The Slow Road

Data shows the U.S. is well behind other developed nations in recovering from the pandemic, but the market cares more about trends in corporate profitability than COVID-19 cases.

Contributed by Doug Walters , Max Berkovich , ,

Stocks put in a positive performance this week, as investors contemplated the competing headlines of improving economic numbers (like Retail Sales) and reopening setbacks in certain states.

There is a lot of noise in the COVID-19 headlines, but for data-junkies like us, there is information ripe for scrubbing, as we separate the science from science fiction. Unfortunately, based on data compiled by Johns Hopkins University, recent headlines pointing to reopening setbacks in states like Texas, Florida, Arizona, and California are accurate. New COVID-19 cases are rising quickly in those areas, as well as a few others. As a result, overall, the U.S. is seeing little improvement in new case trends. This disappointing result comes despite significant progress in hard-hit states like New York, New Jersey, Massachusetts, and Michigan. The stalled improvement in the U.S. is in stark contrast to Europe, which is well along the road to recovery.

Is this all doom and gloom for investments? Not necessarily. The cold truth is that corporate profitability, not COVID-19 cases, drives the stock market. What is best for the economy is not necessarily what is best for limiting human tragedy. The stock market will provide a gauge of just how right or wrong we got the economic side of the equation. The human element is far harder to measure.

Regardless of how this plays out, our portfolios are built and managed to withstand the uncertainty. At the same time, our advisors are your partners in navigating the challenges that these unusual times pose.

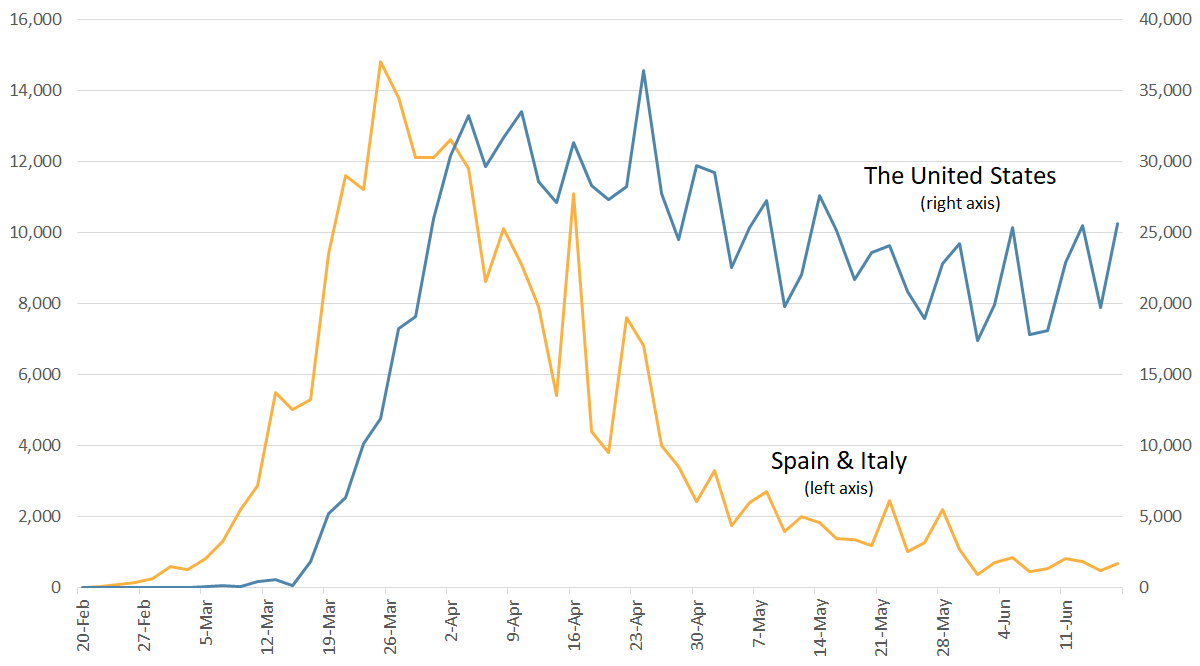

COVID-19 Daily Confirmed Cases: United States vs. Spain and Italy

While Spain and Italy, the two hardest-hit countries in Europe, have successfully flattened the curve, new cases in the United States remain stubbornly high as reopening efforts have resulted in rising trends in some states.

Source: Johns Hopkins University

Headlines This Week

Making Moves

The Fed announced that it is shifting fixed income purchasing from Electronically Traded Funds (ETFs) to the actual bonds as part of two credit facilities it implemented during the coronavirus pandemic.

“The United States federal budget has been on an unsustainable path for years now,” Fed Chair Powell said Tuesday on the first of his two-day testimony. “And that just means the debt is growing faster than the economy, so debt-to-GDP is rising. That is, by definition, unsustainable.”

Not so Easy

The House and Senate have yet to agree on the next round of stimulus. A flood of new ideas regarding where and how the money should be spent is to blame.

- According to Bloomberg, U.S. President Donald Trump is considering launching a $1 trillion infrastructure stimulus plan.

- Bloomberg stated that the funds would likely go to building roads or bridges and improving the 5G network. Trump’s trade advisor, Peter Navarro, is hoping for at least $2 trillion in stimulus, with the focus on bringing manufacturing jobs back to the U.S.

- For comparison, U.S. Gross Domestic Product (GDP) in 2019 was $21.43 trillion.

On Sale

Retail Sales beat their estimates for May, as consumers began shopping again. The surprising report indicated a 17.7% increase in sales from the previous month, though still 6.1% below the level of last year.

- The biggest increase was in clothing, up 188%, but it only makes up a smidgen of total sales. Motor vehicles, on the other hand, makes up 19% of sales and increased by over 44% for the month.

- Retailers like JCPenney and Macy’s are potentially closing some of their stores, offering consumers huge discounts.

Back to Work

Weekly unemployment claims notched another 1.5 million new claims. Continuing claims dropped by about 58,000, though they are still over 20.5 million.

The Week Ahead

Several reports next Thursday out of the U.S. could shed light on the economy’s continued fight with the COVID-19 recession.

- The Initial Jobless Claims will be the primary focus after a recent, higher than expected, number of new claims.

- The number of continuing Jobless Claims will likely provide a broader picture of the overall economy.

- Experts predict Nondefense Capital Goods Orders ex Aircraft for May, which highlights the strength of the country’s manufacturers, to have declined by 10%.

- Annualized GDP for Q1 is set to be released but may not reflect the true nature of the current economy, as lock-down measures only started to come into place towards the end of Q1.

The European Central Bank is set to meet next Wednesday regarding non-monetary policies.

- One issue likely on the table is the impasse caused by a recent ruling by Germany’s highest court that threatens to undermine the ECB’s sovereign bond-buying program.

Bank Stress Test results are set to be released next Thursday.

- The Stress Test rates the largest U.S. banking institutions on their ability to weather various financial situations.

- Given the unprecedented nature of the current global economic situation, the findings may be particularly meaningful.

Last but not least, Happy Father’s Day to all those celebrating on Sunday.

About Strategic

Founded in 1979, Strategic is a leading investment and wealth management firm managing and advising on client assets of over $2 billion.

OverviewDisclosures

Strategic Financial Services, Inc. is a SEC-registered investment advisor. The term “registered” does not imply a certain level of skill or training. “Registered” means the company has filed the necessary documentation to maintain registration as an investment advisor with the Securities and Exchange Commission.

The information contained on this site is for informational purposes and should not be considered investment advice or a recommendation of any particular security, strategy or investment product. Every client situation is different. Strategic manages customized portfolios that seek to properly reflect the particular risk and return objectives of each individual client. The discussion of any investments is for illustrative purposes only and there is no assurance that the adviser will make any investments with the same or similar characteristics as any investments presented. The investments identified and described do not represent all of the investments purchased or sold for client accounts. Any representative investments discussed were selected based on a number of factors including recent company news or earnings release. The reader should not assume that an investment identified was or will be profitable. All investments contain risk and may lose value. There is no assurance that any investments identified will remain in client accounts at the time you receive this document.

Some of the material presented is based upon forward-looking statements, information and opinions, including descriptions of anticipated market changes and expectations of future activity. Strategic Financial Services believes that such statements, information, and opinions are based upon reasonable estimates and assumptions. However, forward-looking statements, information and opinions are inherently uncertain and actual events or results may differ materially from those reflected in the forward-looking statements. Therefore, undue reliance should not be placed on such forward-looking statements, information and opinions.

No content on this website is intended to provide tax or legal advice. You are advised to seek advice on these matters from separately retained professionals.

All index returns, unless otherwise noted, are presented as price returns and have been obtained from Bloomberg. Indices are unmanaged and cannot be purchased directly by investors.

Doug Walters

Doug Walters