon period, focusing on the best features of a Republican sweep, while setting aside the inevitable challenges the new administration will face.

Market Review

Contributed by Doug Walters

Reconciling Differences

U.S. Equities continued to inch higher this week, flirting with all-time highs. As we discussed last week, the most notable rises post the election have been in Financials (on prospects of deregulation and inflation) and Industrials (on expectations of rising infrastructure spending). One has to wonder if this is nothing more than a honeymoon for equities.

- On the one hand, a Republican sweep should in theory lead to the passage of corporate-friendly legislation. However, this could be at odds with Trump’s populist, anti-establishment, drain-the-swamp agenda.

- All honeymoons come to an end. When Trump carries his mandate across the White House threshold, we will find out just how compatible his goals are with those of the legislative establishment.

What now?

A common question we have been fielding since the election is, “What is the Strategic Investment Team doing differently now that Trump is the President-elect?” The admittedly boring, but accurate, answer is, “Nothing.”

- That is not to say that we are twiddling our thumbs post-election, in fact it is quite the opposite. We have been busy performing fundamental, bottoms-up research, looking for emerging valuation opportunities in quality securities. But that is what we always do.

- Chasing momentum or the latest hot theme has the potential to yield short-term riches for the lucky, but also permanent loss of capital for the less fortunate.

- We believe the key to life-long wealth creation for our clients is a disciplined and repeatable process that is used consistently. Our process helps us steer clear of market noise and avoid behavioral biases that could cause us to act on emotion rather than logic.

| Indices & Price Returns | Week (%) | Year (%) |

|---|---|---|

| S&P 500 | 0.8 | 6.7 |

| S&P 400 (Mid Cap) | 2.8 | 14.9 |

| Russell 2000 (Small Cap) | 2.6 | 15.8 |

| MSCI EAFE (Developed International) | -0.5 | -4.9 |

| MSCI Emerging Markets | -0.2 | 6.7 |

| S&P GSCI (Commodities) | 1.9 | 14.9 |

| Gold | -1.6 | 13.6 |

| MSCI U.S. REIT Index | 0.3 | -1.7 |

| Barclays Int Govt Credit | -0.6 | 0.5 |

| Barclays US TIPS | -0.8 | 3.4 |

Economic Commentary

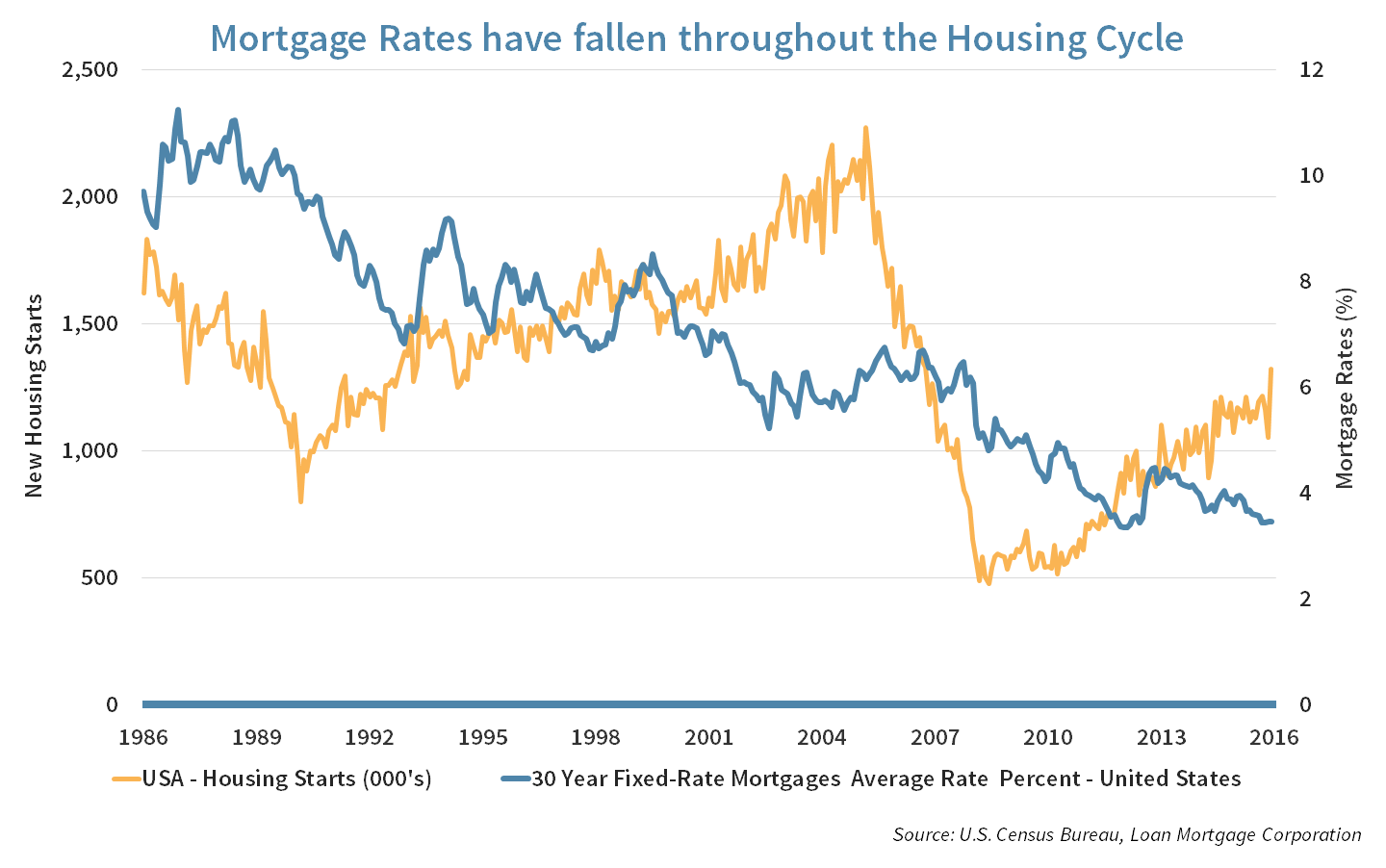

New Houses and Higher Mortgage Rates

The U.S. housing market looked strong last month with new housing starts up 23% year-over-year, reaching 1.3 million. This is still below the thirty-year median housing start number of 1.4 million. However, there are reasons to believe that the cycle may continue upward, namely:

- Increasing wages and steady job growth,

- Strong sales of existing homes, which is 90% of the market, and

- Low inventory of new and used houses.

Bearish analysts, however, see problems in the housing market and point to the risk that increasing mortgage rates would deter potential home buyers. Intuitively speaking, increasing mortgage rates make overall loans more expensive and therefore should decrease demand for a new house. However, when we observe the graph below, we see mortgage rates have decreased steadily throughout the housing cycle. This indicates that mortgage rates may not be the primary driver of a potential home buyer’s purchase decision.

To analyze further the impact of rising mortgage rates on the housing market, we ran a regression between the two variables over the past 30 years with mortgage rates being the independent variable. Our regression results show that variations in the mortgage rate only explain 13% of the variation of new housing starts and the correlation is actually positive instead of negative. New home builders can take comfort in this data as it indicates a strong economy could help their business more than higher rates will hurt it.

Week Ahead

Giving Thanks

A long-awaited and well-deserved holiday is around the corner. As Americans join their families for an epic dinner to celebrate Thanksgiving, retailers will be looking to Black Friday to give insight into the strength of the holiday shopping season.

Fun facts

- Thanksgiving didn’t become a national holiday until over 200 years after the day for which it is named. Sarah Josepha Hale, the woman who wrote the classic song “Mary Had a Little Lamb,” convinced President Lincoln in 1863 to make Thanksgiving a national holiday, after writing letters for 17 years campaigning for this to happen.

- Benjamin Franklin wanted the turkey to be the national bird, not the eagle.

- Campbell’s soup created green bean casserole for an annual cookbook 50 years ago. It now sells $20 million worth of cream of mushroom soup.

Strategic Updates

Contributed by Max Berkovich ,

Strategic Asset Allocation

Flying Birds

Federal Reserve Chairwoman Yellen reiterated a strong signal for going ahead with a rate hike in December. The Fed’s announcement was no surprise to U.S. equity markets, which retained most of the gains from the post-election rally last week, while income-paying investments continued to lose altitude.

Incoming

With interest rates marching higher bonds have witnessed noticeable declines. The further away the maturity of the bond, the worse the decline.

- We remind investors that bonds that are held to maturity and do not default, pay investors interest regularly and return the face value of the principal upon maturity. So the recent declines are purely losses on paper, and would only be realized if not held to maturity.

- The role of fixed return investments in a diversified portfolio is to provide income, preserve capital, and reduce the volatility of the overall portfolio.

- Also, often overlooked, the fixed return portion of a portfolio becomes a source of funds for rebalancing when other assets start to offer better value.

Municipal Winds

As with all bonds, higher rates continue to weigh on the Municipal bond market, but additional headwinds have made it even worse for the tax-exempt market. Relevant U.S. municipal indexes are generally showing negative returns for the year. The headwinds include expectations for lower federal tax rates in 2017 and an increased supply of bonds to support infrastructure spending initiatives at the local level.

Dollar Daze

The U.S. Dollar has strengthened against the Euro and British Pound this week, while Gold remained weak. Precious metals are losing their luster as interest rates continue their rise.

- The price of gold correlates negatively with interest rates. As interest rates increase, gold prices tend to decline.

- A strong U.S. Dollar hurts imports as U.S. goods and services cost more to foreigners, but it does make imports cheaper for the U.S. consumer.

No Action

While volatility in fixed income and equity markets have picked up lately, their moves have not yet warranted a rebalance in our asset allocation. With that said, the weighting of domestic equities in our models are beginning to look a little hefty.

Strategic Growth

Celestial Sign

Consumer sectors were clear leaders this week as last week’s big movers cooled a bit. Consumer Discretionary technically had the best week thanks to…

- The Hain Celestial Group (HAIN) released a report from an independent audit committee clearing the company from any wrongdoing in concession recognition to one of its distributors. The independent committee’s review has prevented the company from issuing its annual report. With audit complete, we hope to see two quarters of results from the company soon. Investors did view this release as a good sign that any accounting issues will not be material to the company.

Strategic Equity Income

Security Upped

Consumer Discretionary had a top finish on the week, while Health Care and Industrials sunk to the bottom. In other strategy news…

- Cisco Systems, Inc. (CSCO) reported a slight beat, but conservative guidance was not welcomed by investors. The company’s guidance called for a 2-4% revenue decline next quarter. Also, earnings guidance of $0.42-$0.47 was shy of the $0.48 analyst expected. Revenue segmentation for the reported quarter showed an 11% increase for the Security division and 6% NGN Routing division, but not enough to offset a 7% decline in the Switching unit. On the call, CEO Chuck Robbins indicated if there was a tax repatriation holiday the first use of funds would be to pay off debt and reiterated his commitment to growing the company’s dividend payments.

About Strategic

Founded in 1979, Strategic is a leading investment and wealth management firm managing and advising on client assets of over $2 billion.

OverviewDisclosures

Strategic Financial Services, Inc. is a SEC-registered investment advisor. The term “registered” does not imply a certain level of skill or training. “Registered” means the company has filed the necessary documentation to maintain registration as an investment advisor with the Securities and Exchange Commission.

The information contained on this site is for informational purposes and should not be considered investment advice or a recommendation of any particular security, strategy or investment product. Every client situation is different. Strategic manages customized portfolios that seek to properly reflect the particular risk and return objectives of each individual client. The discussion of any investments is for illustrative purposes only and there is no assurance that the adviser will make any investments with the same or similar characteristics as any investments presented. The investments identified and described do not represent all of the investments purchased or sold for client accounts. Any representative investments discussed were selected based on a number of factors including recent company news or earnings release. The reader should not assume that an investment identified was or will be profitable. All investments contain risk and may lose value. There is no assurance that any investments identified will remain in client accounts at the time you receive this document.

Some of the material presented is based upon forward-looking statements, information and opinions, including descriptions of anticipated market changes and expectations of future activity. Strategic Financial Services believes that such statements, information, and opinions are based upon reasonable estimates and assumptions. However, forward-looking statements, information and opinions are inherently uncertain and actual events or results may differ materially from those reflected in the forward-looking statements. Therefore, undue reliance should not be placed on such forward-looking statements, information and opinions.

No content on this website is intended to provide tax or legal advice. You are advised to seek advice on these matters from separately retained professionals.

All index returns, unless otherwise noted, are presented as price returns and have been obtained from Bloomberg. Indices are unmanaged and cannot be purchased directly by investors.

Doug Walters

Doug Walters