A Tale of Two Countries

As U.S. equities sit near all-time highs, Presidential candidates presented opposing views about the state of the Union. With the economy sending mixed signals, both sides have plenty of ammunition, but long-term investors need not fret.

Market Review

Contributed by Doug Walters

Rising Expectations

U.S. Equities made little progress this week, with the S&P 500 ending the week near where it started. However, that still leaves the index near all-time highs. It was an eventful week for corporate earnings, the economy and politics.

- Corporate earnings continued this week. With nearly two thirds of the S&P 500 having reported, 73% beat analyst’s earnings expectations.

- The Fed left rates on hold in July as expected. More interesting though were the positive comments on the state of the economy, which could be signaling that the next increase in the Fed Funds rate could be as early as September.

Yin and Yang

The Presidential conventions concluded this week painting two disparate views of America. The Republican’s vision of an America in economic and social peril needing a singular savior, was countered with the Democrat’s boasting of a country made strong and prosperous by the efforts of the many. The Chinese philosophy of Yin-Yang seems fitting. The philosophy describes the interaction and interdependence of opposite forces in permanent conflict. Implied in the philosophy is that out of the conflict comes something greater than either side individually. Let’s hope so.

It is easy to mock the contradiction of the conventions, however, there are real contradictions in the economic landscape today:

- U.S. Equities are at an all-time high… yet the Fed is holding rates at levels which imply concern.

- Unemployment is near historical lows… yet labor participation is low and wages are stagnant.

- The U.S. economy is strong relative to its international peers… yet growth is a tepid 1%.

These conflicts will invariably lead to periods of volatility in the near-term as sentiment waxes and wanes. We continue to see this is an opportunity for patient long-term investors.

| Indices & Price Returns | Week (%) | Year (%) |

|---|---|---|

| S&P 500 | -0.1 | 6.3 |

| S&P 400 (Mid Cap) | 0.5 | 11.5 |

| Russell 2000 (Small Cap) | 0.6 | 7.4 |

| MSCI EAFE (Developed International) | 2.4 | -1.6 |

| MSCI Emerging Markets | 0.5 | 10.0 |

| S&P GSCI (Commodities) | -2.8 | 8.9 |

| Gold | 2.1 | 27.1 |

| MSCI U.S. REIT Index | 0.7 | 15.9 |

| Barclays Int Govt Credit | 0.3 | 3.4 |

| Barclays US TIPS | 0.7 | 6.6 |

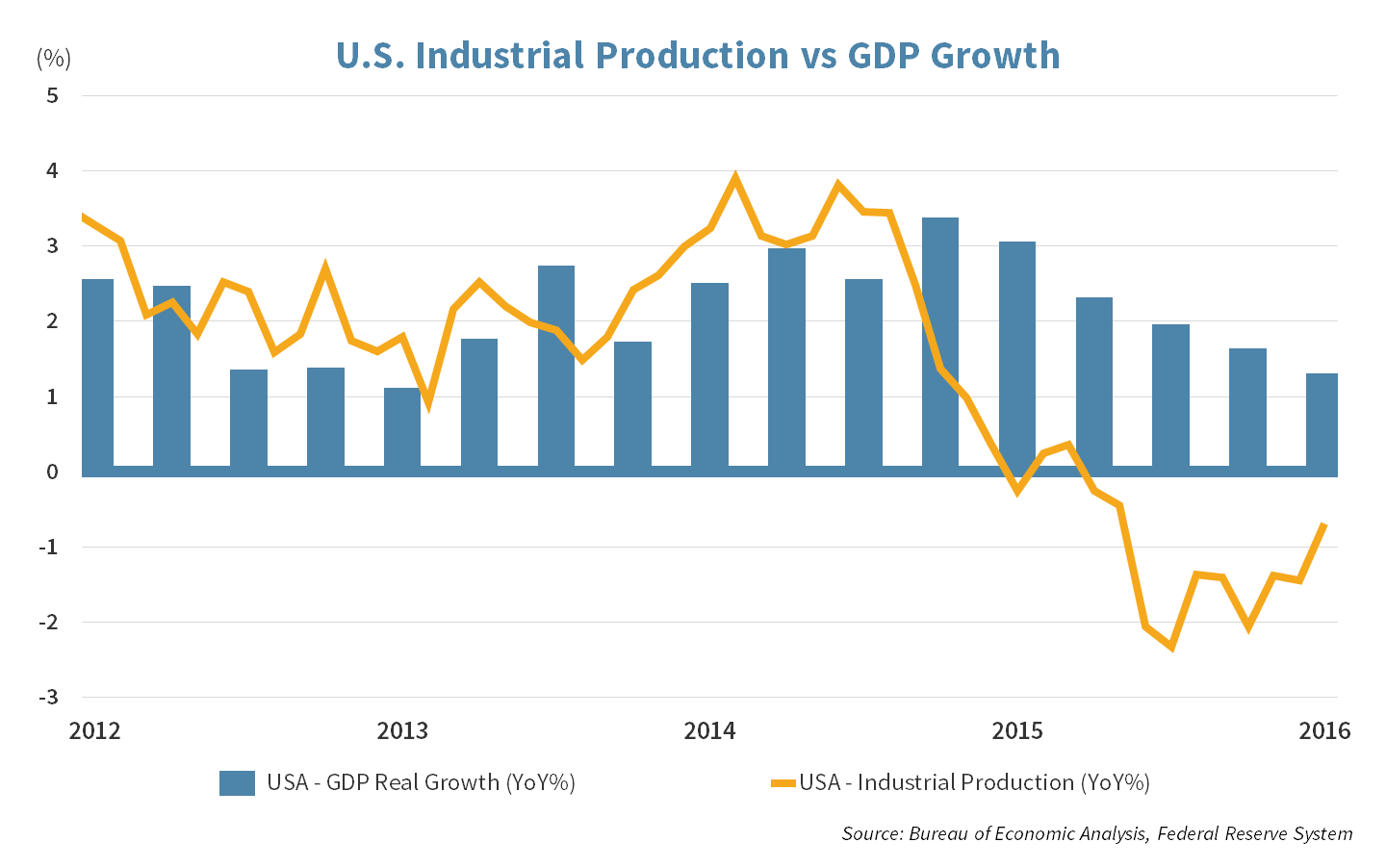

Q2 U.S. Growth Rate

Gross Domestic Product fell below the 2.6 percent growth rate that economists had been forecasting.

Economic Commentary

U.S. GDP Growth Saved by the Consumer

United States economic GDP growth came in at 1.2% on an annual basis this past quarter. While the headline number looks disappointing and is well below economist expectations of 2.6%, the details driving the number are mixed. Industrial production and business spending have been a drag on economic growth while the American consumer has been a driving tailwind.

Management teams are either pessimistic on future demand for their product or their manufacturing utilization rates are low enough where they do not need to add capacity. Business spending declined 2.2% annually last quarter. Home building and improvements declined by 6.1% annually which is unusual as this segment of the economy has been a consistent positive contributor to the economy over the past two and half years, as low interest rates encouraged home builders to build.

The saving grace for the US economy has been the American consumer. Personal consumption accounts for almost 70% of economic activity and consumption expanded at an impressive 4.2% rate. Consumers are still benefiting from paying less at the gas station than they were two years ago and are encouraged to spend even more with easy access to credit.

Week Ahead

Job Creation

The July jobs reported will be released before market open on Friday giving the Fed another data point for their rate hike decision.

- The consensus is pointing towards an increase of 175,000 jobs.

- This follows a historically dismal output in May and a surprise beat in June.

Pampered

Procter and Gamble will report quarterly earnings on Tuesday as we begin to round out the earnings season.

- With its global reach, P&G may provide insight on the impact of Brexit and dollar strength.

- A dozen other Strategic holdings will join P&G in reporting next week.

Passing Of The Torch

The Olympics will be kicking off in Rio de Janeiro as the Opening Ceremonies will take place on Friday and run throughout August.

- Best of luck team USA!

Strategy Update

STRATEGIC ASSET ALLOCATION

The Game Changer

The U.S. equity market has been tussling for direction this week. The scramble was a result of mixed earnings and a potential Fed rate rise as investors read between the lines of their guidance. Oil continued its steady decline which began in June. Production and exploration are once again on the rise; increasing oil supply and weighing on prices.

Déjà vu

The dollar waned and gold increased as the market digested comments from the Federal Reserve. The Fed left the window open for the possibility of a rate hike this year if the economy continues to pick up, perhaps setting up a repeat of last year’s 25 bps December hike.

STRATEGIC GROWTH

Tech Gains

The Technology sector celebrated big wins this week, beating analyst’s expectations. The M&A news of the week belongs to Oracle, who acquired a cloud-base software maker, NetSuite, as the competition in the cloud service ramps up. In other earnings news…

- Alphabet (GOOG) had a stellar quarter. Results were buoyed by a strong rise in the advertising business, which increased by 21%. Google has successfully capitalized on the smart phone revolution, with over half of its searches now coming from mobile devices.

- Expedia’s (EXPE) results failed to impress, despite its Trivago business reporting a 41 percent increase in revenue year-over-year.

STRATEGIC EQUITY INCOME

Oil Sludge

Energy companies are struggling this earning’s season as oil prices have been on the decline. Despite this, many large cap Energy stocks are still up double-digits this year.

- Exxon (XOM) reported lower than expected revenue. The decline was from lower oil prices and refining margins. The CEO stated that their focus is on “…business fundamentals, cost discipline and advancing selective new investments…”.

- Apple (AAPL) delivered strong iPhone and iPad sales this quarter sending the stock higher, and erasing most of the year’s losses.

About Strategic

Founded in 1979, Strategic is a leading investment and wealth management firm managing and advising on client assets of over $2 billion.

OverviewDisclosures

Strategic Financial Services, Inc. is a SEC-registered investment advisor. The term “registered” does not imply a certain level of skill or training. “Registered” means the company has filed the necessary documentation to maintain registration as an investment advisor with the Securities and Exchange Commission.

The information contained on this site is for informational purposes and should not be considered investment advice or a recommendation of any particular security, strategy or investment product. Every client situation is different. Strategic manages customized portfolios that seek to properly reflect the particular risk and return objectives of each individual client. The discussion of any investments is for illustrative purposes only and there is no assurance that the adviser will make any investments with the same or similar characteristics as any investments presented. The investments identified and described do not represent all of the investments purchased or sold for client accounts. Any representative investments discussed were selected based on a number of factors including recent company news or earnings release. The reader should not assume that an investment identified was or will be profitable. All investments contain risk and may lose value. There is no assurance that any investments identified will remain in client accounts at the time you receive this document.

Some of the material presented is based upon forward-looking statements, information and opinions, including descriptions of anticipated market changes and expectations of future activity. Strategic Financial Services believes that such statements, information, and opinions are based upon reasonable estimates and assumptions. However, forward-looking statements, information and opinions are inherently uncertain and actual events or results may differ materially from those reflected in the forward-looking statements. Therefore, undue reliance should not be placed on such forward-looking statements, information and opinions.

No content on this website is intended to provide tax or legal advice. You are advised to seek advice on these matters from separately retained professionals.

All index returns, unless otherwise noted, are presented as price returns and have been obtained from Bloomberg. Indices are unmanaged and cannot be purchased directly by investors.

Doug Walters

Doug Walters