Terms of Endearment

Despite an afternoon rally Friday, the S&P 500 was down for the second week in a row. A lackluster jobs report was not the early Mother’s Day present Fed Chairwoman, Janet Yellen, was hoping for. Flowers will have to do this year.

Market Review

Contributed by Doug Walters

Mom’s Big Day

Mother’s Day in the U.S. traces its roots to 1908, when Anna Jarvis of West Virginia organized a celebration in her mother’s honor. Since then, Mother’s Day has become big business for card companies and florists, with over $20 billion spent on gifts last year. Ironically, Ms. Jarvis was disgusted by the mass commercialization of the holiday and lobbied to remove it from the calendar.

- The build up to Mother’s Day did not help Friday’s jobs number, which showed only 160K jobs were created in April. Economists were predicting 205K. Any chance that the Federal Reserve was going raise rates in June, just got smaller.

- However, this is a notoriously volatile figure, and we should not lose site of the fact that jobs were created… which is better than the alternative.

- The S&P 500 shrugged off the disappointment, ending up on the day Friday, though down modestly on the week.

Appalachian Trail

Speaking of West Virginia, the Mountain State is the next stop on the presidential campaign trail.

- The primary may have little impact on the race as we appear to now have presumptive nominees for both parties.

- However, with talk of third party candidates still rampant and party establishment not backing their candidates, nothing feels like a certainty at this point.

- This is a challenge for investors trying to analyze potential policy changes ahead.

- In our economic commentary, we focus on Trump’s preference for low interest rates.

| Indices & Price Returns | Week (%) | Year (%) |

|---|---|---|

| S&P 500 | -0.4 | 0.6 |

| S&P 400 (Mid Cap) | -0.6 | 3.9 |

| Russell 2000 (Small Cap) | -1.4 | -1.9 |

| MSCI EAFE (Developed International) | -3.2 | -4.4 |

| MSCI Emerging Markets | -3.7 | 1.9 |

| S&P GSCI (Commodities) | -3.5 | 11.6 |

| Gold | -0.4 | 21.4 |

| MSCI U.S. REIT Index | 4.6 | 7.3 |

| Barclays Int Govt Credit | 0.1 | 2.3 |

| Barclays US TIPS | -0.2 | 4.5 |

Economic Commentary

Trump Economics

Donald Trump became the presumptive GOP nominee this week and declared himself a “low interest rate person”. Analyzing a Trump presidency is tricky as his actual policy would be somewhat of a wild card. Nevertheless, we pose the question many clients have been asking us: what would a Trump president mean for the economy?

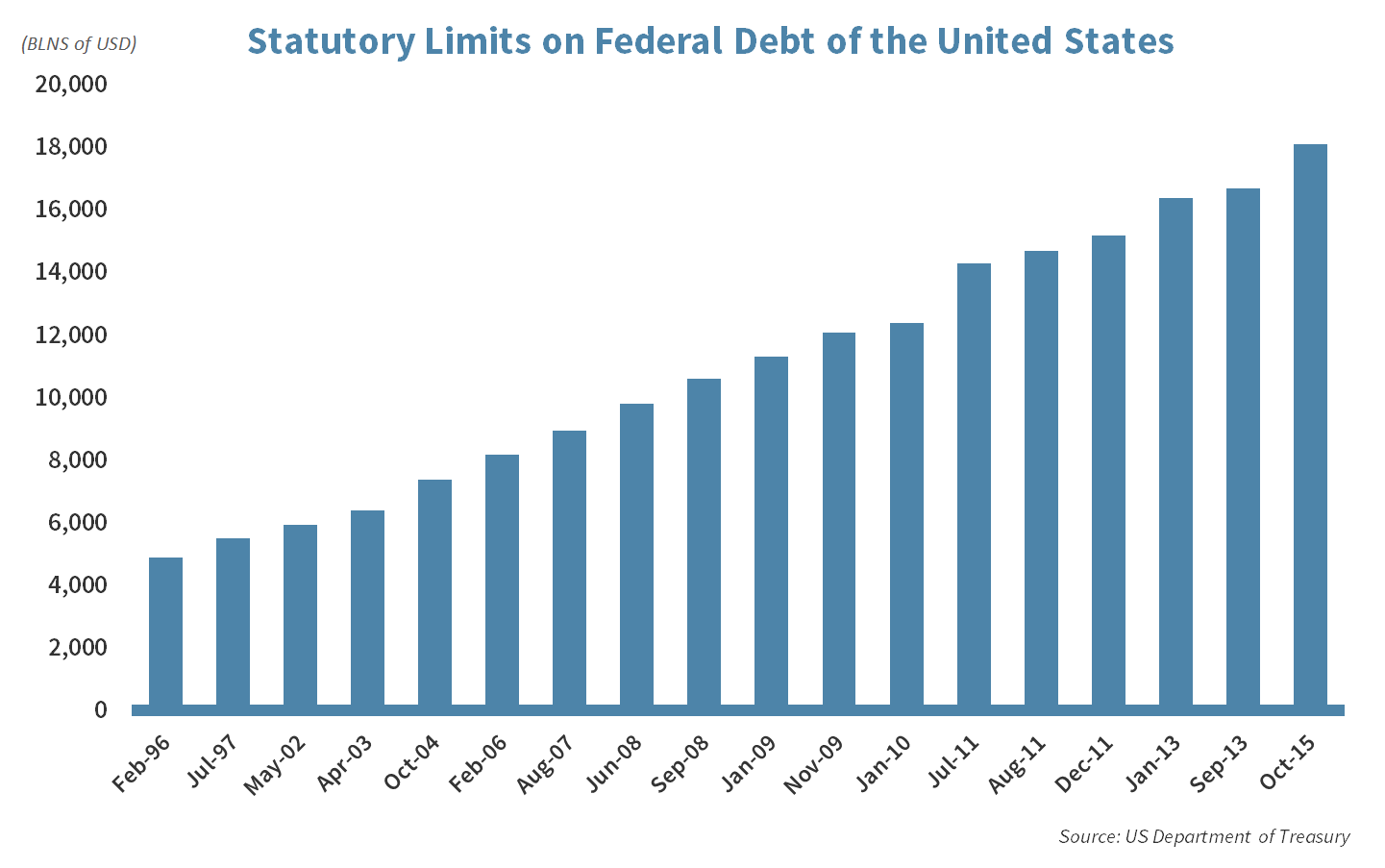

Mr. Trump has made many promises during the debates and on the stump. Among these promises are massive tax cuts and increased spending on infrastructure as well as the military. This combination would lead to an increase in the government deficit and therefore its debt. The US government has over $18 trillion in debt with the load accelerating over the past decade.

An increase in government spending along with tax cuts would stimulate the economy in the short run but increased debt levels would be burdensome in the long run. This burden would be lessened if the US Dollar depreciates and Mr. Trump, as the self-described “king of debt,” understands this dynamic. He often complains about China devaluing its currency but if he did somehow manage to become president, he may end up taking a page out of their playbook.

Week Ahead

Contributed by Doug Walters

A Likely Bet

There is an 84% chance you will be celebrating Mother’s Day this weekend if you are an American over the age of 18 (according to the National Retail Federation)

- Last year’s record spend on the holiday amounted to $173 per person.

- 25-34 year olds were the most generous (perhaps just starting to truly appreciate the challenges of parenthood).

A Consumer Marvel

Strategic holdings Disney (DIS) and Nordstrom (JWN) report Q1 results this week.

- Disney has been on a role with its Star Wars and Marvel franchises, but needs to prove that its real money-maker, ESPN, is staying relevant in this digital, cord-cutting age.

- Nordstrom is battling the challenge faced by many of its brick and mortar peers. They are looking for growth in their Rack discount and online stores to offset any slowdown in their traditional department store business.

Mint Julep anyone? And they’re off!

Strategy Update

Contributed by David Lemire , Max Berkovich

Strategic Asset Allocation

Dr. Mom

The U.S. Economy suffered the equivalent of a scraped knee with a disappointing jobs number. With a quick Band-Aid and a pat on the head (low rates for longer), equity markets had a muted response.

A market only a mother could love

Weak economic data, corporate profit declines, oil volatility, and a toxic political climate could have led to a much uglier market. Moms (and financial advisors) would accentuate the positive such as some encouraging signs of increasing wages and a patient and accommodative Fed. Despite the tough environment, portfolios have held up reasonably well with Growth asset classes declining only slightly to start the month.

STRATEGIC Growth

Earth’s Best® Mom

The industrials and material sectors could have used a little love this week, while the staples ate up some home cooking. One staple in particular brewed up a solid quarter…

- Hain Celestial Group (HAIN) the natural and organic food company reported an in-line quarter and served up guidance that matched consensus. Investors focused in on the reorganization plan. Specifically, cost cutting initiatives and a plan to divest of low volume brands are strategic initiatives that when completed will return the company to double digit growth.

STRATEGIC Equity Income

Dr. Mom: Utilities and health care were leading sectors but for different reasons. Utilities because bond yields moved down and health care because of 2 notable earrings beats…

- Baxter International Inc. (BAX) a health care company focused on kidney and acute diseases, beat estimates and raised guidance. The company also increased its dividend by 13%.

- Pfizer Inc. (PFE), the pharmaceutical giant, also reported a consensus topping quarter. The maker of blockbuster drugs Xanax, Lipitor and Viagra also produces over-the-counter brands that moms (and dads) use including Robitussin, Dimetapp, Centrum, Advil and ChapStick.

About Strategic

Founded in 1979, Strategic is a leading investment and wealth management firm managing and advising on client assets of over $2 billion.

OverviewDisclosures

Strategic Financial Services, Inc. is a SEC-registered investment advisor. The term “registered” does not imply a certain level of skill or training. “Registered” means the company has filed the necessary documentation to maintain registration as an investment advisor with the Securities and Exchange Commission.

The information contained on this site is for informational purposes and should not be considered investment advice or a recommendation of any particular security, strategy or investment product. Every client situation is different. Strategic manages customized portfolios that seek to properly reflect the particular risk and return objectives of each individual client. The discussion of any investments is for illustrative purposes only and there is no assurance that the adviser will make any investments with the same or similar characteristics as any investments presented. The investments identified and described do not represent all of the investments purchased or sold for client accounts. Any representative investments discussed were selected based on a number of factors including recent company news or earnings release. The reader should not assume that an investment identified was or will be profitable. All investments contain risk and may lose value. There is no assurance that any investments identified will remain in client accounts at the time you receive this document.

Some of the material presented is based upon forward-looking statements, information and opinions, including descriptions of anticipated market changes and expectations of future activity. Strategic Financial Services believes that such statements, information, and opinions are based upon reasonable estimates and assumptions. However, forward-looking statements, information and opinions are inherently uncertain and actual events or results may differ materially from those reflected in the forward-looking statements. Therefore, undue reliance should not be placed on such forward-looking statements, information and opinions.

No content on this website is intended to provide tax or legal advice. You are advised to seek advice on these matters from separately retained professionals.

All index returns, unless otherwise noted, are presented as price returns and have been obtained from Bloomberg. Indices are unmanaged and cannot be purchased directly by investors.

Alan Leist III

Alan Leist III