Up, Up and Away?

Wow…what a difference just a few weeks can make! After a brief drawdown post-Brexit, the market has roared towards all-time high levels on the back of low interest rates and Friday’s strong employment report.

Market Review

Contributed by Alan Leist, III

Up, Up and Away?

Almost everything rallied Friday, including bonds (which is odd), in response to better than expected economic news.

- Stocks need economic fundamentals to improve and drive earnings growth to justify a breakout beyond the current multi-year range. Friday’s news was at least a step in the right direction and forced investors underweight stocks to chase returns.

- Bonds should sell-off when data surprises to the upside, but the underlying data remains suspect and interest rate momentum does not yet validate any perceived improvement in the global economy.

- The bottom-line is that while the stock market rally is more than welcomed, we remain focused on owning high quality stocks at a good valuation while momentum investors buy indiscriminately in the face of a still suspect economic environment.

Election 2016

Contributed by Alan Leist, III

One of the most frequent questions we have received from clients lately is “How will the election impact the markets?” With the FBI investigation of the email scandal on the front page this week, the questions have ramped up. Our job is to position portfolios appropriately in relation to a client’s objectives and the market environment without any political bias. With that in mind, we offer a few non-partisan observations:

- The market is operating under the assumption that the polls are accurate and Clinton will ultimately win come November. The market has liked this scenario simply because the Clinton’s are a known (like ‘em or hate ‘em) entity with a history of tacking towards the middle post-election.

- Despite a common perception that a Republican led administration is better for business and therefore the markets, the data would argue otherwise (for any number of debatable reasons). According to Bespoke, Democratic administrations have seen over 4% of stock market outperformance vs. their Republican counterparts since 1900.

- A key component of a positive market outcome in November is a continuation of the checks and balances across the executive and legislative branches of government. Investors like slow change not a wholesale shift in one direction or the other. A divided (but cooperative) government helps to ensure that change is managed prudently.

- The real key for stocks over the long-term, no matter who wins in 2016, is cooperation across the aisle to implement pro-growth fiscal policies that complement the historic nature of stimulative monetary policy. We have gone several years without this level of cooperation and the impact of this trend over the next decade could be catastrophic if the status quo is maintained.

Economic Commentary

Contributed by Max Berkovich

May Went Away

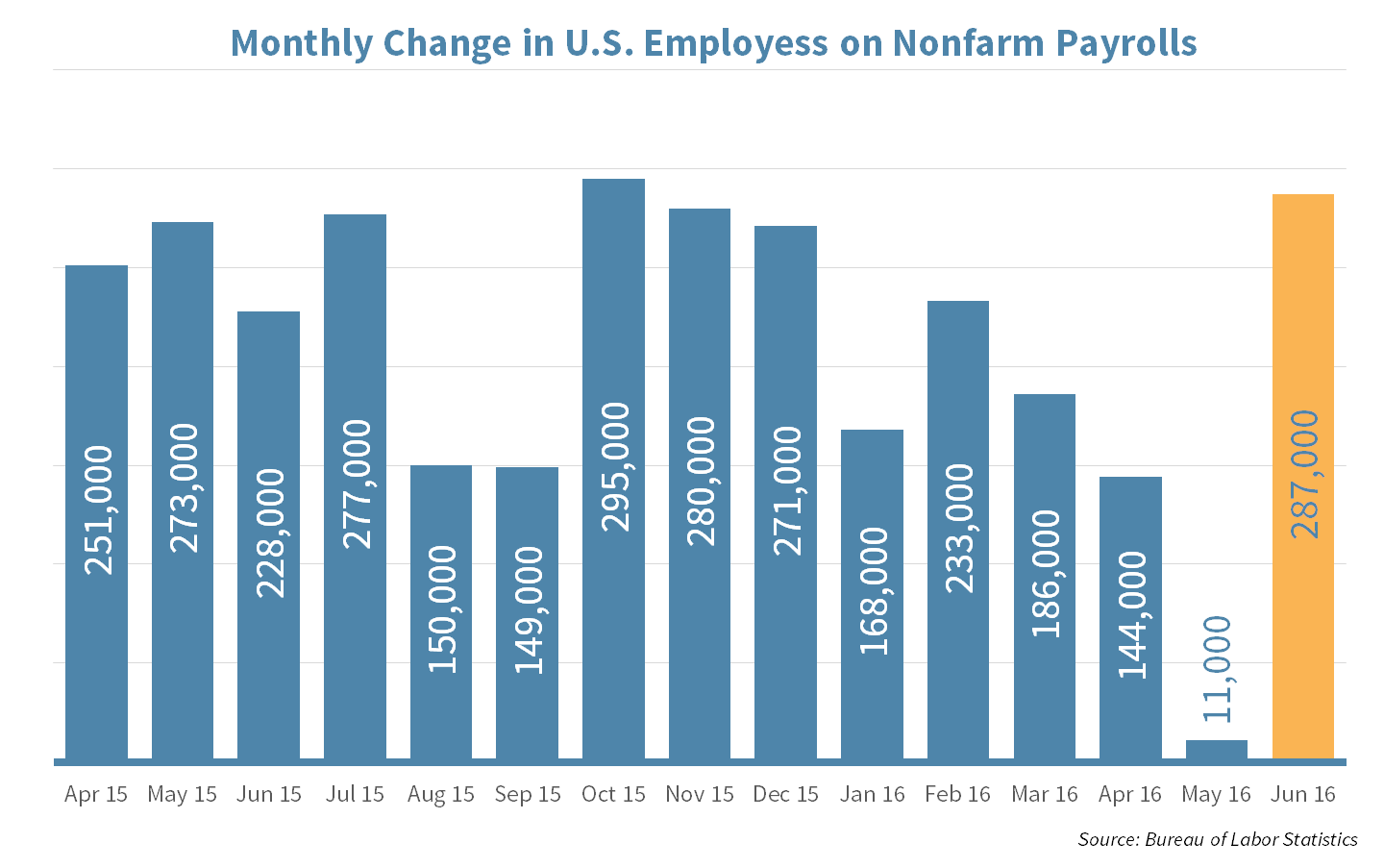

Friday’s Non-Farm Payroll report put labor market anxiety to rest. The whopping 287,000 jobs created in June makes up for some of the awful (revised) 11,000 jobs created in May. Though unemployment crept up to 4.9%, that was due to a tick up in labor participation rate to 62.7%. Consensus expectations called for a strong bounce from May, but to only the 180,000 level.

FOMCing

Federal Open Market Committee (Fed) minutes expressed concern about the slowing business investment and the extremely weak May jobs report. June’s report along with a slight bump up in hourly wages will put the Fed at ease, but developments across the Pond should keep talks of rate hikes this summer and fall off the table.

A few nuggets caught our eye in the report:

- The struggling factory sector reported a gain of just 9,000 jobs in June.

- The transportation sector reported a 9,000 loss and Mining jobs also shrank by 5,000.

- The service sector was 256,000 of the 287,000 jobs created in June.

Week Ahead

Bre-akeout?

After a concerning few days of uncertainty in the market following the Brexit vote two weeks ago, the US markets have erased all loses. This has left certain questions for the near future of the market.

- A rally in commodities prices, stronger dollar and a strong jobs report has contributed to the recent rally.

- Can these gains hold as US financial institutions earnings season begins this week?

- Can the indexes breaking all-time high records?

Banking on Earnings

As the U.S. markets prepare for a number of financial companies to report earnings, Strategic Holdings U.S. Bancorp (USB) and BlackRock (BLK) are among them. Yum! Brands (YUM) and Fastenal (FAST) also report this week upcoming week.

- USB – reports Friday, after a good report on recent bank stress tests the company looks to continue its recent rally.

- BLK – reports Thursday, they have seen a relatively slow year along with the rest of the sector has but they hope to beat earnings yet again.

- YUM – reports Wednesday, a raise in the dividend is on the table if the earnings are as strong as expected.

- FAST – reports Tuesday, Up over 10% YTD they look to continue to deliver fundamental results that match the price action.

Strategic would like to wish the best of luck to those taking part in the 39th running of the Boilermaker this Sunday! Go Team Strategic!

Strategy Update

Contributed by Doug Walters , Max Berkovich

Strategic Asset Allocation

The Halftime Report

Growth oriented asset classes generally outperformed the more conservative or preservation oriented asset classes over the first half of the year. Within these growth assets, the complementary or diversifying assets handily outperformed the equity markets as REITs and Gold had particularly strong first halves.

- Equity market gains were driven largely by strong Emerging Market performance coupled with a solid start by U.S. Large-cap stocks. Developed International was the main laggard with Brexit issues being the most visible concern.

- Declining yields helped to produce solid gains for bonds especially TIPS and International.

Pep Talk

Looking forward to the second half, portfolios appear well positioned. First half performance generally could be described as a rising tide that lifted all asset classes. Thus, no individual positions seem out of balance. Our long held preference for stocks over bonds and U.S equities over International remains in place.

Strategic Growth

Organic Chemistry

The consumer sectors went in opposite directions this week. In a risk on week, it was actually the consumer staples that were in the lead. A few reasons…

- Costco Wholesale Corp. (COST) reported strong monthly sales growth of 3% year over year. Comparable sales excluding the impact of currency and gas sales had U.S. sales up 7%. One Wall Street analyst credited an increase in organic products by 20% as the reason. Speaking of organic food…

- Hain Celestial Group, Inc. (HAIN), the organic food company, received investor attention after a rival organic food company received a takeover bid from a French Yogurt maker.

Strategic Equity Income

Pep Rally

High dividend paying sectors failed to continue their run at the top as cyclical sectors caught investors’ attention this week. In other strategy news…

- PepsiCo Inc. (PEP) the carbonated beverage and snack foods goliath reported a consensus beating quarter. The company squeezed out a 3.3% organic revenue growth for the quarter. The Frito-Lay unit contributed a 9% increase. The company raised guidance for the year as well. The CFO in an interview hinted that the company will be looking for smaller M&A targets.

About Strategic

Founded in 1979, Strategic is a leading investment and wealth management firm managing and advising on client assets of over $2 billion.

OverviewDisclosures

Strategic Financial Services, Inc. is a SEC-registered investment advisor. The term “registered” does not imply a certain level of skill or training. “Registered” means the company has filed the necessary documentation to maintain registration as an investment advisor with the Securities and Exchange Commission.

The information contained on this site is for informational purposes and should not be considered investment advice or a recommendation of any particular security, strategy or investment product. Every client situation is different. Strategic manages customized portfolios that seek to properly reflect the particular risk and return objectives of each individual client. The discussion of any investments is for illustrative purposes only and there is no assurance that the adviser will make any investments with the same or similar characteristics as any investments presented. The investments identified and described do not represent all of the investments purchased or sold for client accounts. Any representative investments discussed were selected based on a number of factors including recent company news or earnings release. The reader should not assume that an investment identified was or will be profitable. All investments contain risk and may lose value. There is no assurance that any investments identified will remain in client accounts at the time you receive this document.

Some of the material presented is based upon forward-looking statements, information and opinions, including descriptions of anticipated market changes and expectations of future activity. Strategic Financial Services believes that such statements, information, and opinions are based upon reasonable estimates and assumptions. However, forward-looking statements, information and opinions are inherently uncertain and actual events or results may differ materially from those reflected in the forward-looking statements. Therefore, undue reliance should not be placed on such forward-looking statements, information and opinions.

No content on this website is intended to provide tax or legal advice. You are advised to seek advice on these matters from separately retained professionals.

All index returns, unless otherwise noted, are presented as price returns and have been obtained from Bloomberg. Indices are unmanaged and cannot be purchased directly by investors.

Alan Leist III

Alan Leist III