When Bad is Good

Continued concerns that the pandemic headwinds will drag on in the U.S. has paradoxically resulted in a positive week for stock market returns, thanks to the outperformance of mega-cap growth stocks.

Contributed by Doug Walters , , Max Berkovich

U.S. stocks advanced a bit this week, but once again, forward progress was driven by a small subset of mega-cap growth stocks. Apple (AAPL) was the leader, followed by Alphabet (GOOGL, formerly known as Google). As we discussed a few weeks ago, this narrow market leadership has been a tailwind for market-cap-weighted indexes, like the S&P 500, but introduces a degree of concentration risk in these indexes that we have not seen for some time.

So why are these mega-cap stocks leading the charge? They are the beneficiaries of an extended pandemic (at least in relative terms).

- Their businesses do not rely on brick and mortar stores.

- They are entertaining us while we are stuck at home.

- They are keeping us connected to our family, friends, and colleagues.

- They are providing safe online marketplaces for our purchases.

- And they are providing the infrastructure for businesses that are increasingly operating in the cloud.

The coronavirus has accelerated the adoption of these services, which only gets magnified as the pandemic drags on. So bad news is now good news for investors… Sort of. A much broader rally would be far more healthy. We would expect that to occur when the good news concerning testing, new cases, and vaccines reaches an inflection point. This more positive space may not benefit the current mega-cap market leaders. To avoid concentration risk, we consider funds, like those in our factor models, which weight holdings based on proven, persistent, positive characteristics – not market cap.

Election Worries?

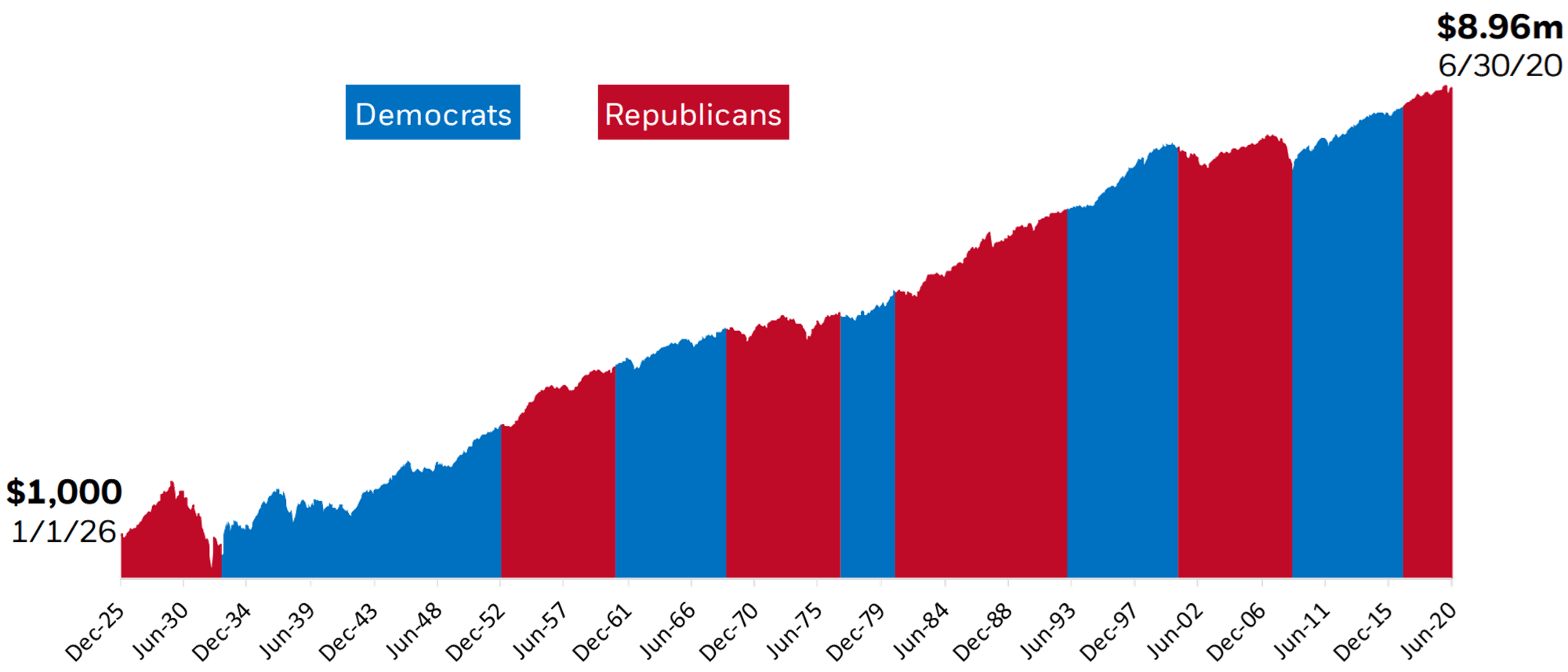

Approaching presidential elections always seem to insight investor angst. However, as the chart below shows, the party of the President has had little predictive power for stock market returns. Stocks tend to go up in the long run as a healthy consumer, and rising corporate profitability, drive U.S. economic growth. The shorter-term ups and downs of the market are impacted more by the inevitable economic cycle, and less by the differences between political parties.

Source: Blackrock, Student of the Market (August 2020). Stock market represented by the S&P 500 Index from 1/1/70 to 6/30/20 and IA SBBI U.S. large-cap stocks index from 1/1/26 to 1/1/70 (total return shown on a log scale).

Headlines This Week

Fighting Together

- U.S. coronavirus infections are trending down but remain at a very high average of 40K new cases per day. Good news came on two fronts though: a new, cheap, quick, saliva-based test has been developed, and Pfizer expects its vaccine will be ready for regulatory review in October.

- China and Russia are pushing other potential vaccines.

- The United Arab Emirates has recruited 15,000 volunteers to test China’s experimental COVID-19 vaccine. Peru and Morocco have approved Phase 3 trials in their countries.

- Russia has announced its Phase 3 vaccine trials will be on 40,000 people. Russia called their COVID-19 vaccine “Sputnik V,” perhaps drawing the parallels between the vaccine race and the space race of the 1950s. If so, it is a risky parallel. The Russians may have been first into space, but they were far from the most successful. There is widespread condemnation amongst the health organizations of their plan to administer the vaccine widely before testing is complete.

Bet on America(n stocks)

- The U.S. may be way behind other developed countries in the handling of the coronavirus spread. Still, the stock market is successfully weathering one of the most significant economic stresses in history. Our markets remain very liquid, thanks to the Federal Reserve.

- On Wednesday, Jerome Powel reiterated that the Fed will do whatever it takes to bring the U.S. economy back to full employment.

The U.K. and Europe

- Countries in Europe are seeing a new rise in daily coronavirus cases. German Chancellor Merkel stressed the importance of everyone following the rules to avoid new lockdowns.

- The United Kingdom (U.K.) and European Union (E.U.) are stuck on key issues that would enable them to ratify a new trade agreement. Some fear that the U.K. might end up exiting the E.U. with no deal at all. A no-deal Brexit was unfavored by the majority in the U.K.

The Week Ahead

Jackson Hole

- Fed Chairman, Jerome Powell, will be speaking at the annual Jackson Hole symposium on Thursday morning.

- The chairman will most likely reiterate the need for accommodative monetary policy to boost our economy by holding the overnight lending rates near zero.

Consumer Health Check

- Consumer Confidence for August will be reported on Tuesday morning and is expected to rise. The current consumer confidence levels remain near the 2015-2016 levels.

- Personal Income for July is expected to decline slightly. Thanks to the stimulus in March, personal income remains above January 2020 levels.

- Inflation via the Personal Consumption Expenditure report is expected to rise to a, still low, 1.1%. This is the Fed’s preferred inflation measure, for which they are targeting 2%.

About Strategic

Founded in 1979, Strategic is a leading investment and wealth management firm managing and advising on client assets of over $2 billion.

OverviewDisclosures

Strategic Financial Services, Inc. is a SEC-registered investment advisor. The term “registered” does not imply a certain level of skill or training. “Registered” means the company has filed the necessary documentation to maintain registration as an investment advisor with the Securities and Exchange Commission.

The information contained on this site is for informational purposes and should not be considered investment advice or a recommendation of any particular security, strategy or investment product. Every client situation is different. Strategic manages customized portfolios that seek to properly reflect the particular risk and return objectives of each individual client. The discussion of any investments is for illustrative purposes only and there is no assurance that the adviser will make any investments with the same or similar characteristics as any investments presented. The investments identified and described do not represent all of the investments purchased or sold for client accounts. Any representative investments discussed were selected based on a number of factors including recent company news or earnings release. The reader should not assume that an investment identified was or will be profitable. All investments contain risk and may lose value. There is no assurance that any investments identified will remain in client accounts at the time you receive this document.

Some of the material presented is based upon forward-looking statements, information and opinions, including descriptions of anticipated market changes and expectations of future activity. Strategic Financial Services believes that such statements, information, and opinions are based upon reasonable estimates and assumptions. However, forward-looking statements, information and opinions are inherently uncertain and actual events or results may differ materially from those reflected in the forward-looking statements. Therefore, undue reliance should not be placed on such forward-looking statements, information and opinions.

No content on this website is intended to provide tax or legal advice. You are advised to seek advice on these matters from separately retained professionals.

All index returns, unless otherwise noted, are presented as price returns and have been obtained from Bloomberg. Indices are unmanaged and cannot be purchased directly by investors.

Doug Walters

Doug Walters